In a previous blog, we shared our early insights into the mobile money industry’s transition towards a transformative new business model: a ‘payments as a platform’ approach that connects consumers with third-party services across a range of industries.

The platform-based approach is not only about enlarging the ecosystem and incorporating more partners and third parties into the mobile money platform. It is about deepening engagement with individuals and businesses by offering a frictionless end-to-end experience.

Our newly-released publication delves further into this topic and addresses the following key questions: how should the mobile money business model evolve to meet the changing needs of individuals and small businesses, and what is required to make this shift?

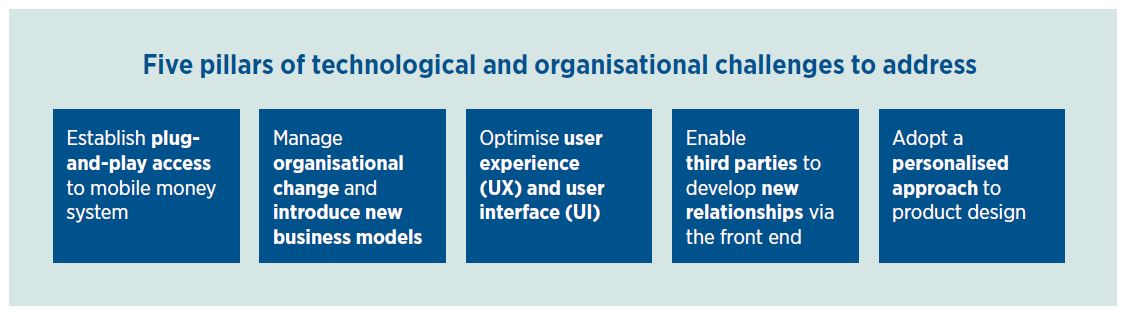

In today’s paper, we argue that while mobile money providers already possess the necessary skills and resources, they will need to confront a number of organisational and technological challenges to transition to a platform-based model. We have grouped these technological and organisational aspects into five key pillars, shown below:

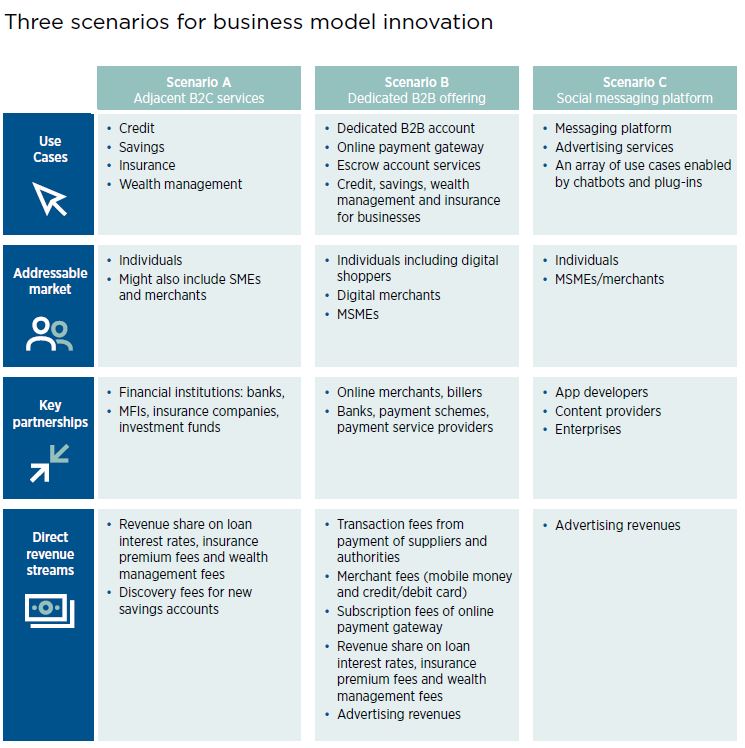

We have also identified potential scenarios that would help mobile money providers address these five key technological and organisational considerations and embrace a more diversified revenue model. These scenarios require forming partnerships with third parties (particularly banks), offering enterprise solutions and leveraging the opportunities of converging messaging and payments. See below for an overview of the three identified Scenarios (A,B,C):

We carried out financial modelling to evaluate the impact of launching these scenarios on the economics of mobile money, looking at the impact of the scenarios individually and collectively. To fully transition away from a revenue model heavily reliant on customer fees to a diversified revenue model leveraging the payments as a platform approach, we recommend that providers launch the three scenarios together. The results of our financial modelling showed that the combined impact of adopting Scenarios A, B and C has the potential to increase revenue 2.3 times, and EBITDA 3.1 times, by year seven after launch.

Who will benefit from the ‘payments as a platform’ approach?

For the underserved, the platform-based approach will open access to a full suite of new use cases to meet the growing needs of consumers in emerging markets, from pay-as-you-go solar and real-time agricultural market data to personal financial management solutions. The benefits will also accrue to start-ups and innovators, banks and smaller financial institutions who will join the platform. Entrepreneurs and small businesses form the backbone of informal and local economies in emerging markets. By enabling them to participate in the digital economy via the platform, providers will stimulate development in this sector, helping to drive employment and economic growth and enabling previously excluded segments to become more active in the economy.

The ‘payments as a platform’ approach will also reduce the dependency of mobile money provider’s on revenues stemming from customer fees. This transition will enable them to transform their revenue model and expand their value proposition to new products and adjacent revenue streams to ensure their business remains sustainable in an increasingly competitive landscape.

The GSMA encourages the transition to a payments as a platform approach, which will not only make mobile money a more sustainable and profitable venture for mobile operators, but will contribute to the economic empowerment of individuals, communities and businesses.

Relevant Blogs and Resources

Wednesday 26 September, 2018 | Blog | Building the financial ecosystem | English | Global | Global | Interoperability | Mobile Money | Uncategorized

The mobile money industry’s transition to a platform-based business model