Since 2013, our Mobile for Development (M4D) Utilities Innovation Fund has awarded grants to many mobile-enabled off-grid energy services, including several frontier companies providing pay-as-you-go (PAYG) solar home systems (SHS). We have awarded grants to both PAYG solar companies working with mobile network operators (MNOs), and, in a few cases, directly to MNOs. This blog captures our current thinking on the various roles of mobile operators in PAYG solar.

Overview: Our experience with MNO engagement in PAYG SHS

The synergy between MNOs and the PAYG solar business model has been clear from the start – MNOs provide the fundamental ingredients for PAYG solar through mobile money and connectivity. On the other side, PAYG solar enhances MNOs’ revenues from mobile money transactions and other services, aided by reliable phone charging.

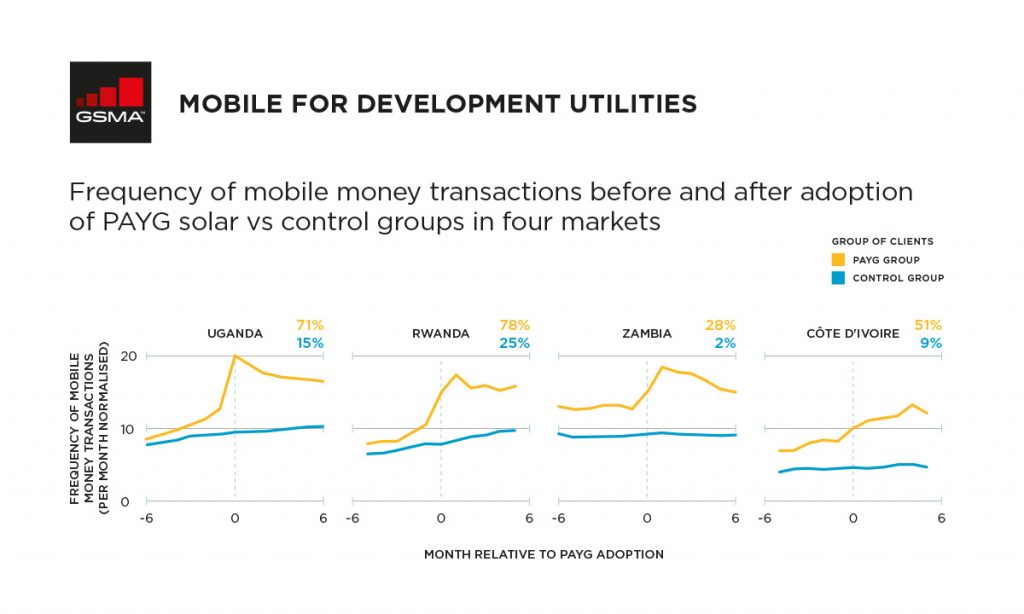

We recently measured the increase in commercial value for MNOs from PAYG solar customers. Looking at data from five MNOs in different markets in Africa, we compared PAYG solar customers’ mobile usage to a control group of non-PAYG customers. PAYG solar customers increased their frequency of mobile money transactions significantly, which expanded beyond payments for solar. Consequently, we saw average revenue per user increased with the adoption of PAYG solar. This aligns with customer facing research we’ve done with our grantees, as well as findings from the Global Off-grid Lighting Association (GOGLA – the voice of the off-grid solar lighting and electrification sector) that 89 per cent of customers adopting PAYG solar report using their phone more.

Despite the clear commercial case for MNOs, there’s long been a question on what is the optimal role for an MNO to play in this business. Questions centre on how existing assets can be leveraged most effectively to generate the greatest value, and at what level of investment. We’ve previously talked about this MNO range of engagement being a continuum based on strategic objectives and risk appetite.

- At a basic level of engagement, MNOs make their mobile money services available as a platform to all PAYG companies;

- At an intermediate level of engagement, MNOs may work more strategically with some partners by leveraging their brand, or their agent/storefront network for distribution; and

- At the highest level, some MNOs seek to gain more value from leading their own PAYG service. By leading the business model and strategy, even if outsourcing the products from vendors, MNOs take on all ownership and risk.

Nearly all of our PAYG solar grants have involved MNOs at least at the basic level, though many have gone much further. Companies we supported early on, like M-KOPA, Fenix, Lumos, and Mobisol, all gained early market trust by leaning more heavily on MNOs’ brand and sales. Some of them are still closely attached to MNO brands in their initial markets, but no longer depend on their sales and distribution (with the exception of Lumos and MTN Nigeria).

