The GSMA Mobile for Development Utilities programme has been working since 2013 to unlock new business models that leverage mobile technology to deliver affordable energy services in emerging markets. Over the last eight years the GSMA has supported the emergence of the pay-as-you-go (PAYG) solar sector through a series of catalytic grants to different providers. This blog examines the work of VITALITE in leveraging their solar home system business to deliver a wider range of products.

VITALITE is a Zambian social enterprise founded in 2013. VITALITE’s initial focus was on addressing the energy needs in rural Zambia through PAYG solar home systems (SHS). To date, VITALITE has sold over 38,000 SHS, and currently sells an average of 10,800 systems per year.

In October 2017, the GSMA Mobile for Development Utilities Innovation Fund issued a grant to VITALITE to support product diversification. The purpose of the grant was to trial the introduction of add-on products to existing VITALITE customers, who have been assessed through viable credit risks based on their PAYG SHS payment history. The add-on products introduced were PAYG smartphone products and clean cooking stoves. The underlying logic is that the SHS network and consumer profiling allow for customers to be reached with affordable products, while at the same time minimising the commercial risks to the provider by using past payment data.

The success of PAYG solar home systems and the potential for other assets

In the last few years the PAYG solar model has spread rapidly across emerging markets. Over 2.2 million PAYG devices were sold in 2019. The rapid growth of the industry, and the potential it holds has seen major investments from international firms in PAYG SHS start-ups. The growth of PAYG solar has only been possible with the rapid growth of mobile money and mobile connectivity that allows customers to pay by instalments, and companies to remotely control and monitor the SHS. The success of the PAYG SHS sector lies as much in the business model as the product itself, as such there is huge potential for existing solar providers to leverage this to deliver products that enhance peoples’ quality of life or productivity.

Under the grant VITALITE began offering new smartphone and cook stove products with two different lending modalities – as an add-on to the existing SHS loan (available for smartphones and cook stoves), and a smartphone PAYG model where the smartphone was equipped with locking software and could be purchased without a SHS.

- The ‘add on’ option was only available to well-paying VITALITE customers with a reasonable time period left on their loan. To be eligible, customers had to have at least 150 days left on their SHS payments and fewer than 30 days (cumulative) of payments missed. The cost of the new products was added to the existing loan amount and repaid in the same way with the SHS acting as the collateral. This segment represented roughly 30 per cent of VITALITE’s customers at the point the service was launched.

- The PAYG smartphone option was available to all VITALITE customers, including the 70 per cent not eligible for the add-on option. This segment included both well-paying VITALITE customers that had paid off their loan as well as those less well-paying VITALITE customers. For the PAYG model to work, the phones needed to lock in cases of non-payment. For this, VITALITE partnered with PayJoy and Aion Sigma, two companies providing locking software working across different phone models.

VITALITE now offer six phones ranging from $35 to $188. A further nine phones were trialled and then discontinued under the grant. It took a significant effort to find the right product-market fit. VITALITE had to test and match the demand from low-income customers, with phones that were available from Zambian distributors at a reasonable price andthat were compatible with the locking software available.

Two cook stoves were offered costing $35 and $49.5. These were available only through the SHS ‘add-on’ option and through direct sales, as locking the product in a PAYG model, clearly, is not an option. The cook stoves were provided through an exclusive partnership with Ecozoom. These products are designed to reduce the amount of charcoal a household uses by 75 per cent.

Results from the grant

As of November 2019, the project had successfully sold 1225 smartphones, and, since the grant closed, a further 741 phones have been sold. During the grant, the majority of the phones were sold via the add-on option, but this was only as the PAYG phones were launched in the last seven of the 24-month grant period. Once launched, PAYG sales were similar in volume to the add-on option. Customers reported very high satisfaction rates: 87 per cent of PAYG customers, and 73 per cent of add-on customers reported they were satisfied or very satisfied.

