This post was written by Tim Hatt, a Senior Analyst for MDI, and Julia Burchell, Community Manager for MDI.

It is a companion piece to the GSMA Intelligence discussion of the recent Microsoft acquisition of the Nokia Devices and Services Unit. It discusses the acquisition from the perspective of app ecosystems that impact Mobile for Development (M4D).

The recent Microsoft acquisition of Nokia’s Devices and Services unit has the potential to bring benefits to those working in the M4D space, by creating an alternative mass-market app ecosystem with the potential to reach around 750 million people.

Currently, among various mobile phone operating systems (OS) on the global market, there are two frontrunners: iOS, owned by Apple and delivered exclusively through the iPhone; and Android, developed by Google and delivered through a range of smartphones, including those by Samsung, Sony, HTC and Huawei. App developers wanting to reach the users of these popular OS need to develop apps that work on these two separate platforms.

While Apple and Samsung each account for more than 30% of global handset revenues, Nokia’s share has steadily declined since 2008 and is now under 10%. With the bulk of Nokia’s sales volume being in lower-priced featurephones, this reduction in revenue share can be attributed both to its declining share of new handset shipments and the rise in higher value smartphones where it has performed poorly over the last five years.

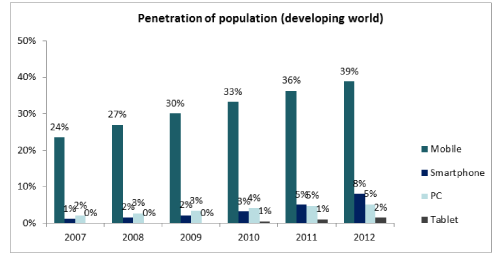

However, this hides the size of Nokia’s user base, which currently stands at over 25% of the global market , or some 750 million people, who are mostly in developing countries,where the majority of mobile owners use featurephones (see Figure 1). Nokia’s historical focus has been on affordable, durable featurephone handsets and especially in the developing world, second and third hand phone use and repair is a very common way for lower income people to obtain phones. Therefore Nokia handsets remain in circulation, taking longer to be replaced by the handsets recorded in the new shipment statistics. For context, the Android and iOS ecosystems are growing, with perhaps 20-30% of mobile users worldwide for Android and 5-10% for iOS, but most of their presence is in mature markets).

Note: mobile is proportion of people that subscribe to mobile services

Source: GSMA Intelligence, Strategy Analytics, Telegeography

Customer income level is important to app developers. However, for developers in general and especially for those bringing development outcomes in emerging markets (e.g. improving health, education or financial inclusion), the more users that an app attracts, the better for business, both commercially and in terms of social impact. The more users that can easily and affordably access, use and derive benefit from an app, the higher the demand for the app itself, others like it and the data connection that powers the ecosystem. As more users become familiar with such services, more localised, relevant content will become increasingly feasible, which will drive greater demand and familiarity in a virtuous circle, supporting social and economic growth at individual and national levels (see Digital empowerment in the developing world).

While Microsoft already maintains an application ecosystem through Windows Marketplace, the attractiveness for developers without the Nokia customer base is generally lower than for platforms with a higher share and audience reach. Nokia automatically augments Microsoft’s customer base, particularly in developing countries and over time this is likely to attract new attention among app developers. We believe this will provide more impetus for developer innovation and position Microsoft’s offering positively to be the source of more locally relevant content and a hub for app innovation in the developing world. We see it likely to expand on and serve the much lower income customer segments that the Android or Apple stores have to date.

Over the coming months, Mobile for Development Intelligence will be examining the interplay between different OS platforms in more detail. In the meantime, share your thoughts below. Will the takeover bring benefits to the M4D sector? How do you think it plays into the battle for mobile OS control and how will this affect long term strategies for M4D players?