1. Introduction to Infrastructure Sharing

1.1 What is Infrastructure?

Mobile network operators provide connectivity and communications service over deployed network infrastructure (whether owned or leased). The definition of network infrastructure is not only limited to electronic components but also includes passive elements such as physical sites and towers that are required to operate the network.

While subscribers do not perceive directly the composition/configuration of the infrastructure, the performance (e.g., throughput and latency) of the whole mobile network infrastructure determines the user experience and therefore the network infrastructure has been one of the key assets for mobile operators.

1.2 Why Infrastructure Sharing?

1.2.1 Difficulties in acquiring sites for access network

Network densification to address coverage demands in indoor environments has led to increasing difficulties in acquiring sites for radio access network (namely, base stations).

This arises mainly from two factors. Firstly, the space within buildings are usually confined and reasons of aesthetics/civil works limit the choice even further. This means that there is only so much space where indoor base stations can be installed, where only a few choices will be available considering the coverage demand to be satisfied.

Secondly, having more than one mobile operators further complicate the problem because the mobile operators will have to compete for a few sites. Even if the operators are successful in securing and deploying base stations in proximity of an optimal site, each operator will have to invest in the civil works of antenna and transmission lines.

In this context, it would be more rational for operators to share in-building infrastructure or at least the transmission lines to share the burden while achieving reasonable coverage.

1.2.2 Cost of 5G Deployments to meet throughput demand

5G networks are expected to incur a higher cost of deployment to meet throughput requirement and demand. Radio access networks already comprise the largest portion of the cost in network deployment and operation. To meet mobile broadband demand, 5G is likely to be offered on higher frequency radio spectrum above 6GHz. This means that cell offers smaller radius of coverage and so achieving widespread coverage may be challenging.

It is true that deployment of 5G sites may be different from sites of legacy cellular networks (e.g., 5G sites may be in the form of indoor small cells rather than grand towers/masts) and that not as much cost may be required to deploy 5G sites than to deploy legacy sites. However, the following can provide an illustrative example of the potential cost increase in the 5G era. A cell using 20GHz is expected to have only a third of the radius of coverage compared to a cell using 3.5Ghz[1]. This means that roughly 9 cells of 20GHz will be needed to replace a cell of 3.5GHz if same coverage is to be provided. The civil works for cell site construction and the rent for the cell site would more than likely increase (not necessarily by the factor of 9, but still a significant increment), which will significantly increase both deployment and operation costs of radio access network already consuming significant investment.

While it is possible to overcome the limitations in coverage with Massive MIMO (Multiple-Input Multiple-Output) and Beamforming (the two technologies together allow extension of coverage area by a factor of up to 10), they come with a significant cost. Having multiple antennas means more expensive radio access equipment and more careful planning of radio elements. Furthermore, beamforming leads to directional transmission and will have to track the mobile user it is allocated to. This means that the transmission is no longer based on stationary configuration but dynamic users which greatly increases the complexity of operation on top of beamforming being an advanced feature requiring more money to implement.

To meet the requirement of ultra-low latency, considerations to place the contents in the edge network (to the extent of base stations if possible) are on-going. The costs of upgrading the edge network to store and process contents in a timely and effective manner will be significant, but such fundamental change in network architecture will incur costs that are not easily captured by accounting cost (e.g., different paradigm of operation leading to more errors).

As noted above, 5G coverage will be constrained by spectrum propagation and by increasing complexity of operation & deployment. According to GSMA Network Economics model, even conservative estimations predict that the number of coverage sites and performance sites will increase by 50%. As infrastructure at base station sites usually comprises the largest portion of infrastructure cost, it will be prudent to consider ways to share these costs. Operators should consider both sharing of passive infrastructure (e.g., physical site and power systems) and sharing of active infrastructure (e.g., antenna and transceivers) to cost-effectively achieve the performance of sites and 5G capability.

