Please click here to download the report as a PDF

PART I: Techno-economic analysis

The evolution of Fixed Wireless Access technology

In this article we will refer to Fixed Wireless Access (FWA) as a wireless link that provides connectivity to objects that are stationary or nomadic (i.e. almost no movement when connectivity is used).

FWA is not a new concept, in fact it has been frequently used as a substitute to wireline connection in the last mile (i.e. from central office to customer premise such as home/building). In terms of functionality, the role of FWA is comparable to that of Fibre-to-the-x as both are connectivity solutions for the edge of the network.

For FWA to be a competitive substitutive proposition to FTTx, it will need to provide fibre-like performance at better cost economics. This document focuses therefore on FWA based on 3GPP radio technologies such as 4G LTE (Long Term Evolution) and 5G NR (New Radio).

The case for FWA

Cost effective network deployment solution

General expectations are high at the dawn of the 5G era: Industry 4.0 and the digital society, for example, will demand support of a network that can provide high throughput and low latency everywhere. Both mobile and fixed networks will therefore need to be densified to serve consumer use cases as well as business use cases effectively.

Fibre densification has proven costly to implement, especially when connecting customer premises (Fibre to the Home, or FTTH for short), what is known as “last mile” due to the need of civil work, involvement of multiple stakeholders (e.g. property owners, road & pavement owners, duct owners, leasers). Anecdotal evidence suggest that the last hundred of metres attract up to 90% of the costs. Similar cost pressure also exists in the case of upgrading and expanding wireline infrastructure from legacy copper wires to more advanced wireline infrastructure such as fibre.

FWA can provide an economic alternative to address network densification. FWA can also provide an easier/cheaper solution to offer broadband connectivity to regions where wireline infrastructure is not present or only copper wireline infrastructure is in place.

In situations where elements such as household density and costs of civil work favours the deployment of fibre, FWA can be used to complement fixed broadband deployments.

Creating social value

By providing broadband connectivity to regions that were not previously covered or covered with mediocre quality, FWA enables national economic growth as connectivity facilitates easier access to information while reducing the cost of communicating. Indeed, the State of Broadband 2015[1] jointly released by the International Telecommunications Union (ITU) and United Nations Educational, Scientific and Cultural Organization (UNESCO) states that affordable and effective broadband connectivity is a vital enabler of economic growth.

FWA can also provide an effective means to overcome the “digital divide”. Digital divide, defined according to OECD, is “the gap between individuals, households, businesses and geographic areas at different socio-economic levels with regard both to their opportunities to access information and communication technologies (ICTs) and to their use of the Internet for a wide variety of activities.” Digital divide is important as it reflects the differences in ability of individuals and businesses take advantage of the Internet and leverage the vast source of knowledge.”

It is worth noting that the digital divide cannot be simply addressed by providing internet access to households. The connection has to be fast enough to accommodate advanced services e.g., multimedia, real-time and social communications. Fixed wireless can overcome the digital divide in the multimedia information by providing cost effective means to deploy connection links to households not reachable via fixed infrastructure.

Already proven business case

FWA realised with 4G technology has already been proven as value proposition of broadband services to consumers and enterprises, ensuring certain degree of return for operators and with lower deployment cost than wired transport networks. Roll out of FWA could be especially attractive to non-incumbent fixed operators that are likely to lack fibre infrastructure compared to the incumbent rivals. As cost to cover the last mile with wireless connectivity is significant lower than with fibre while potentially providing comparable performance, FWA opens up new opportunities for new entrants/challengers in the broadband market.

Broadband value proposition however, is not just about providing higher data speeds to the users, but rather about the capability of accessing, multimedia services and service requiring reliable connectivity such as, for example e-learning. This capability enables quad play package, which is a proven business case globally. With FWA, operators can provide not only connectivity, but also bundle other advanced services such as voice services over IP and 4K UHD TV to attract consumers.

FWA is also well suited to support enterprise customers, especially those customers that are not connected to superior wireline infrastructure (e.g., fibre) by facilitating their digital transformation. Even the enterprises that are connected to the superior wireline infrastructure can make use of FWA to extend the reach of the connection.