We have also supported MNOs to work at the highest level of engagement. We wanted to understand if MNOs’ strengths as large and established corporates with an existing customer base could yield advantages in operating and scaling this complex business. In 2017 – 2019, we saw increased interest from MNOs submitting grant proposals to lead PAYG solar models, and an increased appetite outside of the Innovation Fund in requests for partnership support. To date, we’ve funded three MNO-led PAYG solar pilots: Telenor Easypaisa in Pakistan (2013, in partnership with Roshan and Brighterlite), Orange Madagascar (2017, in partnership with d.light) and Afghan Wireless Communications Company (2017, in partnership with d.light). [1] We’ve supported other mobile operators to launch energy smart-metering services, for both main grids and mini-grids, but will just focus on those in PAYG SHS here.

Beyond just our grants, we’ve seen that most MNOs engage somewhere around the basic and intermediate level, though supporting brand association in special cases, and moving away from direct sales support. This level of engagement often best matches the overall strengths and strategies of mobile operators. Higher levels of MNO engagement are still present in some models, but require significantly higher investments to yield a good return. As we discuss below, the sales, customer education, and on-going support required for a PAYG business is far different than existing MNO services. For MNOs to lead a PAYG business requires investment in building these new capabilities. Crucially, PAYG solar is a complex asset financing business, which requires debt financing that is slowly, and sometimes unpredictably repaid. In contrast, MNOs increasingly seek to optimise capital expenditure, and are accustomed to more commercial and less-risky debt financing for their infrastructure. Therefore, it’s a challenge for MNOs to justify the additional investment, in both the assets and the new business capacities, on top of their already infrastructure-heavy, and customer-centric business, required to operationalise a PAYG solar business.

However, there remains a prize to be won for MNOs in PAYG solar. The PAYG solar business model has quickly replicated into all kinds of PAYG business models – from PAYG smartphones and agricultural appliances, to LPG cooking gas cylinders and pre-paid water connections. A strong MNO strategy is to build robust platforms with strong business to work easily with all of these emerging solutions, toward a broader mobile money ecosystem. Beyond the payment opportunity, there’s an increasing appetite to bundle these essential services with other MNO-linked businesses, from internet connectivity to insurance, and more sophisticated lending and savings products, suggesting a lot of untapped value for MNOs.

For MNOs, PAYG solar is a potential gateway to valuable partnerships with digitally native companies that are constantly providing new and essential services to a market segment that MNOs seek to build. The importance of these essential services is higher than ever in the wake of a pandemic. During COVID-19 we’ve seen that re-payment for SHS has remained fairly stable [2] with respect to other economic slow-downs, signalling the resilience of this industry because of the positive impact that energy has on people’s lives. Even before the pandemic, companies like BBOXX in Togo forged partnerships with government to provide subsidies via solar payments which suggests an opportunity for mobile operators to play a crucial role as this model attracts more enthusiasm. Despite the challenges we’ve observed in MNOs operating these businesses directly, we see the value of partnerships with PAYG companies only increasing for mobile operators in the years to come.

Three insights on the role of MNOs in PAYG solar:

1. MNOs are well-positioned to leverage their technical platforms, making them widely accessible to a range of innovative utility service providers.

MNOs offer the communication platforms and payment solutions that are essential to operating a PAYG solar business that serves remote customers. In return, the value for an MNO goes beyond transaction fees for just PAYG solar. PAYG solar companies have expanded to provide many add-on products that can draw new revenues, such as PAYG smartphones, or insurance. And in the last six years, the PAYG solar model has expanded to a huge range of utility services that improve lives and support income generation and/or cost savings. Some of those supported by our Innovation Fund include SunCulture which provides PAYG solar irrigation, CircleGas (formerly Kopagas) which provides PAYG LPG cooking services, and CityTaps which provides PAYG piped water services. Each of these companies selected MNO partners based on ease of mobile money integration, and extent of mobile money adoption and agent networks. And, in return, they provide MNOs with a highly sticky service to grow mobile money ecosystems and mobile communication.

For example, CityTaps found that 43 per cent of their customers started using mobile money for their service. Some of these utility services, like gas and water, are best suited to a continuous payment model. This is particularly attractive to MNOs, which are often attracted to continuous payment models for SHS. However, in most markets, this model has struggled because customers see payments for periodic use as optional, and resent not owning the appliance on their roof, even if it does come with continuous service and upgrading.