1.2.3 Enabler to Rationalise legacy networks

Infrastructure sharing can be a step to enable rationalisation of legacy networks such as 2G or 3G networks. Considering the falling revenues of 2G/3G networks and higher spectral efficiencies of next-generation networks (4G and 5G), many mobile operators are already rationalising these legacy networks.

However, completely closing the legacy networks are very challenging, if not impossible, as there are many devices that are not tracked by the operator device management system (e.g., bring your own devices within enterprise customers) or are located in inaccessible locations (e.g., subway tunnels).

To accommodate these devices while minimising the capacity, mobile operators can consider infrastructure sharing of the legacy networks. This will mean that there will be only one national legacy network shared by all operators and the operators will be able to divert resources (e.g., manpower and spectrum) to next-generation networks.

1.2.4 Technical Enablers for Infrastructure Sharing in the 5G era

Introduction of NFV (Network Function Virtualisation) and SDN (Software Defined Networking) in cellular networks could also accelerate mobile network sharing. NFV and SDN enable an operator to use commodity hardware in place of physical equipment and all instances of network entities are virtualised and exist as logical entities (i.e. have various logical instances of a network entity such as S-GW on a single physical node). Furthermore, NFV and SDN enable network slicing, which allows “slicing” of one physical network into a number of virtual networks possessing a different quality of service and topology, allowing operators to deploy virtual networks with a different set of requirements on physical infrastructure.

1.2.5 Diverting investment to other innovation

Although network infrastructure has been a key major asset, the introduction of smart devices has altered the mobile industry landscape and competition has been shifting from infrastructure competitiveness to service competitiveness (i.e. rather than the performance of the network, it is more important for subscribers to use various services).

Infrastructure sharing enables operators to focus on the competition in the service layer regardless of the extent of the sharing. Operators can share whole or strategically unimportant parts of its infrastructure to share infrastructure costs while providing acceptable performance. Furthermore, these savings can facilitate mobile operators’ migration to next-generation technologies and provide its customers with the latest technology available.

1.2.6 Cost effective means to address capacity demand growth

Mobile operators are also under pressure to extend the capacity of the network due to the significant growth of traffic that is being handled by mobile networks, traffic that is expected to grow even further in the future. This means that the cost to handle traffic will increase and worsen the profitability of operators.

