Today, the GSMA Inclusive Tech Lab is launching the Interoperability Test Platform, the industry’s first joint test environment combining two key technologies: the GSMA Mobile Money API, a harmonised industry specification for all common mobile money use cases, and Mojaloop, an open source code, developed to accelerate financial inclusion through digital payments. With this test platform, the GSMA provides the industry with an open-source and secure environment, enabling ecosystem participants to test their systems across different use cases in an ever more interoperable mobile money ecosystem.

Interoperability is accelerating the growth of mobile money

Mobile money industry grew significantly over the last year, achieving more than one billion accounts with one of the major factors contributing to this growth being the increased interoperability between ecosystem stakeholders. Mobile money-enabled international remittances are flourishing, with $7.3 billion processed in 2019 driven by a growing trend for cross-border interoperability and integration with traditional remittance service providers – The GSMA’s State of the Industry Report 2019 takes a more in-depth look at this. Still, there remains a huge opportunity to improve mobile money interoperability and further fuel economic growth.

Across developing markets, we have studied various approaches and technical models used to build interoperable ecosystems, our recent publication The many paths to mobile money interoperability: Selecting the right technical model for your market studies six of those key markets. Understanding the new factors and variables in this complex interoperable scenario is challenging, and getting it to work even more so. Hence, testing is a crucial step to successfully launching an interoperable network; we discuss this in detail in our latest blog about interoperability testing. Until today, however, there has been no single place where one can easily understand and further test this type of interconnectivity.

A huge step in the journey towards an interoperable mobile money ecosystem.

While several models exist, there is increasing interest in a centralised interoperability model in which financial service providers are interconnected through a central hub. Creating an interoperable hub is a challenge in itself, and it is important to make the right technological decisions to ensure a better competitive advantage in the future; we discuss this in more detail here – the technical decision can go in several directions:

- Create it from scratch, a long and expensive journey;

- Acquire proprietary technology, a shorter, yet expensive, journey with a potential risk of a less flexible solution for vendor choice; and

- Use of proven open-source technologies, a good compromise time-wise and a relatively cost-free option.

Taking option 3, technology solution provider Mowali – a joint venture between MTN and Orange – chose to use Mojaloop’s open-source software to operate a financial hub. Mojaloop is an initiative supported by The Bill & Melinda Gates Foundation, Google, Coil, and other stakeholders in the market that helps accelerate financial inclusion through digital payments.

Second, a truly interoperable, end-to-end ecosystem also includes service providers. Enabling service providers to connect to mobile money platforms, through easily accessible APIs, allows them to build countless new services to address the needs of underserved user groups across the globe.

One of the major barriers to seamless integration is the market fragmentation observed in many mobile money API approaches, as we demonstrate in our recent Mobile Money API Industry Report. The GSMA Mobile Money API addresses this fragmentation and provides a harmonised API Specification, which is both easy to use and secure, for all common mobile money use cases.

The GSMA Interoperability Test Platform

With the trend towards increasingly interoperable end-to-end ecosystems, the need for industry participants to harness that complexity is becoming paramount. To support this need, we have today launched the Interoperability Test Platform, a free and open-source end-to-end test facility for mobile money providers and service providers alike. We are now inviting industry stakeholders to use it to gain a deeper understanding of how interoperability works, and subsequently to test and gain confidence in their newly-built interconnections before they are ready to go live.

“We are pleased to support the Interoperability Test Platform, as a shared industry resource to accelerate the design of digital payment systems that benefit the poor, including the 1.7 billion people, globally, who do not have access to formal financial services”

Kosta Peric, Deputy Director, Financial Services for the Poor, The Bill & Melinda Gates Foundation