FWA is also as a cost effective solution to address transport network demands for connecting the central offices to remote nodes (i.e. customer premise). Examples include replacement of ADSL networks, support of non-latency sensitive mobile fronthaul networks that connect the central processing unit to indoor small cells replacement of legacy copper/coaxial cable infrastructure.

Finally, FWA will be able to address connectivity demand from the growing number of devices in the era of Internet of Things (IoT), not only for the devices installed in households, but also for general things such as surveillance and security cameras. The things may be connected to FWA directly or connected to an aggregator, which is connected to FWA, via other links (e.g., Ethernet or WiFi).

Business opportunities for FWA

Value Proposition in developed markets

FWA can satisfy three different segments of the broadband connectivity market in developed nations.

The first segment is nomadic/temporary demand. In several situations, mobile operators are required to provide temporary coverage in some areas of the country where there is normally little or no demand. Examples include events/festivals, a skiing resort in winter and so on. The main challenge in these cases is to provide adequate backhaul for the additional temporary radio cells that may be needed. Deploying FWA to satisfy the nomadic/temporary demand represents a flexible, quick and cost-effective solution.

The second segment is broadband connectivity demand in an urban environment. In general, it is challenging to upgrade or deploy infrastructure in dense urban environment due to high civil work costs and complexities associated with buildings. FWA can overcome the challenge by providing wireless connection with high throughput and latency, whether it be replacing ageing wireline infrastructure (e.g. E1 links) or establishing connection to a new network node.

The third segment is rural demand. In rural areas, population density is sparse and, by definition, remote from central offices. Significant investment is hence required to connect a subscriber to the network via wireline infrastructure. FWA can provide flexible and cost-effective solution to connect otherwise economically infeasible customers with reasonable return on investment. As wireless links, with high power transmission/reception and advanced antenna technologies, can effectively reach rural outskirts without major construction work (i.e. only base stations and customer premise need to be installed).

In some markets, existing fixed internet services, such as DSL (Digital Subscriber Line), are provided in a very low price. It is very difficult to penetrate with mere enhanced connectivity value proposition in these markets. This is where 5G technology can be exploited to provide additional value to connectivity. The high bandwidth enables provision of bandwidth consuming residential services such as IPTV (IP Television). The very low latency of 5G access can also be a potential key enabler for future applications. The high-efficiency data compression techniques and variable bitrate video content of 5G allow the delivery of high-resolution video with less bandwidth. Furthermore, adaptive bitrate streaming can optimise the multimedia viewing experience, as it adapts automatically to any changes in network conditions.

Value Proposition in developing markets

Many developing nations suffer from a digital divide when compared with developed nations and as a consequence, demands for broadband service in developing nation often resemble the rural demands of developed markets. Therefore, the considerations of rural demand segment as noted in the previous section apply.

However, the impact of broadband connectivity in developing markets would be greater than that in developed nations as the customers will be given high bandwidth to start with rather than starting from traditional ISDN (Integrated Service Digital Network), ADSL (Asymmetric Digital Subscriber Line) and in the best case VDSL (Very-high-bit-rate Digital Subscriber Line). Developing markets may have more potential as there is little revenue of existing services (e.g., IPTV) to be cannibalised by future applications.

Implications of Mobile ARPU

In approaching FWA, operators must be careful to balance the potential reduction of its mobile communications offerings revenue and the new revenue creation by FWA. Therefore, FWA is more economically attractive in markets with low mobile ARPU, as new broadband connectivity would be likely to increment more revenue than is cannibalised. On the other hand, operators in the markets with high mobile ARPU must be cautious and carefully evaluate the impact of revenue cannibalised by FWA and that of new revenue stream.

Broadband demand currently unserved

The value propositions of FWA can address unmet needs of different markets. FWA can expand the broadband market by providing broadband connectivity to regions that are not yet served. According to Huawei [ref!], as of 2017 there were 1.3 billion unconnected households globally and these are the potential broadband market demand that FWA can address. LightReading [ref!] indicates that about one third of US households are candidate of 5G FWA, where the majority are largely outside operator’s traditional territories. Although not all the candidates would be unconnected, it still shows the magnitude of demand that FWA can address.

