Mobile money continues to be a vital driver of financial inclusion. The increase of mobile money solutions and the reach of their agent networks has helped to spread the access to money transactions over different places and services. Today, the market is progressing to move beyond cash transactions and provide a wider range of services over different platforms and devices.

As stated in the last State of the Industry Report on Mobile Money, close to 80% of mobile money providers have most of their revenues driven by customer fees. Many of them are now seeking to strengthen their value proposition with different financial services. This connects consumers and businesses with a wide range of third-party services to meet their evolving needs, from e-commerce, credit, savings, and insurance, to enterprise solutions for micro-, small- and medium-sized enterprises (MSMEs). This is why today, the market is expanding even further, reaching different platforms and services and demanding a rapid software development to attend market needs.

Mobile Money APIs and SDKs supporting innovation and new services

To enable this fintech evolution of the mobile money ecosystem, there is a need to bring new solutions to market in a fast and agile way. The introduction of Application Programming Interfaces (APIs) has revolutionised fintech industries over the past two decades, and similarly they are leading key advances in the mobile money industry. APIs enable mobile money providers to expose their services through which third parties can offer their solutions, seamlessly integrating tech between the two.

The use of APIs aids to accelerate product innovation in a fintech’s ecosystem, increasing system interoperability and decreasing time-to-market. This is essential to propel a vibrant and structured innovation space, attracting developers and supporting them to create new technological assets.

Nevertheless, using APIs can be challenging, as implementers first need to closely understand the product being integrated with, in addition to developing the actual code. This can add development complexity and extra time for understanding the integration. Therefore, providing implementers with the right developer tooling is of key importance to support developers with the skills and plug-and-play solutions they need when connecting to mobile money APIs.

Software Development Kits (SDKs) aim to provide exactly that; An SDK is a toolkit that developers use to build applications using prebuilt components instead of having to build each of those components themselves. An SDK may contain libraries, documentation, code samples and software tools developers require to build their solutions.

Back to the world of mobile money, SDKs can make the job of building innovative solutions much simpler for developers. They are designed to allow developers to rapidly integrate the different mobile money functionalities and services into new applications, making the development cycle shorter. This is possible because SDKs are built as a layer around APIs, abstracting many configurations that need to be done for the use of the API. They also provide enhanced features like better error handling, and security features like authorisation and authentication. Importantly, they enable easy use of specific scenarios, like specific merchant payments, disbursements or remittances flows, that otherwise would need to be fully built directly by the developers.

From the perspective of mobile money providers, SDKs can enhance their platform offering, and support the creation of an active developer community consuming their APIs, as developers can save time integrating vital API services in a quick and reliable fashion. It helps to enhance provider’s API product proposition, enables the developer community, drives traction in the market, and maximises the provider’s brand credibility.

Using GSMA API SDKs for your business

To sum up, making SDKs available for mobile money APIs has clear value and benefits for both mobile money providers and their third-party developer communities. In support of the industry, the GSMA Inclusive Tech Lab has therefore developed state-of-the-art SDKs for the GSMA Mobile Money API.

The GSMA Mobile Money API is an initiative developed through collaboration between the mobile money industry and the GSMA. The initiative provides a harmonised API Specification for all the common mobile money use cases which is both easy to use and secure. In a way to make our specification more attractive to use, the GSMA Inclusive Tech Lab created SDKs for the different use case scenarios of our API Specification. Using these SDKs, mobile money API providers can quickly create and deploy new services.

