This article explores mobile performance in select countries across Sub-Saharan Africa (SSA). We examine how four operator groups – Airtel, Orange, MTN, and Vodacom – mobile performance compared against each other during Q2 2022 across ten countries. In our previous analysis of the state of the 5G networks South Africa Spearheads 5G in Africa, but the Road is Long and Windy for Others we analyzed mobile performance on modern chipsets during 2021 (full year) across the African continent. We concluded that these are still early days for 5G across the region as challenges remain around affordability and infrastructure. In this article we focus our analysis on these four operator groups which command the majority (62%) of the SSA subscriptions. We also compare mobile performance on modern chipsets across ten countries. Those ten countries account for 59% of the region’s connections, including:

- East Africa: Kenya, Rwanda, Tanzania, and Uganda;

- Southern Africa: Democratic Republic of Congo, South Africa, and Botswana;

- West Africa: Côte d’Ivoire, Guinea, and Nigeria.

Key messages:

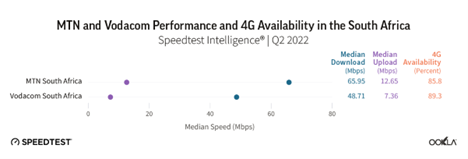

- Speedtest Intelligence® data shows that MTN South Africa delivered the fastest median download speeds across analyzed operators, at 65.95 Mbps in Q2 2022. However, Vodacom in Johannesburg was the fastest operator considering speeds across top cities, reaching 81.36 Mbps median download speed in Q2 2022. In South Africa, MTN outperformed Vodacom in terms of median mobile speeds during Q2 2022.

- Comparing Airtel and MTN performance across the three countries they operate in, Airtel took the top spot in Nigeria, both in terms of median download and upload speed in Q2 2022, while in Uganda and Rwanda there were no winners. Such was the case in Botswana too, where there was no winner between Mascom and Orange.

- In Côte d’Ivoire, MTN took the market lead versus Orange in Q2 2022, whereas in Guinea, the situation was reversed and Orange took the top spot.

- Vodacom subsidiary Safaricom won the accolade in Kenya vis a vis Airtel, in Tanzania there was no clear winner as Vodacom won the download speed and Airtel the upload.

- In the DRC, which is host to three of the operator groups, there was no winner overall, although Orange was the top player in terms of download speeds.

- During Q2 2022, South African network performance has been affected by load shedding, which resulted in consumer reporting not having signal and access to mobile internet according to Downdetector®.

MTN South Africa delivered the fastest median download speed in Q2 2022

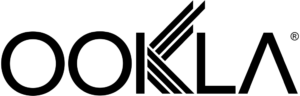

Using Speedtest Intelligence® data we compared mobile performance in Q2 2022 on modern chipsets across 21 operators. Our results show that median download speeds ranged between 2.89 Mbps (MTN Guinea) and 65.95 Mbps (MTN South Africa). Median upload speeds varied between 1.55 Mbps (MTN Guinea) and 14.84 Mbps (Airtel Uganda).

We can clearly see the impact that 5G has on overall performance as South African operators came first thanks to having 5G networks in place. MTN South Africa was well ahead of the rest of operators, despite facing challenges with load shedding, with median download speed of 65.95 Mbps, followed by Vodacom South Africa with a median download speed of 48.70 Mbps. If we take 5G out of the equation, Safaricom Kenya was the fastest operator among the analyzed operators.

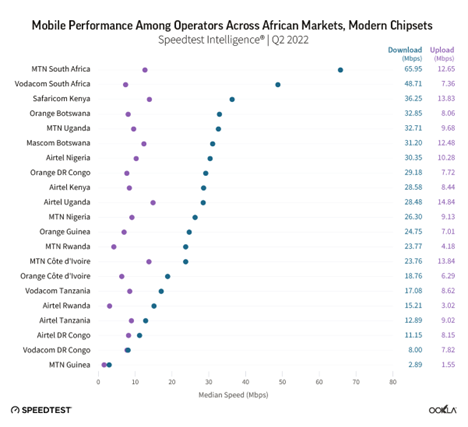

Vodafone in Johannesburg stole the show

When it comes to mobile speeds in capital cities, it is not surprising that cities that have 5G networks came top of the list. As such, Johannesburg led the pack, with a median download speed of 66.54 Mbps, ahead of Cape Town at 49.22 Mbps. Vodacom got ahead of MTN in Johannesburg and was the fastest operator across 12 cities we analyzed, with a median download speed of 81.36 Mbps in Q2 2022 compared to 73.83 Mbps in Q1 2022. MTN was faster in Cape Town. Taking 5G out of the equation, Orange in Gaborone, the capital city of Botswana, achieved median download speeds of 39.46 Mbps.