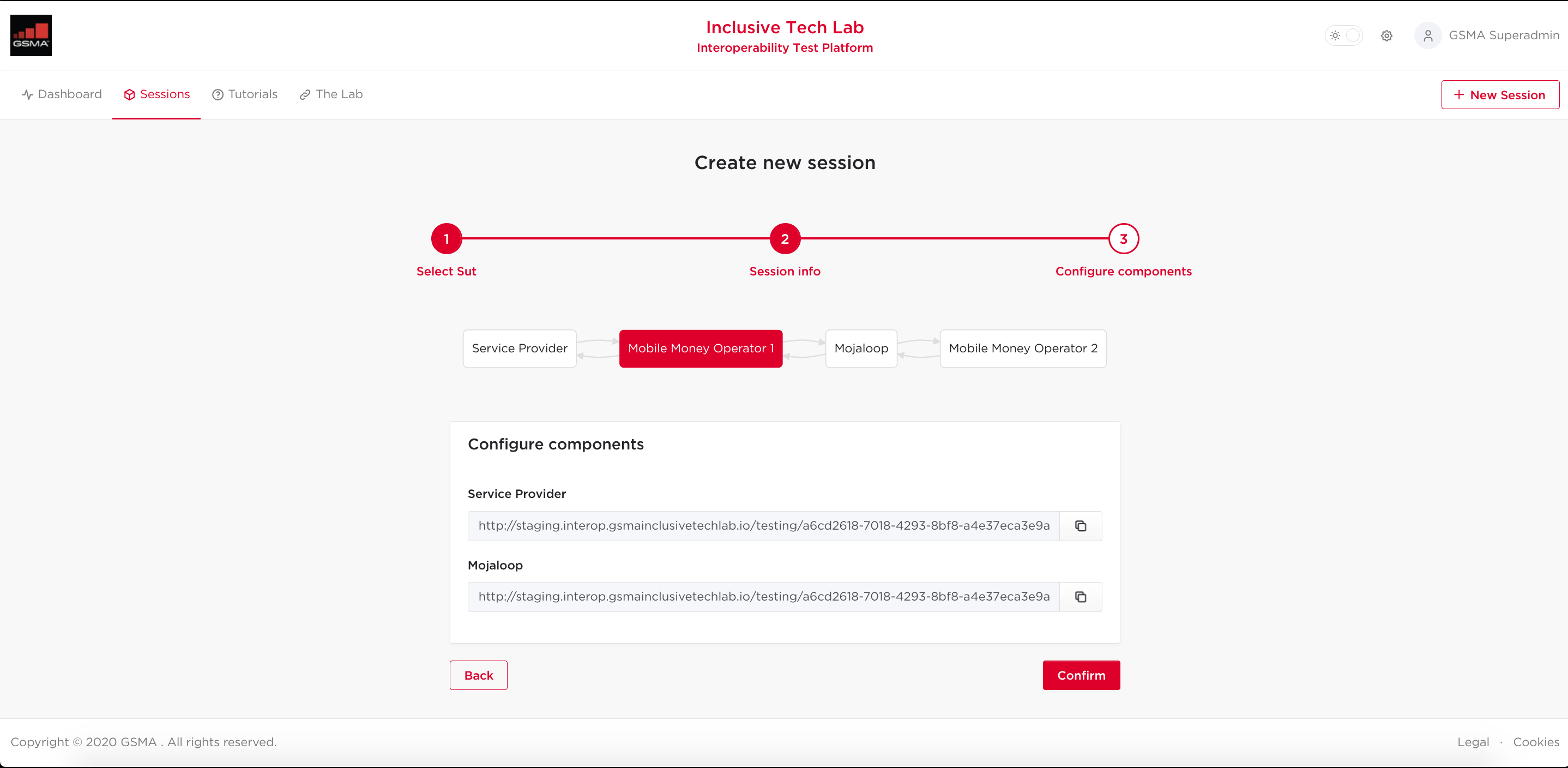

In March, we released the platform in Beta, allowing early access to the environment for its service provider module. During this Beta phase, we have worked with users to improve the platform and develop new functionalities. Today, we are launching the full platform, including our second, brand new mobile money provider module. This means that the platform is ready to fully support any industry stakeholder, capable of supporting any entity from the end-to-end ecosystem in a plug and play environment.

“The platform empowers both third-party service providers and digital financial service providers to test their software implementation in an end-to-end ecosystem. It solves complex testing scenarios through the simulation of the different ecosystem entities, the different APIs and different use cases.”

