Disclaimer

The GSM Association (“Association”) makes no representation, warranty or undertaking (express or implied) with respect to and does not accept any responsibility for, and hereby disclaims liability for the accuracy or completeness or timeliness of the information contained in this document.

The information contained in this document may be subject to change without prior notice.

Antitrust Notice

The information contained herein is in full compliance with the GSM Association’s antitrust compliance policy

1. Executive Summary

Following a raft of 5G commercial launches in Asia, Europe and North America a subtle shift has taken place in industry focus. Rather than justifying the elusive 5G business case, the attention is moving on to fine-tuning 5G deployments and optimising 5G-era costs. We use the concept of total cost of ownership (TCO) to evaluate the long term 5G-era cost evolution in this study. 5G-era TCO will be a result of an interplay of a diverse mix of factors including 5G cost drivers such as spectrum and rollout strategies; 5G cost accelerators such as 5G RAN upgrades and densification; and 5G cost optimisers, such as RAN virtualisation.

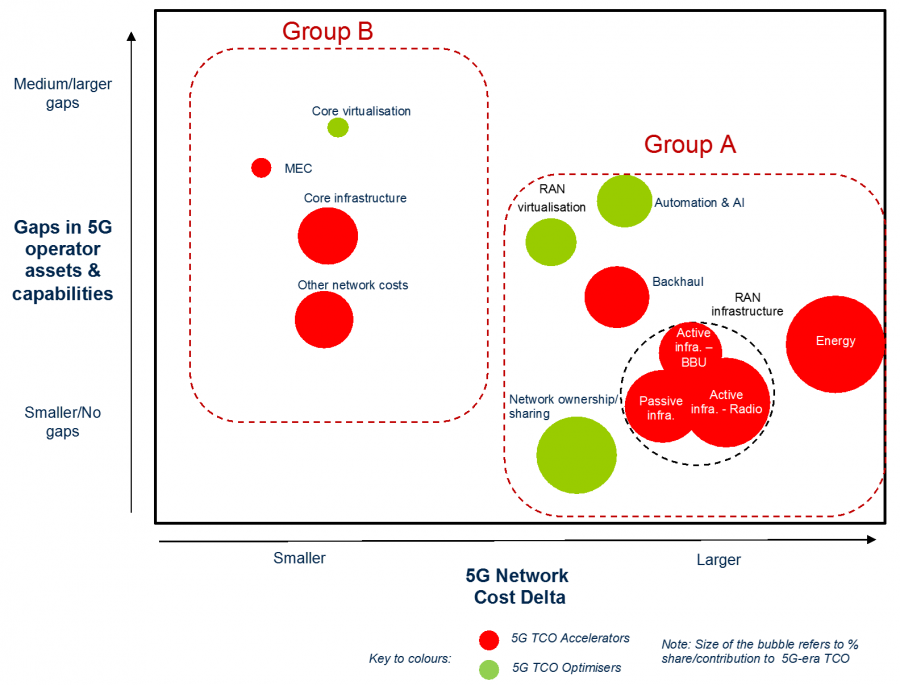

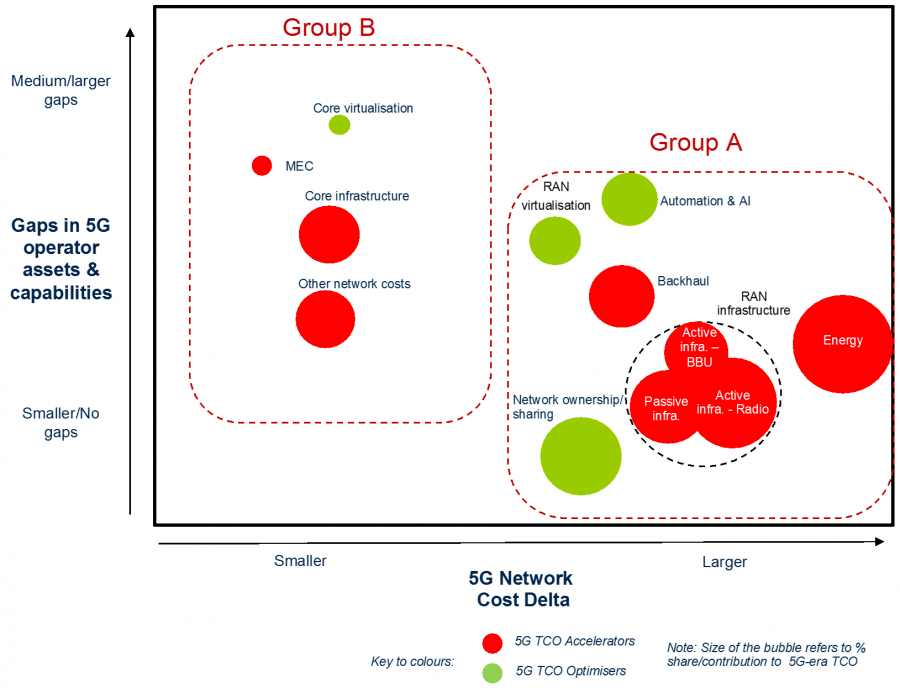

Figure 1 below illustrates a synthesis of the generic, industry-wide 5G-era cost optimisation insights from this study.

Figure 1. An indicative 5G-era cost optimisation framework (Source: GSMA)

Three dimensions are set to shape operators’ 5G-era cost optimisation approaches: –

- The first is the 5G-era share of total network TCO of each 5G cost accelerator (or optimiser), represented by the size of the bubble in Figure 1. The more significant a factor (e.g. RAN), the more its weight will be felt in operators’ cost optimisation considerations.

- The second is the concept of ‘5G Cost Delta’, or the change in the 5G-era[1] TCO of a network component area versus 4G, which is the horizontal axis in Figure 1. We find that some network components (e.g. Energy) have a disproportionately larger 5G Cost Delta than others, and may require more attention as a result.

- The third dimension relates to operators’ 5G assets and capabilities, or more precisely, the gaps between their required (‘to be’) and current (‘as is’) assets and capabilities – the vertical axis of Figure 1. The smaller the gap, the easier would be for operators to execute their cost optimisation efforts in that area.

RAN, transport and core networks have very high interdependencies that are critical for the optimal performance of the whole mobile network. Hence, most, if not all, factors in the 5G-era cost optimisation matrix will likely be as important to most CTO in executing 5G-era cost optimisation.

However, financially minded stakeholders such as CFOs looking at the 5G-era optimisation matrix will likely spot important distinctions between the two groups outlined in Figure 1. Group A includes big-ticket, high 5G Delta, and small-to-medium capability gap items such as RAN, energy, backhaul, network sharing and Automation & AI. These are the areas where purely in financial terms, most of the changes in 5G-era network economics are set to take place. Group B items such as core infrastructure, MEC and Other/operations all have critical capability enhancing aspects. However, from a pure cost perspective, items in Group B are both smaller in size and have low 5G Delta, as well as presenting more significant operator gaps in 5G assets and capabilities.

The GSMA intends that the generic cost optimisation framework in Figure 1, together with the analysis in rest of this study serve to support lively, well-informed debate among senior technology and financial stakeholders on the operator-specific 5G-era cost optimisation priorities that will be uniquely different in their local market context.

The key recommendations for mobile operators based on this research include:

- Make 5G-era energy a cost optimisation priority

- 5G-era networks will be much more efficient on a per-bit basis. However, they are set to carry many more bits over more cell sites powered by energy-hungry Massive MIMO antennas, so 5G-era operators could face up to 2-3 times higher energy costs versus 4G.

- Start planning 5G-era RAN densification now

- M-MIMO is unlikely to be sufficient to meet the coverage, performance and capacity requirements in urban 5G-era networks deployed in >3GHz spectrum bands on its own.

- Evaluate RAN virtualisation savings on a TCO basis

- Virtualised RAN infrastructure can deliver substantial cost savings on a like-for-like basis against traditional D-RAN infrastructure. However, these savings are less impressive when backhaul upgrades and new performance (i.e. latency) management issues included in the TCO considerations.

- Secure high capacity backhaul

- Operators will need transport links of at least 10Gbps backhaul per 5G-era site, while C-RAN adopters will likely need 25-100Gbps fronthaul links to run their networks effectively. Fibre is the best and most likely, but far from being the only, technology that can deliver on these backhaul requirements – enhancedwz4 wireless links also have a role to play in meeting backhaul demands.

- Balance 5G core transformation with capability and cost enhancements

- The NG core will be lower cost. However, it is its enhanced capabilities of network slicing, open platform and greater business agility and flexibility that will make the NG core enhancements especially valuable.

- Reap programmable automation savings first before reaching out to AI

- Most mobile operators have enormous scope to reap automation savings from rules-based, programmable automation before reaching out for fancier, but harder-to-deliver AI-based efficiencies.

2. Introduction: A Subtle Shift in 5G Priorities

After years of planning, 5G has become a reality in 2019, with currently 36 commercial deployments in Asia, Europe and North America. The first 5G networks are mostly small in coverage and lean in capacity. There are still few 5G devices available in volumes on the market; nevertheless, gaining precious lessons learnt on optimising the cost of this critical next-generation mobile technology.