Fixed internet market that can be upgraded to broadband

Another market that fixed wireless can address is non-broadband fixed internet market. These markets can be cost effectively upgraded to broadband connectivity without the need of waiting for the costly update of wireline infrastructure. According to ITU statistics, 45.9% of the global population is using the internet, but only 12.4% of the global population have a broadband subscription as of 2016. The difference of 33.5% would be an overestimation of the potential market for broadband upgrade. However, the statistic provides an estimate of the magnitude of the upgrade demand. Huawei estimates that there are 400 million households needing faster connections globally.

Covering time-limited demand

The nomadic demand covers the case where customers stay in locations only seasonally or temporarily and seek connectivity there. While it is difficult to identify the exact magnitude of this market, the statistics from EU (European Union) may provide a hint on the potential size of the market. Eurostat states that the domestic travel demand in EU is 54.6% of the 2.78 billion nights stayed in EU-28 states, approximately 1.52 billion nights. Although this number includes nights stayed in urban areas, crudely assuming that one third of the nights were stayed in rural areas or locations with limited capacity lead to 500 million nights. This calculation excludes events/festivals as well as international travellers.

Internet of Things

According to Ericsson [Ref!], there will be 18 billion IoT devices by 2022 globally, where 16 billion are short-range objects that are usually fixed or stationary. As the objects are not long-range, it is rational to provide connectivity to these objects with short-range LAN (local area network) technology and then connect the area with long-range connectivity. FWA can provide a cost effective long-range connectivity in this case. Crudely assuming that there will be one long-range connection device per 100 short-range things, there is a potential demand for 160 million FWA connection.

Benefits of FWA

Cost effective network deployment and operation

The benefit of FWA is fully realised when deployment and operational costs are kept relatively low compared to wireline infrastructure for providing broadband access to customers. Huawei[2] estimates the total cost per broadband line for FTTx is significantly higher than that of FWA. Focusing on CAPEX only, FTTx costs $500~$1,000 per subscriber while wireless transport network would cost only $100~$400. The economics of FWA may not be as good as that of legacy fixed infrastructure such as DSL, but operators should consider the advanced capabilities (e.g., Quad-Play, low latency and high bandwidth) FWA enables.

Experiences with FWA providing consumer broadband services suggest that the cost per bit to connect a household to broadband can be reduced by 74% when compared to wireline connections. Furthermore, implementation of radio innovations such as massive MIMO with 3D beamforming can further reduce the cost to 80% compared to wireline connections, once the investment costs to develop these technology has been absorbed. The reduction of cost enables operators to quickly and flexibly deploy data connection for intended use cases.

Most of the cost reduction can be attributed to reduced civil engineering, which is one of the most complex and costly component of network deployment/operation due to the need for apply for licenses, digging trenches, installing poles, erect towers and so on.

In summary, the cost competitiveness of FWA depends on the components of the network being considered. When considering only the backbone network, backhaul and equipment costs, the overall capital expenditure associated with FTTx scenarios are similar to that of FWA. For the last mile, however, FWA outperforms FTTx and provides a more flexible and cost-effective solution. Under the point of view of operating expenses, FWA has advantages over FTTx with regards to the maintenance costs and in the provision of new services that may require modifications to the transport infrastructure (labelled GTM, for go-to-market, in Table 1). However, when taking into consideration elements such as rental, power consumption and spectrum licenses the OPEX of FWA may become higher than FTTx.

| CAPEX | OPEX

|

||||||

| Backbone | Backhaul | Last mile | Equipment | GTM | Maintain | Run | |

| FTTx | + | ++ | +++ | + | + | + | |

| FWA | + | ++ | + | + | |||

Table 1 Cost comparison between FTTx and FWA

Although FTTx can result to be a more costly option, it still has a number of advantages compared to FWA. The main merit of FTTx is the fact that it is more stable not suffering from degradation due to radio conditions or weather. FWA is not meant to completely replace the wireline infrastructure, and both technologies have a role to play in providing broadband access. Fibre infrastructure is very suitable for regions with concentrated customer density (especially where civil engineering is not regulated) and for major backbone networks requiring stable and high bandwidth. For the last mile, instead, FWA is appropriate as it provides better commercial viability.