MTN got ahead of Orange, Airtel, and Vodacom

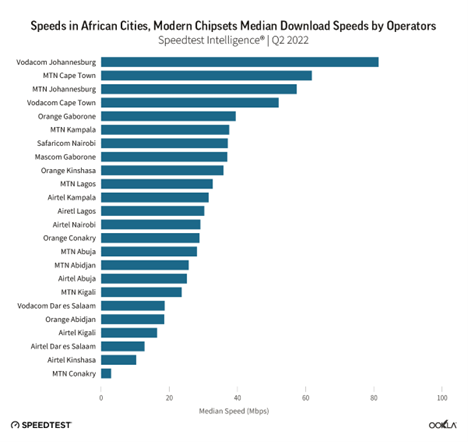

Using Speedtest Intelligence data for Q2 2022, we compared mobile performance on modern chipsets and 4G Availability in the countries where Airtel, Orange, Vodacom, and MTN operate.

MTN outperformed Orange in Côte d’Ivoire and Vodacom in South Africa, both in terms of median download and upload speeds. While MTN had better download speed in the Democratic Republic of Congo, in Rwanda MTN performed better than Airtel with regards to median download speed. Orange took the top spot in Guinea, Airtel in Nigeria, and Safaricom in Kenya. In the rest of the countries, the difference in mobile performance was either not statistically significant or there was not a single operator that delivered better performance across both upstream and downstream.

We have included a more detailed analysis below.

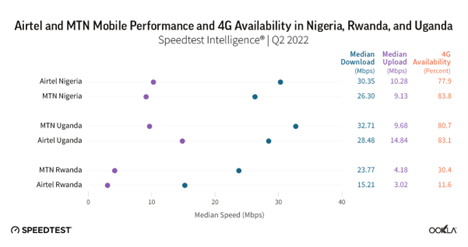

Airtel versus MTN

Nigeria: Airtel took the top spot in terms of speed, MTN had better 4G Availability.

- As of Q2 2022, MTN Nigeria commanded 38.9% of Nigeria’s mobile users, with its 74.1 million subscribers almost double that of Airtel’s 46.0 million.

- Yet when it comes to mobile performance, Airtel Nigeria was ahead of MTN; in Q2 2022, Airtel Nigeria recorded a median download speed of 30.35 Mbps and a median upload speed of 10.28 Mbps, both of which topped those of MTN (26.30 Mbps download and 9.13 Mbps upload).

- Those speeds are set to increase as both companies have invested heavily into network infrastructure, with a combined investment of N208.5 billion ($502 million). The investment translates into an increase in 4G Availability as well. In Q2 2022, MTN had 83.8% 4G Availability compared to Airtel’s 77.9%.

Uganda: MTN ahead in download speed, Airtel had better upload.

- MTN’s 53.9% market share in Uganda translates to 16.3 million subscribers as of Q2 2022. Meanwhile, Airtel Uganda had a 45.1% market share (13.6 million).

- In Q2 2022, MTN Uganda was ahead of Airtel in terms of median download speeds, while Airtel had at least a 33% better median upload speed.

- In its recent annual report, Airtel announced that its 4G network was available to 90% of the population of Uganda, effectively providing coverage to the entire country. To aid its capacity, Airtel Uganda is also rolling out fiber, which helps to boost data throughput. For example, in the capital – Kampala – 79% of sites are connected through fiber. In terms of 4G Availability, MTN and Airtel came closely together at 83.1% and 80.7%, respectively.

Rwanda: MTN took the top spot for median download and 4G Availability

- MTN Rwanda increased its customer base by 1.7% year-on-year (YoY) to 6.6 million as of Q2 2022, expanding its lead in customer market share by 2.7 pp to 65.6%, Airtel controlled the remainder of the market.

- MTN Rwanda performed better than Airtel when it comes to median download speed: MTN had a 33% better median download speed.

- MTN Rwanda also had the best 4G Availability order to further increase smartphone penetration in the market and stimulate demand for data services, in June 2022, MTN Rwanda and Bank of Kigali (BK Group) signed an agreement to introduce device financing. This program will enable customers to spread over the cost of smartphones over an extended period of time.