The reality of 5G has elicited a subtle shift in (mature market) operator focus: it is not only about justifying the 5G business case or timing the network launch. Instead, operators are turning more of their attention to issues such as finding ways to fine-tune 5G deployments, monetising existing, and planning new use cases, and in particular optimising 5G-era network costs. The last one is the focus of this study.

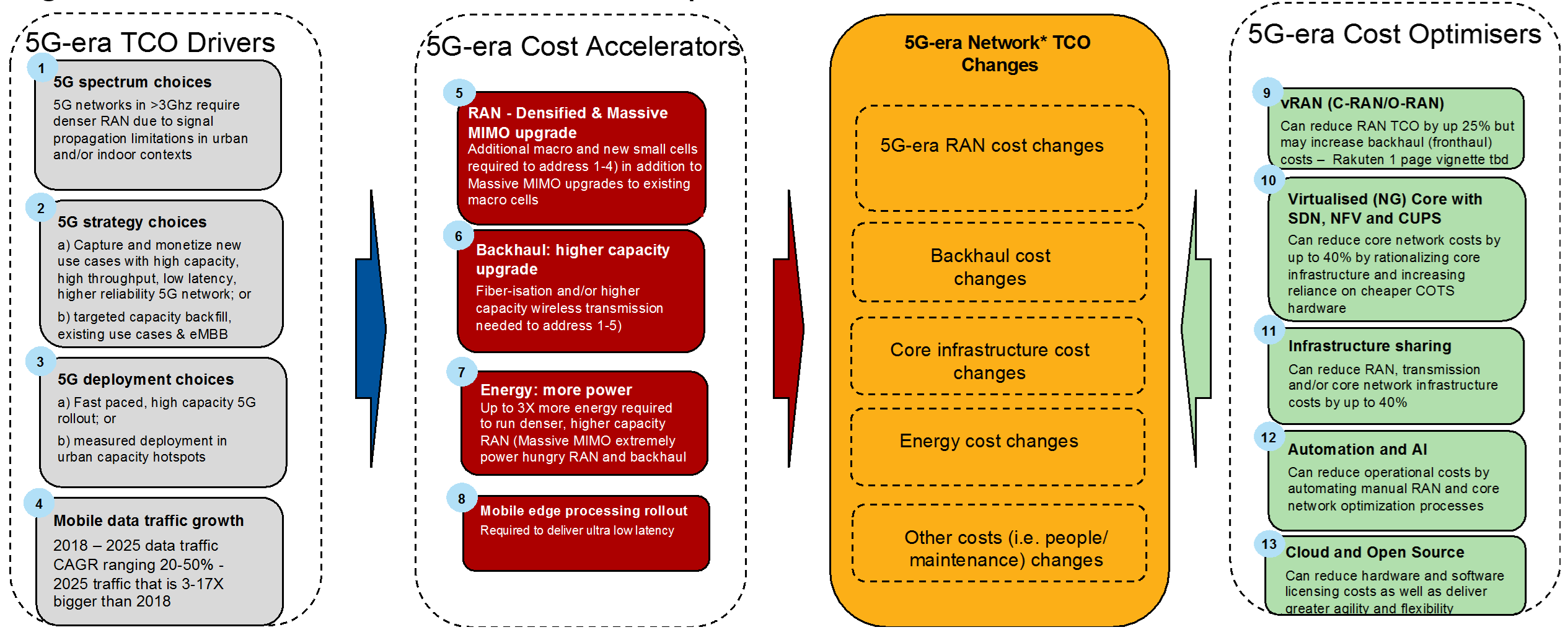

This study takes a longer-term assessment of likely 5G-era cost evolution, based on a combination of in-depth discussions with leading 5G equipment vendors and operators, and secondary research and analysis (see methodology in Annex). We use the holistic concept total cost of ownership (TCO) that subsumes both CapEx and OpEx but pays less regard to the vagaries of short-term CapEx expensing, valuable as it is. The 5G-era TCO looks set to be an outcome of the dynamic interplay of a diverse mix of factors broadly falling into three groups: a) 5G cost drivers; b) 5G cost accelerators, and c) 5G cost optimisers, as outlined in Figure 2.

Figure 2. 5G-era cost accelerators and optimisers (Source: GSMA)

The cost dynamics around the factors depicted in Figure 2 are detailed further in the rest of this study. While assessed separately, it is vital to bear in mind their deep interconnectedness. For example, virtualised RAN architecture can only be implemented over a very high capacity backhaul network; while a distributed cloud NG core requires consideration of space constraints in the RAN network (e.g. for placing edge computing servers and user-plane nodes).

3. Evaluating 5G-era Cost Accelerators and Optimisers

3.1. 5G-era RAN infrastructure

The Radio Access Network (RAN) infrastructure is the biggest 4G cost ticket for mobile operators, typically accounting for 45-50% of network TCO. RAN subcomponents include passive infrastructure (towers, cabinets), and active infrastructure (radio antennas, as well as baseband processing, and related power and cooling, equipment). This study indicates 5G-era RAN costs for an established operator may go up by 65% in some deployments, albeit the increase could be limited to 15% in some lower-cost deployment scenarios, as outlined in section 4. The wide range of potential RAN TCO Delta is dependent on operator choices in three areas a) 5G deployment strategy (see section 4), b) the extent of network densification with small cells, and c) the adoption of C-RAN architecture deployment as a cost optimiser. The latter two are examined below.

3.1.1. 5G Massive MIMO and RAN densification

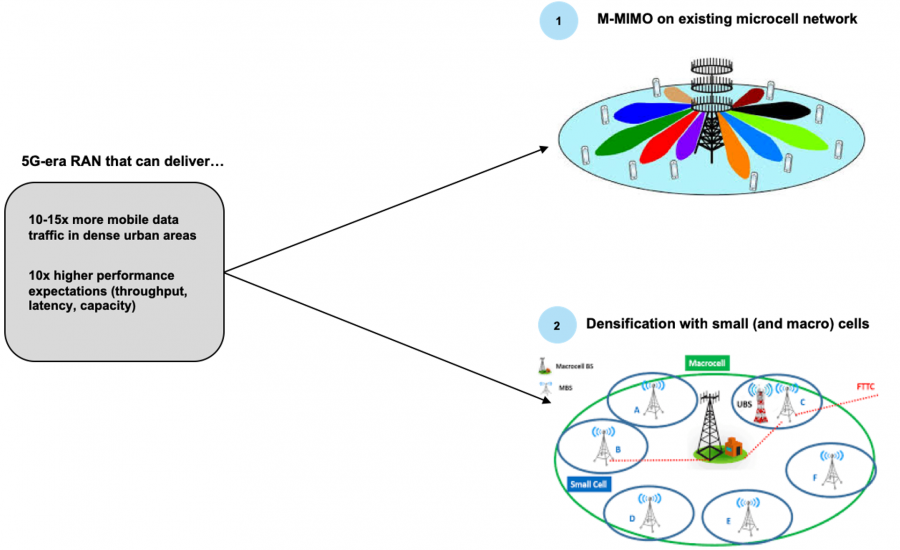

Delivering 5G coverage, capacity and a step increase in network performance (i.e. throughput and latency) to enhance existing services (i.e. eMBB) and provide new services (e.g. industry-specific applications) require 5G RAN upgrades that will lead to an increase overall network TCO. Such upgrades will typically go along two avenues. The first one includes 5G upgrades of existing macrocells, including 5G-era Massive MIMO (M-MIMO) upgrades. The second is network densification with additional small and macrocells, or macrocells alone, as illustrated in Figure 3.

Figure 3. 5G-era RAN upgrade approaches (Source: GSMA)

MIMO (multiple in, multiple out) antenna technologies are already a 4G performance-enhancing feature, with 4×4 MIMO increasingly common in urban 4G deployments. 5G-era RAN can push the M-MIMO technical boundaries to 64×64 antennas, which will provide an enormous boost in RAN coverage and capacity. These enhancements are critical for 5G networks in >3GHz spectrum bands, which face significant signal propagation challenges in urban and indoor contexts when compared to networks in lower spectrum bands.

5G-era M-MIMO upgrades of the macro network may be considered a replacement of the smaller (4×4 MIMO) 4G RAN ‘lightbulbs’ with much bigger and brighter ones – up to 16 times larger (in the case of 64×64 M-MIMO). This upgrade will come at a higher cost in both cell site infrastructure, and in particular power consumption (see Energy in section 3.3), in addition to requiring much higher capacity, low latency backhaul such as fibre.

Most respondents for this study indicated that while 5G M-MIMO will help boost coverage and capacity early in 5G deployments, it may not be able to handle capacity challenges of higher network traffic loads on its own in urban contexts. Indeed, there is a broad agreement that network densification with both small cells and additional macro cells looks set to almost certainly be required. To continue the earlier analogy, this is effectively adding additional RAN ‘lightbulbs’ alongside existing ones to illuminate ‘shadier’ spots of the urban network. Network densification increases site rental, RAN infrastructure, backhaul and energy costs of 5G-era networks.

The research for this study suggests that neither M-MIMO nor network densification are likely to be effective on their own as in addressing the elevated 5G-era RAN performance, coverage and capacity requirements. Instead, operators will need to compose a custom blend of the two approaches that will be shaped by local factors such as urban topology and density, ease and cost of site acquisition/upgrade, and local energy costs.