Increase in performance

FWA based on 3GPP radio access technology leverages radio innovations such as the LTE air interface, carrier aggregation, advanced modulation schemes and multi-antenna technologies. Unlike mobile phones, terminals for wireless transport network do not have stringent requirements such, as power supply, which allows to further boost the performance. In addition, high-gain outdoor CPEs and multi-antenna CPEs are available as options. These advantages allow FWA to have fibre-like performance although they also result in higher deployment costs.

4G LTE technologies, with radio innovations aforementioned, currently provide experienced peak rate of 1Gb/s. This figure supersedes that of copper wire transmission and is comparable to that of the fibre network. Multi-antenna technologies and carrier aggregation enables the increase in throughput. With 4×4 MIMO technologies and carrier aggregation of five 20MHz carriers, the throughput increases significantly. 5G is able to leverage even wider bandwidth and massive MIMO technologies targeting a peak user rate of up to 20Gb/s in up to 1GHz bandwidth. 5G will enable FWA to accommodate more users per base station and provide high user rates.

The 3GPP radio access technology can also provide superior coverage to that of the fibre networks. Analysis by Ericsson[3] shows that for an ISD (Inter-site distance) of 350m, 78% of the households were able to achieve good throughput using indoor antennas (usually integrated into CPEs), whereas the rest required either outdoor wall-mounted antennas (17 percent) or rooftop-mounted antennas (5 percent) to achieve sufficient signal quality.

5G technology readiness

While 4G-based FWA has been deployed after the technology was adopted in mobile networks, the 5G based FWA in above 6GHz bandwidths is likely to be the first large scale deployment.

5G FWA represents an opportunity to learn more about the properties of the propagation at very high frequencies, as well as massive MIMO and 3D beamforming. This experience will be essential when deploying conventional mobile networks in these frequencies as well as giving the opportunity to gauge the potential of using FWA technologies for wireless backhauling.

Challenges of FWA

Interoperability and scalability

Globally interoperable devices and network infrastructure, a large community developing standards collaboratively pushing the boundaries of technology are thought to be cornerstones behind the success of mobile communications. While FWA deployment numbers will be orders of magnitude smaller than cellular and IoT, achieving scale remains an essential goal in order to release the value.

Currently, there are variety of technology solutions considered by mobile operators. However, without the global mobile operator community converging to a technology standard, the economics of network deployment and devices will not be at its full potential, and fragmentation of technology must be minimized to achieve economies of scale. Adoption and compatibility with 3GPP defined radio access technology has the highest potential in fostering interoperability and scalability.

AT&T indicated that one of the key high-level elements of a successful deployment of 5G FWA is completion of 3GPP release 15 and eventually the release 16 standards, as it will enable a global ecosystem of devices and infrastructure rather than proprietary or local solutions.

It is therefore desirable to deploy solutions that comply with the global 3GPP standard or use technologies that can in time converge into 3GPP standard to achieve economics of 5G FWA. This, coupled with the stepping-stone nature of FWA to the next generation of mobile network technology, will also extend the economics to 5G network deployment for mobile use cases.

PART II: Implementation considerations

FWA with 3GPP specifications

3GPP radio technologies, such as LTE, enjoy an extremely wide industry support and a mature ecosystem of vendors and operators, their global adoption and open specifications process means that hundreds of companies and possibly thousands of experts drive the development of the standards. Other technologies (e.g., WiMAX), on the other hand, have failed to establish an equally mature ecosystem.

For reference, FWA based on 4G LTE is booming with over 100 mobile operators providing the service, more than 37 vendors that manufacture customer premise equipment, producing over 230 different types of CPEs. Major vendors in the industry such as Qualcomm, Intel, Hisilicon, GCT, and Sequans provide 4G chips for FWA. Other proprietary radio access technologies, lacking such economies of scale, suffer from potentially higher costs and slower pace of development.

3GPP radio technologies (starting from 4G) also offer a great advantage in terms of throughput and are optimized for providing broadband services. The new radio network defined for 5G, is expected to provide a further leap forwards in terms of performance. While WiMAX offers users tens of megabits per second and LTE offers users hundreds of megabits per second, 5G is expected to usher the era of gigabits per second. This very high throughput is made possible by a radio access technology that can exploit the availability of large amounts of spectrum in the range of hundreds of megahertz of spectrum bandwidth. The high speed and low latency of 5G can be used to enhance the experience of the customers, as well as enable new services such as VR and HD video. Taking the case of a streaming service such as Netflix as an example, the expectation is that with 5G capacity operators will be able to upgrade 720p HD videos at 5Mb/s to 4K UHD videos at 25Mb/s.

