This blog focuses on insights from our series of in-country primary research-led reports on mobile money agents in Côte D’Ivoire, Kenya and Mozambique, launched between March and October 2022.

Agent networks remain the mobile money sector’s backbone, digitising over USD 700 million per day in 2021

Mobile money agents play an essential role in enabling unbanked and underbanked populations access financial services, thanks to their robust geographic reach. Previous research has suggested that expanding agent networks can have a causal relationship with digital financial inclusion (e.g. CGAP, 2019). In addition to digitising cash, agents are the face of mobile money services worldwide, performing crucial tasks such as on-boarding, supporting, and educating millions of customers.

Mobile money is also an important income-generating activity for over 5.6 million agents and their households, who partly or wholly depend on cash-in/cash-out (CICO) commissions to sustain their livelihoods.

Despite these well-documented facts, mobile money agents face a number of challenges that encouraged us to gain a better understanding of their current socio-economic circumstances – especially from their own perspective:

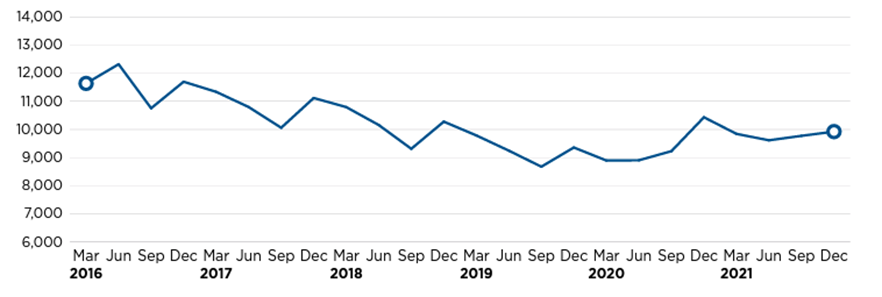

- In Sub-Saharan Africa, the total number of agents – both registered and active – continues to grow. However, the number of active agents has been growing faster than the combined value of CICO transactions, which account for agent revenues. In December 2016, each agent in Sub‑Saharan Africa processed about USD 11,700 per month on average (cash‑in + cash‑out). As of December 2021, this has fallen by 15% to about USD 9,900.

Figure 1: CICO transaction values (in USD) per active agent in Sub-Saharan Africa, 2016-2021

- Decreasing withdrawal fees in several markets could result in lower agent commissions, due to pressure on mobile money providers’ margins.

- Increased industry digitisation, particularly in the urban areas of the most mature markets, could potentially threaten the growth in CICO transactions, where banked populations and ecosystem transactions may be more prevalent.

- Agent distribution networks remain low in many rural areas in low-and-middle-income countries.

Based on these observations, the GSMA Mobile Money programme commissioned MicroSave Consulting (MSC) to research – through comprehensive surveys – current agent circumstances in three mobile money markets in Sub‑Saharan Africa: Côte d’Ivoire, Kenya and Mozambique. This involved:

- Assessing agents’ current satisfaction levels with their agent activity, particularly their income, and their confidence in the future of their livelihoods,

- Identifying agents’ perceived challenges and opportunities, and

- Exploring strategies to sustainably maintain and/or expand mobile money agent networks

The sample sizes comprised 72 respondents in Côte d’Ivoire, 79 in Kenya and 81 in Mozambique (see each country report for more details on methodology).

Key findings: Côte d’Ivoire, Kenya and Mozambique

Across all countries, all interviewed agents were satisfied with their agent activity, and most envisage maintaining their activity in the near future. Agents in urban areas of Kenya and Mozambique tend to be more satisfied with their agent-based income than agents in rural areas. The rural vs urban trend is reversed in Côte d’Ivoire, where more agents in rural areas were satisfied with their agent-related income than those in urban areas. This is likely to be tied to higher transaction volumes during the commercial cocoa season in Soubré (Côte d’Ivoire).

Mobile money is the primary source of income of agents in Côte d’Ivoire and Mozambique, but not in Kenya. Relative to urban agents, rural agents earn relatively more revenue from other activities (non-mobile money) in all three countries.

Potential decreases in commission rates are perceived as a key risk, particularly in Côte d’Ivoire. Due to an increasingly competitive environment in Côte d’Ivoire, agent commissions decreased in 2021. Agents in Côte d’Ivoire and Kenya provided mixed responses regarding the trajectory of their commission revenue over time, with less than half reporting an increase in Kenya. In Mozambique, most reported an increase, primarily due to the growing acceptance of mobile money.

Many agents saw rising operating costs (rent, salaries and taxes) as a critical challenge, in light of high inflation. A majority of agents surveyed in Côte d’Ivoire found the rising costs of managing their outlets challenging. Those in urban areas were particularly impacted, as their average monthly costs are 25% higher than rural agents. In Kenya, the trend is different: less than half of agents interviewed found operating costs challenging, with those in rural areas more negatively impacted compared to those in urban areas.

The lack of working capital or float is particularly challenging, especially in Mozambique.

In all countries, most acutely in Mozambique, agents are challenged by shortages in working capital. This not only hinders income growth, but can hamper agents’ ability to operate seamlessly, affecting the quality of service to mobile money users.

In Mozambique, 74% of respondents claimed to rely on their CICO transactional activity to acquire the necessary funds for their agency business. Elsewhere, float replenishing methods vary according to geography. In urban settings, formal channels such as super-agents or financial institutions are typically used, while rural agents tend to rely more on agent-to-agent loans or digital credit apps.

In all three countries, agent activity is perceived as risky – subject to fraud and robbery.

Our research highlighted unique attributes and challenges in each market, from which we can draw lessons for the mobile money industry as a whole:

- In Côte d’Ivoire, concerns over commission rates were the highest compared to the other two markets, with 82% of agents considering it a “very challenging” or “challenging” issue. These concerns were expressed just before the country’s mobile money landscape suddenly became more competitive, leading to significant drops in agent commissions. As a consequence agent revenue dropped, prompting social unrest and the closure of many agent outlets.

- Agents in Mozambique experienced the most notable challenge, more significantly than in other markets: a shortage in working capital – a key ingredient for float replenishment, enabling agents to effectively fulfil customer transactions. Many agents have often had to turn down transactions due to a lack of funds. Most relied heavily on their CICO transactions to acquire the necessary working capital, rather than financial institutions or super-agents. This closely correlates with the fact that CICO commissions are the most important source of revenue for Mozambican agents – highlighting the need to boost income diversification.

- Kenya was the only country where over half of agents stated that the majority of their income came from non-mobile money activities. Most reported that they were satisfied with their agent activity too, intending to maintain this over the coming years (87%). This is in spite of only around half of agents stating that their commission income had increased since they started operating. This could be explained in part by the fact that agents may have multiple revenue sources, helping them mitigate revenue fluctuations and allowing them to address potential float shortages.

To find out more about the growth of mobile money, read through our milestone 10th State of the Industry Report on Mobile Money. For more information on the GSMA Mobile Money Programme, visit our website.

Keep up to date with new insights by registering for our Mobile for Development newsletter here.