Bart-Jan Pors, Director, Inclusive Fintech, GSMA

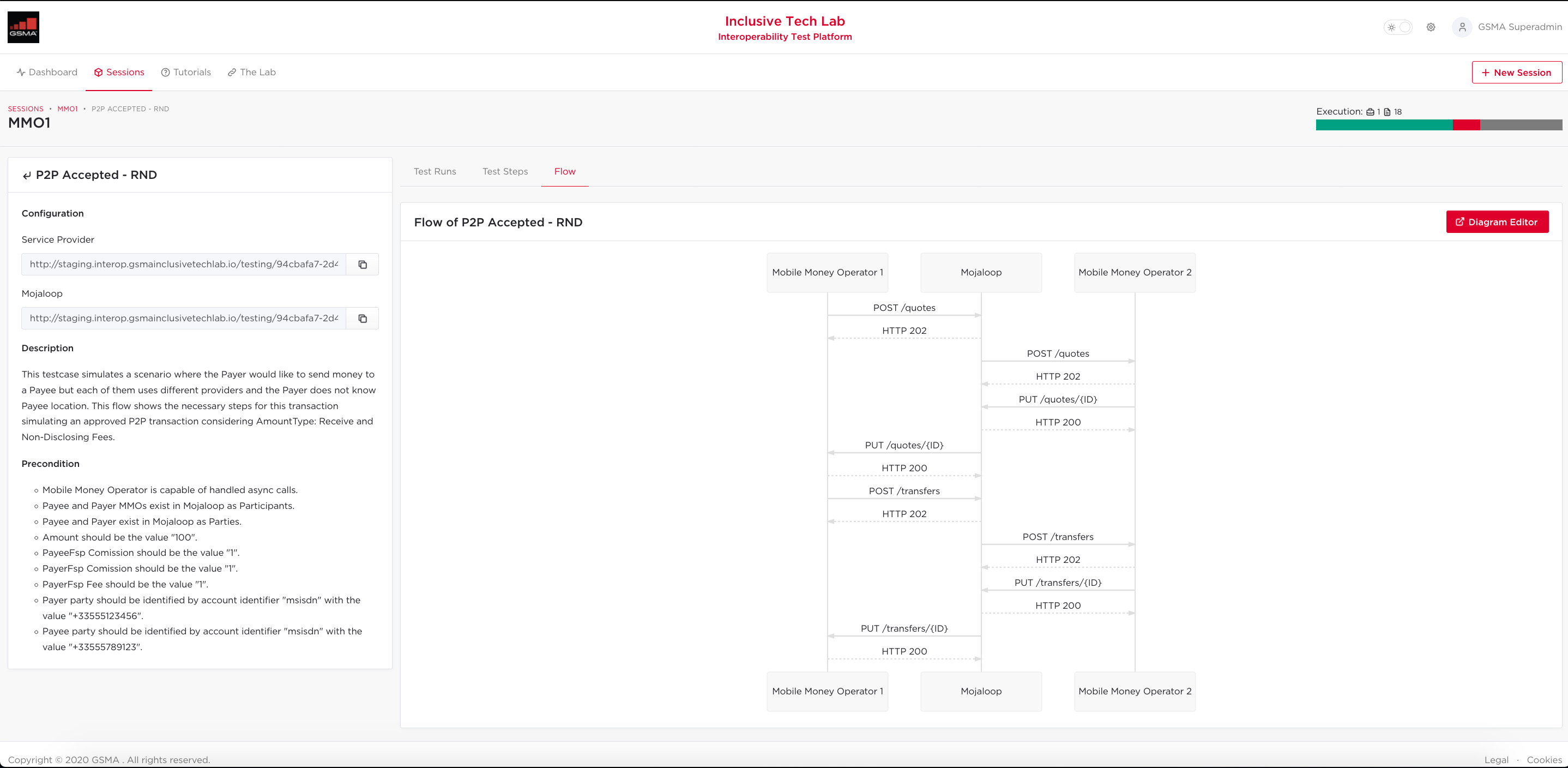

The Platform was created to ensure an excellent developer experience, supporting software development cycles and making it easier to create test scenarios. One of the big challenges that the Platform solves is that of understanding the bigger picture and the ability to test the end to end scenario.

