This blog is the first in a two-part series on how digital platforms can help emerging economies recover from the economic impact of the COVID-19 pandemic. The second blog will explore the same topic for the Asia Pacific region.

This blog is co-authored by Matthew Dunn, an Associate at Cenfri. Cenfri is an economic impact agency focused on financial-sector development and digital transformation for sustainable development in Africa and beyond.

The global COVID-19 pandemic has emphasised the importance of connectedness – and micro, small and medium sized enterprises (MSMEs) across Africa are no exception. As MSMEs begin a path to recovery in 2021, digital platforms can be a way to get them reconnected.

The impact of COVID-19 on MSMEs in Africa

MSMEs play a vital role in the economic development of African countries by driving economic growth and providing employment, accounting for 90 per cent of trade in Sub-Saharan Africa. However, due to their smaller size, restricted resources, and limited contingency plans for supply chain disruptions, they have been highly vulnerable to the consequences of COVID-19 lockdowns. The implications of social distancing measures and curfews mean that microentrepreneurs are more likely to be disproportionately economically affected, as they typically operate in densely populated areas, relying on footfall in physical marketplaces for sales and marketing of products and services.

In May 2020, 87 per cent of businesses in Africa reported fearing for their survival following restrictions related to the pandemic and for those businesses that do survive, many anticipate a slow and protracted road to recovery.

The following table outlines the COVID-19 consequences for MSMEs, as laid out in a study by the OECD:

| Supply-side implications | Demand-side implications |

| Reduced labour supply due to employees being unwell, needing to look after dependents or children who are at home due to school closures. | Loss of demand and revenue affects MSME ability to function, causing severe liquidity shortages. |

| Lockdowns, quarantines and curfews lead to drops in capacity utilisation. | Loss of consumer income, fear of infection and increased uncertainty causes reduction in spending and consumption. |

| Interrupted supply chains lead to shortages of parts and intermediate goods. |

What is clear is that MSMEs are likely to need additional support if they are to survive and, in the medium to long term, begin to grow their operations once again.

How digital platforms can support MSME recovery and development

Recent years have seen the rapid emergence of digital platforms in industries such as transport, retail, travel and services. A digital platform is defined as a technology-enabled business model that creates value by facilitating exchanges between two or more interdependent groups. Research by Cenfri shows the number of digital platforms in operation across Africa increased by 37 per cent between 2018 and 2019. Platforms such as Jumia, Bolt, SweepSouth and Khula have played a key role in lowering the barriers to digitisation for MSMEs by providing relatively mature and easy-to-manoeuvre digital ecosystems at a reasonable cost thanks to economies of scale.

As a result of the COVID-19 pandemic, MSMEs may look to further rely on digital platform partnerships as a way to support their recovery, build resilience and drive future growth. Digital platforms offer the following benefits for MSMEs:

- Broadening customer reach by matching consumers and suppliers through established platforms like Jumia or Konga. This also offers MSMEs the opportunity to access new markets both locally and internationally.

- Providing access to liquidity to cover ongoing operating and fixed costs, such as rent and labour expenses, when income flows become unreliable. Platforms have provided an alternative channel for MSMEs to access liquidity, especially when lockdown requirements have made it challenging to physically visit financial institutions. In Kenya, for instance, Twiga Foods is currently piloting its own short-term credit solution for vendors and engaging with financial institutions to partner on a credit product. In this way, MSMEs will have access to crucial financing to ensure survival.

- Lowering the cost of transacting through innovative digital financial services such as mobile money. In 2019, Cenfri found mobile payment channels were present on more than half of the 365 digital platforms operating across eight focus countries, a 17 per cent increase year-on-year. In East Africa in particular, mobile payment channels continue to feature strongly on digital platforms.

- Offering online payment for offline MSMEs, such as the mobile payment platform offered by Cape Town-based Krowdbox, which enables start-ups and MSMEs to manage, receive and track online payments from their customers.

- Digitising operations and providing access to affordable capital, as offered by Ghana-based fintech start-up, OZÉ, which helps small business grow by recording their sales, expenses, payables and receivables.

- Enabling last mile delivery through courier services – mobile and in-app notifications are a crucial linkage to support this advantage. Kenyan delivery platform, Sendy, offers last mile package delivery, accepts M-Pesa payments and provides insurance on packages.

