Appendix: connecting the world through mobile

The global unique subscriber base for mobile telecommunications grew by 2.5% in the previous 12 months, reaching 5.6 billion in 2023. Growth in the unique subscriber segment is driven by LMICs across South Asia, South America and Sub-Saharan Africa. These regions are forecasted to grow by 340 million subscribers over the next six years.

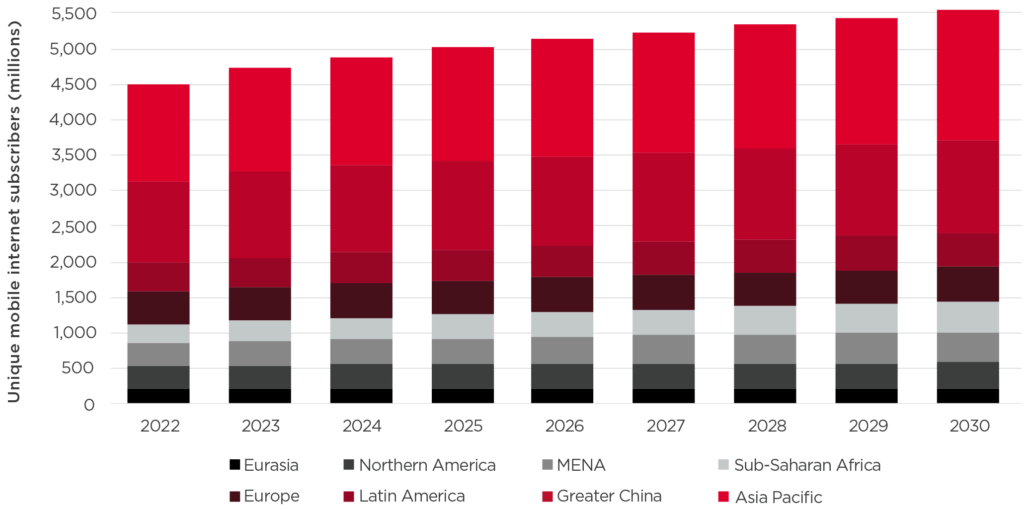

The mobile internet subscriber base grew by 5.1% in the previous 12 months, fuelled by growth in developing markets in South Asia and Sub-Saharan Africa.Recent regulator and mobile operator strategies that have increased the coverage and quality of long-term evolution (LTE) have catapulted the number of mobile internet subscribers to 4.7 billion.

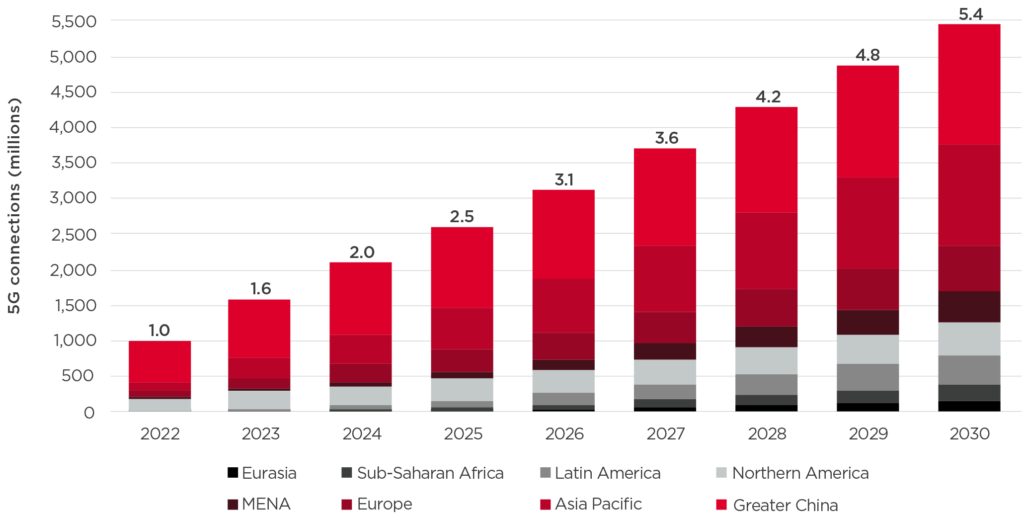

GSMA Intelligence forecasts that 5G connections will grow by more than 170% between 2023 and 2028 to reach 4.3 billion connections overall, with markets outside North America and East Asia launching more networks within the next two years.

