The climate finance definition

How would you define climate finance? Is your definition based on the United Nations Framework Convention on Climate Change1, or the Cancun Agreement2? Is it influenced by whether you serve as a public or public actor, or the context of your work?

While the term “climate finance” has come to feature prominently in headlines globally, it is an evolving concept often clouded in jargon. This has inadvertently brought confusion to its application – even among those working directly in the sector. Without a universal definition of “climate finance”, it is difficult to develop strategies to ensure climate finance flows are impactful and reach the most vulnerable.

How does climate finance flow?

The climate finance conundrum can partially be answered by understanding its evolution. At the 2009 climate summit in Copenhagen (COP15), rich nations pledged to channel US$100 billion a year to fewer wealthy nations by 2020 to help them adapt to climate change and further mitigate temperature rises. This initiated the flow of climate finance from donor countries to low- and middle-income countries (LMICs).

Interactive graph source: Judith Mulwa, Insights Manager, GSMA

Six years later, the Paris Agreement (2015) aimed to balance climate finance between mitigation and adaptation projects. As a result, international governments agreed that a significant share of new multilateral, multi-billion-dollar funding should be channelled through the Green Climate Fund to achieve their Nationally Determined Contributions (NDCs). Despite the pledges to finance for climate change, adaptation continues to make up only a small percentage of climate finance – currently around 20 percent3.

As a result, many countries sought added sources of financing from actors other than governments – marking a shift to the private sector. Efforts to engage the private sector to meet the Paris goals started to gain momentum, largely due to the adoption of the Sustainable Development Goals (SDGs) of the 2030 Agenda for Sustainable Development in 2016. The Agenda has since then explicitly engaged the private sector as a key actor in its delivery and meeting SDG 13 on Climate Action.

Actions by the private sector

The increased willingness of the private sector to “walk the talk” in its commitments to addressing climate change has raised a surge in interest in sustainable business plans that are compatible with a 1.5°C future. The private sector has developed products and technologies that can catalyse and deliver climate finance effectively and transparently. For example, mobile and digital technologies have the potential to transform climate finance by making data available that can be used in the allocation of finances to climate change initiatives. Investors have also focused on financing innovative or unproven technologies and business models. Some innovations have been bold enough to venture into the Voluntary Carbon Markets, despite extensive costs associated with the market.

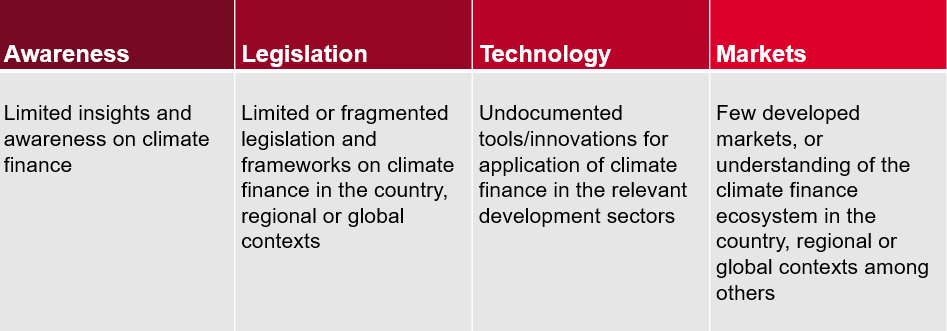

Despite these efforts, the climate finance nexus has faced various challenges that include, but are not limited to, the following:

Moving the dial of climate financing in LMICs

The appetite for understanding contemporary trends and applications of climate finance (e.g. National Climate Change) has led various practitioners to publish some important, complementary research reports on this topic4. However, it is still unclear what role technology can play in the delivery of climate finance in LMICs. As a result, the GSMA ClimateTech team is currently conducting innovative research to explore the role of mobile and digital technology in accelerating climate investment and financing in low- and middle-income countries.

The research will identify climate finance mechanisms (e.g. National Climate Change Funds, Voluntary Carbon Credit market, etc) or types (e.g., loans, grants, equity, insurance, etc) that are most ready for digital innovation and can deliver socio-economic impact at the local level. In doing so, the GSMA seeks to find and share case studies and recommendations to strengthen future climate finance mechanisms. The study will present ideal business models, as well as outline the benefits that initiatives currently (or could eventually) deliver when using digital technology or engaging with organizations, such as mobile network operators.

Contribute to GSMA’s climate finance research

The GSMA ClimateTech team invites practitioners from diverse sectors to take part in the ongoing climate finance research. If this work interests you and your organization, please do get in touch here.

We would love to leverage your insights and networks to further explore the future of climate finance in LMICs, which will be further discussed in an upcoming roundtable at the 2022 MWC Africa event in Kigali on 25-27 October 2022. To attend the event, please register your interest please email here.

Watch out for the upcoming ClimateTech research report on Climate Finance in the coming months – subscribe to our newsletter here to be notified.

[1] (UNFCCC) defines climate finance as local, national, or transnational financing – drawn from public, private and alternative sources of financing – that seeks to support the two facets of climate change; mitigation and adaptation.

[2] Climate finance even more narrowly, incorporating the notion of “incrementality” or “additionality

[3] United Nations

[4] CPI global climate finance landscape report track financial flows for climate adaptation and mitigation from various sources, including governments, bilateral aid agencies, climate funds, and bilateral, multilateral, and national financial institutions. IIED research analyses the leading international climate funds to understand how effective they are in getting finance to the local level. It also looks at what design features enable or prevent local-level finance. FSD Africa appreciates that the private sector has significant potential to meet Africa’s climate finance.