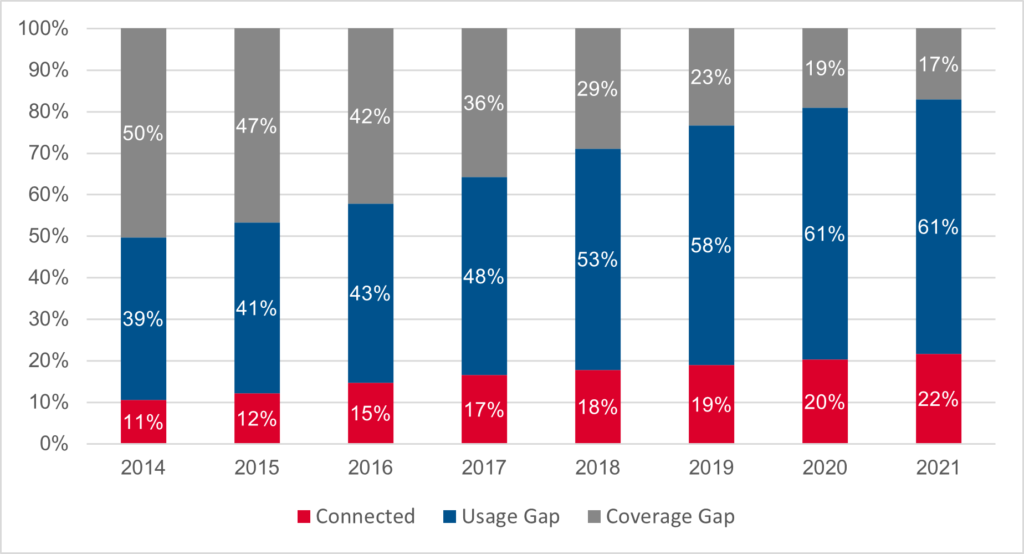

Since 2014, the progress in connectivity in Sub-Saharan Africa has been substantial. By the end of 2021, 22% of the total population in Sub-Saharan Africa was using mobile internet (and 40% of adults over 18 years of age). Despite being the region with the largest gaps in mobile internet coverage and usage, it’s clear to see the progress that has been made over the years in addressing supply-side and demand-side barriers in the region.

Mobile broadband coverage continues to grow but the usage gap is widening

Over the past five years, the proportion of the population covered by a mobile broadband network has more than doubled. As a result of continuing mobile broadband investments in the region, 83% of the population was covered by a mobile broadband network by the end of 2021. However, globally, there are 400 million people still not covered by a mobile broadband network (5% of the world’s population), with half of them living in Sub-Saharan Africa. Yet, there are substantial differences within the region. In Central Africa, 39% of the population live outside a mobile broadband coverage area, while this figure is 16% for West Africa, 13% for East Africa and 12% in Southern Africa.

Interestingly, Sub-Saharan Africa is the only region where mobile broadband coverage continues to outpace mobile usage. As a result, the usage gap – i.e. the percentage of the population covered by mobile broadband but not using it, has been widening over the years. It stood at 61% in 2021 (or 44% of adults aged 18 and above).

Figure 1: Evolution of mobile internet connectivity in Sub-Saharan Africa

Most connections in the region are now made with 3G or 4G/5G smartphones and smart feature phones but with wide disparities in data consumption

For the first time, 3G, 4G and 5G handsets account for more than half of all connections in the region, mostly due to availability of more affordable handsets. Data usage and network quality continue to increase but the gap between ‘heavy’ users and ‘light’ users is wide, meaning that most internet users are likely to consume much less than the average 1.5 GB/month seen in the region. Our State of Mobile Internet Connectivity Report 2022 illustrates this point. For example, in 2021 Safaricom Kenya reported that half of its 20 million active data customers used less than 100 MB/month.[1] Similarly, Airtel Africa reported that 80% of its data traffic is driven by 4G, which accounts for only 20% of its handsets.[2]

This means that even when connected, many people use mobile internet only in a limited way. It is therefore important to start thinking about this consumption gap alongside the usage and coverage gaps to ensure people are not limited in their ability to use the mobile internet to meet their needs.