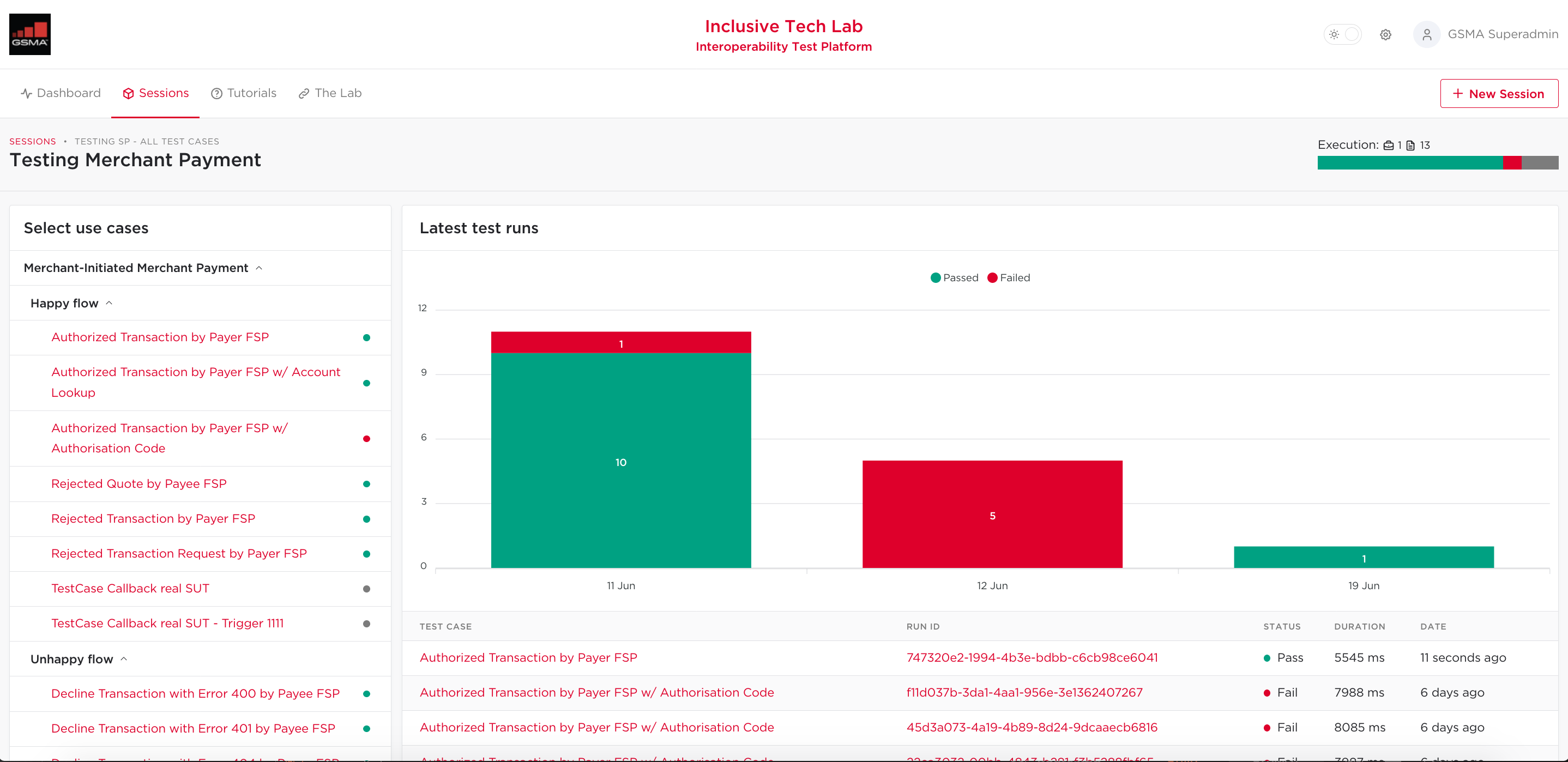

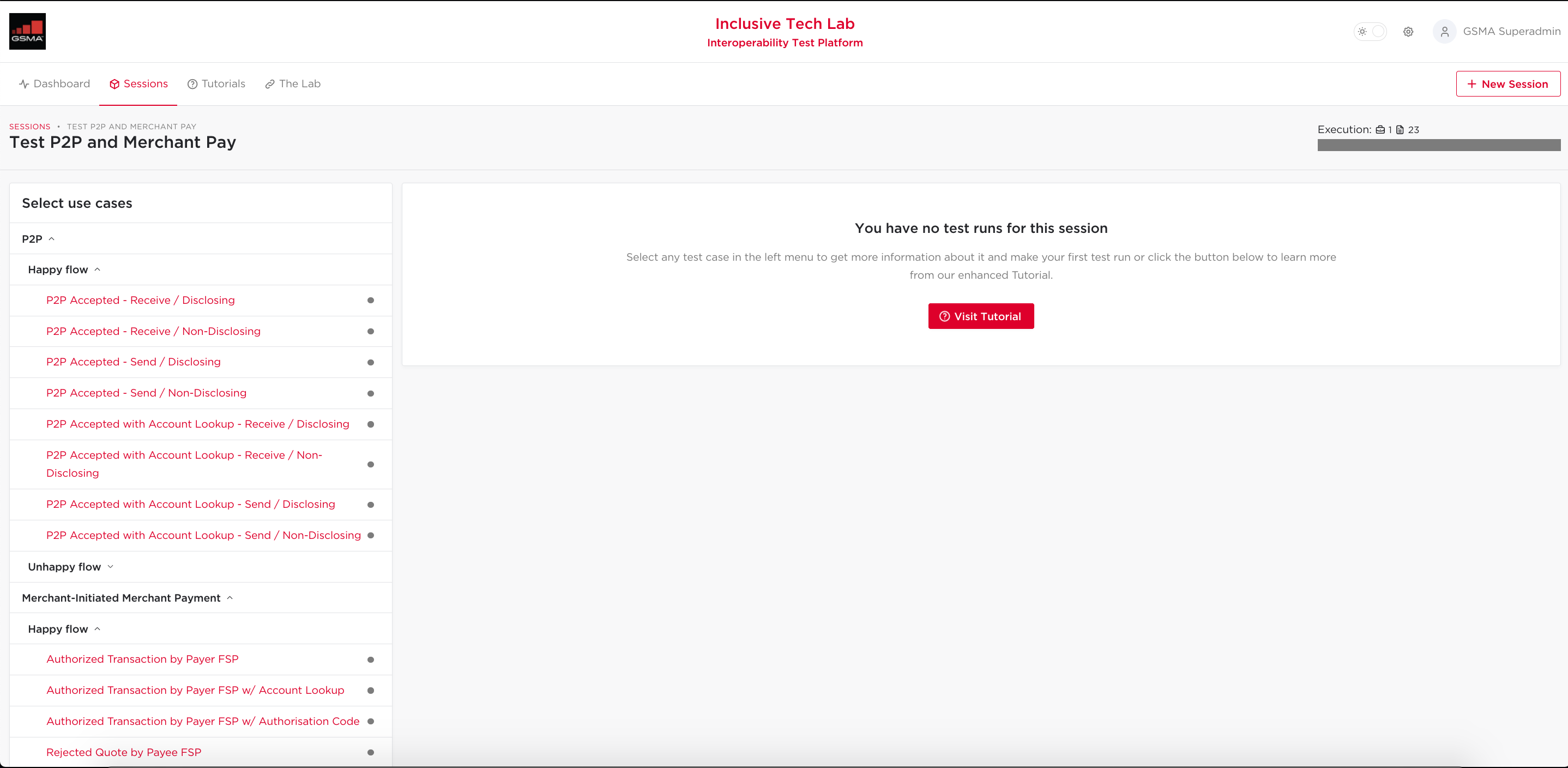

Users can create custom test sessions with tailored use cases, so they can test a specific functionality or create a full cycle to test everything. Since it supports any stakeholder in the chain, we are able to provide valuable feedback to two main groups:

- Mobile money operators, who at times play different roles within an interoperable scenario, are empowered to test their system from different perspectives – acting either as an acquirer of transactions or an authoriser of them.

- Service providers, using the GSMA Mobile Money API can have an in-depth understanding of the flow outside their circle of influence, and evaluate how that may affect their systems.

With this focus, we have included functionalities that are tailor-made to support developers, quality assurance professionals and other product-oriented people, with the aim of guiding users through a simple and intuitive platform, featuring:

The platform is fully open to anyone to use, and also to contribute to, through the Inclusive Tech Lab GitHub page. Using the best practices from software development such as “Agile” methodologies, continuous integration and deployment, and a high level of code standards in a cloud environment, we have created an open-source platform to support our vision and increase financial inclusion across the world.

Join our community and take advantage of our industry-leading open platform to test your system’s interoperability. Create your account now and start testing.