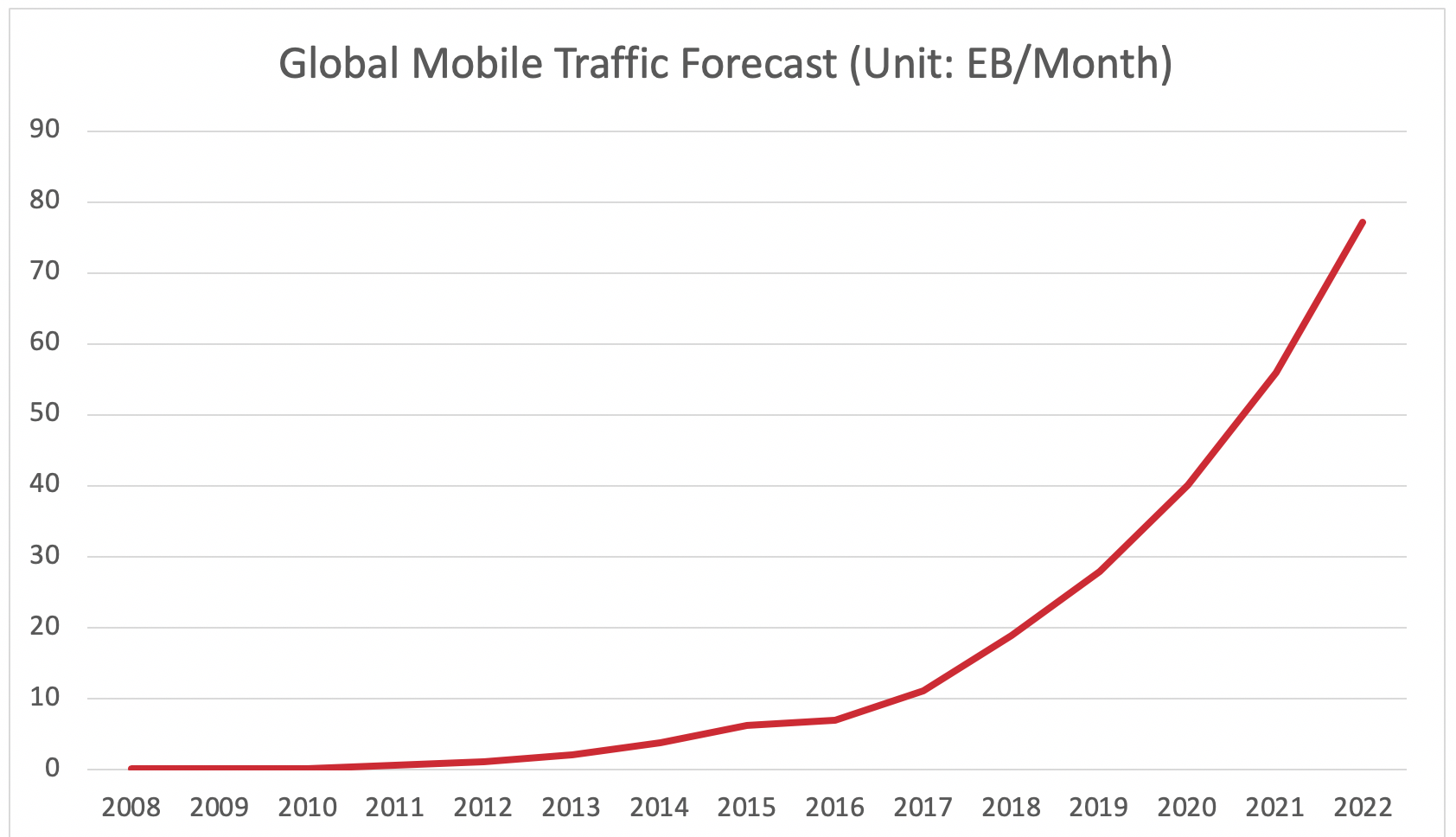

Figure 1: Traffic Growth (Source: CISCO VNI)

In this context, mobile operators need to employ cost-effective methods such that accommodation of the increased traffic does not require similar magnitude of growth in infrastructure cost. Traditional infrastructure deployment scheme can only bring limited cost reduction even under tight cost reduction pressure, but infrastructure sharing enable significant cost reduction for mobile network infrastructure deployment.

1.2.7 Social benefits

Some regulators are encouraging infrastructure sharing of mobile operators because they believe that there are regulatory/social benefits that society can reap. Major social benefits come directly from the economic benefit, where mobile operators can direct saved cost to the customer in pricing. In addition, infrastructure sharing can help reduce energy consumption and radio emissions of networks.

1.3 Expected Cost Savings of Infrastructure Sharing

Existing reports and researches on mobile network sharing confirm that infrastructure sharing can bring in significant cost reduction. Ericsson[2] (2012) predicted that asset savings from infrastructure sharing can reach up to 40% and cash-flow improvement up to 31% depending on the type of sharing. Booz & Company[3] (2012) stated that infrastructure sharing can enable operators to save as much as 30 to 40 percent of the network costs. Coleago[4] (2010) calculated that savings in roll-out CAPEX and savings in network operations and maintenance can reach up to 65% each with network sharing.

The breakdown of CAPEX and OPEX by Analysys Mason provides a hint on why infrastructure sharing can potentially reduce costs so extensively. For CAPEX, building, rigging, materials and power (i.e. building access to electrical networks to connect base stations to power) consists of more than 50% of CAPEX for both developed and emerging markets. Sharing these costs can significantly reduce required costs and some operators have experienced 35~40% reduction of TCO (Total Cost of Ownership) from sharing passive infrastructure. For OPEX, Land rent, power and backhaul consist of more than half of OPEX in developed markets and almost half of OPEX in emerging markets. Again, sharing these components can significantly reduce the cost.