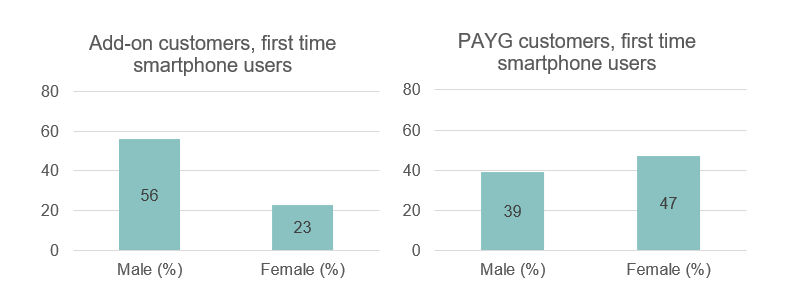

Many of the customers reached were first time smartphone users. 41 per cent of PAYG smartphone customers and 48 per cent of smartphone add-on customers were first time smartphone customers, opening the door for these people to start using data services. Additionally, 29 per cent of the PAYG customers were first time mobile money subscribers. Across both payment options, approximately half of all device owners are women.

Source: Grant endline survey, November 2019. Add-on n=56. PAYG n=78

1,357 cook stoves were sold during the grant. 538 of these were through customers using the ‘add-on’ option, and a further 819 in direct sales. VITALITE estimate clean cooking customers saved $9 per month on fuel, a 45 per cent reduction in spending from $20 to $11. In a survey of clean cook stove customers at the end of the grant, 82 per cent reported a decrease in respiratory issues.

Insights from the grant

The grant confirmed the value of utilising the SHS distribution and payment networks for other products

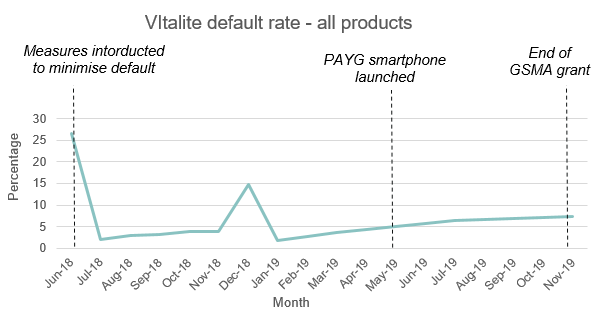

The VITALITE add-on model was successfully trialled on low-end smartphones ($70 -$90) and demonstrated that PAYG SHS providers can effectively leverage their existing customer relationship for new products linked to having a new source of power (including smartphones). That the customers were familiar with the payment plans enhanced the acceptability of the model. Importantly, the default rates on the new products were low. At the end of the grant, only 14 per cent of PAYG smartphone customers were late on payment, and most of these were for short periods of time. Only five per cent of customers have over 30 cumulative days of non-payment.

To combat high default rates, in mid-2018, VITALITE introduced the following – increasing agents’ commissions (from five per cent to 10 per cent) to incentivise them to follow-up with late-paying customers, increasing the customer down payment to cover 60 per cent of the first month rather than just the first seven days, and providing customers with regular reminders of the consequence of late payment throughout the customer journey. Adding the new products to VITALITE’s portfolio did not significantly affect the company’s overall default rate.

After proof of concept with the smartphones, VITALITE began offering more products during the grant period. VITALITE launched an agricultural loan for 10 kg bags of seed to well-paying SHS customers through the same add-on model used for the smartphones. At the close of the grant none of seed customers had defaulted, and VITALITE had distributed approximately 7.5 tons of seed to their customers.