3.1.2. 5G C-RAN as a cost optimiser

Centralised, or cloud-RAN (C-RAN) architecture, is a 5G-era cost optimiser that can deliver TCO savings of up to 25% versus traditional distributed RAN (D-RAN). In a C-RAN architecture, the centrally located Base-Band Units (BBU) process the radio signals of hundreds of Remote Radio Heads (RRHs) connected via a fronthaul network. However, the deployment of a reliable fronthaul network for a large number of cells in a way that meets stringent capacity and delay requirements is widely acknowledged as both costly and challenging[2]. Hence the capacity, end-to-end latency and overall performance of the C-RAN based 5G network rely disproportionately on the fronthaul technology and the architecture in use.

C-RAN cell site infrastructure is substantially lower cost than its D-RAN equivalent, and C-RAN vendors typically forecasts RAN infrastructure savings of up to 45%[3]. However, the C-RAN architectural requirement of very high capacity, low latency fronthaul transmission (typically expensive high-end fibre links) offsets some of the RAN infrastructure savings when assessed on a TCO basis.

C-RAN based 5G deployments will also need to carefully balance issues such as the capacity and latency of the fronthaul network, number of fronthaul connections, BBU placement, ability to use different types of optical technologies and RRU and BBU interfaces, as well as peak user capacity requirements. For example, one study indicates that achieving a targeted mobile data rate of 1 Gbps with 8×8 MIMO antennas in three sectors, a 100+ Gbps fibre link is required for a CPRI interface-based fronthaul use irrespective of RRH real traffic load[4].

3.2. 5G-era backhaul networks

Backhaul transport networks already account for 10-15% of 4G-era network TCO. 5G-era traffic growth and RAN upgrades will demand high capacity, low latency backhaul upgrades that can increase backhaul costs by up to 55% in some deployment scenarios. There is a debate in industry and academia[5] as to whether the 5G-era backhaul network would need to be all-fibre, or whether upgrades to wireless links could be suitable for 5G-era transport networks in some instances.

What is certain is that 5G-era transport networks will need significant capacity enhancements to support an order of magnitude increases in 5G-era RAN network capacity, throughput and latency. Many existing up-to-1Gbps backhaul links will require upgrades to 10Gbps. Some urban 5G sites may require 25Gbps or even 100 Gbps links, especially for CPRI interface-based fronthaul in C-RAN implementations. Rakuten, for example, is rolling out 100Gbps backhaul across all of its ‘soon-to-launch’ backhaul network (see Rakuten case study in 3.10).

Fibre is the best technology to deliver on 5G-era backhaul requirements for its throughput and latency performance, but also the costliest. Mobile operators that already own fibre networks will, therefore, have a significant cost advantage against those that have to lease or build it themselves.

3.3. 5G-era energy

Energy is a major network cost item that accounts for 20-25% of network TCO for 4G operators. High performing 5G-era mobile networks (including legacy 2G, 3G and 4G networks, as well as new 5G rollouts) will require even more energy – up to 140% more in some deployment scenarios (see section 4). Three factors will drive a significant increase in 5G-era power consumption:-

- Massive MIMO

- The up-to-16x bigger and brighter, 64×64 5G M-MIMO-based cell site ‘lightbulbs’ will require lots more energy in comparison to current 2×2 or 4×4 MIMO configurations. Huawei estimates[6] that M-MIMO alone can potentially increase cell energy consumption from 5-7 kW per 4G site per month to over 20 kW per 5G-era site.

- More sites

- 5G-era network densification with new macro and small cell sites in urban areas will add to the increase in total energy consumption.

- Mobile data traffic growth

- The concept of ‘Bit drives Watt’ means that mobile data traffic growth of up to 50% (see Annex 6.1) drives an increase in power consumption, despite 5G being more power-efficient on a per-bit basis.

There are additional RAN infrastructure, and operational challenges to be considered when evaluating the costs of the elevated 5G-era power consumption. The mains capacity of existing sites may not support 5G requirements and may require capacity expansion. Back-up power and cooling systems may also need upgrading, as may power distribution systems. Space expansion in equipment rooms or cabinets may also be required as a result. All of this, in turn, may add additional costs in terms of more complex maintenance, and higher lease costs to accommodate new power and cooling equipment and cabinets.

Energy management is, as a result, one of the top cost optimisation priorities for all 5G network equipment vendors and operators we interviewed for this study. Their energy optimisation measures broadly fall in several groups. The first includes building a more intelligent power management architecture, including new automation & AI network load optimisation algorithms running from module level to site, network and service levels. The second includes initiatives to expand the use of ‘green’, renewable energy sources such as solar and wind[7]. The final includes efforts to recover energy expended by hardware and convert it back to top up back up batteries on-site.

3.4. 5G-era core network

Transforming silos inherent in current core network architectures can result in cost savings of up to 20% in 5G-era core networks, as well as yield other significant business benefits. The journey from EPC to 5G core (5GC), already underway with some mobile operators, relies on several building blocks:

- Virtualisation of network functions

- 5G virtual network functions (VNFs) will run on common cloud infrastructure and provide open Application Programming Interfaces (APIs), turning the network into an open ecosystem.

- Service-based architecture

- This removes overlaps, provides signalling efficiency, allows the running of network functions at the right location to comply with latency requirements, and shifts from telecoms-type interfaces to web-based APIs for the control functions.

- Cloud-readiness

- Optimising VNFs for the cloud by making them state-less and data-less, with a shared data repository makes them cloud-ready, if not fully cloud-native. Network functions are decomposed into microservices or containers for faster design, development, and integration of applications into live network systems.

- Distributed cloud architecture

- Many mobile operators are already members of the CORD (Central Office Re-architected as a Data Centre) initiative that seeks to evolve operators’ physical footprint – central offices, and potentially even aggregation sites – into distributed data centre networks. Distributed data centres will host functions closer to the edge of the network, with the principal aim of reducing latency. The data layer may also need to be instantiated closer to the network to improve reliability and response times. In time, the distributed data centres can also support C-RAN hub sites and core functions such as distributed user-plane nodes.

- Programmatic automation

- This will provide capabilities for seamless instantiation of required network functions and services; connecting, customising and personalising the use of these functions (i.e. service chaining); optimising the customer experience when using these functions, and for providing the cognition necessary for automated decision making (i.e. analytics)

A fully developed 5GC will be lower cost, reducing TCO in deployment and management of network functions, including significant hardware and external IT services cost reductions. But these cost savings will come after the short-term spike in investment in 5GC, and when operators move up the steep learning curve in this area. As importantly, fully deployed the 5GC will provide far greater stability and performance, together with agility to rapidly evolve network functions to respond to changing business requirements, as well as offer substantially more flexibility to scale resources to serve the needs of different industry verticals.

3.5. 5G-era network virtualisation

Network virtualisation will be a major 5G-era cost optimiser that can deliver savings of up to 25% of network TCO. There are several strands of network virtualisation with separate cost considerations and impact:

- RAN virtualisation with C-RAN provides infrastructure savings by stripping the cell site RAN equipment to basic radio and antenna functions (i.e. as an RRU) while centralising the baseband processing function of multiple RRUs at aggregation points as BBUs. Besides the cost savings of not having to place BBU equipment at each cell site, by running the centralised BBU functions on commercial-off-the-shelf (COTS) hardware, generating additional savings. However, as discussed above, C-RAN needs a very high capacity, low latency fronthaul link – typically point to point fibre – between the RRU and the BBU for C-RAN architecture to operate effectively.

- Core virtualisation, a process is already in train for many 4G operators as highlighted earlier. NFV rides on the trend IT virtualisation, by decoupling network functions from associated hardware into virtual network functions (VNFs) which can run on virtual machines over commercial-off-the-shelf (COTS) hardware. The control plane is then centralised, which provides better network agility, programmability and routing, as well as lower cost.

Network virtualisation is more than a cost optimiser; it is also a potential revenue-generating tool for 5G-era operators in two specific use cases:

First, network slicing is the major outcome of NFV and SDN in a 5G Core implementation. Network slicing virtualises the physical 5G network into multiple logical 5G network slices with different performance parameters (i.e. throughput, latency) that can address different service needs of B2B clients in industry verticals such as automotive or healthcare.

Second, 5GC can enable operators to open up (and monetise) network APIs to third parties (e.g. augmented reality or content providers) so they can, for example, better optimise the performance (i.e. latency) of their B2C services.

3.6. 5G-era automation & AI

Automation and artificial intelligence (AI) will be significant cost mitigators in 5G-era mobile networks, with the potential to deliver up to 25% network TCO savings. In practice automation and AI are two different tools: automation typically refers to rules-based, programmable, zero-touch execution of a (network) process; while AI includes a range of techniques, of which machine learning (ML) is vital, that use self-learning algorithms to adapt and execute in specific network operating situations dynamically.

While AI grabs most of the attention right now; recent research[8] suggests that actual AI deployments in mobile telecoms remain rare, and modest in scope. There are more substantial network TCO savings in the 5G-era to be reaped by rules-based network programmability and automation. These technologies have the potential to deliver significant cost savings by bringing mobile network operations closer, if not equal, to the ‘zero-touch, lights-out’ data centre operations that web-scale digital players such as Google and Amazon have been extracting over the last decade. This type of automation is very much the focus of disruptive new mobile entrants such as Reliance Jio or Rakuten (see Rakuten case study in 3.10) in the planning and execution of their modern mobile network operations.