Connectivity varies significantly by different socio-economic groups and by country income levels

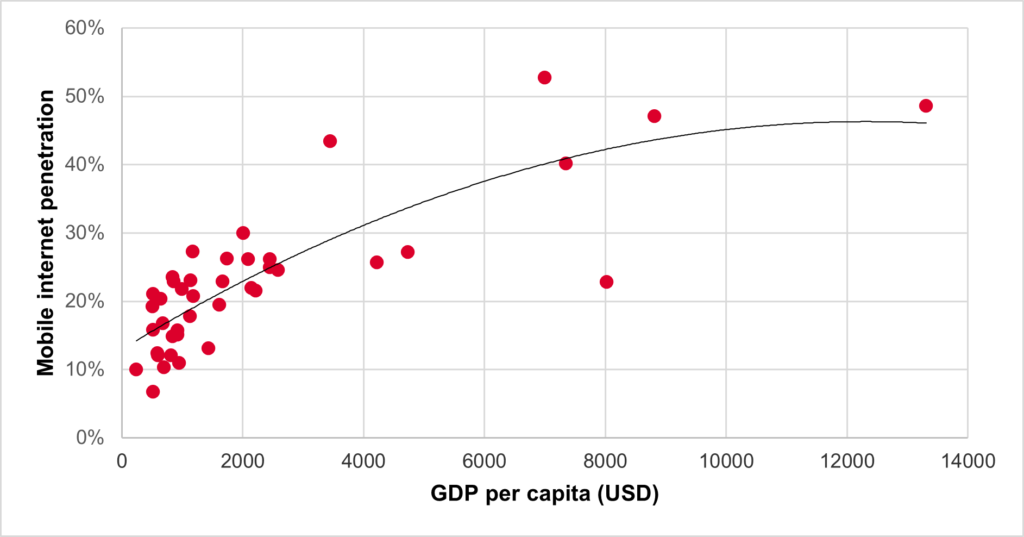

Mobile internet penetration is highly correlated with the GDP per capita of a country as seen in the graph below. In addition, across low- and middle-income countries in Sub-Saharan Africa, certain underserved populations are less likely to use mobile internet:

- People living in rural areas are 54% less likely to use mobile internet than their urban counterparts

- Women are 37% less likely than men to use mobile internet

- People living in the bottom 40% are 54% less likely to use mobile internet than the richest 40%

Figure 2: Relationship between GDP per captia and mobile internet penetration

Note: Based on 40 countries for which we have data and excluding Equatorial Guinea[3]

Barriers to using mobile internet

While mobile internet connectivity has improved over the last few years, the gaps are still wide, and we must continue to step up our efforts to tackle the barriers to mobile internet adoption and use for greater digital inclusion. Affordability, literacy and digital skills are most often cited as key barriers by those aware of mobile internet but not using it.[4]

Not being able to afford an internet enabled handset is a critical barrier to using mobile internet. Although affordability has continued to improve over the last five years, purchasing a handset would still cost, on average, 25% of a person’s monthly per capita income (it’s worth noting this was 39% five years ago). Affordability remains a significant barrier for the low-income, women and rural populations.

Among mobile users who are aware of mobile internet but don’t use it, a lack of literacy and digital skills is also reported as a major barrier. For example, in Senegal and Kenya, a lack of digital skills is reported as an important barrier for 80% and 40% respectively, of mobile users who are aware of mobile internet but not using it. Understanding these barriers to getting online will help in developing products and services that resonate with consumers in Sub-Saharan Africa and address the multiple barriers they face.

In Sub-Saharan Africa, 78% of the population are still not connected, either because they are not covered by any mobile broadband network or because they face other barriers to mobile internet adoption. And even when looking at the adult population, 60% are unconnected. This highlights that a strong collective effort is needed if we want people everywhere to be connected.

[1] Safaricom PLC (2021), FY21 Investor Presentation

[2] Airtel Conference call transcript, FY 2022 results, 11 May 2022

[3] Equatorial Guinea was excluded as a clear outlier. The country is also an outlier when it comes to many development indicators. See for example: https://s3.amazonaws.com/infobeautiful-wdvp/assets/2019/full/28_20190113133222-Aditya-Shrivastava.pdf

[4] Based on 10 countries surveyed for the GSMA Consumer Survey in 2021.

The Connected Society programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO) and the Swedish International Development Cooperation Agency (SIDA), and is supported by the GSMA and its members.