Satellite links, remain a possible competitor of FWA, however due to the relatively low throughput and high latency, there are limited scenarios where their adoption is more beneficial than using terrestrial FWA solutions.

Another advantage of adopting or aligning with 3GPP technology for FWA is that mobile operators do not need to acquire additional spectrum as FWA can also be operate in the spectrum allocated to providing mobile broadband service.

Compared to the traditional smartphone paradigm, when using the 3GPP specifications in a FWA context, it is possible to optimise a number of parameters both at the base station and at the customer premises equipment. For example, FWA equipment can support 4×4 and higher order MIMO as well as other multi-antenna technologies; and CPEs enjoy less stringent power consumption constraints than smartphones allowing for extending the attainable range and throughputf.

In summary, when using 3GPP radio technology, operators can benefit from scale, a thriving community of technical experts improving the specifications and evolving the capabilities of the system, high performance and potential to deploy in already acquired spectrum to address FWA use cases.

Spectrum

4G spectrum

Technically, there are no limitations to bands that can be used to deploy FWA. Generally speaking, in the case of LTE network deployments, operators are known to prefer 800MHz, 1.8GHz and 2.1GHz bands for rural and suburban areas while using 2.3 GHz and 2.6 GHz for urban areas. The same strategy could be applied for FWA, however due to the possibility of mitigating the adverse effects of higher propagation loss, it is feasible to also consider high carrier frequencies such as those in the 3.5GHz range where large bandwidths are more readily available.

Most of the existing FWA deployments use medium- and high-frequency bands, but where demand for mobile broadband is low, it is possible to deploy FWA also in the low- and medium-frequency ranges without negatively impact the mobile users experience.

Dedicated carriers on medium- and high-frequency bands for FWA are mostly in the frequency bands higher than 2 GHz. Mainly, 2.3 GHz (band 40), 2.6 GHz (band 41) or 3.5 GHz (band 42 or band 43) are chosen. By using multiple antennas at both ends of the link and a higher transmit power than what is normally used for mobile devices (23 dBm) it is possible to compensate for the higher propagation loss than when using carriers in the low-frequency range. The available bandwidth makes possible to provide optical fibre-class broadband performance. It is also easier for operators to ensure quality of FWA, enabling advanced services such as multimedia and real-time services

5G spectrum

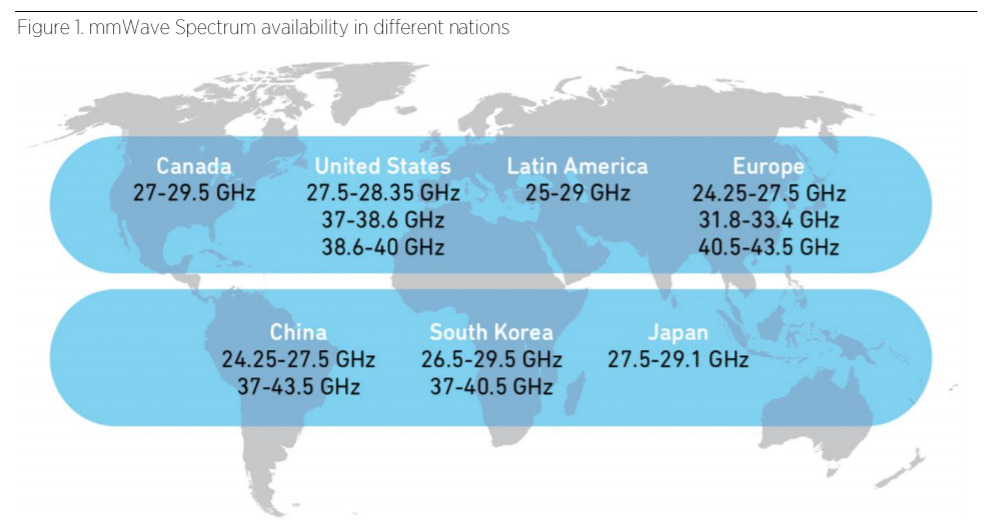

Early 5G will use a mix of spectrum ranges. 3.5GHz will be popular for initial deployments of cellular communications with different combinations of mmWave spectrum to be adopted in a second phase by operators depending on the availability (see figure 1) and operator’s strategy.