The vendor and operator interviews for this study indicate a substantial industry investment in extracting automation TCO savings in the biggest 5G-era network cost tickets: RAN, energy and network management and maintenance. To accelerate automation TCO savings, operators will also need to balance investment in automation with efforts to simplify legacy infrastructure, processes and tools[9].

3.7. 5G-era network sharing

Network sharing will remain one of the most significant cost mitigators in the 5G-era[10]. It can potentially deliver TCO savings of up to 40% in instances where operators share spectrum, active and passive infrastructure across the site, radio, transport and core network domains.

The range of network sharing models in the 5G-era will continue to expand as operators learn new lessons in their quest to reap the benefits while mitigating the drawbacks of different network sharing approaches. Macro-level (i.e. whole market) single neutral hosts (SNH) may remain attractive from a cost perspective, despite some recent SNH challenges in countries such as Mexico, South Africa and Russia.

Micro-level SNH models (i.e. small cells in lamp posts, transport corridors, stadia) could be especially attractive due to physical space constraints for multiple networks on these locations. Arial Aerial networks will also require careful scrutiny as an option in the 5G-era, particularly in reaching remote or rural areas.

The rapid growth in mobile data traffic, combined with the elevated 5G network performance expectations in terms of capacity, throughput, resiliency and latency, as well as the need to place MEC equipment at the edge of the network look set to act as slight brakes to the scope of 5G-era network sharing, as well as the extent of TCO savings operators can achieve. So while the GSMA has historic network sharing case studies that realised savings of up to 50%, we expect these to be slightly smaller at up to 40% of network TCO in the 5G-era.

3.8. 5G-era MEC

Multi-Access Edge Computing (MEC), a tool to primarily improve 5G-era latency performance, will be a modest cost accelerator, accounting for up to a 2% increase in network TCO. MEC means deploying servers deep at the network edge (i.e. in the distributed data centres or network aggregation points) to help reduce the network latency to a low enough level acceptable for applications such as augmented reality (AR) or remote surgery.

Operators face cost/latency balance choices in the positioning edge computing servers: as deep in the network as at the cell site (highest cost & lowest latency) or the central office/data centre (lowest cost & highest latency). The GSMA expects most operators to strike the middle ground and place MEC servers in aggregation points or the distributed (regional) data centres – as Rakuten is currently doing (see Rakuten case study in 3.10)– and ensure significant latency benefits at a relatively modest cost.

3.9. 5G-era cloud & open source

Cloud and open source will be modest cost optimisers in 5G-era networks delivering savings up to 5% of TCO. Even more critical will be the greater flexibility and agility that the two will yield for 5G operators in managing their cloud-native, virtualised 5G-era technology estate. To date, most mobile operators have been exploring cloud and open source primarily in small-scale trials and pilots. There are signs that this is changing, with leading operators such as AT&T, Verizon and SK Telecom positioning as keen adopters of cloud and open-source platforms.

AT&T signed a multi-million, multi-year deal in February 2019 to use Kubernetes and OpenStack, container orchestration and cloud infrastructure platforms respectively, as the foundations for its 5G rollout[11]. Kubernetes is increasingly establishing as a standard new infrastructure API for next-generation applications. OpenStack is deployed to manage commercial VNFs from leading 5G equipment vendors in a cloud environment.

The VNFs that are to be deployed in the AT&T (private) cloud include vEPC, RAN backhaul, traffic shaping services, customer usage tracking, smart voicemail and video streaming. At the same time, AT&T also announced a partnership with Intel and SK Telekom on Airship, an open-source project under the OpenStack Foundation for lifecycle management of open infrastructure. Meanwhile, Verizon has been reported to have 80 applications in production on containers managed by Kubernetes[12].

3.10. Rakuten: a case study in 5G-era cost optimisation

Rakuten is positioning to disrupt the mature Japanese mobile market with its preparations to launch a greenfield 4G/5G network in October 2019. As an innovative and highly successful e-commerce platform with 103 million members in Japan, Rakuten sees significant revenue synergies between telecoms and online retail.

Rakuten’s near-completion of a legacy-free, low-cost, cloud-native, fully virtualised and highly automated mobile network is what makes it very interesting. Key aspects of its soon-to-launch mobile network include:

- 5G-ready virtualised RAN

- Rakuten is deploying very lean, lower-cost cell site infrastructure hosting only RRUs, with the radio processing done in aggregated BBU in distributed data centres. A traditional D-RAN infrastructure combines the RRU and BBUs at the cell site, so it tends to be more expensive.

- 5G-ready transport infrastructure

- Rakuten is building a very-high capacity, 100Gbps fibre backhaul and fronthaul network connecting its cell sites with aggregation points and the core network. By contrast, typical operator backhaul deployments have 1Gbps or 10Gpbs capacity.

- Virtualised and distributed cloud core

- This includes carrier-grade telco (private) cloud for all VNFs supported with brand new SDN-enabled central and regional data centres. Rakuten’s network core strategy includes Control & User Plane Separation and Mobile Edge Computing to deliver greater scalability, agility and lower latency.

- Standardised and simplified hardware

- Rakuten is ensuring its network is supported by less than ten hardware SKU (stock keeping units, or hardware platforms). By contrast, more established operators typically have accumulated hundreds of SKUs over the years, which add cost and complexity to their operations.

- End-to-end automation

- Rakuten vowed to automate most, if not all, of the initial deployment and ongoing maintenance of every infrastructure and service component as a way of enhancing operational resiliency and lower cost.

- Unified OSS

- Rakuten aims to avoid the challenge of siloed OSS functions such as network design and service assurance and has adopted a unified OSS platform with a single OSS layer.

Rakuten’s vendor ecosystem includes a mix of established players such as Cisco, Intel, NEC/Netcracker, Ciena, Fujitsu and Qualcomm, as well as challengers such as Mavenir and Altiostar, which specialise in RAN virtualisation. Nokia will provide its RRUs and some Core network elements. Notably, Ericsson, Huawei and Samsung are absent from this list.

Rakuten’s ambition to build the world’s most modern, yet one of the lowest-cost 4G/5G mobile networks is now on public record. Having first secured 4G spectrum in April 2018, Rakuten was also awarded 5G spectrum in April 2019, including 100MHz in the 3.7GHz band and 400MHz in the 28MHz bands. Rakuten then announced that its additional cumulative CapEx on its mobile network in the period to March 2025 will be JPY 200bn (US$1.9bn). US$2bn does not feel like a lot of (CapEx) money to build a greenfield mobile network in a country such as Japan with 127 million people, even with the additional OpEx bill which adds to overall network TCO. Rakuten is clearly taking full advantage of the latest networking and IT technologies – as well as the intense competition among technology vendors – unburdened by legacy infrastructure in the way so many of its peers are.

There are recent reports that Rakuten’s network rollout is slower than anticipated, and as a result its October 2019 launch may be smaller than planned[13]. So whether Rakuten’s highly-ambitious, pioneering approach will be a commercial success remains to be seen. Rakuten’s sought to boost its chances of success with its appointment of CTO Tareq Amin, who helped build Reliance Jio’s rapidly growing and highly disruptive Indian operation.

