Over-the-counter (OTC) activity, which involves an agent performing a transaction on behalf of a customer, remains important particularly in regions where the OTC customer experience can spread awareness of mobile money and enable mobile money to reach poor and illiterate customers. However, an account-based business model offers a better opportunity for long-term profitability, a broader mobile money ecosystem and a better platform for offering new products to an established customer base. This blog aims to support the rationale for transitioning to an account-based mobile money model by exploring recent trends in OTC migration and the resulting impact on operator profitability.

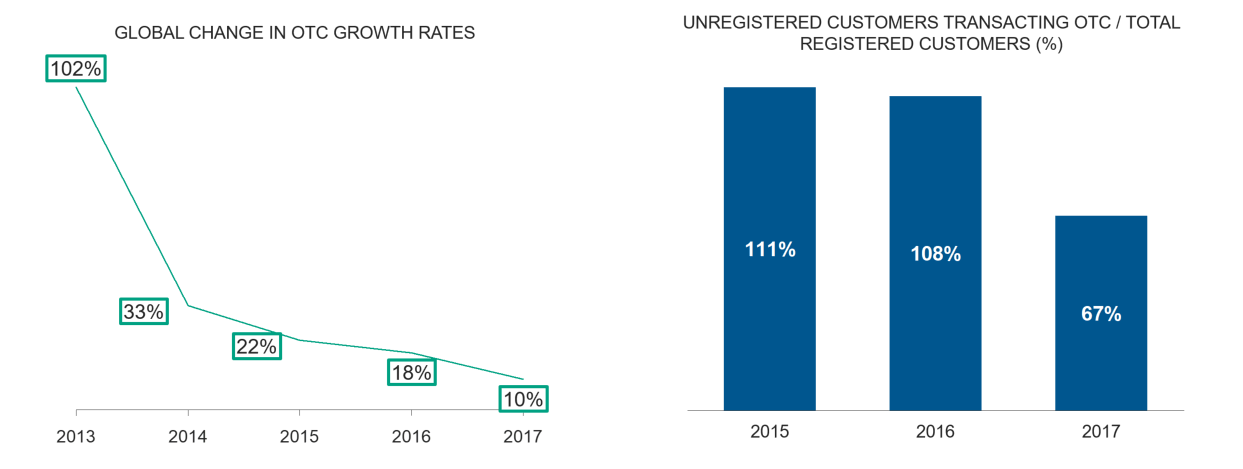

Over the last five years, there has been a slowdown in the growth of primarily OTC deployments. Five years ago, OTC customer numbers were doubling – but by 2017, OTC customer growth had trickled to 10 per cent (Figure 1). As a result, for primarily OTC-based deployments, the number of OTC customers transacting as a proportion of registered customers saw a marked decline over the same period (Figure 2).

Figure 1 | Figure 2

Over the last few years, an increasing number of primarily OTC deployments have prioritised the transition from OTC to digital transactions. In the GSMA’s 2015 State of the Industry Report on Mobile Money, our analysis found that in South Asia, where deployments are more likely to be primarily OTC-based, the 22 per cent OTC growth rate was dwarfed by a 47 per cent increase in registered accounts. This growth in registered account openings has continued ever since: Between September 2016 and June 2017, there was a 66 per cent rise in registered mobile money account openings in South Asia. Pakistan is a prime example of this phenomenon, where a combination of regulatory and commercial developments helped to accelerate account adoption. Notably, the roll out of biometric SIM registration can be considered an enabler for a rise in branchless bank account adoption given that this allows for easier remote registration. (In Pakistan, digital financial services and mobile money are defined as “branchless bank accounts”.)

The migration of accounts also led to changes in the mix of transaction values for primarily OTC deployments: In September 2016, 54 per cent of mobile money transactions were conducted through a mobile money account; by June 2017, this figure had grown to 67 per cent.

In the long term, migrating to an account-based model offers a better position for product development and for profitability. For customers, account-based services are able to provide a better range of sophisticated products. Our analysis shows that customers with a registered account are more likely to transact frequently than OTC customers. For the three main categories of OTC transactions, namely person-to-person transfers, bill payments and bulk disbursements, average numbers of transactions per customer are far higher for active 30-day customers than their unregistered OTC equivalents.

OTC is often embraced by providers because of its immediate revenue potential. However, a decreasing number of transactions and the lack of a “sticky” customer base are likely to have a negative impact on revenue, especially in the long term. Our analysis in the 2017 State of the Industry Report showed that average revenue per active mobile money account had risen from US$1.3 in 2016 to US$ 1.4 in 2017, and was 2.3 times higher than the revenue per OTC customer.

In addition to lower revenues for OTC customers, we also observed a higher amount of revenue paid out as agent commission. OTC deployments tend to rely more heavily on their distribution network, which can be costlier to run. As a result, OTC deployments paid out at least 54 per cent of their revenue as agent commissions, while the equivalent figure for account-based services stood at 48 per cent.

OTC-based deployments have been historically instrumental in introducing mobile money to customers, and they remain important in the development of mobile money in a number of regions. However, many providers may now find that to sustain growth, to offer a better customer experience and to increase profitability potential, they may be better off transitioning to an account-based business model.