While spectrum below 6GHz would provide much better coverage than mmWave, its limited availability and relatively narrow bandwidths has led many operators to decide to deploy 5G FWA initially in mmWave bands, where massive MIMO and beamforming can be more easily employed. The main preoccupation with mmWave is the penetration loss in buildings and maximum range that can be supported by base stations. In the mmWave spectrum radio link performances greatly improve when the transmitter and receiver are in Line-of-Sight, many antennas would need to be mounted externally making the deployment and operations more complex. This reduces the cost efficiency of a wireless last mile connection as engineer visits and installation are likely to be required. Indeed, this is confirmed by Ericsson’s experiment that shows that 3.5GHz can provide much better coverage than mmWave in all situations (see table 2). For example, the shortest range of 1,800m of 3.5GHz provided by base station below clutter to an indoor terminal antenna outperforms all cases of 28GHz except when the base station is above clutter and the antenna terminal is on rooftop.

| Antenna Terminal | Indoor | Outdoor | Rooftop | |||

| Base station | Below clutter | Above clutter | Below clutter | Above clutter | Below clutter | Above clutter |

| 3.5GHz | 1,800m | 2,500m | 2,500m | 5,000m | 3,500m | 100,000m |

| 28GHz | 180m | 250m | 250m | 500m | 350m | 10,000m |

Table 2. Coverage experiment results for 3.5GHz and 28GHz (Source: Ericsson)

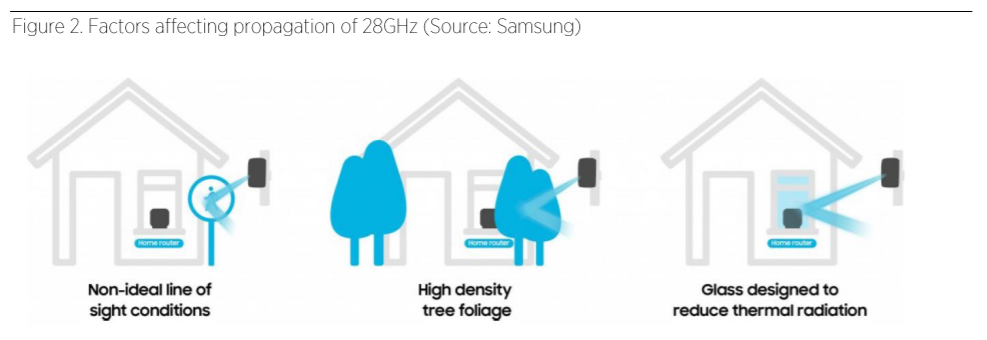

It is also critical to consider the propagation effect of foliage on the cell ranges at 28GHz (see figure 2). Deploying the base station antennas at a height greater than that of the tallest trees in the area significantly boosts the cell ranges. In terms of capacity, the availability of larger bandwidth and the possibility of utilizing a large number of antennas for massive beamforming enables very large cell capacity at 28GHz. These factors make the 28GHz band more appropriate for fixed wireless service in dense suburban and urban areas despite the disadvantages described above.

Overall consideration

The choice between LTE and 5G depends heavily on the operator strategy and the availability of spectrum. High-speed links over a relatively short distance are optimally realised using 5G in mmWave spectrum (LTE is not designed to be operated at frequencies above 6GHz), while LTE could be used effectively in mid-range frequencies over long distances although providing lower throughput.

Especially for 5G, which can use the higher spectrum bands that offer more bandwidth, it is important for operators to acquire government consent to avoid interference with legacy deployments using adjacent spectrum bands and to make full use of the spectrum nationwide.

It is also important to strike the right balance between the quality and the economics of spectrum. In the era of 5G where capacity is extremely high, experts recommend adopting shared spectrum for FWA and mobile use. In the case where quality is important, however, the operators may choose to adopt dedicated spectrum for FWA, as the benefits of spatial diversity cannot be fully exploited when sharing with cellular users.