4. Assessing 5G-era Cost Dynamics in Three 5G Deployment Strategies

4.1. Three 5G deployment strategies lead to different 5G TCO profiles

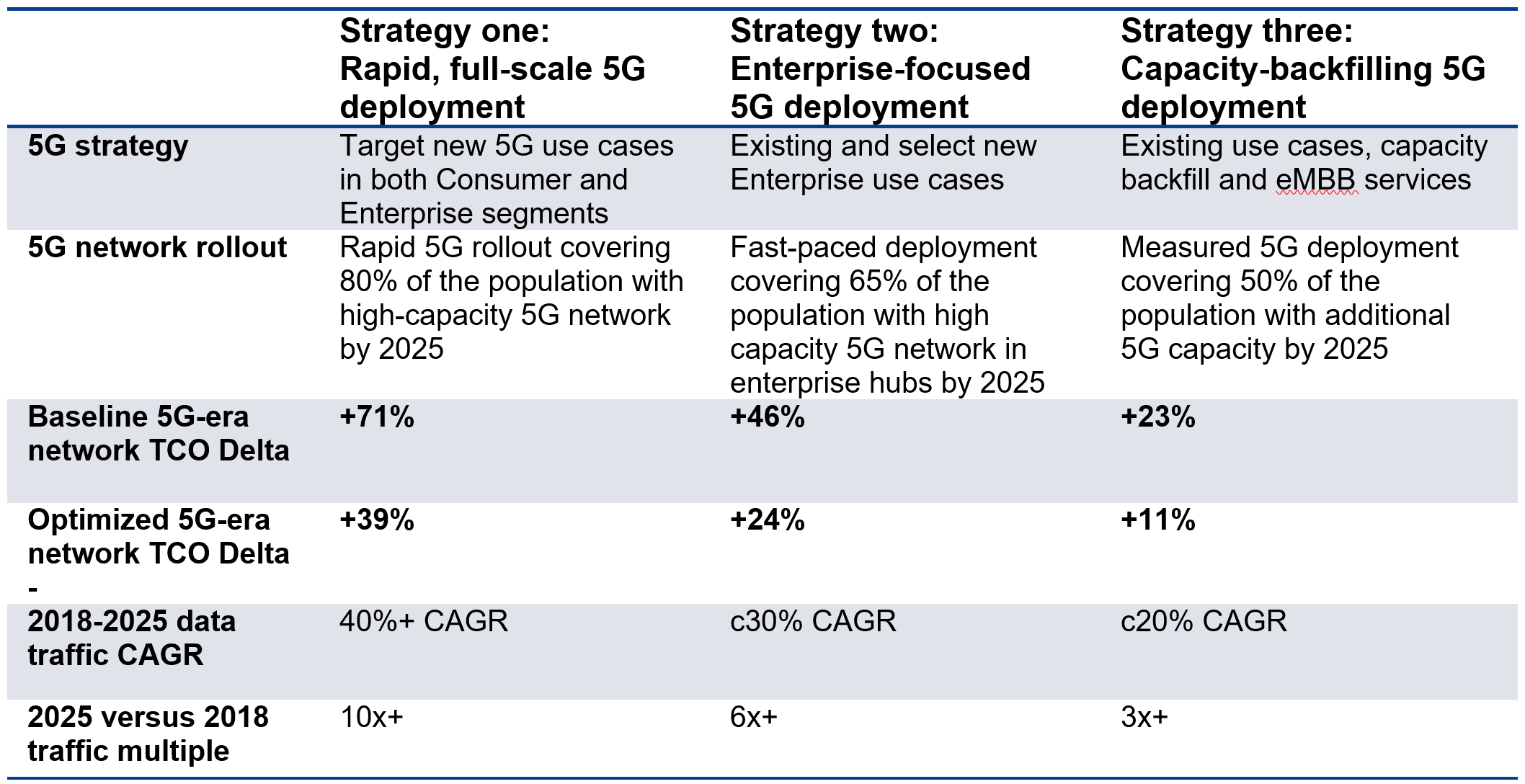

The choice of 5G rollout strategy will unsurprisingly be the most significant factor in the 5G-era TCO cost difference versus 4G (the ‘5G Delta’ in the rest of the study). The three core 5G deployment strategies the GSMA identified for its 5G Guide will also be used to examine 5G-era cost dynamics in this study.

Figure 4 outlines a high-level summary of the three strategy choices and their overall 5G cost Deltas:

- A rapid, full-scale 5G deployment can lead to a 5G Delta of up to 71%, while in aggregate the 5G cost optimisation tools can help reduce the 5G Delta to 39% in this scenario.

- The middle-of-the-road, enterprise-focused 5G deployment has a baseline 5G delta of 46%, which can potentially be optimised down to 24%

- The highly measured, capacity-backfilling 5G deployment can lead to a much more manageable 5G delta of 23%, which can reduce to 11% with 5G cost optimisation.

Figure 4. Three 5G deployment strategies and associated 5G TCO Deltas (Source: GSMA)

Note: 5G Baseline & Optimized Cases = average annual TCO for the 2021-2025 period for a European mobile operator rolling out a 5G network in 3.4-3.6 GHz band. 4G Reference Case = the average 2013-2018 annual network TCO.

The expected 5G Deltas of the various network components across different scenarios is evaluated next.

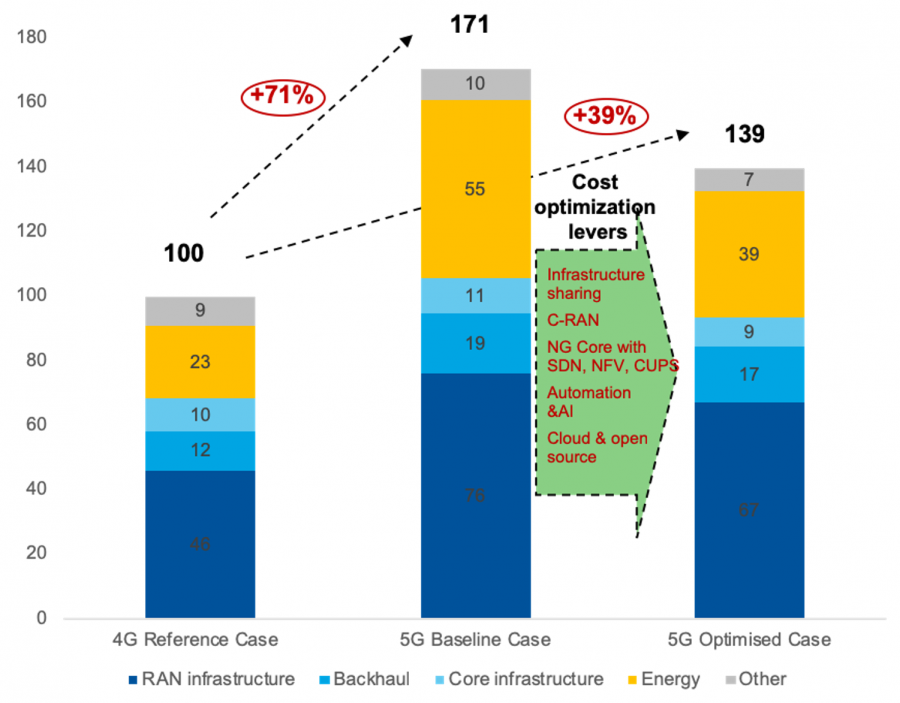

4.2. Strategy one: Full scale 5G deployment

A full-scale 5G rollout that seeks to rapidly cover 80% of the population with a high-capacity 5G network would be, unsurprisingly, costly for an operator. This scenario can lead to a 5G-era overall network TCO Delta of up to 71%, as outlined in Figure 5.

Figure 5: 5G-era cost dynamics in a rapid, full-scale deployment (Source: GSMA)

Note: 5G Baseline & Optimized Cases = average annual TCO for the 2021-2025 period for a European mobile operator rolling out a 5G network in 3.4-3.6 GHz band. 4G Reference Case = the average 2013-2018 annual network TCO.

Some 5G-era network cost components will have very different 5G Deltas within this approach:

- Energy is set to have the highest cost Delta range of up to 140% as a result of 5G-era RAN densification, 5G M-MIMO and mobile data traffic growth, as outlined in section 3.3. Aggressive energy optimisation techniques may reduce the energy Delta to 70% in this scenario. The big 5G delta can push Energy from 23% of 4G-era network TCO to up to almost a third, or 32% in the 5G-era. This explains one of the critical findings of this study on why energy is currently the most significant cost optimisation priority for 5G vendors and operators alike.

- RAN infrastructure will have the second-highest 5G Delta range of 45-65% linked to the extent of network sharing, densification and RAN virtualisation. This means RAN infrastructure will remain the most prominent mobile operator network cost component at 45-50% of network TCO.

- Backhaul 5G Delta will broadly track RAN cost dynamics, but with a tighter range of 45-55%, a result of more limited opportunities for operators to mitigate costs in this area. Backhaul is therefore likely to stay within the 10-12% range as a proportion of network TCO in this case.

- Core network infrastructure will have the smallest and most stable 5G Delta of -10% to +10%, which is broadly similar across all three scenarios. In combination with the big Deltas of other network cost components, the Core share of network TCO in this scenario reduces from 10% to 6% in the 5G-era.

- Other network costs (people, network management and maintenance) 5G Delta will have a wide range of -20% to 10%, with the level of Automation deployed a key variable.

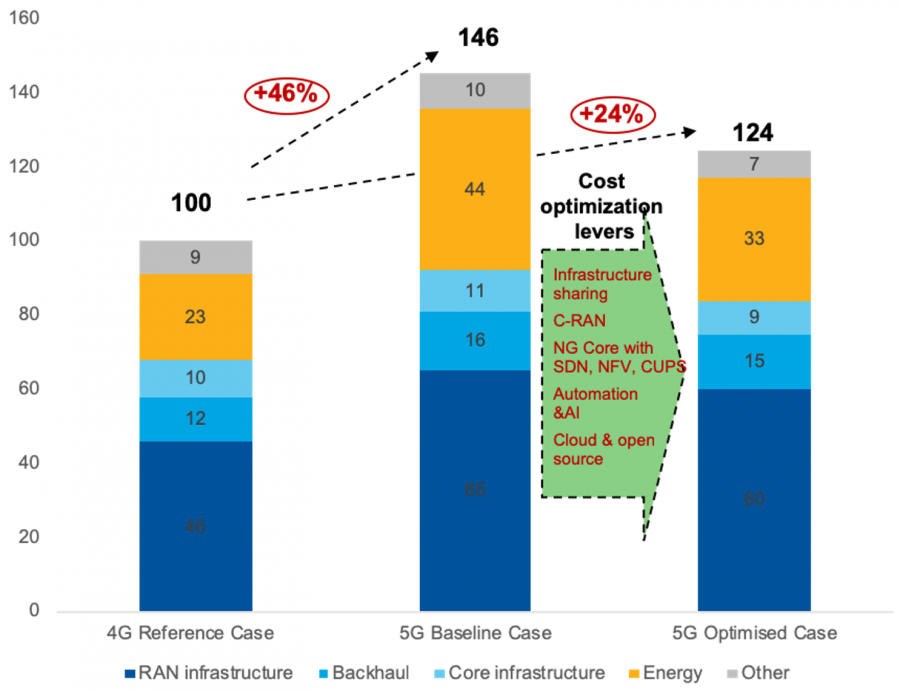

4.3. Strategy two: Enterprise focused 5G deployment

A fast-paced, Enterprise focused 5G deployment indicates a slightly less daunting, albeit still substantial 5G-era TCO Delta of up to 46%, which can be optimised down to 24%, as outlined in Figure 6.

