In the second half of 2018, the GSMA Mobile for Development (M4D) Utilities programme and the Consultative Group to Assist the Poor (CGAP) collaborated to explore the opportunities and challenges in offering digital payments in the water sector. In addition, the M4D Utilities programme also conducted a qualitative field research with Grundfos and mobile operator Safaricom to understand uptake of pay-as-you-go (PAYG) water services using mobile payments in Kenya. We discuss the findings from both these research projects in this blog.

Testing the waters: Results from CGAP-GSMA research

Written by Daniel Waldron, Financial Sector Specialist – CGAP.Since 2015 Daniel has led CGAP’s research into the impacts of financial inclusion on access to modern energy and safe water.

At CGAP, we share the GSMA’s belief that digital financial services (predominantly delivered using mobile money) can transform poor households’ ability to access basic services. But, it can also transform the providers of those services – shifting revenue collection to mobile money is one of the first steps that water and sanitation providers can take on the road to operational and financial sustainability.

But don’t take my word for it, just ask them. That is what CGAP and the GSMA Mobile for Development Utilities programme decided to do in 2018, when we partnered on a stocktaking of mobile payments in the water supply and sanitation sector (WSS). Together, we interviewed respondents from 25 organisations that provided water and sanitation services, hardware, and support across Africa, Asia, and Latin America.

We came away from the exercise encouraged by the impact that mobile payments and other mobile services are having for providers, but also freshly aware of the unique difficulties that WSS providers face when adapting innovations for their organisations. Looking back on a year’s worth of research that can be read here, three things jump out at me:

First, there is real money to be saved in digitising payments, and the WSS sector needs those savings more than anyone. As one CEO of a hardware/software provider told me, “changing the tariff (the regulated price of water) will literally take an act of parliament; we’ll all be dead before you can [do it].” His point was that WSS providers – his clients – were locked into below-cost prices. The only way to be sustainable was to cut their costs and become much, much more efficient. Mobile payments are cheaper than cash collections – ecological sanitation provider, SOIL, in Haiti, estimated that every mobile payment saved them $1.05 versus cash. In some cases, this enabled WSS operations to turn a small profit, in other cases, the savings were passed directly on to the end users.

Second, PAYG water is the wave of the future, but needs mobile payments to get there. Respondents told us that mobile payments were the cornerstone of their shift to prepaid, pay-as-you-go service models, such as water ATMs or in-home smart meters.

Without digital payments, they would have had to build out an entire cash-in, cash-out infrastructure, but with digital payments they were able to leverage the ‘cash-in-cash-out’ of mobile money operators (providing, of course, that infrastructure was in place). The combination of mobile money and prepaid service was enough to shift Safe Water Network, an organisation that builds and owns water treatment and distribution stations in Ghana, from a -30 per cent margin per cubic meter delivered, to a 1 per cent net profit.

Third, low-margin public service providers need more efficient channels to integrate with mobile money operators. Venture-backed start-ups may be able to devote resources to long-term, bespoke integrations. But container toilet companies and small water enterprises are operating on very small margins, and costly software integrations can rapidly exceed their budgets. Public goods such as open APIs and the IPN Hub are the only way that mobile ecosystems can expand to accommodate services that vitally need them.

Analysing mobile money usage in PAYG water – GSMA M4D Utilities research at Safaricom-Grundfos kiosks in Kenya

