Reaching the one billion mark is a tremendous achievement for an industry that is just over a decade old. In this webinar, hear from the author of the State of the Industry Report on Mobile Money 2019 and understand the key trends and insights beyond the data.

Questions and Answers

A past quantitative study from the GSMA, in collaboration with Harvard Business School, showed that MNO-led mobile money deployments were more successful in developing and delivering digital financial services with broad outreach than non MNO-led mobile money deployments. The report can be downloaded here.

Mobile money transactional trends

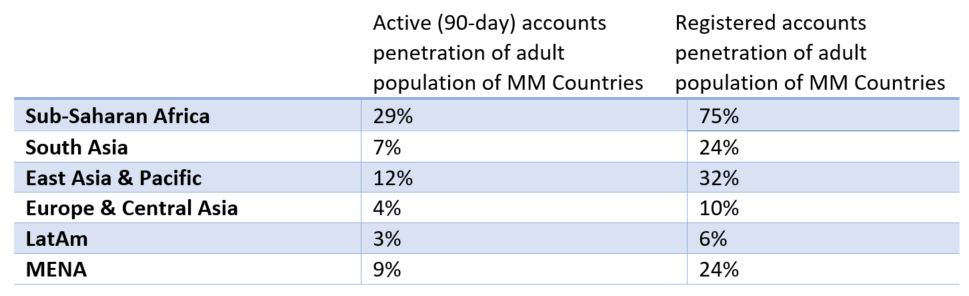

There are significant differences between regions when it comes to circulation. Mobile money regions that are more developed or have high levels of digitisation have seen more value circulate in the ecosystem than leave the ecosystem. This is a trend that can be observed in Sub-Sahara Africa, South Asia and East Asia and the Pacific regions.

Interoperability between accounts at different mobile money providers is available in 19 countries, up from one market in 2013. Interoperable P2P transfer volumes have also grown by nearly 40 per cent between 2018 and 2019 without an impact on existing on-net P2P transfers in these markets. The latest GSMA reports on interoperability can be found here and here.

Mobile money agent distribution

Yes, the number of agents vs banks and ATMs vary across the regions depending on the relative strength of traditional banking sectors across the regions. For example, agents in Sub-Saharan Africa outnumber ATMs and bank branches by a larger margin than agents in East Asia and the Pacific.

Mobile money profitability

60% of mobile money providers responding to our survey reported a positive EBITDA.

Mobile money regulator landscape

The ability to conduct Know Your Customer (KYC) efficiently and effectively has been key in expanding access to mobile money. Mobile money providers have a statutory responsibility to identify and verify the identity of their customers. The inability to perform KYC identification and verification checks owing to the lack of acceptable forms of identification (i.e. government-issued ID) creates barriers to entry for those excluded from the national identity system.

The unintended consequence of government inaction on the issuance of national identity documents is financial exclusion. According to the World Bank, 494 million people in Sub Saharan Africa (45% of its population) lack formal identification making the region’s people disproportionately excluded from the formal financial system.

Cross-border data flows are critical to ensuring the safe and secure provision of mobile money-enabled remittance services. In that context, data localisation requirements can directly challenge emerging markets’ ability to unlock mobile money’s potential to reduce the cost of remittances, to formalise remittance flows and to empower migrants and their families. The latest GSMA reports on data localisation can be found here and here.

Mobile money fees and barriers to entry

The vast majority of countries have minimum capital requirements placed on mobile money providers. While some countries have onerous minimum capital requirements (Democratic Republic of Congo, Malaysia, Myanmar and Nigeria), most countries have proportionate minimum capital requirements at 10% or less, relative to the minimum capital requirements for banks, which have a higher risk profile than mobile money providers.

The following countries do not have any minimum capital requirements: eSwatini, Fiji, Georgia, Maldives, Mauritania, Paraguay, Samoa, Sierra Leone and Zambia. While having no capital requirements reduces the burden on providers, requiring some initial capital ensures that entrants can cover their operational costs and that they have sufficient assets to cover customer claims in the event of insolvency. It is therefore important to impose a capital requirement that is proportionate, given the low-value and low-risk nature of mobile money.

Receive the latest insights on mobile money straight to your inbox by subscribing below.