Zoona – pronounced ‘Z-oh-na’ and meaning ‘it’s real’ – is the leading mobile money provider in Zambia. The company’s core product is a mobile-based Zoona Account. Transactions are processed through a network of Zoona Entrepreneurs, enabling them to process money transfers, pay suppliers, and access working capital financing. These Zoona Entrepreneurs provide members of the public – the service’s end users – with a quick and safe money transfer service, along with third-party cash-in/cash-out services. Additionally, the company offers a supplier payment service in partnership with major Fast-Moving Consumer Goods companies such as Zambian Breweries, a subsidiary of SABMiller. The Zoona back and middle office teams are based in Cape Town, with operations teams working in Zambia and Malawi. The company plans to expand into several new markets in the coming years.

Year Launched: 2008

Business Model: B2B, Consumer

Targeted Device: Basic Phone

Primary Delivery Technology: SMS, USSD, Mobile Web

Products & Services: Payments, Interactive content (Business Management Tools)

Markets Deployed In: Zambia, Malawi

Estimated Total Number of Users: 650+ Zoona Entrepreneurs

Estimated Number of End Users: 600,000+

BACKGROUND AND OPPORTUNITY:

Zambia has an agriculture-heavy and primarily cash-based economy, with over 60% of the population without access to basic financial services. This reliance on cash transactions brings inefficiencies and insecurities that act as obstacles to economic activity. For example, the Zoona team speak of having observed agricultural payments being made using trucks of cash accompanied by armed security guards. One company alone transferred over $30 million dollars in cash to pay 150,000 farmers in a year. When M-Pesa, the preeminent mobile money service in Africa, was beginning to thrive in Kenya in 2008, Zoona’s founders were inspired to set up a mobile money transfer service beginning in Zambia that could help to overcome the above challenges and stimulate economic growth.

OBJECTIVE:

Zoona holds a vision of a ‘cashless Africa’. In pursuit of this, the company aims to support small businesses by allowing entrepreneurs to transact through their mobile money product, providing them with capital and giving them tools to manage their businesses.

RESULTS:

As of August 2013:

- Number of Zoona Entrepreneurs (customers/agents facilitating the service): 650+

- Unique active end users (members of the public who transfer money once every 90 days): 600,000+

- Combined monthly average transaction volume: $25,000,000+

IMPACT:

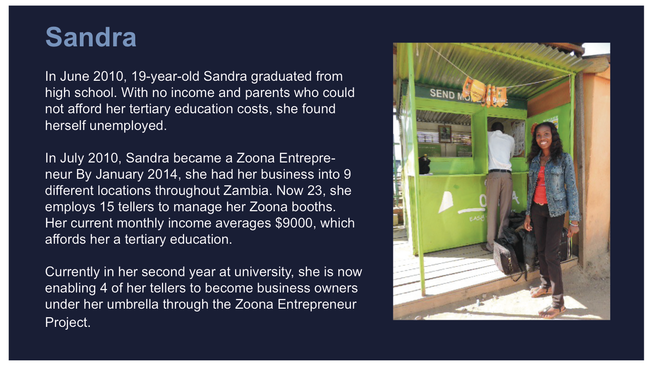

Zoona offers money-making opportunities and valuable business support to small businesses and entrepreneurs, whom the company believes to be the drivers of the economy. The Zoona Entrepreneurs earn an average of $500 per month in commission per outlet, bringing them increased financial security. The service also removes the inefficiencies and insecurities of cash payments for people and businesses.

LESSONS LEARNED:

- Get the right staff and processes in place early on –

These are the foundations for growth and scale – without them, a high quality product and/or strategy will not be sufficient.

Although minimising the number of staff during the start-up phase may be tempting to keep costs down, hiring effective team members early on can save money and add value in the long run. - Always focus on your customer – Start with customers’ specific needs and work from there; use robust data analysis to investigate customer behaviour and engagement, and provide evidence for service improvements.

- Ensure that partnerships are based on common interest and don’t deviate from your vision – Much value can be gained through establishing mutually beneficial partnerships. However, it is important to retain a degree of flexibility that allows for continued pursuit of your own objectives, and to ensure that certain key values are shared between organisations.

APPROACH:

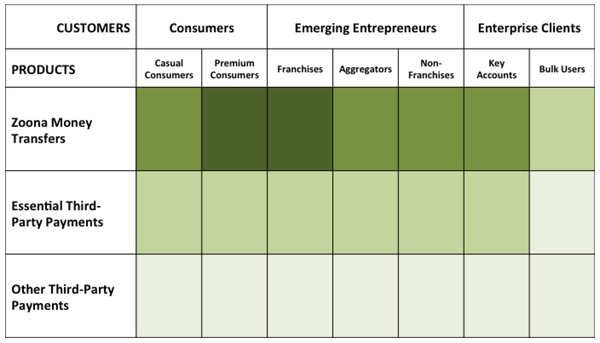

Zoona’s primary customers are the Zoona Entrepreneurs, the company’s agents on the ground. These entrepreneurs have one of three different types of businesses. They may be a franchise, providing the core cash in/cash out services from booths across the country. They may be retailers, providing this service as a value addition to general goods services. Or finally, they may be distributors, who use B2B payments to transfer money to their suppliers.