1.3.1 Savings estimated by GSMA Network Economics Model

Please login above to view this paragraph.

1.4 Forms of Infrastructure Sharing

As raised by previous literature, the benefits and costs of infrastructure sharing depend on the types of infrastructure sharing agreement. The sharing deals can be classified depending on the technological entity shared, business/ownership assumed and geographical distribution.

1.4.1 Technology

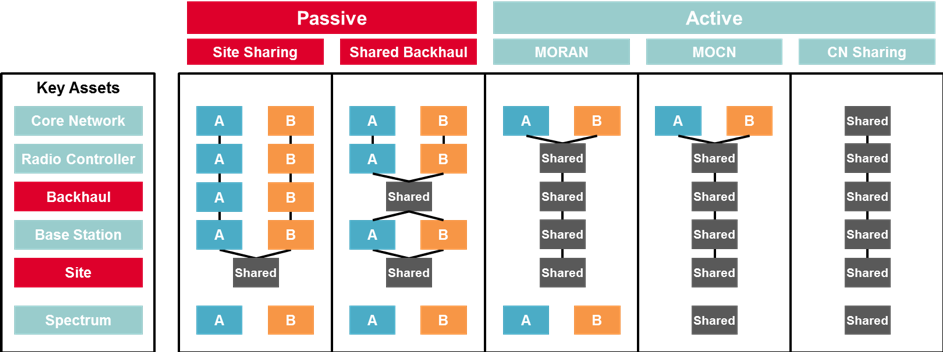

Most prevalent classification criterion for network sharing is technology. The following figure provides an overview of infrastructure sharing types depending on entities that can be shared.

Figure 2: Technical classification of infrastructure sharing

Passive infrastructure sharing is where non-electronic infrastructure at a cell site, such as power supply and management system, and physical elements such backhaul transport networks are shared. This form can be further classified into site sharing, where physical sites of base stations are shared and shared backhaul, where transport networks from radio controller to base stations are shared (for more information on innovations to optimise backhaul cost see here). Passive infrastructure sharing is the simplest and can be implemented per sites, which enables operators to easily share sites and maintain their strategic competitiveness depending on the sites shared. Operation is also easier with this form of sharing because network equipment remains separated. However, the cost-saving potential of sharing is limited relative to other forms of sharing.

Active infrastructure sharing is sharing of electronic infrastructure of the network including radio access network (consists of antennas/transceivers, base station, backhaul networks and controllers) and core network (servers and core network functionalities). This form can be further classified into MORAN (Multi-Operator Radio Access Network), where radio access networks are shared and dedicated spectrum is used by each sharing operator, MOCN (Multi-Operator Core Network), where radio access networks and spectrum are shared, and core network sharing, where servers and core network functionalities are shared.

As in the case of site sharing, MORAN and MOCN can be implemented per sites and enables strategic differentiation. However, operation of network equipment needs to be shared (or at least issues must be shared with participants) and therefore increases the complexity of sharing relative to site sharing. The cost-saving potential is greater than site sharing. Core network enables greater cost-saving potential but is complicated to operate and to maintain strategic differentiation. It is important to note that core network sharing has not been popular and only a few cases have been suspected to be so. In this document, core network sharing is considered to present the full theoretical picture of infrastructure sharing.

Finally, although not indicated in the figure, national roaming is a method of infrastructure sharing. National roaming refers to roaming agreements in the national context. For example, a subscriber from Vodafone Spain may roam into Telefonica’s network when entering into non-overlapping coverage provided by Telefonica and vice versa. This type of sharing enables cost saving comparable to or greater than core network sharing. However, national roaming comes with complexity (e.g., when to choose home network over visited network has given signal strength) and there can be regulatory issues where regulators may be concerned with reduced competition.