Written by Akanksha Sharma, Senior Insights Manager, GSMA M4D Utilities

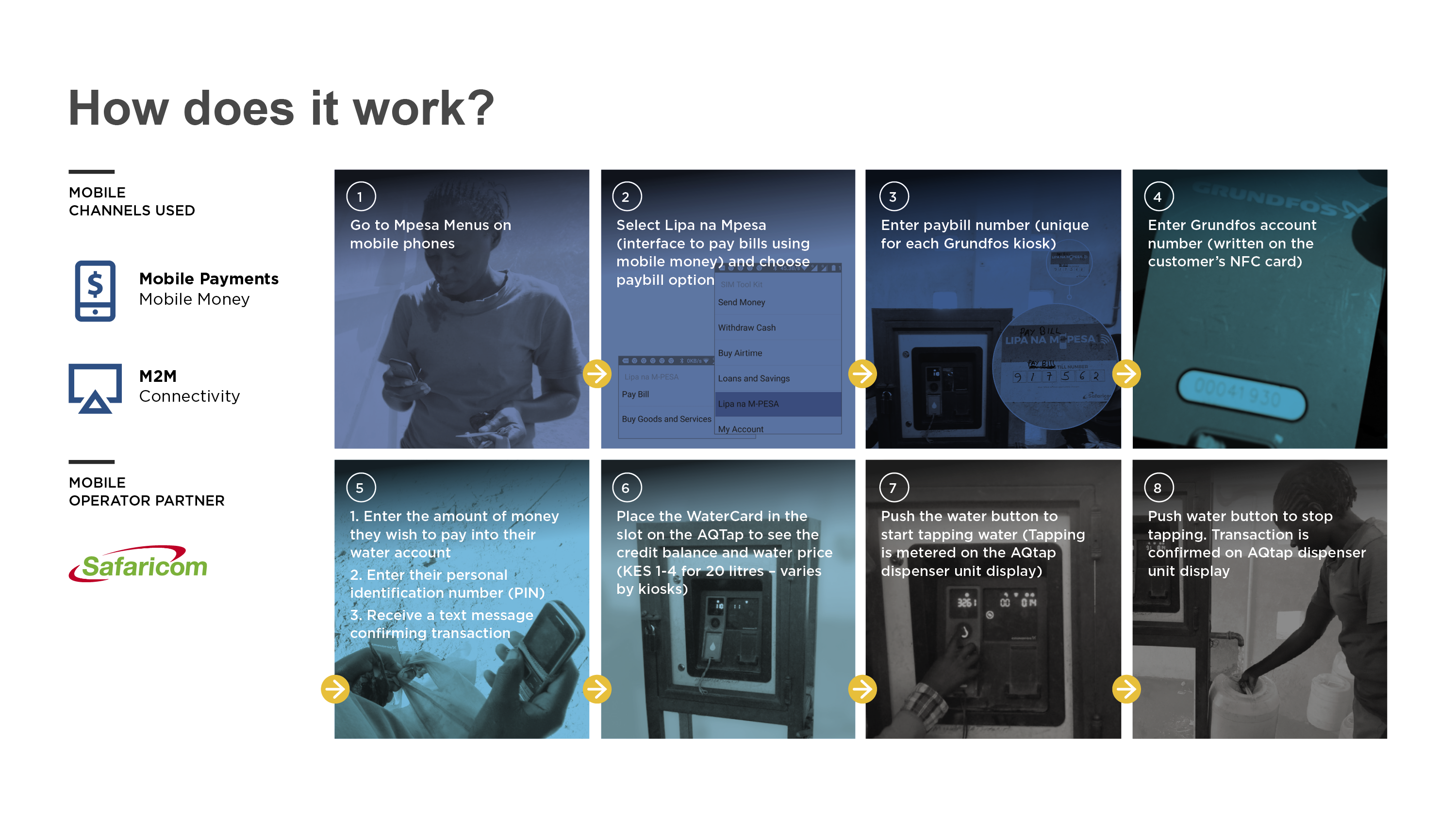

Mobile payments and machine-to-machine (M2M) connectivity are playing an important role in enabling access to quality water by optimising costs, improving revenue collection and enabling transparency and efficient use of customer data. Grundfos – a Danish water pump manufacturer, in partnership with an international charity – World Vision and local communities as well as mobile operator, Safaricom, have installed 32 self-service water kiosks called Lifelink systems in locations lacking water infrastructure to serve homes and businesses in Kenya. The kiosk is an automated water distribution point integrated with a mobile money payment facility (through Safaricom in Kenya). It also offers real-time GSM monitoring of water dispensed and payments made.

The M4D Utilities team conducted a qualitative field research (individual and group interviews) at 10 of these self-service water kiosk sites in Kenya. The objective was to understand the level of mobile money awareness and usage for PAYG water payments amongst the users including questions around frequency, mode (cash/mobile money), payment experience and limitation of using mobile money.

What have we learnt?

- There is good mobile network coverage even in remote rural locations and mobile money agent network facilitated service adoption;

- The water is cheaper (KES 1-4 for 20 litres) and cleaner than that sold by private sellers (KES 4-5 for 20 litres);

- Increase in mobile money usage – in six out of the seven sites surveyed, mobile money was being used as the only mode of payment for water at Grundfos sites.;

- Expanding mobile money use-cases – customer familiarity with using MPESA to pay for water bills is leading to more frequent and diverse use of Safaricom’s mobile money platform-mPesa. While previously their interaction was limited to receiving/withdrawing money and buying airtime, they are now using the pay-bill function for shopping and to pay school fees. In fact, 35 per cent of the customers used the pay-bill function for the first time after using the self-service water kiosk; and

- Raising awareness – many customers are now tracking and optimising their spend on water thanks to this digitisation.

Some insights from the users

“Paying via mobile money is more convenient since you don’t get to carry around cash. When you deposit money in your phone, it also limits your chances of misuse as compared to having it in cash.”

“It is safer, you can access the service anytime you want to as long as your card is loaded [with credit] unlike in the past where the people in charge at the kiosk had a lot of favouritism or worked when it was only convenient for them.”

“Water supply via the [PAYG service] is far much better. We don’t have to queue waiting for someone to open the kiosk for us to fetch water. We also don’t need to walk long distances to get water. In the long run, it is much cheaper and efficient using the [PAYG water service]. The water is also safe for consumption.”

We would like to end this blog post by thanking CGAP, Safaricom, Vodafone UK, Grundfos, World Vision and all our interviewees for extending their support for both these research projects.

The GSMA Mobile for Development (M4D) Utilities programme is funded by the UK Department for International Development (DFID), USAID as part of its commitment to Scaling Off-Grid Energy Grand Challenge for Development and supported by the GSMA and its members.