This blog is the second in a two-part series on the State of Mobile Money in Sub-Saharan Africa.

In our last post, we explored mobile money as the driving force for financial inclusion in Sub-Saharan Africa, and the increasing digitisation of use cases across different sectors – many of which were not imagined in the early days of mobile money. This post focuses on the future of mobile money. Looking ahead, we see three key areas of future growth in mobile money across Sub-Saharan Africa.

Africa’s mobile money sleeping giants

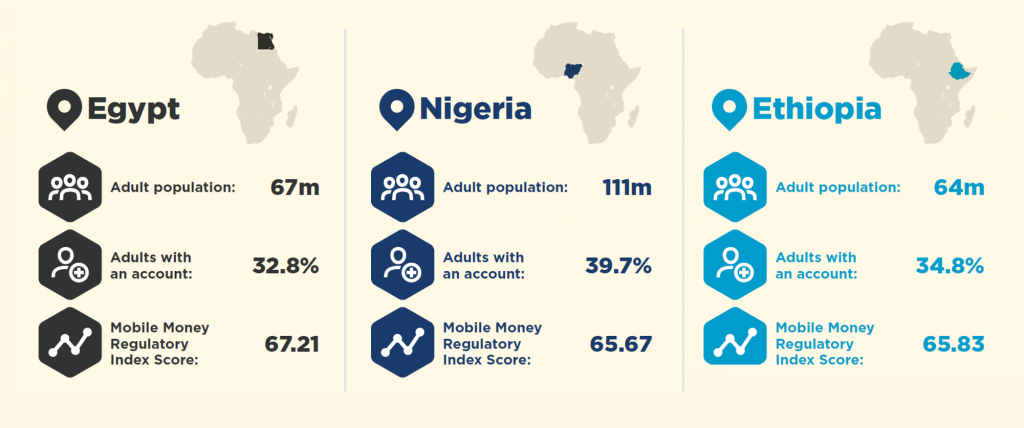

The average annual growth rate in account adoption across Sub-Saharan Africa is lower than the global average (13.6% vs 19.8%) and, in many markets, providers are shifting their focus on driving usage rather than acquiring new customers. However, there is still a tremendous opportunity to unlock growth and increase financial inclusion in the continent’s mobile money sleeping giants: Nigeria, Ethiopia and Egypt. Home to a combined adult population of over 242 million, Africa’s three most populated countries have experienced limited availability of mobile money services and low rates of financial inclusion.

All three markets have had unfavourable conditions for mobile money uptake, to date. In Nigeria and Egypt, for instance, regulatory frameworks have allowed few players to offer mobile money services. In Ethiopia, a strictly regulated telco, restrictions on competition, intermittent internet connectivity, and low levels of consumer trust and financial literacy have created barriers to uptake and market entry. These conditions are reflected in their low scores on the GSMA’s Mobile Money Regulatory Index.

But this won’t be the case for long. In 2018, Nigeria and Egypt softened their policies to allow new players to offer mobile money, including mobile network operators. Promising signs of Ethiopia moving closer to opening the mobile market are also emerging. We anticipate that these reforms could spark a wave of adoption in these three countries with the potential to unlock over 110 million new mobile money accounts in the next five years.

Sectors on the cusp of transformation: MSME and e-commerce

Micro, Small and Medium Enterprises (MSMEs) play a major role in economic development across the region. According to the IFC, MSMEs account to roughly 90% of all businesses across Sub-Saharan Africa, and contribute to 78% of the region’s employment. These figures are significantly higher when informal MSMEs are included. Despite this, the majority of MSMEs’ financial needs are not currently being met across the region. We see a huge opportunity for mobile money providers to bridge this gap and offer solutions tailored to MSMEs’ needs. In fact, our recent research in two Sub-Saharan African countries showed that approximately 80 per cent of MSMEs have a mobile money account and, of these, 83 per cent were using it for business needs.

Fortunately, mobile money providers in the region are increasingly recognising this opportunity. 46% of Sub-Saharan African respondents to our 2018 annual Global Adoption Survey highlighted building enterprise solutions as one of their top three strategic priorities. Mobile money offers a host of benefits to MSME customers, such as the proximity and service of agents, and for the flexibility and ease of processing a payment. Mobile money providers can capitalise on this untapped opportunity by offering MSMEs differentiated rates and tools that help with their day-to-day management of their business, such as customer analytics, inventory management and accounting.

A vibrant and growing MSME market is fundamental to achieve long-term economic growth and to create sustainable work opportunities for the growing young population in the region. One of the main pain-points hindering the sector’s growth is access to financing, both for working capital and investments. By digitising MSMEs’ economic activities that are often cash-based, inconsistent and undocumented, mobile money providers can help bridge the $528bn credit gap in the region. This requires partnerships with banks or financial institutions and fintech companies.

In 2018, value of e-commerce transactions facilitated by mobile money more than doubled across the region. This strong growth signals that more integrations are happening directly between operators and online businesses or through online payment gateways. Despite this impressive growth, e-commerce transactions represent only 0.3% of mobile money retail transactions in the region. A growing number of MSMEs across the region are moving towards marketing and selling their products across digital channels such as WhatsApp, Instagram, Facebook, and e-commerce platforms such as Jumia, OLX and SkyGarden.

Most of these channels do not have an integrated payment mechanism and the majority of transactions between sellers and buyers takes place off the platform through either cash-on-delivery or a P2P mobile money transaction. This is where we see a huge opportunity for mobile money providers to remove some of the pain-points for buyers and sellers by providing a seamless experience, and unlock the e-commerce potential across the region.

The untapped smartphone opportunity

Today in Sub-Saharan Africa, USSD remains the dominant channel for accessing mobile money services, accounting for over 90% of mobile money transactions. This demonstrates that the industry is continuing to reach those at the base of the economic pyramid. However, USSD protocol was not originally designed for customer-facing applications and therefore has restricted capabilities, such as limits on character count and a narrow range of languages. This hinders the ability of providers to share content and information, to on-board customers digitally and to offer locally relevant content.

The proliferation of mobile internet and smartphone adoption across the region is creating new and exciting opportunities to narrow the digital inclusion gap. In fact, across the region, smartphone adoption is expected to dramatically rise to 66% by 2025 with an estimated 280 million new mobile internet subscribers coming online. Mobile money providers therefore have a tremendous opportunity to leverage the sophisticated capabilities of smartphones and offer a diverse suite of products and services, which will ultimately boost customer engagement and mobile money use.

Sub-Saharan Africa has come a long way in the past eight years, but there are still strides to be made. The growing young population across the region is a unique asset for reshaping the future of local communities, and for stimulating innovation and economic growth. This will not be possible, however, without furthering the digitisation of the economy and converting the informal sector. Taking advantage of these opportunities requires sustained dialogue and collective practitioner cooperation among stakeholders, while at the same time keeping the needs of the underserved at the very centre of this evolution.