NOTE 1: According to technological criterion, MVNO can also be perceived as a type of infrastructure sharing agreement where MVNO leases almost all of the necessary network infrastructure. However, it has been excluded as this document intends to focus on efficient deployment & operations of physical networks rather than creating virtual operators on top of physical networks.

NOTE 2: This document does not cover spectrum sharing or use of unlicensed spectrum as the regulatory landscape is diverse depending on the regional/national context.

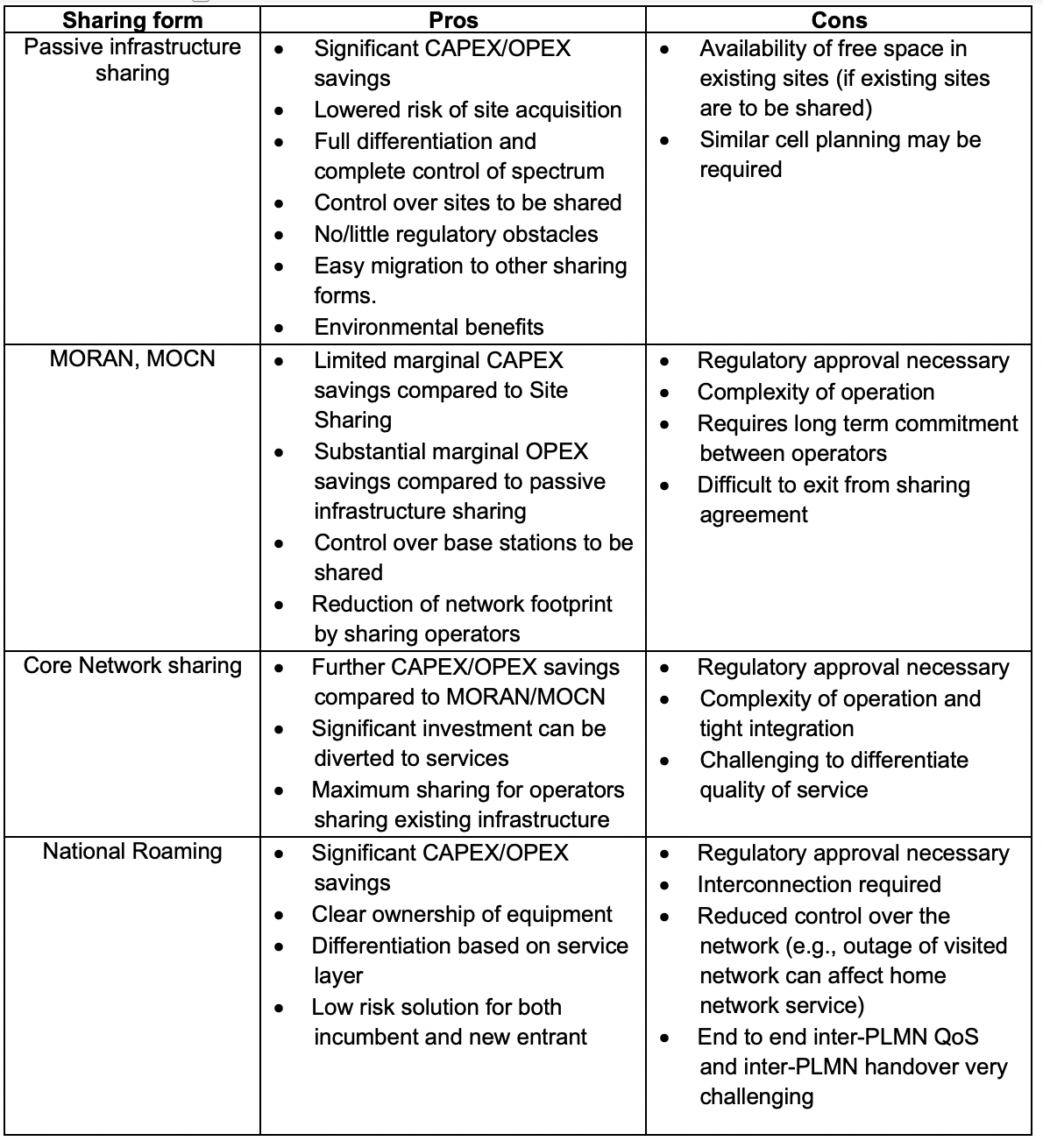

Table 1: Comparison of infrastructure sharing forms (technology)