Energy is once again the component with the biggest 5G Delta of 45-90%. RAN infrastructure has the next largest 5G-era Delta of up to 42%, followed by backhaul with 30%. Core and other network costs have the same Deltas as in scenario one.

Energy and RAN infrastructure in this scenario will account for over four-fifths (83%) of the absolute increase in network TCO and rightly remain the leading areas for cost optimisation in the 5G-era.

Figure 6: 5G-era cost dynamics in an Enterprise-focused deployment (Source: GSMA)

Note: 5G Baseline & Optimized Cases = average annual TCO for the 2021-2025 period for a European mobile operator rolling out a 5G network in 3.4-3.6 GHz band. 4G Reference Case = the average 2013-2018 annual network TCO.

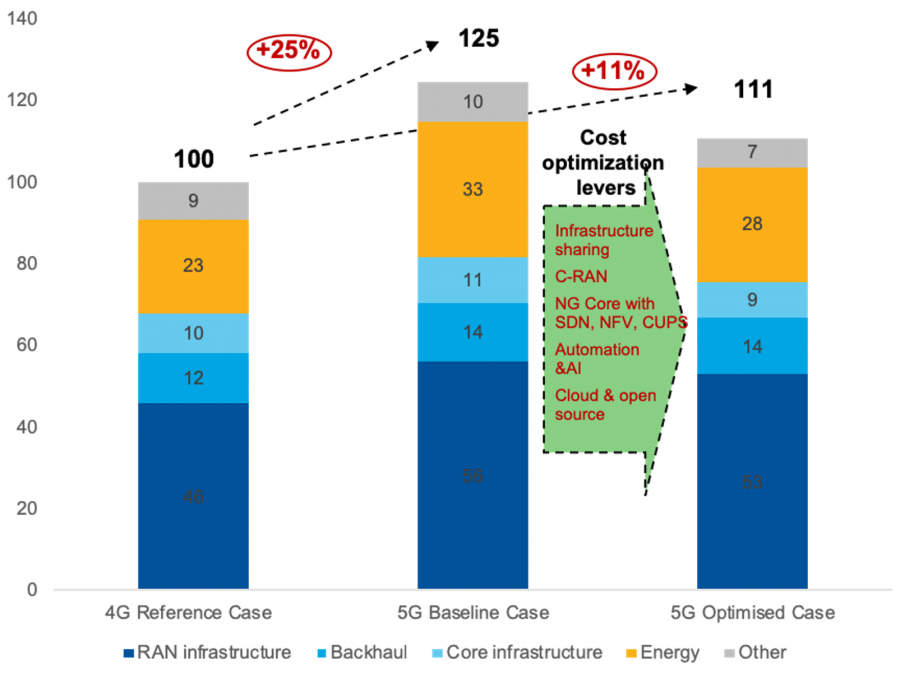

4.4. Strategy three: Capacity-focused 5G deployment

A capacity backfilling 5G rollout is currently the most common operator approach. The 5G cost accelerators in this scenario push the total 5G Delta by up to 22%, which can be reduced to 11% with keen cost optimisation, as outlined in Figure 7. In effect, this scenario implies gradually rolling out a 5G network within the existing flat to low single-digit financial envelopes that most operators operate within.

The share of network TCO of various network components is interesting within this scenario’s largely stable cost dynamics. Energy share of 5G-era network TCO will grow to up to 27% as a result of its faster than average 5G Delta of 22-45%. RAN and backhaul cost Deltas are largely in line with the scenario average and retain a constant share of TCO. Core and other network costs slower-than-total 5G Delta increase bring their share of TCO to less than 10% each.

Figure 7: 5G-era cost dynamics in a capacity-backfilling deployment (Source: GSMA)

Note: 5G Baseline & Optimized Cases = average annual TCO for the 2021-2025 period for a European mobile operator rolling out a 5G network in 3.4-3.6 GHz band. 4G Reference Case = the average 2013-2018 annual network TCO.

5. Assessing 5G-era Cost Optimisation Priorities

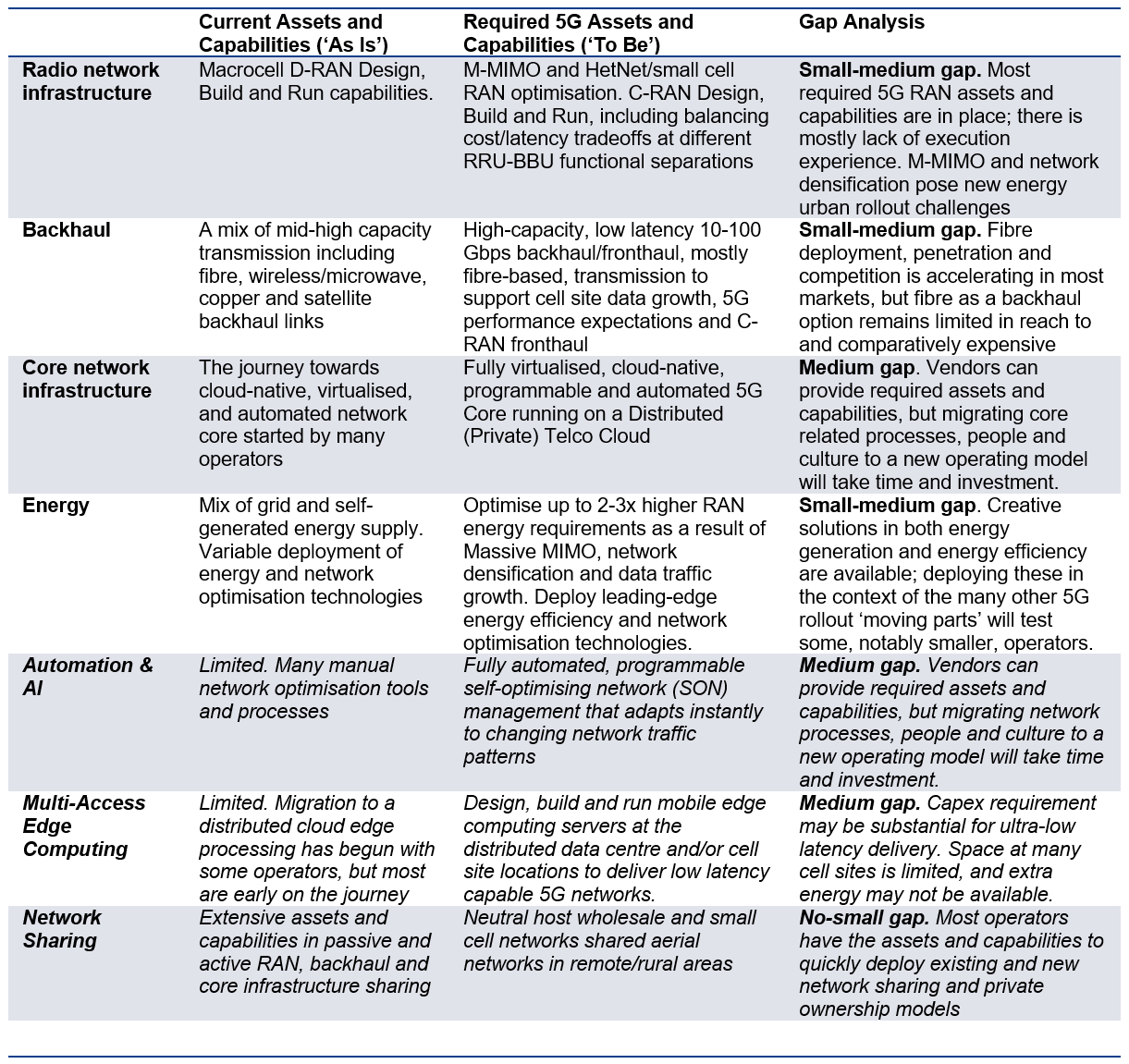

5.1. A gap analysis of operator 5G assets and capabilities

Mobile operators’ efforts to optimise 5G-era network economics will be contingent on their individual assets and capabilities across major 5G-era cost drivers and optimisers. In particular, the pace of 5G-era cost optimisation will depend on the gap between their current (‘as is’) and required (‘to be’) 5G assets and capabilities, which will, of course, vary from operator to operator. Figure 8 outlines a generic gap 5G-era gap analysis between the current and required 5G-era capabilities for a typical European mature market mobile operator.

Figure 8. Generic gap analysis of operator 5G-era assets and capabilities (Source: GSMA)

Figure 8 indicates several different types of gaps in the operators’ 5G assets and capabilities. First, there are few, if any, gaps in operator network sharing assets and capabilities, which will remain an essential 5G-era cost optimiser. Second, there are small-to-medium, easier-to-bridge gaps in the required 5G-era capabilities in RAN, backhaul and energy, which are critical 5G-era cost accelerators. Finally, there are medium gaps, which may challenge some operators – even with vendor assistance – in an important group of areas which need to be addressed such as core network infrastructure, automation & AI, and MEC.

