Government and mobile industry set the stage for 5G in assignment of 2.3 GHz, 3.5 GHz, and 26 GHz to mobile.

O blog também está disponível em português aqui

Brazil’s recent multi-band auction was one of the largest in history and it was designed to drive a period of intense investment and competition in 5G services. Brazil has taken regional and global leadership in spectrum management for some time. Thanks to a successful 700 MHz DSO and LTE expansion process using low- and mid-band spectrum, 99.1% of the population is currently covered with 4G.

The new 5G era is now a reality in Brazil. The recent auction, with signed contracts on December 7, made more than 3.7 GHz available for bids.

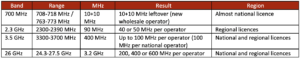

There was a lot of interest on the 2.3 and 3.5 GHz bands by current and new operators, resulting in an average premium of 200% in regional blocks and almost 40% in national licences. National operators ended up with 40 MHz or 50 MHz in 2.3 GHz and 100 MHz each in 3.5 GHz. These channel sizes, which follow industry best practice, will provide a strong launchpad for 5G.

When it came to the 26 GHz band, strategies were different by national operators, but all were able to acquire from 200 MHz to 600 MHz. It marked a great success for the second mmWave auction in the region – one of the first with the full 26 GHz range available anywhere in the world.

Policies promoting investment

The successful spectrum assignment process focussed on striking a balance between government objectives, operators’ requirements and consumer welfare.

This process began several years ago with the modernisation of various Brazilian regulatory policies that were designed to support investment. In 2019, an updated telecommunications law was introduced with three crucial aspects:

- Introduction of longer licence terms

- A secondary spectrum market

- Unlimited renewal terms

These decisions were crucial to support current networks, attract new players and guarantee better services to end users. Certain auction policies also focused on long-term network investment. New payment terms were introduced including yearly instalments for the duration of the licence, the exchange of the premium for investments and the deduction of obligation costs from reserve prices. The auction conditions also included support of Brazilian policy objectives such as the coverage of motorways, protection of adjacent services, 4G in remote areas and a set timeline for 5G to be introduced.

TVRO Ku-band migration

Another aspect of long-term planning surrounded the use of Television Receive Only (TVRO) services. These services are used in certain countries around the world, including in Latin America and South-East Asia, as an opportunistic application in the fixed satellite service (FSS) bands.

In Brazil, these services have been using spectrum at 3.5 GHz. The 3.5 GHz range is already used in the majority of commercial 5G networks worldwide and has the largest ecosystem of devices. As such, it is a crucial 5G band and a solution for the TVRO services was needed.

Initial considerations centred around either continuing TVRO services above 3.8 GHz or maintaining them in 3.6 GHz. To achieve this, Anatel, broadcasters, operators and suppliers worked to develop a bespoke LNB filter with a performance gain above the previous commercially available devices. The model has been finalised, is 100% effective and is now commercially available.

However, as the extent of 5G mid-band spectrum needs became clearer during the process, and after careful consideration with the entire industry, the decision took another path. Brazil decided that TVRO services would be migrated to the Ku-band.

This approach was seen to have several benefits, not least creating a pathway to the future availability of the 3.8-4.2 GHz range for 5G. Historically, Ku- and Ka-band satellite services have been more susceptible to rain fade and Brazil, which has periods of high rainfall, has been a strong supporter of C-band satellite services in times gone by. The Brazilian move follows a global trend of using higher bands for satellite. It shows confidence that the satellite industry has moved beyond reliance on C-band with the development of advanced satellite modulation techniques. Delivery of services in higher bands without rain fade issues is now becoming the global standard.

Lessons to follow

Research from Coleago Consulting on global mid-band 5G spectrum needs shows that careful consideration of 5G spectrum demand in the 2025-2030 timeframe is crucial. The research proposes that regulators make 2 GHz of mid-band spectrum available for the development of 5G, including FWA. Brazil has gone some way to making this capacity available and, with the move of TVRO to Ku-band, has the potential to go further in future.

Various aspects of the Brazilian process can be noted as best practice including:

- Cooperation among regulator, operators, vendors, broadcasters, academy and other stakeholders

- 20-year national licence terms, with presumption of unlimited renewals, and a secondary market framework

- Spectrum made available as soon as practical, with 400 MHz in 3.5 GHz

- Payment terms that encourage long-term investment

- Studies on TVRO protection leading to Ku-band migration. The development of the high-performance LNB filter may be replicated in countries where migration to the Ku band is not possible

- Long-term spectrum needs planning – relocation of legacy services paving the way to 5G in the 3.8-4.2 GHz range

5G is here and countries such as Brazil can serve as an inspiration. In these extraordinary times, effective spectrum licensing can benefit the whole society in the short term and in the longer term. This multi-band auction shows that Brazil is serious about ensuring that its citizens are ready to embrace the benefits of the future of mobile.