Farmcrowdy: A virtual marketplace for farmers

In Nigeria, FarmCrowdy is an agritech platform operating a network of over 800 aggregation centres and sourcing produce from over 25,000 small-scale farmers since it started in 2016. Instead of dealing with farmers on an individual basis, it selects crops and locations to invest in and then engages with farmers associations or community leaders to enter into commercial agreements. Once farmers and crops are identified, FarmCrowdy provides inputs such as seeds and fertilisers as well as technical support to individual farmers. FarmCrowdy registered a 20 per cent increase in the first quarter of 2020 compared to the same period in 2019 due to the increased interest of consumers in online commerce solutions. FarmCrowdy also provides a link to a sister crowdfunding platform called CrowdInvest, in which individual investors can fund FarmCrowdy initiatives. The platform’s ultimate buyers can be large-scale firms, including both those in Nigeria and international importers, as well as individual consumers in the local market.

Source: (World Bank, 2020)

Mobile operators enabling the rise of digital platforms

Since MSMEs are vital to African economies, improving their productivity presents a significant opportunity for mobile operators. A report by the GSMA Digital Identity programme states that ‘mobile is uniquely positioned to deliver the critical services and information that SME owners need to grow their business, increase their customer base, make better-informed decisions, manage their day-to-day finances and contribute to the local economy.’

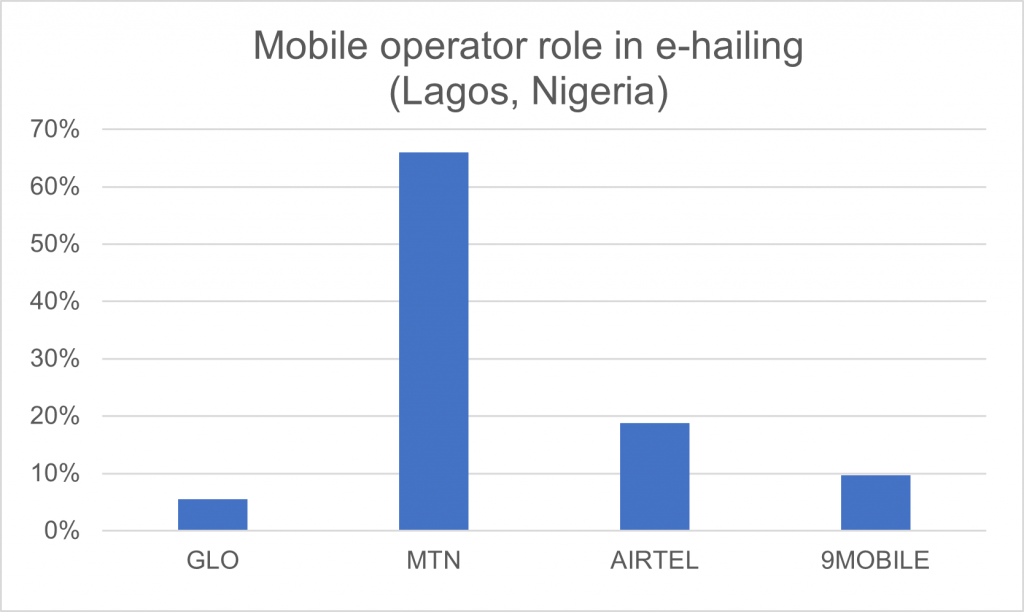

For MSMEs making the shift to digital operations and the digital platforms they partner with, the opportunities to discover more about their consumers and shape marketing strategies is likely to see them become increasingly reliant on consumer information held by mobile operators. In Figure 1, workers on e-hailing platforms in Nigeria rely on a range of mobile operators to engage with the platform and make a living. This big data is already a crucial asset for mobile operators, and as more of Africa goes mobile, this will continue to be more lucrative.

Figure 1: Proportion of surveyed e-hailing drivers (MSMEs) using mobile network operators in Nigeria

Source: Lagos Business School (2020)

A prime example of mobile operator collaboration with digital platforms is ride-hailing start-up Gozem and MTN Benin, creating mutual value by facilitating access to affordable transport for MTN Benin subscribers, while reducing cost barriers for Gozem users. Their zero-rating partnership enables MTN subscribers to order transport via Gozem’s app without using up their mobile data.

Looking ahead, MSMEs that can leverage the benefits of digital platforms and mobile operators will more easily be able to rebuild and relaunch their businesses. But barriers to digitisation still exist — including cost, access, and lack of familiarity. Effective digitisation of MSMEs will require the collaboration of industry players to develop effective digital ecosystems, offer training for MSMEs to leverage these platforms, and provide financial tools and resources to help them plan for the future.

The Ecosystem Accelerator programme is supported by the UK Foreign, Commonwealth & Development Office (FCDO), the Australian Government, the GSMA and its members.