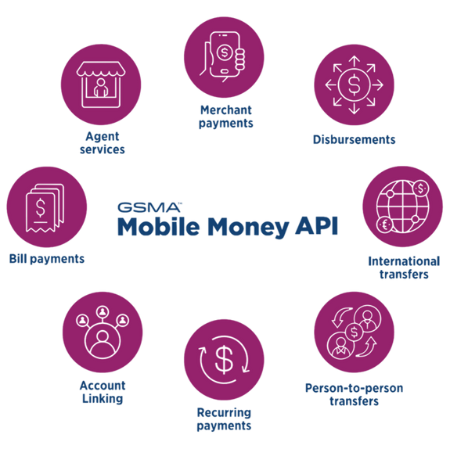

Attending to the business needs of mobile money operators, the development of the SDKs was driven to support all the current use cases and scenarios of the GSMA Mobile Money API. There are solutions available for all eight use cases, being Merchant Payments, Disbursements, International Transfers, P2P Transfers, Recurring Payments, Account Linking, Bill Payments and Agent Services (including Cash-In and Cash-Out). When using the SDKs, it is possible to handle all the use cases of the Mobile Money API in a quick and simple way. It provides more flexibility to mobile money operators to expand their API platforms enabling their partners to customise applications as needed.

Five SDKs with over 500 scenarios ready to be used

In way to create our SDKs, we collected intelligence on market trends and commonly used technologies in the mobile money industry. Insights were gained by researching the API platforms of providers in the market as well as qualitative interviews with Leading industry players. This intelligence helped us understand the market needs concerning different technologies, particularly the main programming languages that are commonly used for backend and frontend development.

Based on these results, our SDKs were created in 5 different programming languages: Java, NodeJS, PHP for backend; JavaScript and Android for frontend. For each language we approached all the eight use cases mentioned earlier.

In a way to make the solution even more attractive and customisable, the SDKs also include a diverse range of code snippets. These are generic pieces of code that help developers to better understand in a general way how the SDKs work for the several scenarios and use cases available. Several code snippets were created, covering over 500 use scenarios, available in all the mentioned programming languages.

Contributing to innovation in fintech

As for all technologies developed by the Inclusive Tech Lab, the codes created for the SDKs are an open-source initiative, and freely available to the mobile money community. The SDKs’ code is organised based on use cases and programming languages.

The SDKs were built against our Mobile Money API simulator created based on the GSMA Mobile Money API Specification. If your API is based on the GSMA API Specification you can directly use the SDKs. Alternatively, if a provider uses another API, they can easily adapt our solution to their needs and requirements and customise their own SDKs.

Developers have the flexibility to adapt the use cases by changing, adding or even removing the ones that are more suitable for their solution.

All code was built in alignment with mobile money providers’ business needs, making it easier to customise the code, as noticed by MTN Group.

I am very excited about the release of GSMA Mobile Money API SDKs given the kind of innovation possibilities these tools accelerate. The SDKs enable quicker time to value where the core API capabilities are provided like a reusable utility for any developer, hence leaving the developer to focus more time on their innovation competitive advantage. The fact that the SDKs are available in several frontend and backend programming languages is bonus to the Fintech Ecosystem. The SDKs being open source is another key industry enabling trait that will let any Fintech expand on their capabilities while contributing to their robust and secure evolution through gradual community improvement. In the same spirit, the several scenarios made available by the GSMA Inclusive Tech Lab will help us to tailor our own MTN MoMo SDKs and take our API to another level of usability.

John Mark Ssebunya

General Manager – Technology Strategy and Architecture MTN Group Fintech

Chair of GSMA Mobile Money API industry working group.

In addition, all the SDK integration for new applications can be checked through a full set of testing algorithms, created to automate the validation between new solutions and the mobile money provider’s requirements. This reduces the effort of industry players when they decide to use our SDK as a guide to create/adapt their own APIs SDK.

Ready for innovation? We are here to make it easier for you

All SDKs, including the code snippets and extensive documentation, are available at the Mobile Money API Developer Portal, SDKs information page, or in our GitHub repositories.

The GSMA Inclusive Tech Lab can give you the support you need to understand how the use of SDKs can trigger innovation and expansion for mobile money services, or help you with customisation of the current assets.

Contact the Inclusive Tech Lab and let’s innovate together!