Transport network

FWA provides connectivity via wireless links in the last mile. The links from the core network to the base stations (i.e. transport network) can adopt any types of solution including both wireline and wireless solutions. There is no panacea for the transport network but operators should be mindful of available options and their advantages/disadvantages. The table below provides a high-level comparison among the available options.

| Solution | Advantages | Disadvantages | |

| Optical systems | P2P Fibre (Grey Optics) | · Low-cost optics and support for high capacity and low latency | · Requires fibre-rich deployment |

| TWDM-PON | · Low cost potential

· Potential system reuse between FWA and FTTH clients |

· Limited capacity (less than 10Gbps) and limited low latency support

· Limits possible RAN deployment options and RAN services (low latency) |

|

| WDM-PON | · Dedicated solution for RAN transport which can be tailored for desired RAN deployment | · Limited reuse of potentially existing FTTH infrastructure

· Potential issues for future migration of customers to FTTH |

|

| P2P WDM Overlay | · Reuse of potentially existing fibre plant for providing P2P connections for mobile transport

· Support for high capacity and low latency |

· High costs and footprint | |

| Active systems | Ethernet, OTN | · Reuse of existing infrastructure | · Deployment options practically limited by deployed active equipment |

| Wireless systems | In-band wireless (e.g., 5G, LTE) | · Low-cost deployment | · Spectrum is shared between access and transport |

| Out-of-band wireless (e.g., microwave) | · Low-cost deployment compared with fibre (but more effort compared to in-band wireless) | · Dependent on solution or spectrum (e.g., weather conditions, dedicated spectrum) |

Table 3. Transport network options for FWA (Source: Ericsson)

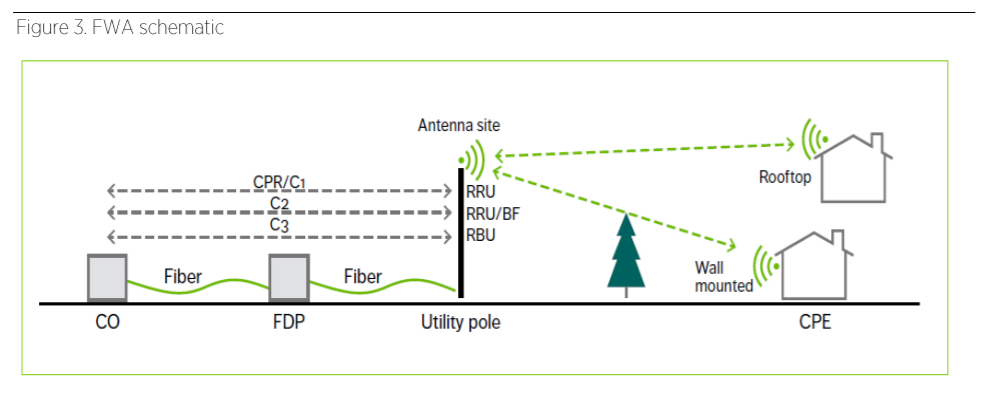

Furthermore, as FWA based on 3GPP radio access technologies essentially adopt the 3GPP RAN architecture the radio functional split alternatives specified for mobile networks also apply. As shown in figure 3, functional splits are applied to the region from CO (Central Office), FDP (Fibre distribution panel) and finally to antenna site. Table 4 lists the possible functional split options and corresponding capacity per site. It can be observed that there is a trade-off between transport capacity per site and implementation complexity of sites.

| RAN Split | Protocol stack implementation per site | Required transport capacity per site (Gbps) |

| CPRI (4G) | Only RF implemented | 40-100 |

| C1 – Evolved CPRI | Only RF implemented (with evolution to reduce capacity of transport) | 40 |

| C2 – Split-PHY | RF and lower PHY implemented | 10-25 |

| C3 – MAC-PHY Split | RF, lower PHY and upper PHY implemented | 5-10 |

Table 4. RAN Split options and characteristics

Devices

In providing FWA, the different device form-factors and conventional router/CPE both need to be taken into consideration. Especially in the context of mmWave 5G, it is important for the devices to support operations in outdoor environment. As the radio link may considerably deteriorate because of obstacles or lack of LoS characteristics of glass material, the device must be durable in any weather conditions found outdoors. This will enhance the economics of network deployment as less number of base stations would be required provide adequate coverage.

