In June 2019, Facebook announced the launch of Libra, a digital currency based on a new decentralised blockchain, backed by a reserve of real fiat currencies guaranteeing built-in low volatility.

In this first blog of a series exploring Libra, we will assess Libra’s financial inclusion potential based on a quantitative breakdown and key qualitative considerations. The second and third part of the series will look at the technological setup of the platform and explore the regulatory constraints facing Libra’s intended global expansion.

As one of its key objectives, Libra aims to reach the 1.7 billion adults who remain outside the formal financial system by reducing the costs of circulation to zero (or almost zero) for customers. Transaction fees remain one of the main barriers to increasing uptake and usage of financial services, and removing these barriers would certainly be a strong catalyst for the service.

When assessing Libra’s true potential in reaching the financially excluded, however, the following challenges are set to limit its intended reach, at least during its first years of operation:

- Geographical reach: While Libra’s aim is to be a global service, roadblocks have already appeared. While the Libra blockchain will be global, the custodial wallet providers will determine where Calibra, Libra’s digital wallet, can operate. It appears that, at least initially, Calibra won’t be available in India (with 191 million unbanked people) and Zimbabwe (4.2 million unbanked), where cryptocurrencies are banned; in Iran (3.7 million unbanked), a US-sanctioned country, or in China (224 million unbanked), where Facebook is blocked. According to the World Bank’s Global Findex data, these countries are collectively home to over 423 million financially excluded adults. This will significantly impact the scope of Libra’s financial inclusion efforts.

