For more than a decade agent distribution networks have been at the heart of successful mobile money services. Responsible for converting physical cash to digital value, and performing crucial tasks such as on-boarding, supporting and educating millions of customers on a daily basis, mobile money agents represent the face of mobile money services around the world. In 2018, $136 billion (the total value of cash-in transactions) were digitised by mobile money agents globally. By way of comparison, this is equivalent to more than twice the overall value of international remittances flows to Sub-Saharan Africa the same year.

As the uptake of mobile money services continues to grow, the expansion and evolution of the agent network becomes all the more critical to ensuring a high quality of service. Mobile money providers have therefore focused both on growing their distribution network and supporting agents with dedicated education and training. Indeed, the number of agent outlets more than doubled over the past five years, reaching 6.6 million in 2018, as revealed in this year’s State of the Industry Report on Mobile Money1. The proportion of agents active on a 30-day basis also increased during the same period, reaching 55 per cent.

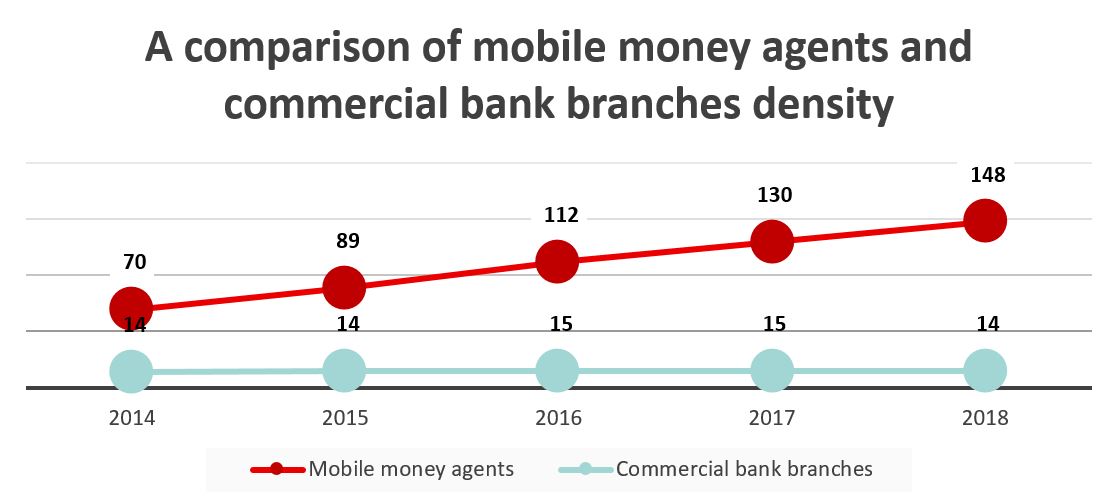

The presence of mobile money agents in rural and hard-to-reach areas has been instrumental to increasing financial inclusion in many markets. According to the 2017 Global Findex, 22 per cent of adults without a formal financial account cited physical distance to a financial institution as a barrier. A comparison of the increase in mobile money agent density against brick-and-mortar banking shows the impact of agents in this regard. In 2018, agent network density indeed reached an average of 148 active mobile money agents per 1,000 sq km – more than twice the 2014 figure. The density of commercial bank branches across the same markets has not substantially changed over the 2014-2018 period, averaging 14 per 1,000 sq km.

In over 80 per cent of markets where mobile money is available today, agent outlets outnumber bank branches. In two thirds of those markets, there are more than ten times as many registered mobile money outlets than bank branches. A similar trend emerges when examining active agents: in 50 per cent of markets, there are more than ten times as many active agents than bank branches.

GSMA research published earlier this year demonstrated the association between mobile money expansion and growth in the commercial banking sector, indicating that mobile money is complementary to commercial banking services as it can enable its diversification and expansion. In this way, mobile money agents have played a fundamental role in strengthening the banking industry by helping to extend its reach. Anecdotal evidence suggests that a significant proportion of bank-to-mobile money account transfers – one of the fastest growing mobile money products in recent years – are eventually being cashed out, especially in rural areas where it is harder to set up a bank branch. Mobile money agents effectively work as a liaison between banks and mobile money services in these areas, improving access to financial services for the underserved.

Footnotes:

Note that this is not the number of unique mobile money agent outlets, but rather the sum of the agent outlets providing cash-in and cash-out services for the mobile money services that are available globally. In many markets, individual outlets may serve several mobile money service providers. This practice is more pronounced in mature mobile money markets, particularly where competition among service providers is high. For that reason, the number must be interpreted with care, as it does not reflect the number of unique mobile money agent outlets.