Figure 4. Situations where outdoor device is needed (Source: Samsung)

Effective marketing measures

As in the case of all products and services, FWA must be accompanied with effective marketing measures to succeed. First, the operator must be aware of the specific segment it intends to target. For example, if the operator is targeting urban demand, then the operator could aim at offering a performance equivalent to fibre. On the other hand, if the operator is targeting nomadic or rural demand, the operator may decide to prioritise coverage and stability over throughput equivalent to that of fibre.

Second, competitive price plans offering sufficient data allocation is required to attract customers. Furthermore, the service must be easy to use in the perspective of consumers such that they can access to the service and easily (e.g., Plug and Play) without professional assistance. This must be done immediately after the customers are subscribed to the service.

Third, the operator must think beyond mere broadband service and provide differentiated services to ensure compelling value proposition. Services on top (e.g., Pay TV, OTT, VoIP and VPN) are essential in attracting consumers and operator platforms such as edutainment can assist the sales while enabling learning & development across the nation.

Summary

Rationale for fixed wireless

- Broadband connectivity proposition for consumers and enterprises

- Possibility to bundle advanced services (e.g., VoIP, IPTV, on top services)

- Market potential in various segments: Unconnected, upgrade, nomadic, IoT

Recommendations

- Interoperability and scale are essential elements for the success and cost economics of FWA: adopting 3GPP specifications can fast track the realisation of these objectives

- The static point to multipoint nature of FWA permits operators to quickly deploy in very high frequency bands providing speeds in the order of Gbps.

- Devices (CPEs) should support outdoor operations to enhance economics of FWA

- Marketing strategy needs to be adapted to the needs of the customers and specific business opportunity that may differ from market to market.

[1] “The State of Broadband 2015”, http://unesdoc.unesco.org/images/0023/002346/234674e.pdf

[2] https://www-file.huawei.com/-/media/CORPORATE/PDF/News/4G-Wireless-Broadband-Industry-WHITE-PAPER.pdf?la=zh

[3] https://www.ericsson.com/assets/local/publications/ericsson-technology-review/docs/2016/etr-5g-and-fixed-wireless-access.pdf

About the GSMA

The GSMA represents the interests of mobile operators worldwide, uniting nearly 800 operators with almost 300 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces industry-leading events such as Mobile World Congress, Mobile World Congress Shanghai, Mobile World Congress Americas and the Mobile 360 Series of conferences.

For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA.

About the Future Networks Programme

The GSMA’s Future Networks is designed to help operators and the wider mobile industry to deliver All-IP networks so that everyone benefits regardless of where their starting point might be on the journey.

The programme has three key work-streams focused on: The development and deployment of IP services, The evolution of the 4G networks in widespread use today, The 5G Journey developing the next generation of mobile technologies and service.

For more information, please visit the Future Networks website at: www.gsma.com/futurenetworks

Document Editor

Michele Zarri, Director of Technology – Networks

Dongwook Kim, Networks Technical Specialist

Acknowledgement

Special thanks to the members of the Future Networks Programme 5G Project Coordination Group who reviewed this document.

The Future Networks Programme 5G Project Coordination Group consists of the following members:

AT&T Mobility, Axiata Group Berhad, Cellnex Telecom, China Mobile Limited, China Telecommunications Corporation, China Unicom, Deutsche Telekom AG, Ericsson, Hutchison 3G UK Limited, KDDI Corporation, KT Corporation, LG Electronics Inc, MediaTek Inc., Nokia, NTT DOCOMO Inc., Orange, Radiomóvil Dipsa, S.A. de C.V., Samsung Electronics Co Ltd, SK Telecom Co., Ltd., SoftBank Corp., Syniverse Technologies, Inc, Telecom Italia SpA, Telefónica S.A., Telenor Group, TELUS Communications Inc., Turkcell Iletisim Hizmetleri A.S., United States Cellular Corporation, Verizon Wireless, Vodafone Ltd.