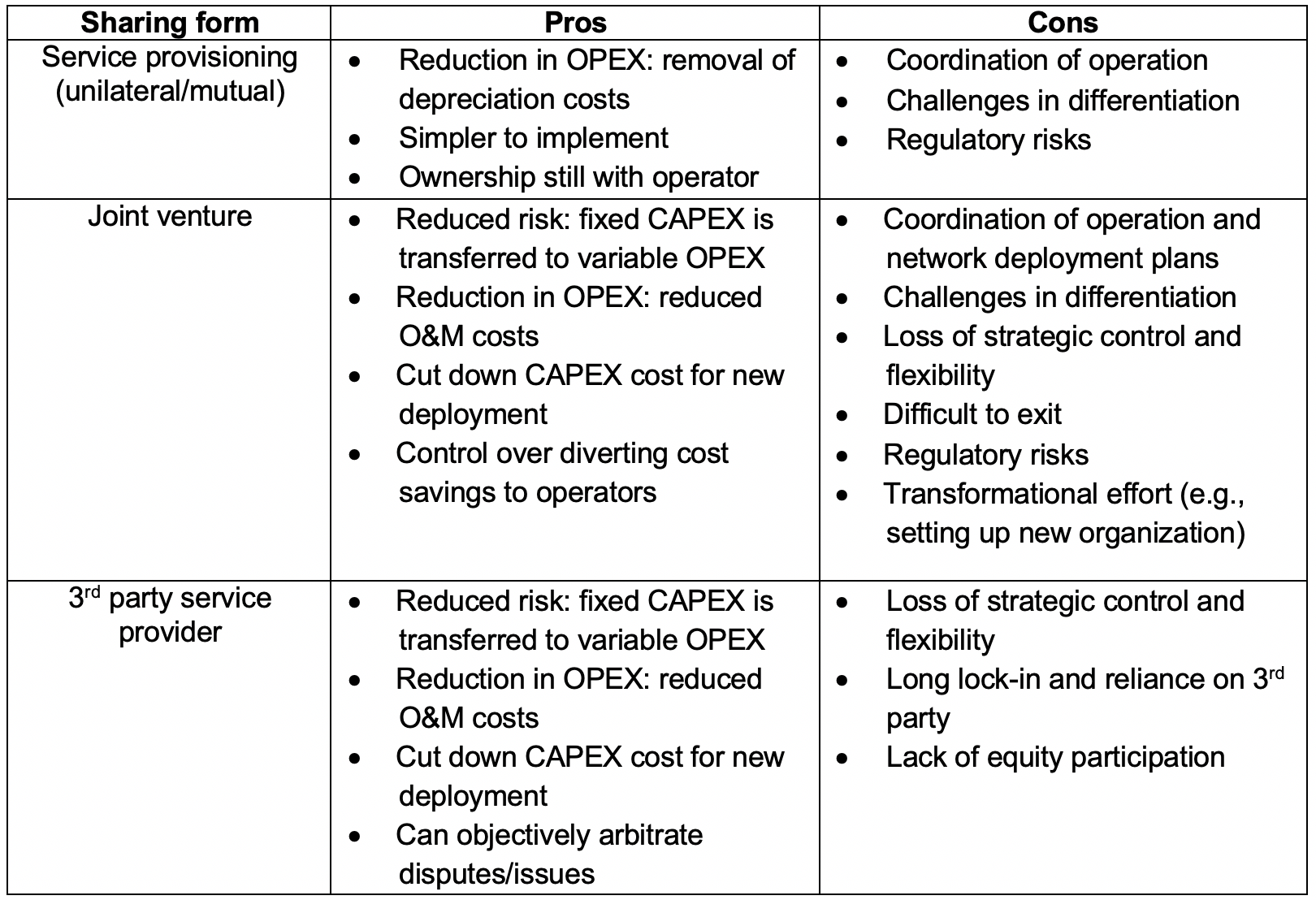

1.4.2 Business/ownership

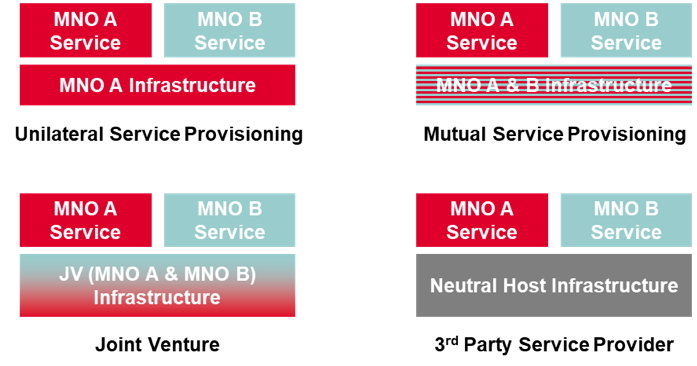

A different perspective of business/ownership can also classify infrastructure sharing agreements to four types. The first type of infrastructure sharing agreement is unilateral service provisioning, where ownership of infrastructure remains separate (each company owns its own network) and only one of the participating companies provides its infrastructure to be shared. Therefore, as indicated in Figure 4, communications service (e.g., voice, SMS and data) of participating operators A and B is provided on the infrastructure of operator A. Mutual service provisioning is similar to unilateral service provisioning except that two or more of the participating companies provide their infrastructure to be shared.

A joint venture is where companies in the agreement form a joint venture to own and operate the networks, which means that the shared infrastructure is consolidated, owned and operated by the joint venture (but the companies do not directly own the infrastructure). Note that joint venture can also operate as tower companies that own towers and lease them to mobile operators for use.

Finally, a 3rd party service provider is where a company, not necessarily affiliated with a mobile operator, leases infrastructure to mobile operators for use. This type is also called neutral host, with successful examples in the market already. There are tower companies (comprising 31.8% of disclosed 154 infrastructure sharing deals as indicated in Coleago’s network sharing database) that own towers and lease them to mobile operators for use. The potential strategic implication of neutral host is that the control power over the sites shifts from the mobile operators to the neutral host. That is, the value of the site is transferred and additional consideration is necessary for mobile operators.

