Mobile connectivity in the Caribbean is a growth industry with 28 million unique mobile subscribers as of Q2 2022, a market penetration of 63.7%, according to the GSMA, short of the global market penetration of 67.1%. Additionally, few Caribbean markets have 5G. In advance of the CANTO conference on July 17, we examined Q2 2022 data from the five most populous Caribbean countries as well as Puerto Rico to see how initiatives to enable digital evolution and transformation are progressing. We looked at country-level performance data as well as mobile availability statistics in each country.

Mobile performance varies widely across the Caribbean

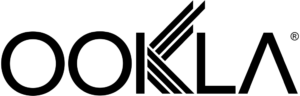

At 46.84 Mbps, Puerto Rico had the fastest median mobile download speed by far when comparing the most populous Caribbean countries during Q2 2022 using Speedtest Intelligence®. This was at least a 43% improvement over Q2 2021. 5G is a big differentiator with only Puerto Rico and the Dominican Republic having commercial availability for 5G according to the Ookla® 5G Map™ and Trinidad and Tobago showing only limited 5G Availability. Puerto Rico was 35% faster for download speed than Jamaica, which fared well for median download speed, coming in second on this list at 32.77 Mbps, at least 20% faster than in Q2 2021. Trinidad and Tobago (27.57 Mbps), the Dominican Republic (19.67 Mbps), and Haiti (12.83 Mbps) followed. Cuba was far behind the other countries on this list with a mobile download speed of 5.78 Mbps, at least a 162% drop from Q2 2021.

Trinidad and Tobago had the fastest median mobile upload speed among the most populous Caribbean countries during Q2 2022. At 10.54 Mbps, Trinidad and Tobago’s mobile upload speed was 24% faster than that in Jamaica (8.34 Mbps) and up at least 6% over Q2 2021. Puerto Rico (7.48 Mbps) followed, then Haiti (6.94 Mbps), the Dominican Republic (6.87 Mbps), and Cuba (3.71 Mbps). Cuba’s median upload speed was down at least 117% when comparing Q2 2021 to Q2 2022.

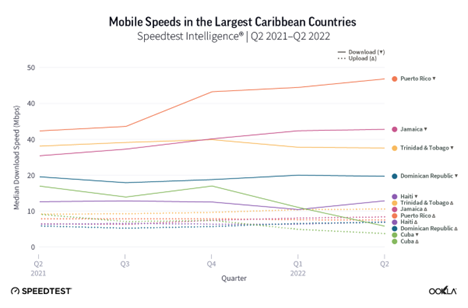

Trinidad and Tobago had the lowest median multi-server latency on our list during Q2 2022 at 33 ms followed by the Dominican Republic (52 ms), Jamaica (60 ms), Haiti (86 ms), Puerto Rico (89 ms). At 141 ms, Cuba’s latency was the highest.

Availability shows some populations are stuck with decades-old technologies

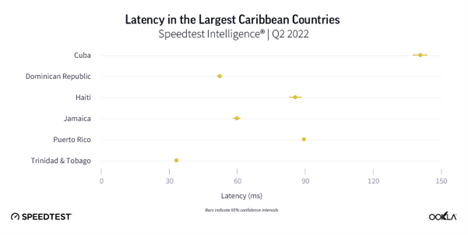

Data from Speedtest Intelligence in Q2 2022 shows that Puerto Rico had a 5G Availability, the proportion of users with 5G-capable devices who spend the majority of their time on 5G, of 63.1%. While we also saw 5G results in the Dominican Republic, there were insufficient 5G samples in the Dominican Republic to reliably analyze.

Puerto Rico had the highest 4G Availability, the proportion of users who spend the majority of their time on 4G and above, among the most populous Caribbean countries at 92.0%. Cuba followed at 77.0%, then the Dominican Republic (76.2%), Jamaica (71.2%), Haiti (69.2%), and Trinidad and Tobago (68.1%).

Unfortunately, the other countries show a large number of users who are still relying on legacy mobile technologies. 3G and 2G are only sufficient for basic uses including: voice and texting, social media, and navigation apps. Users who want rich media experiences or video calling need access to 4G or higher.

2G and 3G Availability, the proportion of users who spend the majority of their time on 2G and 3G, was higher in Haiti (29.1%) and Trinidad and Tobago (30.4%) during Q2 2022 with no statistical difference between the two. Jamaica closely followed at 26.7%, then Cuba (20.2%), the Dominican Republic (19.6%), and Puerto Rico (5.7%) where both Liberty Mobile and T-Mobile have both recently sunsetted their 3G networks. Affordability of new handsets and more expensive subscription tiers could play a role in slow upgrades.

The Caribbean is certainly an exciting and growing telecom market. We’ll be interested to see what new initiatives come out of CANTO and how they help consumers in the region get closer to a digital future. Please stop by Booth 22 at CANTO to visit with us and discuss local provider performance and more.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.