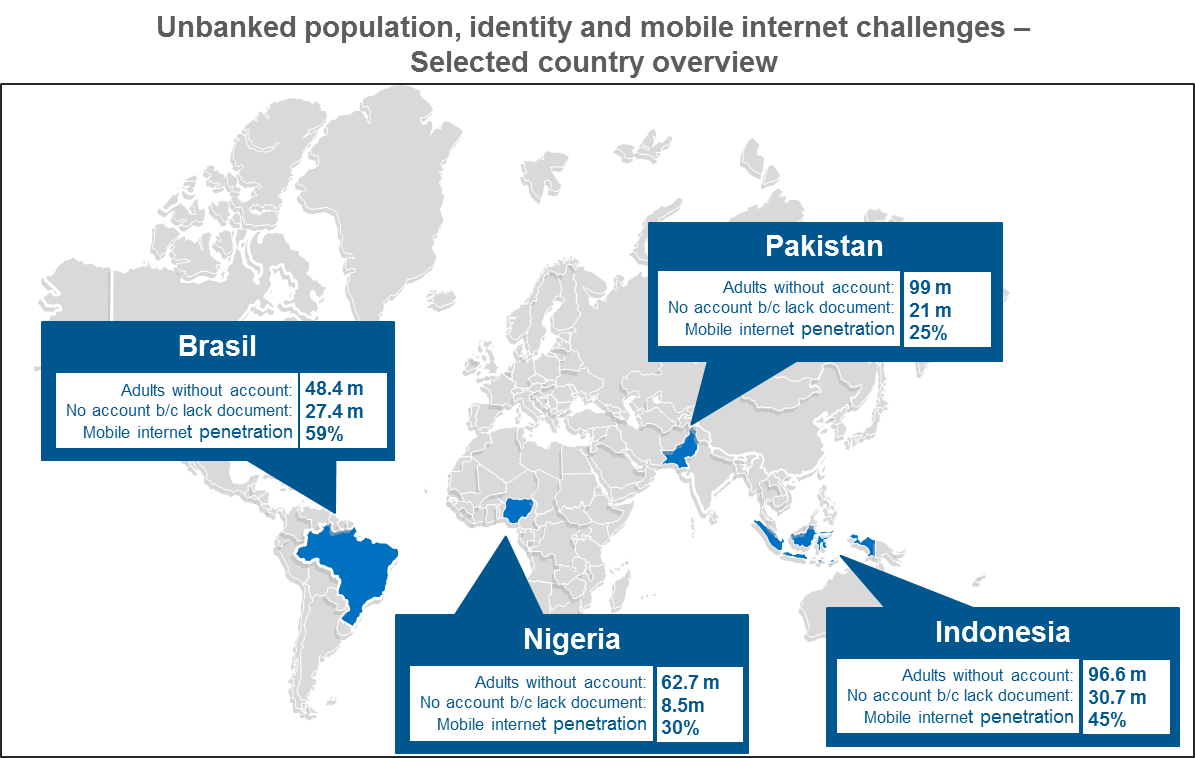

- Identification: Facebook believes in a decentralised and portable digital solution, and one of the most exciting goals of the Libra Association – the membership body which will govern the new currency – is to develop and promote an open identity standard. Despite these ambitions, detail is lacking on how this will be achieved. While some countries’ tiered know-your-customer approach to financial services may allow customers to register and access basic services (such as sending and receiving small value remittances), it appears that, as part of the initial verification process, all new customers will need to provide a government-issued ID. Excluding the four countries mentioned above, we know that an additional 350 million adults cite a lack of documentation as their main reason for being unbanked.

- Mobile internet: The above factors effectively decrease Libra’s prospective customer base to 870 million adults, before considering potential customers’ access to internet and smartphones – two additional preconditions to access and use Libra. While an additional 1.4 billion people are set to start using the mobile internet for the first time over the next seven years, the connectivity gap will remain high in a large number of developing countries. When looking at regions with the highest number of financial excluded adults, Latin America has the highest mobile internet penetration at 55%, followed by Asia-Pacific at 42% and Sub-Saharan Africa at 22%. While there is limited research combining both mobile internet penetration and financial inclusion data, this highlights that the actual target base of unbanked customers who could be served by Libra may be significantly smaller.

Even discounting the large number of unbanked adults who don’t have formal ID or mobile internet, and whom Libra won’t be able to reach in its initial stages, we estimate that Facebook’s digital currency still has the potential to reach between 370 and 800 million unbanked people1 by providing access to financial services, cheap capital, and the open, instant, and low-cost movement of money. When assessing the longer term picture, research shows a move from cash to digital and a strong increase of smartphone adoption and access to internet in emerging countries over the next five years. However, when addressing financial inclusion even in the longer term, some further constraints will need to be addressed by Libra:

- Access to Libra / cash digitisation: There are two main ways that cash can enter the Libra ecosystem: one is digitally, via remittances or disbursements (such as salary payments or government programmes) and the second is via cash-in at specific agent outlets. As of 2018, the amount of international remittances flowing into low- and middle-income countries (excluding China, Zimbabwe, Iran and India) was just over US$ 380 billion – a 9% increase from the previous year – representing a vast opportunity for players able to reduce transaction costs. While international remittance flows into emerging countries are growing steadily, the majority of transactions still happen in cash. A widespread agent network is therefore critical to allowing customers to cash-in to the ecosystem and to easily access their digital funds. Libra will have to build such a network or establish key partnerships to achieve this.

- Circulation of currency: To ensure uptake and usage of the service, Libra will have to build an ecosystem which will enable customers to use the currency for multiple use cases. Digital commerce and merchant payments are priority opportunities but present challenges related to building an acceptance network and sustainable pricing models. Data suggests that merchant interoperability in particular is essential to scale merchant payments. Establishing partnerships with governments will also be critical to capturing the opportunity of cash digitisation programmes, and Libra’s impact will be limited unless it achieves this.

- Awareness / education: Above all else, Libra’s future success will hinge upon consumers embracing the digital currency as their preferred means of transacting. Achieving the shift from consumers’ awareness of Libra to regular use of the digital wallet will require coordinated on-the-ground interventions through multi-targeted campaigns and communications, and will likely take a number of years to be realised.

As the mobile money industry can testify, trust and reliability are critical to the success of a digital financial service and must be established both with consumers and, particularly in the context of emerging markets, regulators and policymakers. In the next blog, we will explore the main regulatory challenges facing Libra in its pursuit of ambitious objectives.

Footnotes:

[1] As different datasets are not mutually exclusive (i.e. the proportion of mobile internet users is based on total population rather than unbanked population), it is difficult to provide a final number on the current number of unbanked people Libra could reach. This estimate is based on subtracting the number of geographically excluded unbanked people (approx 420 million) from the total global unbanked population (1.64 million). The upper range is calculated by assuming 60% of the remaining unbaked population would have mobile internet, while the lower range assumes 30% of the remaning unbanked population would have mobile internet. Adults who are unbanked due to their lack of formal ID have been excluded from the calculation, as the total sub-set (350 million) is smaller than the mobile internet subset.