These Zoona Entrepreneurs can be found near post offices (the traditional channel for transferring money), in urban markets, at border posts, and in rural areas far from bank branches. Crucially, end users are not required to sign up to their own mobile wallet. Instead, users can conveniently transfer money across the mobile platform via their local Zoona Entrepreneurs: the money is transferred between Entrepreneurs’ mobile wallets, to then be collected by the intended end recipient.

Zoona identified an opportunity to move into B2B payments when the team realised that the money transfer service could be adapted to a supplier payment service. They started working with the SABMiller distribution channel in Zambia, which had previously operated almost entirely in cash. The move into the B2B market had considerable potential to increase efficiencies for Zambian businesses.

Zoona undertakes analysis of their entrepreneurs’ behaviour and performance through the substantial amounts of data that they collect. Using this to create median performance rates, they can identify how an entrepreneur is performing compared to their regional expectations. They can then feed this through to the Zambia team who react accordingly, whether through corrective action or further incentives.

At the time of Zoona’s launch in Zambia, it anticipated that the country’s mobile money space would soon be taken over by mobile network operators (MNOs). They therefore hoped to use the money transfer product as a short-term way of bringing money into the business. Then, when large MNOs came in with their own mobile money transfer services, Zoona could act as an interoperable agent that would facilitate cash going in and out of mobile wallets. It would then shift focus more on corporates, seeing this as an opportunity to diversify in the B2B space. However, whilst larger MNOs did introduce their own mobile money services, there has still been plenty of room for Zoona to compete in the market. As a result, Zoona continued to roll out and grow its service, partnering with MNOs as an independent service provider where appropriate.

USER CENTRIC ATTITUDES:

The Zoona service was not initially based on customer research. Rather, a gap in the landscape was identified and a money transfer product, and later a supplier payment product, were created to fill it. Nowadays, the company focuses more closely on designing for customer needs. The company has an iterative approach to design, which it terms ‘‘traction by action’. The team have an idea, experiment with it and learn from it, thereby evolving the service. This demonstrates Zoona’s dynamic working culture, which encourages and cultivates agility, organisation, innovation and entrepreneurship.

THE USE AND VALUE OF DATA:

Transactions made through Zoona generate large amounts of data. Every time the service is used, Zoona receives the user’s name, ID number, phone number, origin of transfer, collection of transfer, and its value. As such, Zoona has swathes of valuable end user data at its disposal, which can be used to monitor and inform the direction of the service. For this reason, Zoona is working towards increasing the sophistication and effectiveness of data analysis within the company.

Its first move in doing so was to implement the business intelligence tool, Qlikview, into which all Zoona transactions are now fed. This allows them to produce dynamic dashboards, reports and data visualisations. Through these, the team are able to understand much more about end users’ behaviour and interaction with the service. For example, they recently used Qlikview to identify their top 500 users as of January 2013 and map out what had been happening to them over the past 18 months, supplementing this with phone calls to individual users where necessary. They used this information to collect an understanding of users’ activity in order to identify key acquisition and drop-off points, and to segment their user base.

A sample screenshot of Zoona’s data analysis software

Data collection and analysis have also proved useful in Zoona’s financing of entrepreneurs. The company has developed an algorithm that can offer more favourable financing to customers according to how much they transact through Zoona – essentially allowing the company to build a credit scoring model. The majority of these customers will not have had any formal credit before, as no banks will lend them money and microfinance is too expensive. Data analysis therefore supports the company in providing an effective financing service for small entrepreneurs and enabling it to identify and realise an opportunity that may otherwise have been missed.

SUCCESS AND SCALABILITY:

Zoona has three key metrics for measuring short-term commercial success. The first of these is the number of customers (meaning Zoona entrepreneurs) currently standing at over 650 – and the number of unique end users who transact at least once every 90 days, of which there are currently over 600,000. Secondly, they measure the revenue that their services are generating, focusing on driving revenue growth as quickly as possible. Finally, Zoona’s own revenue is seen as a key indicator of its success as well as its capacity for continued success.

These short-term metrics are framed by Zoona’s key long-term strategic goals. One of these is to maintain its position as the number one mobile money operator in Zambia in terms of value transacted. The economy remains primarily cash-based, and Zoona believes that it has an ideal model to fit into the ecosystem as it develops. On top of this, it wants to eventually become the top mobile money brand in Africa. Currently, this honour belongs to M-Pesa. However, Zoona hopes to emulate the number of markets in which M-Pesa operates in the coming years. Finally, it aims to become the top employer in Africa, attracting more entrepreneurs through its positive working culture, which features strong focus on professional and personal development.

