All data is derived from the 2021 World Bank FINDEX database unless otherwise stated

Launched in 2008 in Tanzania, mobile money has driven financial inclusion by improving access to affordable and accessible financial services for underserved populations. Despite its current reach (45% of the population age 15 and over own an account), women’s use of mobile money and digital financial services in Tanzania remains limited compared to men, as well as women in neighbouring East African countries.

Women have lower rates of mobile money account ownership than men in Tanzania—40% compared to 49%. This is due to a range of reasons, including lower levels of mobile phone ownership, education, income, and awareness of mobile money services and how to access them.

Limited usage

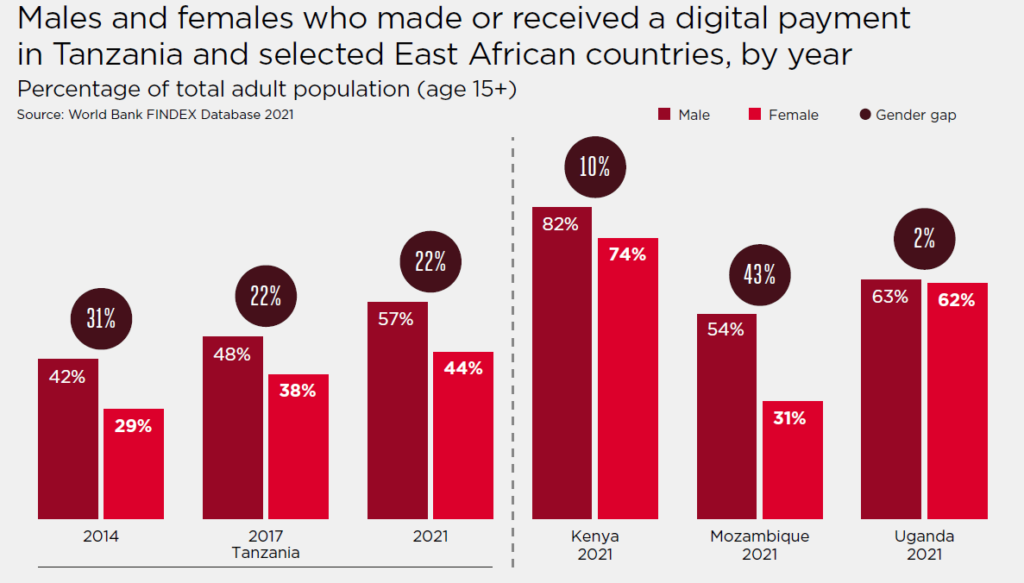

The World Bank FINDEX 2021 data shows that Tanzanian women use a limited range of mobile money and digital financial services. At present, women mostly use mobile money to send or receive digital payments, albeit less frequently than men. While overall use of person-to-person (P2P) transfers has grown, women remain 22% less likely than men to have sent or received a digital payment. As a result, there is no change in the gender gap since 2017 (Figure 1). Compared to Kenya, Mozambique and Uganda, absolute usage levels are low and the gender gap1 is considerably wider in Tanzania. Furthermore, only 2% of women in Tanzania have made a digital merchant payment, compared to 8% of men; this is considerably lower than women in other East African countries.

Figure 1 : Males and females who made or received a digital payment in Tanzania and selected East African countries, by year

Despite relatively high numbers of Tanzanian women saving money, women are 50% less likely than men to save using mobile money, with only 13% of them doing so. Comparatively, the level of women’s savings using mobile money in Kenya and Uganda sit at 34% and 29% respectively, both with substantially lower gender gaps of 17% each. Tanzanian women are less likely to make digital bill payments too. Only 15% of women reported having done this, compared to 38% of women in Kenya and 22% in Uganda. Ultimately, based on the 2021 Global Findex, Tanzanian women’s use of various mobile money use cases is substantially lower than men’s, and lower than women in neighbouring countries.

Demand and supply side usage barriers

This limited use of mobile money is indicative of Tanzanian women experiencing several barriers, which can be split into demand- and supply-related barriers. The demand side includes low literacy levels, time poverty, and sociocultural barriers resulting in women’s lower educational achievement, and employment opportunities resulting in lower levels of income. Accompanying this is a lack of digital skills, often making women less confident and trusting in the signing up and use of mobile money and its array of offerings.

Supply side barriers, such as limited raising of awareness, training and lack of affordability have constricted women’s mobile money usage. The levy on mobile money services, introduced during the COVID-19 pandemic, in July of 2021, by the Tanzanian government, increased the average transaction fee from 3 % to 369 % depending on the transaction size. This led to decreased use across the board and, in some cases, prompted people to revert to cash transactions. Women were particularly likely to revert to using cash, as their lower economic standing can make them more price sensitive. The detrimental effects of the levy were compounded by women’s limited awareness of mobile money’s full range of services. This is influenced by insufficient advertising made with women and their needs in mind. Finally, there is often limited mobile money provider-led training offered to women, let alone with their specific financial needs in mind.

Increasing usage

To tackle women’s lower uptake and use of mobile money, mobile money providers can pursue several actions. First, providers should understand women’s specific usage levels through collecting and monitoring gender disaggregated data. This may enable providers to know how many women are using different services and where further resource allocation, such as increased marketing or targeted training, could increase value.

Secondly, leadership matters. Having senior leaders set and champion targets to reach more women customers can lead to further action. The GSMA’s research suggests that this is an essential step in mobile money providers reaching more women. Without concerted effort attempts to raise women’s uptake and use of mobile money risk falling by the wayside.

Ultimately, for Tanzanian women to benefit from the value that mobile money can provide, women’s awareness, comfort, and trust must be increased. For example, marketing campaigns and products should be designed with women in mind to raise their awareness of mobile money services that could add value to their daily lives. Any awareness-raising initiatives should include simple steps of how to use mobile money services to meet women’s specific financial needs. Finally, to encourage women to use a wider range of mobile money services, in-person practice sessions matter to build trust and help women to feel comfortable in using the services. This can be done, for example, through existing women’s savings groups, as well as training and incentivising agents. Data from Kenya and Uganda show that women across East Africa can benefit from using a broader range of mobile money services to meet their financial needs and aspirations. Yet, without a stronger focus on building trust and the knowledge and skills to use it, women in Tanzania may continue to miss out on integral financial services that have the power to positively impact their lives.

To discover more about women’s usage of mobile money in Tanzania, read our report: Advancing women’s financial inclusion in Tanzania: The role of mobile money.

Figure [1] : The gender gap in ownership / use (%) = (Male owners / users (% of male population) — Female owners / users (% of female population)) divided by (Male owners / users (% of male population)