A good example of Tower Company is edotco, owned by Asian telecommunications group with six subsidiary mobile operators (Axiata Group). It provides end-to-end solutions in the tower services sector from tower leasing, co-locations, build-to-suit, energy, transmission and operations and maintenance (O&M). As of August 2017, edotco operates and manages a regional portfolio of over 26,000 towers across core markets of Malaysia, Myanmar, Bangladesh, Cambodia, Sri Lanka and Pakistan with 18,461 towers directly operated by edotco and a further 8,100 towers managed through a range of services provided. edotco with its business model of establishing and leasing passive infrastructure such as towers enables operators to share infrastructure from the rollout phase. As operators can lease towers instead of establishing their own, operators can choose to lease towers from edotco to transform high-risk large investment to recurring low risk smaller payments.

Furthermore, to provide effective indoor coverage to address subscriber’s connectivity demand, each room/a unit of space within a building needs to have a cell deployed and wired. In this case, deployment of cells and wiring of the cells of two to four operators would not only incur significant infrastructure cost for the mobile industry but also complexities for building owners to deal with (e.g., civil work and wire coordination). It may be better for operators to share infrastructure in these places in the deployment process and consequently share maintenance and operations of shared infrastructure. Building owners may become a 3rd party service provider that deploys and operates the network to be leased to operators.