Alongside these metrics and goals, Zoona has a clear vision for growth through both internal development and external expansion.

Internally, Zoona’s current capacity is constrained somewhat by its ability to scale its systems in house. This essentially comes down to how quickly the team can find and hire good people. To overcome this challenge it is strengthening its branding team in order to implement actionable steps towards becoming the top mobile money brand across the continent, which Zoona hopes will attract new, capable talent. It is also increasing its capacity to leverage data by building a data analytics team, in order to more strategically target areas for scale.

Externally, Zoona plans to expand into a number of different markets over the next 5 years. Beyond Zambia, the most immediately suitable market for Zoona is neighbouring Malawi. It is immature in terms of mobile money and has similar market conditions and a shared language with Zambia. As a result, Zoona launched its service in Malawi in September 2014.

Beyond this, Zoona is also exploring expansion into Tanzania, DRC, and Mozambique. Tanzania in particular will be something of a test case; given the market’s relative maturity in terms of mobile money, it is unclear how well their service will fit into the landscape. The existence of three large mobile networks gives Zoona the chance to position itself as an interoperable agent, building a shared agent network. Here, a key task for Zoona will be to use this test case to understand how it can fit into a more advanced mobile money ecosystem. The outcome will steer Zoona’s future direction in terms of market expansion.

PARTNERSHIPS:

Since their launch in 2008, Zoona have benefitted from a number of key partnerships.

Investor partnerships have been crucial in Zoona’s evolution from a family-run business to an incorporated company. It has sold equity to the likes of the Omidyar Network, Accion and Sarona. These partnerships have given Zoona credibility and investment from which to scale. The Omidyar Network also offered Zoona tailored business support, courtesy of the network’s Human Capital Development Team. The team, made up of ex-PayPal and eBay employees in Silicon Valley, has provided Zoona with pro bono executive coaching, brand development training and management training, all of which have proved fundamental to the way in which Zoona does business.

Various commercial partnerships have been important in Zoona’s growth. For example, SABMiller used Zoona to move towards efficient cashless payments in its Zambian distribution channels. Zoona is now working with Zambian Breweries (SABMiller’s subsidiary in Zambia) – with the help of a group of Oxford MBA students – to carry out a thorough cost-of-cash analysis of their usage of Zoona’s service. Zoona instigated this project to quantify the value that its service brings to Zambian Breweries, as well as to understand more about its costs.

Relationships with mobile network operators have achieved varying degrees of success. MNOs bring benefits such as marketing weight, which can raise the company’s profile – especially with other operators who could become future partners. However, the goals and administrative processes of large MNOs can be at odds with the more nimble culture of the start-up. Therefore, to support its goal of positioning itself as an interoperable agent across networks, Zoona now aims to work with operators as an independent service provider in place of formal partnerships.

Zoona has also enjoyed a number of NGO partnerships over the years. For example, it received seed capital from the USAID project PROFIT, which was extremely valuable in establishing the business early on. Additionally in 2010, Zoona partnered with the World Food Programme on a subsidy voucher programme in Zambia, Zimbabwe and Mozambique that has since spilled over to smallholder farmer subsidy vouchers in Zambia and Malawi. To date, Zoona has processed $17.5 million worth of subsidy e-voucher transactions.

In identifying potential successful partnerships, Zoona’s experience has taught them that aligning ‘on paper’ is necessary but not sufficient in itself. These relationships also require a shared vision to be held by a number of individuals inside both organisations. As a result, Zoona has found that the flexibility that comes with positioning themselves as an independent service provider across an industry can bring greater benefits than exclusive partnerships.

CHALLENGES:

Initially, Zoona’s main challenge was cash flow. However, a successful investment round in 2012 solved this problem. Subsequently, the team were able to begin thinking more about long-term strategy as opposed to short-term sustainability, allowing them to shore up the business’ foundations and structures.

In the beginning, activities were focused on putting in place rigid systems, processes and legal procedures, which were the foundations from which future growth and scale would come. For example, Zoona realised how challenging it was to find the right people to join the team and get them into place efficiently. However, this process has been refined over the years, thanks largely to the aforementioned structures and procedures.

Future Plans:

Looking forward, the big change that Zoona hopes to see a year from now is activity in an additional 3 or 4 countries, starting with Malawi and Tanzania. Whilst their brand within Zambia is strong, the step-up to having a recognisable regional brand is a significant one. Building this brand therefore represents an important challenge for them. Zoona also hopes to develop its role as an interoperable agent network, working with and adding value for MNOs.

Zoona believes that they’re building the right kind of business, ones with effective and suitable models, and desirable aims. In raising the Zoona brand and profile in these ways, it can continue to spread and develop the impact that it is already having in Zambia. For these reasons, the Zoona team are very excited for the future.

This document was originally produced as part of the former Mobile for Development Impact programme.