Mobile operators planned to invest approximately 85% of capital expenditure (CapEx) in 5G in 2023 and more LMICs are shifting investments to 5G to meet consumer demand for data. The highest growth rates will be observed in Latin America, South Asia and Western Europe.

GSMA Intelligence forecasts that mobile operators will boost revenues by 1.8% CAGR between 2023 and 2030 to r each$1.3 trillion. While connections will continue to increase, a lower subscriber growth rate, coupled with declining levels of ARPU, will produce this modest increase.

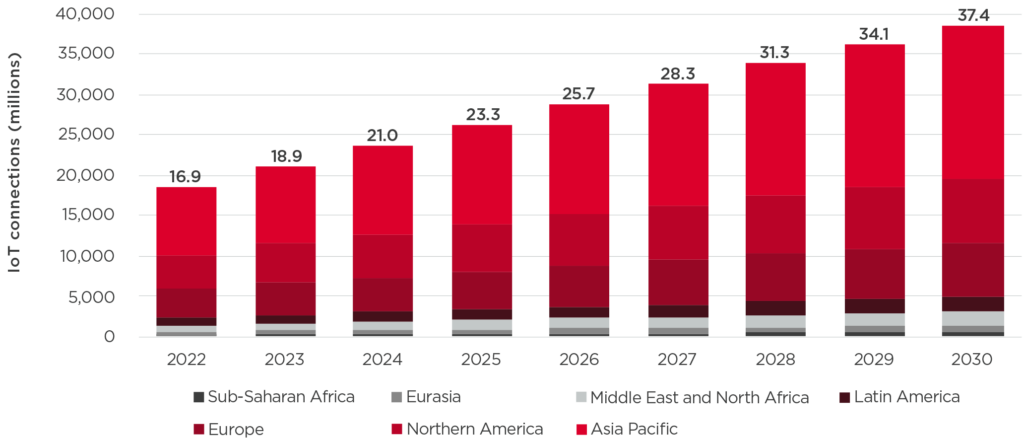

Furthermore, GSMA Intelligence forecasts that the total number of IoT connections (cellular and non-cellular) globally will reach 26.1 billion in 2025 and rise to 38.5 billion by 2030, 5.8 billion of which will

be licensed cellular technologies (including 5G). While the pandemic had an adverse impact on the uptake of 5G, growth has returned in both the enterprise and consumer sectors.

GSMA Intelligence

GSMA Intelligence is the definitive source of mobile industry insights, forecasts and research used around the world for benchmarking and business planning.

The analysis covers five key areas: 5G and network transformation; spectrum; IoT and the wider enterprise space; the digital consumer; and fixed and pay-TV. Covering every mobile operator, network and MVNO in every country worldwide, the team of analysts and experts use their deep understanding of markets, technologies and regulatory issues to identify and understand mobile trends and form captivating analysis on the topics shaping the mobile industry.

Global coverage

GSMA Intelligence publishes data and insights spanning 240 markets and 900 mobile and fixed network operators.

Comprising more than 50 million individual data points, GSMA Intelligence combines historical and forecast data from the growth of the industry in 2000 with forecasts out to 2030. New data is added every day.

Numerous data types

The data includes metrics on mobile subscribers and connections, operational and financial data and socio-economic measures that complement the core data sets. Primary research conducted by the GSMA adds insight to more than 7,000 network deployments to date.

White papers and reports from across the GSMA and weekly bulletins are also available as part of the service.

Powerful data tools

Information in GSMA Intelligence is made easy to use by a range of data selection tools such as multifaceted search, rankings, filters, dashboards and a real-time data and news feed, as well as the ability to export data into Excel and add graphs and charts to presentations.