Figure 3: Business/ownership classification of infrastructure sharing

Table 2: Comparison of infrastructure sharing forms (business/ownership)

1.4.2.1 Public-private partnership

As in the case of building owners, the municipalities or the government can become the 3rd party provider of infrastructure under a public-private partnership. Public-private partnership is where municipalities act as a 3rd party service provider and the private sector (mobile operators) partially finances the investment while leasing the infrastructure. Taking an example of autonomous driving, it would be burdensome for owners of road infrastructure (e.g., lamp posts, traffic lights and lane control) to provide hubs for two to four operators to connect to and coordinate connection. Rather, it would be simpler and more cost-effective for operators to share the infrastructure in deployment and operations processes.

Another example of public-private partnership is the communications and transport sector of Mexico’s national infrastructure program. In the new phase starting from 2014, the Mexican government intends to construct a nationwide wholesale LTE network infrastructure for mobile operators to operate. While the plan is still on-going, Altán consortium was selected as the final bidder in November 2016.

1.4.3 Geographic

Geographically, infrastructure sharing can be viewed in two different perspectives. Firstly, it can be divided into whether the infrastructure is shared in rural areas or urban areas. Some operators would want to address coverage issues in rural areas where ROI is significantly lower than that of urban areas. Some would want to relieve cost burdens in urban areas (especially in the case of public coverage to resolve high costs of site acquisition, physical space limitations and aesthetic/emissions concerns of having multiple antenna structures) while maintaining coverage to ensure user experience. Others would want to focus on relieving cost burdens overall in both rural and urban areas.

The second perspective is whether the ownership and/or operation of infrastructure is separated per region. For example, operators may already have national coverage and may share the operation/ownership of its infrastructure. On the other hand, operators may be deploying greenfield and each operator can be in charge of different regions to deploy and operate infrastructure.

1.4.4 Process

Although not analysed and described in the case studies within this document, another perspective that infrastructure sharing can be analysed is in the perspective of the process. The processes can be divided into three distinct phases:

- Engineering, planning and network design

- Deployment and rollout

- Maintenance and operations

Whilst this perspective has not been explored in depth, trends of network densification (applicable especially to 5G network deployments leveraging mmWave bands) will compel operators to consider infrastructure sharing in the perspective of last two processes: deployment and rollout, and maintenance and operations.

1.5 Scope

As can be seen from the taxonomy of infrastructure sharing described above, infrastructure sharing agreements can take many different forms. This means that the benefits and disadvantages of infrastructure sharing can vary and general implications and/or predictions may not be precise.

Network Economics attempts to analyse cases of passive infrastructure sharing and active infrastructure sharing that are actually implemented commercially (or at least pre-commercial test) and deduce lessons learned from these cases for effective infrastructure sharing. The rationale behind covering only these types is that, as discussed in section 1.2, the largest cost element of a network is the radio network (70% according to Gemalto) and therefore where most savings can be realised (for innovations that optimise backhaul cost specifically, see here). Besides the two forms of sharing enables differentiation of infrastructure competitiveness, which is still an important determinant of customer satisfaction in most mobile markets. Furthermore, both forms of sharing are less complicated to implement than other types of sharing.

Please sign in above to make comments or edits to this document. To sign up for our newsletter, please click here.

[1] Nakamura T. (NTT DoCoMo), “5G Concept and Technologies”, Globecom 2014

[2] Ericsson, 2012, “Successful Network Sharing: a structured approach to network sharing – how to benefit while maintaining competitive advantage”

[3] Booz & Company, 2012, “Sharing Mobile Networks: Why the Pros Outweigh the Cons”

[4] Zehle S. and Friend G., 2010, “Network Sharing business planning”, Coleago