Widespread adoption of mobile money in recent years, and the consequent creation of transactional data, has enabled access to short-term loans for individuals who were previously excluded from formal credit markets due to lack of credit history. By partnering up, banks in many LMICs are expanding financial access through agent outlets and bank agents by adopting technology based on connectivity often provided by mobile network operators (MNOs). However, high default rates and over-indebtedness are gaining increasing attention as risks to consumer protection, financial health and empowerment for users of digital financial services (DFS) that facilitate digital credit. In order to better understand these challenges, the Competition Authority of Kenya (CAK) and Innovations for Poverty Action (IPA) recently conducted a study (2021) to identify and address potential consumer protection concerns in Kenya’s digital credit markets. The insights from this research focus on the role of policy and regulation in addressing some of the problems currently facing Kenyans using these digital lending products. As research and dialogue on consumer protection within DFS increases, it is important to ensure that such regulations are proportionate responses that confer with the needs of DFS providers, where DFS has the ability to empower consumers through the facilitation of affordable and resilience-enhancing credit facilities for financially underserved populations, including low-income and rural consumers.

Innovations in the mobile money sector are increasingly addressing consumer protection concerns surrounding transparency over fees and Ts&Cs, the provision and awareness of effective recourse mechanisms, protecting consumers’ data and investing in financial literacy programmes for consumers. All of these are identified criteria within GSMA’s Mobile Money Certification for mobile money providers (MMPs) and examples of best-practice in the industry with regards to mitigating risks of over-indebtedness are explored in GSMA’s recent publication on financial health within the mobile money industry.

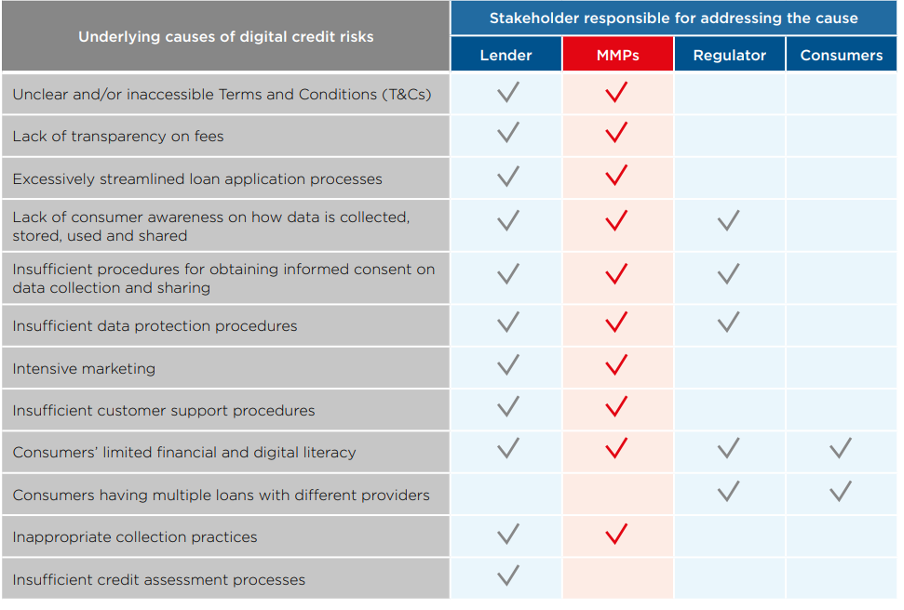

The first step to understanding what makes a harmonious and proportionate regulation of digital lending products facilitated by mobile money, starts with establishing the extent of responsibilities that fall under the remit of the MMP and those that fall under the remit of the partner lending institution. It is important to note that the vast majority (85%) of global digital credit services are partnerships between an MNO and a financial institution, rather than business models whereby MMPs take part only as a channel through which the service is offered. These are important roles to distinguish as they determine the extent of MMPs responsibilities over digital credit risks. The figure below outlines the responsibilities of stakeholders involved in such lending models in mitigating risks of over-indebtedness, and it is essential to note that whilst MMPs can play a role in mitigating these risks, they cannot be solely responsible:

Focusing on the digital credit market in Kenya, which is where it first emerged in 2012 with the introduction of M-Shwari, the digital lending product was the result of a partnership between Safaricom and Commercial Bank of Africa. Such partnership models have enabled effective use customer data on mobile money use and transactions to assess creditworthiness, which in turn, is helping to strengthen KYC compliance for mobile money users, mutually reinforcing customers’ financial integrity. Enabling access to formal credit in this way allows mobile money consumers, particularly low-income and rural users, to access borrowing funds in times of economic shock or crises, and increase their resilience in a more effective and targeted way than previously possible. In this model, loans are typically tied to savings accounts; both the mobile money provider and lending institutions are licenced; and integration typically happens through APIs and/or access to mobile money menu.

What makes an enabling consumer protection framework? Notes for regulators:

It is important that policymakers and regulators strike an appropriate balance between protecting consumers and creating an enabling environment for mobile money services as a driver of robust consumer financial health. Regulators should understand the partnership models of digital credit facilitated by MMPs in their markets, and therefore their respective responsibilities to develop informed regulation that enables industry investment, innovation and development of safer and more transparent practices that further empower consumers and protect them from risks of over-indebtedness.

Furthermore, the GSMA Mobile Money Regulatory Index (MMRI) provides an insightful tool for policy makers and regulators to measure the effectiveness of mobile money regulatory frameworks by scoring countries between 0-100, where a higher score is associated with more enabling regulation. Within the Consumer Protection indicator, 20 points are awarded for each of the regulations that are in accordance with the following: (i) There are consumer protection rules that apply to mobile money services (either in the mobile money regulatory framework or in other consumer protection regulations or legislation); (ii) The consumer protection rules require that customers are granted access to recourse and complaint procedures in order to resolve disputes; (iii) The consumer protection rules require price disclosures for mobile money transactions; (iv) The consumer protection rules provide a general disclosure requirement to make the terms of the service available to customers; (v) The consumer protection rules provide for the protection of mobile money customers’ data.

| A clear and strong data protection framework helps foster consumer trust and increased use of DFS, which in turn can incentivize investment, competition and innovation in the digital economy. At the same time, regulation should foster necessary data sharing and analysis by DFS providers to enable their ability to better assess consumer creditworthiness and risks that could lead to over-indebtedness. |

Regulators and policymakers should continue to participate in industry forums and specialist groups to share best practices with service providers and balance regulation with the needs of the industry. Additionally, investing in financial education and awareness campaigns so that consumers understand the risks of reliance on credit can also help consumers to improve their financial health and improve financially excluded customers’ access to more affordable products and services enabled by MMPs.

The GSMA Mobile Money team is developing further insights on consumer protection in digital financial services that address a variety of markets, as well as relevant, interrelated topics within this remit.