Despite this win-win for MNOs and PAYG utility providers, many PAYG utility providers still face lengthy administrative and technical barriers working with MNOs to set-up seamless mobile money integration with real-time notifications. The GSMA has helped to bridge this gap through initiatives like the harmonised Mobile Money API specifications and the Instant Payment Notification Hub (IPN Hub). These provide important tools to reduce the time and costs of connecting new businesses to mobile money platforms, which is critical for MNOs to pursue a ‘payments as a platform’ service.

As detailed in the GSMA Mobile Money State of the Industry Report in 2018, payments as a platform means building mobile money platforms designed to connect with a range of third-party services from across industries. Doing so allows MNOs to diversify revenue streams by offering more enterprise and adjacent services. In 2019, the mobile money industry saw a significant drop in the reliance on customer fees indicating a diversification of revenue models and a shift towards the payments as a platform approach. The expansion of PAYG beyond solar directly supports this. Many companies are now also experimenting with different modes of payment (like push payments). In this context, MNOs can position themselves to capture the most value by building robust, dynamic and versatile payment platforms.

2. Scaling PAYG solar depends on specialised sales and customer support which differs significantly from existing MNO agent network and customer support activities.

Most early PAYG solar models were built to leverage mobile operators’ agent networks based on the strong synergy between the industries. There was an initial expectation that there were similarities with how successfully MNOs had grown the model for ‘pay-as-you-go’ airtime, and that utilising their existing agent networks would be cost effective and support rapid scaling and replication.

However, unlike the sale of mobile services, the success of PAYG solar depends on targeting the ‘right’ customers who likely have the ability and willingness to repay the loan. For example, selling PAYG solar systems that are too large to households with the most minimal income is likely to fail without some kind of subsidy. Targeting urban customers connected to unreliable grids may seem like low-hanging fruit, and align with an MNOs’ existing customer stronghold. However, customers will repay slower if they see their system as a backup to the grid which can quickly kill the PAYG business model, if not designed to accommodate this. The specialised sales approach needed for assessing the right PAYG solar customers is totally different than selling mobile services, and requires a high level of agent education.

In addition, agents take on a key role of training PAYG solar customers, who often must learn about two new products at once – solar technology and a loan. Compounding this is the need to overcome digital literacy barriers, particularly in contexts where mobile money adoption is low. Ongoing follow-ups with customers are a necessity to address product failures or misuse, and any trouble they have making payments. The PAYG industry has repeatedly found that the importance of customer support and education cannot be underestimated.

PAYG solar companies have tried many approaches to achieving high-quality agent and customer training. Pro-active customer support through a call-centre is now standard best-practice. And agents are typically incentivised with sales commissions paid not just at the initial sale, but after several months of good repayment. This pushes them to provide good customer education, but also target customers who can repay.

Although MNOs already have sales agents and customer care centres, the PAYG business model requires new and significantly more training to provide the level of support customers require for a new technology. PAYG SHS companies, and the MNOs leading PAYG solar businesses, have learned that this is an essential business cost, and they need to include these costs in their model and work continuously to optimise those activities. For many of these companies the hope is that this cost will be repaid through a positive customer experience that leads to more PAYG purchases from them. The consequences of not providing good customer support can be very damaging for any PAYG solar provider, and perhaps particularly for MNOs seeking to use the PAYG business as a route to building a more long-term customer relationship.

Given the challenge in finding and selling to the ‘right’ customers, many models, including some led by the MNOs themselves, have moved away from using only MNO agents. However, Orange Energie is the exception, as they have invested in training their own agent networks in most markets. Orange Madagascar’s M-Jiro service (supported by a GSMA grant) is different, where Orange partners with a local distribution company called Heri for rural sales, but use their own stores for some sales as well. Whether it’s MNOs leading, or PAYG solar companies leading, the bottom line is the same – signing up too many customers who can’t repay in the timespan of the business model is deadly, and profitability needs to be balanced with customer growth.

Finally, since the initial launch of PAYG, most MNOs now outsource management of their retail locations to third parties that manage all the operations of the brick-and-mortar operations. So, in these contexts, using an MNO’s retail outlets to sell PAYG products (an obvious synergy) is not straight forward as might be expected, and depends on negotiating with third parties that distribute for multiple MNOs. Nonetheless, there are some MNOs that do still manage their own stores and use these for PAYG solar and other product sales, as noted for Orange Madagascar.