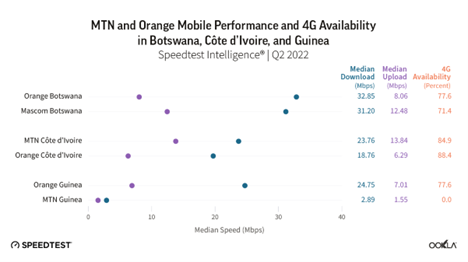

MTN versus Orange

Botswana: Mascom and Orange performed similarly.

- Mascom (MTN) is the largest operator in Botswana, with 1.8 million subscribers in Q2 2022 and a 42.2% market share. Orange is the second largest operator, ending Q2 2022 with 1.7 million subscribers and 41.2% market share.

- Comparing the operators’ performance, the difference in terms of both median download and upload speeds as well as 4G Availability was not statistically significant and there is no winner.

Côte d’Ivoire: MTN stole the show in terms of performance.

- MTN had 38.9% subscriber market share in Côte d’Ivoire as of Q2 2022, which equates to 15.8 million subscribers, Orange ended Q2 2022 with 14.6 million subscribers (36.0% market share).

- MTN had faster median download and upload speeds compared to that of Orange, and the gap might widen even more going forward. In December 2021, MTN Côte d’Ivoire started 5G trials at nine locations in Abidjan. This was followed by the Ivoirian government adopting a roadmap for the launch of 5G technology in February this year, with 5G networks expected to go live by 2023.

Guinea: Orange commands the Guinean market.

- Market leader, Orange, which switched on its 4G network in 2019, accounted for 60% of mobile connections in Q2 2022 in Guinea, ahead of MTN (30.8%). According to telecom regulator ARPT, in Q4 2021, Orange held a 69.9% market share of mobile Internet traffic, while MTN held 26.9%.

- Orange was far ahead in terms of performance during Q2 2022. Part of the reason being that Orange is currently the sole provider of 4G services in the country, with MTN awarded a 4G operating license in February 2022 but it has not launched the services yet.

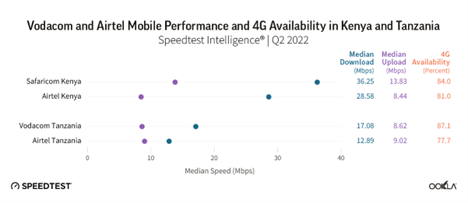

Vodacom versus Airtel

Kenya: Safaricom won across all metrics.

- Safaricom is the largest operator in Kenya by a mile, with 67.1% market share (equivalent to 42.7 million connections) ahead of Airtel 25.9% (16.4 million).

- Safaricom also exhibited better network performance during Q2 2022, with a median download speed of 36.25 Mbps and upload of 13.83 Mbps, compared to Airtel (28.58 Mbps download speed and 8.44 Mbps upload).

- Safaricom has signed a multi-year contract with satellite provider Intelsat to modernize its network and expand LTE coverage. Safricom is focusing more on 4G rather than pursuing 5G as the cost of 5G handsets is prohibitive and slowing down its 5G expansion. In a bid to increase smartphone usage on its network, Safaricom partnered with Google to allow its customers to pay for 4G-enabled phones in installments. Customers pay as little as KES 20 ($0.34) per day over a nine-month period. The operator’s ultimate target is to upgrade about four million 2G and 3G phones to 4G. Safaricom had also partnered with Vivo to sell 4G phones.

- Meanwhile, Safaricom’s top competitor in Kenya, Airtel Kenya, paid $5 million as part of an agreement with the regulator to acquire and operate spectrum from 2015 through 2025. The operator has a remaining balance of $10 million to settle over the next three years, with a cumulative payout of $20 million.

Tanzania: Vodacom did better on download speeds.

- Tanzania’s mobile market is served by seven mobile operators, making it one of the most competitive markets in Sub-Saharan Africa. Vodacom ended June 2022 with 15.6 million subscribers, which translated into a 28.8% market share, GSMA Intelligence estimates that Airtel held a 27.4% market share in Q2 2022, equivalent to 14.8 million subscriptions.