Add-on products contribute to an increase in the use of MNO services, but challenges remain on fully realising synergies

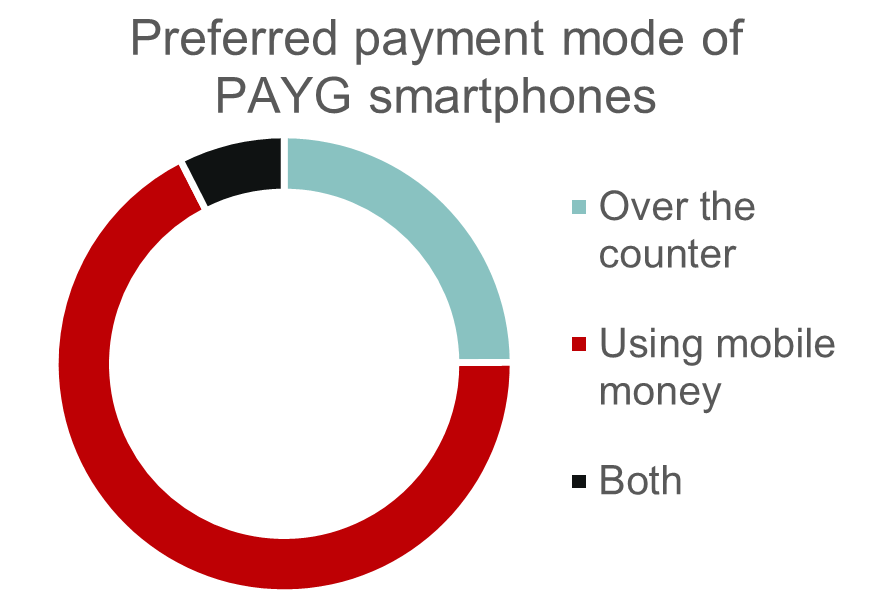

Despite a customer preference for mobile money for payment over cash, and that many users were first time mobile money customers, the introduction of the smartphone add-on did not increase the overall proportion of VITALITE collections paid via mobile money.

The key barriers around the adoption of mobile money related to:

Source: VITALITE data, n=178

- A lack of mobile money agents and agents not having a suitable float;

- The additional transaction charges incurred when using mobile money instead of giving cash to VITALITE agents;

- Customer digital literacy; and

- Past technical issues undermining trust.

To combat some of these challenges, VITALITE has developed short manuals for customers on using mobile money for SHS payments. VITALITE also conduct campaigns to promote mobile money use, and, use the point of sale as an opportunity for customer education.

Entering the market for new products was not straight forward

To provide the new products VITALITE had to invest in developing new relationships and identifying the right product-market fit. Entering the ecosystem for smartphones required more investment in time than expected. The phone market in Zambia is controlled by a few key distributors who hold the rights to certain brands. As a new market entrant and initially dealing in low volumes, Vitalite found these negotiations challenging. The negotiations were also informed by the parallel process of identifying the right product to be offered to entry-level customers at the right price point. The critical factors identified for selecting the right phone included sufficient internal memory, a large screen, and that the phones were robust.

Finally, integration with the PAYG locking software took longer than expected, delaying the launch of that service. Recently, PayJoy have ended offering locking software support to companies like VITALITE and other PAYG SHS providers as they have discontinued their PAYG software product offering in some markets. This is forcing companies like VITALITE to look for other providers, and in the meantime, focus on using the add-on sales channel.

Looking forward

Over the course of the grant, VITALITE expanded their operations enormously. At the start of the grant VITALITE operated in six of Zambia’s 10 provinces and had 18 shops. By the end of the grant VITALITE had a presence in nine provinces with 32 shops. Over the same period, the number of sales agents doubled to 500. VITALITE is now a household name in rural Zambia, and has just expanded into neighbouring Malawi.

The experience under the GSMA grant has demonstrated there is high demand for a range of PAYG products, as it eliminates the affordability barrier for assets beyond solar. Following the grant, VITALITE has successfully attracted larger funding, including a $2.4 million service contract and over $2 million in debt financing. VITALITE is now looking towards Series A funding.

The GSMA Mobile for Development (M4D) Utilities programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO), and supported by the GSMA and its members.