3. For an MNO considering leading a PAYG solar business, the need to provide credit and manage repayments can be at odds with broader strategies to optimise network investments.

Deploying PAYG SHS to low-income households requires raising significant credit to purchase the assets. While MNOs do raise and invest significant capital on network infrastructure, there are some key differences in the overall business strategy compared to credit for solar asset financing. Just as MNOs have optimised their investments in retail shops, many have also optimised network investments by sharing network infrastructure and placing ownership and/or management responsibilities onto third-party tower companies. MNOs thus seek to optimise asset investments to limit credit on their balance sheets. Although holding credit for solar assets might be on a different scale than network investments, it goes against the broader strategy of reducing asset ownership. And when it comes to the risk of not being able to repay credit for assets, distributed SHS in rural areas are far more difficult to re-sell than network infrastructure.

Additionally, as many PAYG solar companies and investors have learned, raising and managing the credit for low-income customers with variable incomes is not easy, and requires significant flexibility in the loan model. MNOs can build this capacity, but it’s yet another new business area in which to invest. And demonstrating the ability to manage credit to low-income households is key to raising more debt to scale PAYG SHS, as is raising it from the right investors, who understand the risk. While there have been more commercial investors in PAYG solar, a lot of financing still comes from DFIs and impact investors that have explicit development objectives. MNOs typically raise funds from capital markets, and some MNOs have struggled to shift to raising funds, beyond initial grants, from typical funders of PAYG solar.

Financing PAYG solar assets remains a broader industry challenge not only for MNOs, but also for other local distributors. While MNOs, due to their larger corporate nature, may technically be better positioned to finance the assets, it must still be commercially beneficial for them to do so. MNOs must weigh this against their priorities and existing investments toward scaling networks and service adoption, which are their core services, and the additional costs mentioned previously that are needed to develop a strong PAYG sales and distribution capacity. Our past Mobile for Development Innovation Fund grantee, Orange Madagascar, shifted their model so that the asset costs are also paid for by their distribution partner, Heri. However, in their other seven markets, Orange Energie is pushing to gain the full value of the PAYG business by retaining the distribution and the asset financing costs.

Conclusion: MNOs may generate the most immediate value from PAYG solar through investing in their platforms and strategic partnerships

MNOs leading PAYG solar businesses, and PAYG companies themselves, have learned crucial lessons about what it takes to make these models succeed. The unique sales approach required is time-consuming and costly, as is raising and managing debt, so PAYG business models must account for these costs. This isn’t well-matched to most MNOs’ business strategies to optimise capital investments. This isn’t to say that MNOs cannot lead PAYG solar, rather that it would require a larger business strategy to develop the asset financing, and sales and support capabilities needed to support a range of emerging PAYG products and services.

However, as PAYG companies have determined, there’s a clear business opportunity in PAYG solar. This is true for MNOs too, but generating the most immediate value may come from partnerships across the value chain. The maturing PAYG solar industry has seen important value-chain disaggregation, as companies have specialised in their strengths, and moved away from their weaknesses. And the industry has also seen consolidation as well, based on many of the lessons learned above. These changes have produced a much stronger industry that has a deeply nuanced understanding of reaching remote and low-income households with life-enhancing technology.

Through providing communication and payments, mobile operators remain the lynchpin of a much broader industry that’s attracting significant interest from governments and DFIs. The PAYG industry is expanding rapidly to appliances like agricultural equipment and smartphones. With companies now thinking much more broadly about the power of bundling these assets with improved access to information and financing through digital inclusion. These elements are key MNO strengths, and many MNOs are right to be focusing on digital transformation initiatives to support literacy and mobile internet adoption. These pieces directly drive their own core services, and show high synergies with the evolving PAYG industry.

As the PAYG industry grows, and MNOs find themselves again asking what’s the best role for them, many of the insights above remain pertinent. Mobile operators may have the most to gain by investing in robust and easy to access platforms, while working alongside partners to build the digital inclusion components that drive the adoption of mobile services.

[1] Unfortunately, due to administrative barriers beyond the control of GSMA and AWCC, this grant could not be completed, and only a small portion of the grant was provided to AWCC.

[2] Data on payment and burden levels indicates that in October 2020, 81% of customers were repaying as they normally would.

The GSMA Mobile for Development (M4D) Utilities programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO), and supported by the GSMA and its members.