5.2. Assessing 5G cost optimisation priorities

So what should be mobile operators’ 5G-era cost optimisation priorities? Figure 9 outlines an approach to answering this question by synthesising three dimensions of the analysis as mentioned above: a) the 5G Delta analysis across different network components, b) the gap analysis in operators’ 5G-era assets and capabilities, and c) the network TCO contribution/impact of various cost accelerators and optimisers.

Figure 9. 5G-era cost optimisation framework (Source: GSMA)

5G-era mobile networks will have very high interdependencies across the RAN, transport and core networks that are essential for optimal performance of the whole mobile network. Hence to most CTOs, all factors in the 5G-era cost optimisation matrix will likely be as crucial in executing their 5G-era network cost optimisation. However, financially minded stakeholders such as CFOs looking at the 5G-era optimisation matrix will probably spot important distinctions between the two groups circled in Figure 1.

Group A includes big-ticket, high 5G Delta, and small-to-medium capability gap items such as RAN, energy, backhaul, network sharing and Automation & AI. These are the areas wherein financial terms, most of the changes in 5G-era network economics will take place. Group B items such as core infrastructure, MEC and Other/operations have critical capability enhancing aspects. However, from a financial perspective, these are both smaller in size and have low 5G Delta, as well as face more significant operator gaps in 5G assets and capabilities.

The GSMA intends that this generic cost optimisation matrix, combined with the analysis in this study serves to support a lively, well-informed debate between senior technology and financial stakeholders on where and how to address operator-specific 5G-era cost optimisation priorities relevant to their unique market context. With that said, GSMA’s general, high-level recommendations on mobile operators’ 5G-era cost optimisation are outlined below.

5.3. Recommendations to mobile operators

Make 5G-era energy a top priority

Operators need to start planning their 5G-era energy optimisation strategies now. 5G-era networks will be more efficient on a per-bit basis. However, they will carry lots more bits (see Annex A) over many more cell sites with power-hungry M-MIMO antennas so their energy consumption can be up to 2-3 times higher. If left unoptimized, this spike in energy costs can make a big dent in operator profit margins. Some of the energy optimisation approaches include reducing AC to DC conversion; placing base stations in sleep mode; and the use of AI in conjunction with DCIM[14].

Start planning 5G-era network densification now

M-MIMO will be necessary, but insufficient to fully meet 5G-era coverage, performance and capacity expectations in urban networks deployed in >3GHz spectrum bands on its own; network densification with small and new macrocells will be required. Operators need to start planning their cost-optimised 5G-era network densification approach now, given the considerable lead times in identifying, securing and deploying new cell sites, as per the analysis in section 3.1.1. above.

Evaluate RAN virtualisation savings on a TCO basis

Virtualised RAN architectures can deliver substantial cost savings on a like-for-like basis against traditional D-RAN, particularly in greenfield build, or densification. However, these savings are less impressive when factoring backhaul upgrades and new performance (i.e. latency) management issues into account. Operators must holistically consider V-RAN savings from a network TCO perspective, rather than narrowly considering the RAN infrastructure savings.

Secure high capacity backhaul

A high capacity, low latency transport network is a critical enabler without which delivering the 10x improvements in 5G-era network capacity, throughput, latency and reliability will be hard, if not impossible. Operators must plan for 10Gbps backhaul links per site, while C-RAN adopters must plan for 25-100Gbps fronthaul links to effectively run their 5G-era networks. Fibre is the best and most likely, but not the only, technology that can deliver on these elevated backhaul requirements.

Position your 5G core as both cost and capability enhancer

The 5GC that is fully virtualised, automated and running over a distributed cloud infrastructure will be lower cost than the traditional tightly coupled, siloed core. However, it is the enhanced capabilities of network slicing, open platform/APIs and greater business agility and flexibility that will make the 5GC enhancements especially valuable.

Reap automation savings first before reaching out for AI

Most mobile operators have enormous scope to reap automation savings from rules-based, programmable automation that can deliver ‘zero-touch, lights-out’ network operations of the type web-scale giants have been extracting in their data centres for years – this should be the priority before reaching out for the harder to deliver AI-led efficiencies.

6. Want to get involved?

Network Economics

It’s no secret that Network Economics will play a part in determining how quickly 5G networks are rolled out around the world, and the industry has a significant role to play in supporting the deployment. Only by following a coordinated industry-wide approach can we deliver the networks of the future.

Throughout the year, Beta Labs has placed the spotlight on four core areas, Energy, Backhaul, Infrastructure sharing and Network Automation and AI, all of which supports a number of the UN Sustainable Development Goals and plays an important role in the deployment of network serves as well as driving much of the costs in the networks as illustrated in this report.

Beta Labs has developed a Network Economic Model (NEM) which first basslines existing network topology, and then iteratively overlays and profiles new, disruptive technologies or network management strategies that can deliver efficiencies or new revenues. The modelling is then ratified via operator review to evaluate their potential impact, and the goal is to showcase the “best of the best”, and identify collaborative actions to support operators.

Ultimately, the economics drives the speed of the deployment of MNO (Mobile Network Operator) network and services. The case studies we cover are a reflection of the emerging future networks.

If you will like to join the Beta Labs Innovator roster or to find out more information, please visit Beta Labs or contact us.

7. Annexe: Supplementary Research and Scope

Annexe A. Mobile data traffic growth in the 5G-era

5G-era networks arrive with expectations of superior, up to 10 times better levels of network throughput, latency and resilience. Mobile data traffic growth is a significant influencer of 5G-era investment requirements in this context. Faster-than-expected data traffic growth would – all things equal – require higher network investment to maintain a given level of network performance.

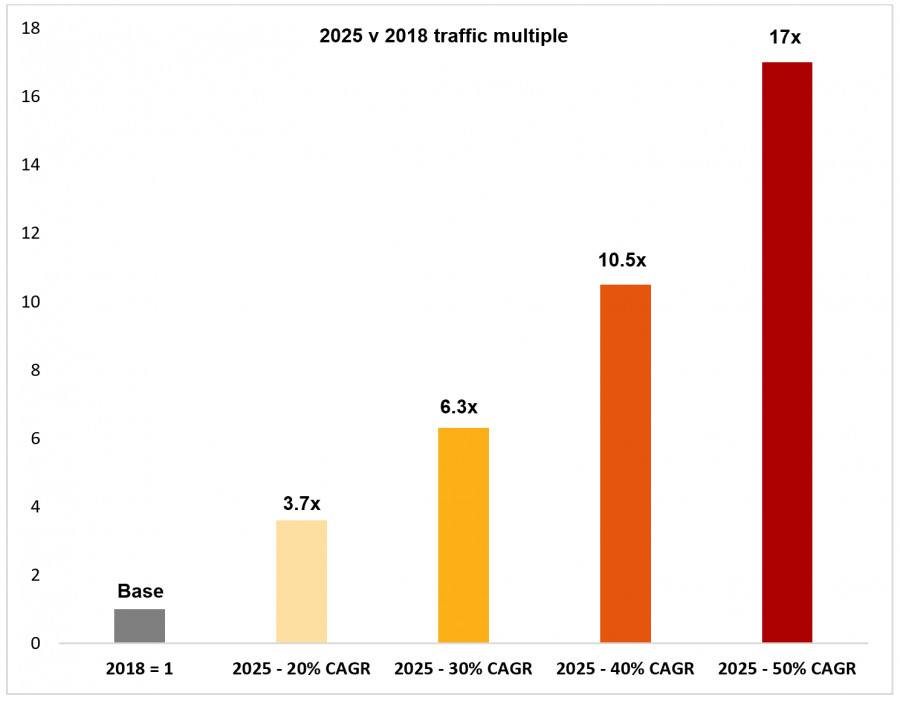

Mobile data traffic has been estimated to have grown at an annual rate ranging from 20-50% in the 2012-2017 period across different markets. Moreover, most recent industry forecasts, including those from Cisco[15], Ericsson[16] and McKinsey[17] forecast mobile data traffic growth to continue within this 20-50% range to 2025. Urban traffic is expected to grow at a faster rate, exacerbating 4G traffic imbalances, and creating new 5G-era urban pressure hotspots[18].

There are major differences in the size of the 5G-era mobile data traffic at either end of this forecast range. A modest 20% annual growth would mean that 2025 traffic would be only 3.7 times higher than in 2018, but at a 50% growth rate, it is 17 times higher, as illustrated in Figure 10.

Figure 10. Mobile data traffic growth multiple in 2025 versus 2018 (Source: GSMA)

5G networks are vastly more efficient than 4G equivalents on a ‘cost-per-bit’ basis. However, a 40-50% annual traffic growth combined with a market prevalence of unlimited mobile data plans leads to a severed link between volume and revenue growth for mobile operators. So faster-than-expected 5G-era mobile data traffic growth could impose choices on unlimited data providers of having to either accelerate 5G-era network investment (and depressing margins) or maintaining same levels of investment (and depressing network performance) – all things equal.

