Authored by Rishi Raithatha and José Sanin

Deployment and market growth

In a previous blog we found that the mobile money industry in Latin America and the Caribbean (LAC) has been playing catch-up to the rest of the world. Below, we take a closer look at the last five years of mobile money in LAC, noting encouraging signs of recent progress and key factors which will unlock future growth prospects.

Between 2011 and 2016, the number of Latin American deployments rose over threefold (from 10 to 33), while the number of markets with mobile money more than doubled from eight to 17 markets. The number of deployments within Latin America has also grown consistently within each sub-region (Central America, South America and the Caribbean), proving that mobile money adoption is not restricted to a particular part of the region.

Where are the markets now?

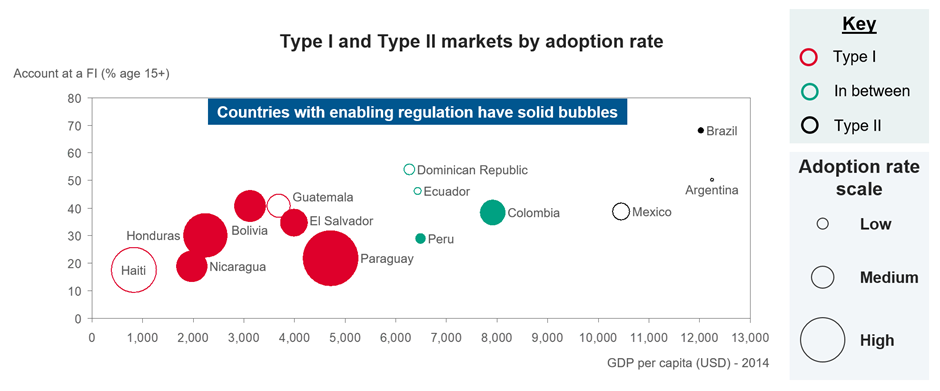

In 2015, we grouped Latin American countries into type I and type II markets based on CGAP’s market archetypes for financial inclusion. The aim of the original classification was to provide policymakers, regulators, financial services provides, donors and investors with a framework showing different starting points to achieve financially inclusive ecosystems.

Building on this analysis, we have introduced the 2016 mobile money adoption rates – defined as registered accounts / total GSM connections excluding cellular M2M – for the markets with mobile money in the region, to consider actual performance to date. Based on this, we can observe higher mobile money adoption rates amongst Type I markets (as shown in Figure 1).

Mobile network operators in Type I markets have been able to take advantage of their broad reach in providing basic financial services via mobile. The prevalence ofenabling regulatory environments amongst Type I markets leads us to believe that that rising mobile money adoption in these markets could be partly attributed to a favourable regulatory environment.

Faster user growth than other emerging regions

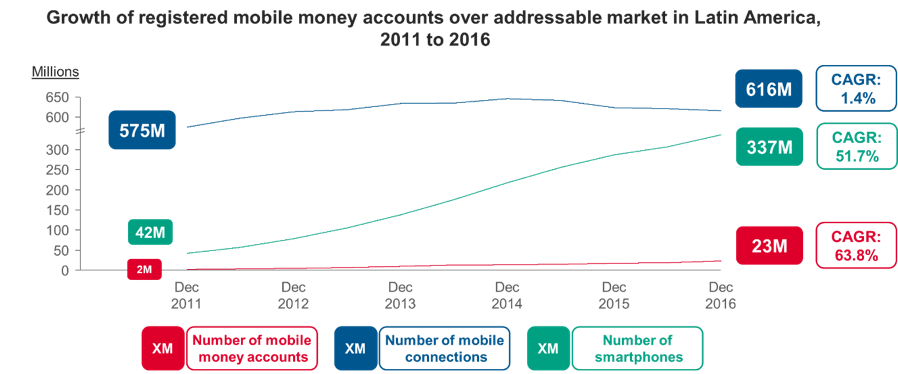

Between 2011 and 2016, mobile money adoption grew at a faster rate than mobile connections – as shown in Figure 2. In fact, the latter began to show signs of saturation towards the end of 2015, perhaps a sign that mobile money is a growth area worthy of continued investment. Smartphone penetration also increased rapidly during this period, presenting mobile money providers with an opportunity for improved user experience and sophisticated products and services, as well as the opportunity to acquire new customers beyond their traditional GSM base. Additionally, increasing smartphone use exposes mobile money providers to new competition.

The LAC region is dominated by “ecosystem” transactions, comprising bill payments, bulk disbursements, international remittances and merchant payments. Merchant payments, in particular, constitute almost 60% of all Latin American transactions, while bulk disbursements make up almost half of the value of all mobile money transactions (both as of 2016). This stands apart from the global snapshot, in which airtime top-ups and peer-to-peer transfers make up almost 75% of transactions and over 80% of the value of all transactions (as of 2016).

The increase in the region’s ecosystem use cases is unique. Between 2011 and 2016, peer-to-peer transfers grew steadily, but the benefit of digitising ecosystem transactions led to a 62% growth in transactions – from 92 million transactions in 2013 to almost 400 million transactions by 2016. While the increase in transaction values during 2011 and 2016 could be attributed to bulk disbursements and bill payments, the value of peer-to-peer transfers remained constant.

Even at a nascent state, with a relatively small active user base, the mobile money activity rate in LAC – that is to say, the number of active 90-day accounts as a proportion of the number of registered mobile money accounts – is the highest in the world (see the below graph). In fact, the region’s activity rate has been consistently higher than the global and Sub-Saharan African rates between June 2011 and June 2016. This high activity rate appears to be driven by the prevalence of frequent, relevant use cases such as transport and bulk payments found in the region.

The benefits of increased cash digitisation

One overlooked benefit to emerge from the adoption of mobile money in the region has been the growing value of cash being digitised via mobile money (see Figure 5). The value of cash-in transactions increased from 38.3% in 2013 to 47.6% in 2016, showing a willingness among users to digitise their cash. The fact that this figure is much higher globally – 80.5% as of 2016 – sheds light on the outsized contribution of bulk disbursement transactions in the region: Bulk disbursement transaction values grew from 45.1% in 2013 to 47.1% in 2016, dwarfing the global average of 8.5% in 2016.

While this increase can be attributed to some governments in LAC digitising government-to-person (G2P) transfers, such as in Mexico (through Transfer Mexico) and Colombia (through DaviPlata), or digitising humanitarian cash transfers (through Digicel Haiti), the private sector is also finding value in utilising mobile money as a tool for salary payments. This, in turn, has increased financial inclusion rates and further encouraged innovative digitisation efforts.

What are the future growth prospects for mobile money in LAC?

Mobile money in LAC has not only shown consistent signs of growth over the last five years, but has also developed a sophisticated mix of use cases – much unlike other emerging regions. However, there remains a ripe opportunity for further mobile money growth in the region.

For most LAC deployments, fewer than 10% of their GSM customers are active mobile money users. Providers could increase their active user base by 57 million if they were to increase mobile money activity by 10% across their existing GSM base.

Mobile money remains a budding industry in LAC, but has experienced fast and consistent growth across the region. Moreover, mobile money is building an ecosystem of diverse use cases from the point of inception. This not only enriches the user experience of mobile money, but also augments the financial inclusion impact beyond peer-to-peer transfers. Mobile money can offer more to its users by digitising local economies, leading to significant use cases through bulk payments, transportation payments and merchant payments. Even more could be achieved; LAC’s high activity rate suggests that increasing adoption could enable the creation of diverse, sustainable business models based on ecosystem transaction.