- Vodacom’s median download speeds were ahead of Airtel’s – 17.08 Mbps versus 12.89 Mbps. Vodacom’s 4G Availability also topped Airtel’s at 87.1%, compared to 77.7%. To further increase its network reach, in May 2022, Vodacom Tanzania signed a deal with the National ICT Broadband Backbone (NICTBB), a national fiber optic cable network. This will allow Vodacom to increase rural connectivity after an initial investment of €5.82 million ($6.22 million) in October 2021. Furthermore, in September 2022, Vodacom launched 5G mobile service in Dar es Salaam with a target to expand to approximately 230 locations in other cities. In time, as more users migrate to 5G smartphones and tariffs this will lead to Vodacom improving its speeds further.

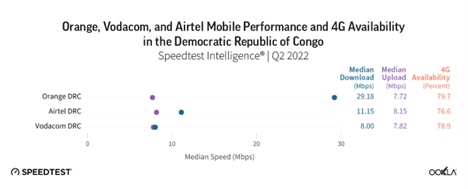

Orange versus Vodacom versus Airtel

Democratic Republic of Congo: Orange was the top player in terms of download speeds.

- The Democratic Republic of Congo is the third largest country by population across the SSA and largest by area. It hosts seven mobile operators, including three of the four groups we analyze — Vodacom, MTN, Orange, and Airtel.

- In Q2 2022, Vodacom was the largest operator by number of connections with market share of 35.3% and 16.0 million connections, followed by Airtel (12.8 million) and Orange (12.2 million).

- Comparing operators’ mobile performance, Orange led in terms of median download speed (29.18 Mbps), ahead of Airtel (11.15 Mbps) and Vodacom (8.00 Mbps). Operators came head to head with regards to 4G Availability.

MTN versus Vodacom

South Africa: MTN outperformed Vodacom in terms of mobile speeds.

- Vodacom ended June 2022 with 45.1 million subscriptions equivalent to a 41% market share. MTN is the second largest player with 35.3 million connections, and had a net addition of almost 837,000 in the quarter. MTN noted in their results that: “The overall growth in the base was particularly encouraging given the significant ramp-up in load shedding, which impacts systems and typically constrains new customer acquisitions.”

- The South African market might see a consolidation if the proposed acquisition of Telkom by MTN gets the green light. This will change the market dynamics as MTN will become the number one player by number of connections.

- In terms of mobile performance, MTN had better median download and upload speeds, while Vodacom led on 4G Availability. We have commented on the state of the 5G market in South Africa in our recent article.

Mobile networks don’t exist in a vacuum

It is important to note that mobile performance is impacted by a number of factors, including underlying infrastructure such as access to fiber backhaul and reliable power supply, spectrum availability as well as end-user devices to name a few. Case in point is the fact that, despite being the regional leaders when it comes to mobile performance, South African operators faced issues related to infrastructure reliability and availability over the past three months. Operating conditions in South Africa were affected by increased incidents of rolling power outages (load shedding) and there are no signs of respite.

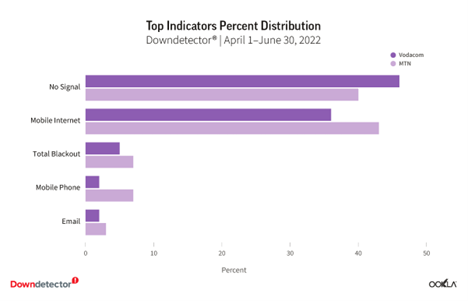

We have seen these outages reflected in Downdetector® data, which is the world’s most popular platform for user-reported service status information. During Q2 2022 users reported 46,810 incidents for Vodacom and 34,882 problems for MTN. There were two top issues reported: no signal and no mobile internet: lack of signal accounted for the majority (46%) of Vodacom’s reported outages, followed by inability to access mobile internet (36%). This has been reversed for MTN — majority of issues were related to mobile internet (43%), followed by no signal (40%). Noteworthy is the fact that there were reports of total blackouts: 7% for Vodacom and 5% for MTN.

Vodacom commented in its results call for the quarter ended on June 30, 2022 that they already spent ZAR 1.7 billion ($99.9 million) on batteries and generators to offset the impact of load shedding with further ZAR 500 million ($29.4 million) allocated to battery purchases. Vodacom also continues to optimize site utilization by using IoT.nxt technology to reduce the amount of energy consumption per site but also piloting wind power and solar projects. While its competitor, MTN, stated in its interim results report that it “rolled out a comprehensive network resilience plan including additional batteries, generators and enhanced security features.”

We will continue to monitor mobile networks performance across Africa, looking at how various factors affect it. If you are interested in benchmarking your performance or if you’d like to learn more about internet speeds and performance in other markets around the world visit the Speedtest Global Index™.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.