Annex B. 5G-era security

Security is a top concern of technology and business decision-makers in most surveys, and 5G is no exception. 5G-era security is a complex topic covered in detail in multiple detailed studies[19], with key considerations including:

- 5G is different from 4G in that it will eventually be a platform for a massive number of connected devices and critical digital systems. As a result, 5G introduces new, much larger attack surfaces in terms of new use cases (i.e. AR), new devices (e.g. IoT), and new network components (e.g. MEC)

- Security solutions in different parts of the network (RAN, transport, core) must be interoperable, rather than domain-specific so that no security gaps can be exploited between different solutions. 5G security will, therefore, be about more than securing the 5G network alone, but possibly the services running over it, which will necessitate close collaboration between operators and service providers

- A unified, end-to-end cross-layer approach that also adopts security by design principles is fundamental to effectively executing 5G-era security. The deployment of AI-based tools is seen as critical for 5G-era security for dynamically adapting to evolving threat landscapes.

Annex C. Study scope and methodology

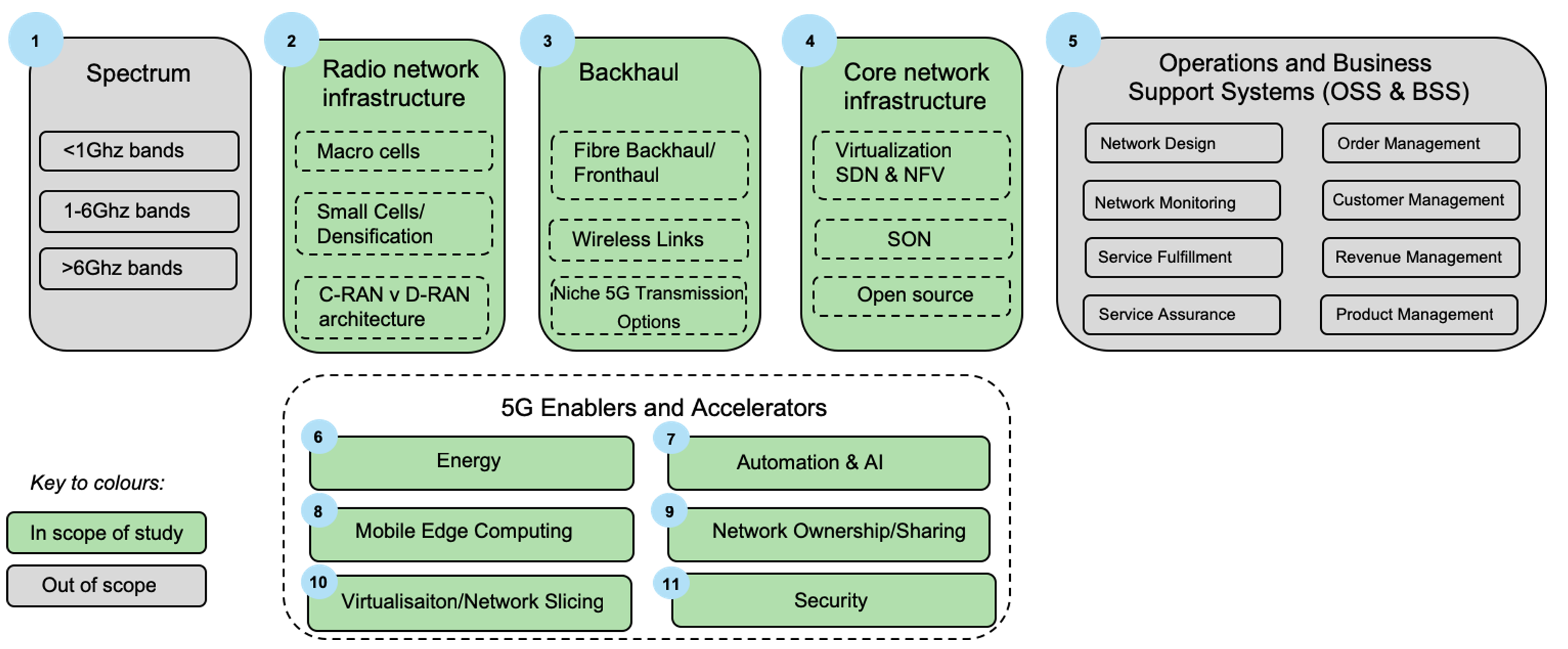

The TCO analysis for this study focused on mobile network infrastructure and enabling components, excluding spectrum costs and OSS, BSS systems, as outlined in Figure 11 below.

Figure 11. 5G cost dynamics study scope (Source: GSMA)

The study included in-depth interviews with leading 5G operators and vendors including Nokia, Huawei, Deutsche Telecom, Korea Telecom, Orange, Telenor, Three and Telekom Austria, as well as an extensive review of recent academic and industry research on 5G network economics. A list of some of the research reviewed for this study included:

- McKinsey: A 5G Manifesto for the CEO, February 2019

- McKinsey: Cutting through the 5G hype: Survey shows telcos’ nuanced views, February 2019

- McKinsey: The road to 5G: The inevitable growth in infrastructure cost, February 2018

- McKinsey: Network share and 5G: A turning point for lone riders, February 2018

- BCG/Huawei: A playbook for accelerating 5G in Europe, September 2018

- BCG/GSMA: Delivering the Digital Revolution: Will mobile infrastructure keep up with rising demand?, February 2018

- Telzed: Fixed-line broadband substitution by mobile, May 2019

- Telzed: Mobile cell site numbers with growing demand and higher capacity per site, March 2018

- Ovum: 5G Needs New Approach to Deployments, April 2019

- Light Reading: ‘Analyst Maps Verizon 5G in Sacramento, Finds ‘Pretty Sparse’ Coverage, April 2019

- Heavy Reading: Designing 5G-Ready Mobile Core Networks, September 2016

- 5G Americas: The Status of Open Source for 5G, February 2018

- Senza Fili/Mavenir: Future Proofing Mobile Network Economics, February 2018

- Senza Fili/Mavenir: How much can operators save with Cloud RAN? 2018

- Senza Fili/Mavenir: In building virtualisation, 2018

- Senza Fili/Mavenir: BT and Mavenir promote new shared vRAN solution, 2019

- Huawei, 5G Network Architecture, 2016

- Ericsson Mobility Report, June 2019

- Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2017-2022, February 2019

- Cisco: Ultra 5G Packet Core, 2018

- Nokia: Building a cloud native core for a 5G world

- Ericsson, The path to a new earth: Evolution from EPC to 5G core made easy, June 2018

- Oughton and Frias: The cost, coverage and rollout implications of 5G infrastructure in Britain, July 2017

- Jaber et al.: 5G Backhaul Challenges, 2016

- Oughton et al.: Assessing the capacity, coverage and cost of 5G infrastructure strategies: Analysis of the Netherlands, July 2018

- Small and Weijia: Techno-economic Analysis and Prediction for the Deployment of 5G Mobile Network, 2018

- A Techno-Economic Framework for 5G Transport Networks, Yaghoubi et all, 2018

- 5G C-RAN with Optical Fronthaul: An Analysis from a Deployment Perspective, Ranaweera et all, 2017

- Light Reading: Some Massive MIMO Antennas Might be a Little Too Massive, February 2019

- IEEE, Massive MIMO for 5G, March 2018

References

[1]For the average annual TCO evaluations in this study we define the 4G baseline period as 2013-2018, and the 5G-era as 2021-2025, with 2019-2020 period as a transition period between the two

[2] 5G C-RAN With Optical Fronthaul: An Analysis From a Deployment Perspective, Ranaweera et al, IEEE, 2017

[3] ‘How much can operators save with Cloud RAN?’, Mavenir/Senza Fili, 2018

[4] 5G C-RAN With Optical Fronthaul: An Analysis From a Deployment Perspective, Ranaweera et al, IEEE, 2017

[5] See for example ‘5G Backhaul Challenge and Emerging Research Directions’, M. Jaber, 2016, IEEE; and ‘A Techno-Economic Framework for 5G Transport Networks’, Yaghoubi et all, 2018, IEEE

[6] 5G Power White Paper, Huawei, February 2019

[7] For more detail, see GSMA’s Energy Efficiency research: www.gsma.com/energy-efficiency

[8] AI in Telecoms Operations: Opportunities and Obstacles, Heavy Reading, September 2018

[9] See GSMA’s Automation research for more detail: www.gsma.com/automation

[10] See GSMA Infrastructure Sharing research for more detail and case studies: www.gsma.com/infastructure

[11] www.lightreading.com/mobile/5G/atandt-and-openstack-5g-deal

[12] https://www.zdnet.com/article/5g-depends-on-kubernetes-in-the-cloud/

[13] www.mobileworldlive.com/rakuten-mobile-scales-back-launch-plans

[14] See the ‘Going Greener with 5G’ paper for more detail on some of these

[15] Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2017-2022, February 2019

[16] Ericsson Mobility Report, June 2019

[17] The road to 5G: The inevitable growth of infrastructure cost, McKinsey & Company, February 2018

[18] Delivering the Digital Revolution: Will mobile infrastructure keep with rising demand?, February 2018, GSMA and BCG

[19] See for example UK Department of Culture, Media and Sport paper ‘5G Network Architecture and Security’, December 2018 at www.uk5g.org/5g-architecture-security-report