This blog is the second in a two-part series.

Subsidies in the utility sectors

Utility services – particularly water and energy – are among the most heavily subsidised sectors globally. Government subsidies to water and sanitation total $320 billion annually, equivalent to 0.5 per cent of global GDP. For low- and middle-income countries this figure rises to between 1.5 – 2 per cent. Pre-tax subsidies in energy are estimated to be approximately $300 billion.

In water and electricity, the vast sums going to subsidising services have long been shown to disproportionately benefit the wealthier in society. A recent World Bank study in 10 low- and middle-income countries found that 56 per cent of subsidies in water found their way into the pocket of the top income quintile. While only six per cent reached the poorest quintile. In the energy sector, governments have historically heavily subsidised centralised utilities through grid extension schemes and tariff subsidies. National utility connection costs often exceed $2,000 per connection in rural areas. Meanwhile off-grid energy services, such as pay-as-you-go (PAYG) solar or mini-grids, serving more low-income and remote populations have not benefitted from equivalent support.

The reasons for this inequity vary from country to country and depending on the type of subsidy, but there are some common causes. First, and most fundamentally, is that subsidies are often delivered on the basis of consumption through tariff prices. Those without a connection or access to services will, by definition, not benefit from tariff subsidies. A second critical reason that the wealthier benefit more from consumption subsidies is simply that they consume more. When a service is subsidised, the more you consume the more you capture the benefits of the subsidy, which means that richer households benefit more in absolute terms.

Finally, it is common that many subsidies are indirect (e.g. an organisation is subsidised) rather than the subsidy being directly delivered to the user (often referred to as demand-side subsidies or end-user subsidies). For the reasons outlined above, these indirect subsidies will tend to benefit the wealthier households in the case of centralised services. Indirect subsidies do not, however, necessarily have to be regressive. Targeting indirect subsidies to off-grid providers, or those focused on extending first time access to services, can act to direct the subsidies to the lower wealth quintiles.

The case for utility subsidies and the need for smarter subsidies

The case for subsidies in utilities sectors

Before considering the role of technology in improving subsidies for utilities, it’s important to take account of the case for subsidies, and also the common criticisms. Subsidies are generally accepted as economically ‘efficient’ when either: i) there are significant positive externalities from consumption (i.e. where someone consuming a product has benefits for others), and/or ii) there is a market failure.

Basic utility services all have significant positive externalities. This is most notable in the case of water and sanitation: sewage not entering water sources has benefits for not only the person who had their sewage safely disposed of, but the general public as well. And as 2020 has shown us, public health is most certainly a public good. Our health is not entirely our own, it can directly impact all those around us (as well as globally).

In terms of correcting market failures, subsidies can act to influence people’s behaviour or incentivise firms and providers that would otherwise not participate in the market.

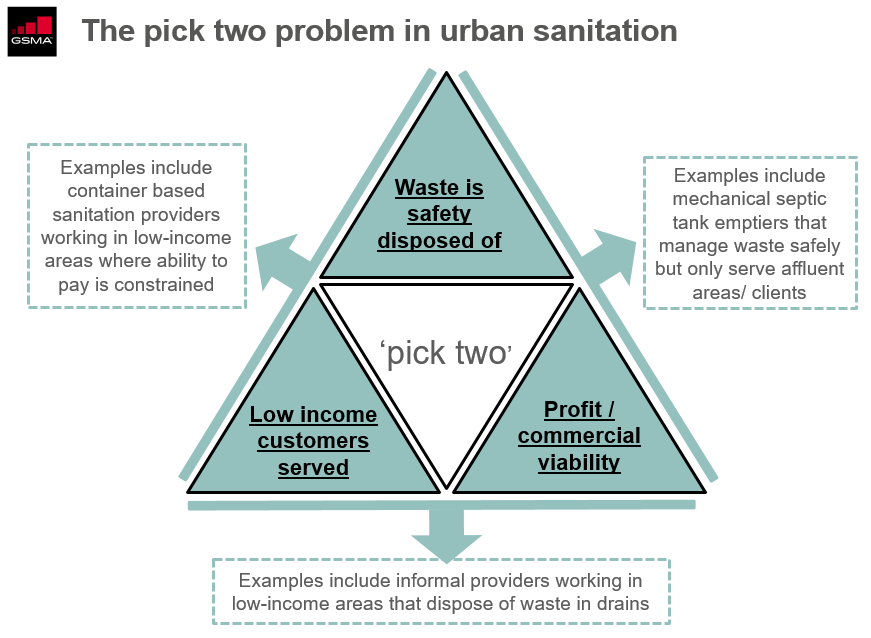

On a more localised scale, market failures are common in the sanitation sector, where currently ability to pay and the costs of providing safe sanitation services are not well aligned. Meaning one of these three service challenges usually has to be given-up from: i) profit/commercial viability, ii) serving low-income customers/ the mass market, and iii) disposing of waste safely. There is increasingly robust evidence to support this view, and consequently the need for direct subsidies or cross-subsidisation with other services.

Source: Developed by authors in discussion with Ian Ross

Subsidies for essential services can also be justified from a rights-based perspective. In 2010 the UN recognised access to water and sanitation services as a basic human right, and the SDGs related to water, sanitation and electricity all set the goal of universal access to affordable services. Additionally, many constitutions enshrine these rights in law as foundational national principles. Subsidies undoubtedly have a role in reaching these goals, both due to their current prevalence and that these goals are extremely ambitious.

Common criticisms of subsidies

Beyond the issues related to inequity outlined above, other common criticisms of subsidies include that they are non-transparent and distortionary within markets. Subsidies can be distortionary when they: Support inefficient or poorly-targeted service delivery, dis-incentivise innovation and/or create market barriers for new entrants. Global climate change could be described as the greatest market failure of all time. Using an expanded definition of subsidy that includes the costs of the damages from dirty energy consumption, the IMF estimates global energy subsidies to be $4.7 trillion (over 6 per cent of global GDP). Such a mind-bogglingly large number needs a frame of reference: that is more than the annual GDP of all South Asian and sub-Saharan African economies combined. Refocusing subsidies on clean energy sources, while also correctly accounting for the costs of consumption has long – dating back to the 1997 Kyoto Protocol – been a central tenet of addressing climate change. Though it is only more recently that concerted action has begun to be taken

At the service provider level, a critical issue in distortionary subsidies is that all too often the subsidy given is not linked to specific performance indicators, or set at a price that disincentives performance improvements. Reforming subsidies can also be highly political, especially in the area of basic services where a political pressure to provide water and energy at low costs can act as a barrier to reform.

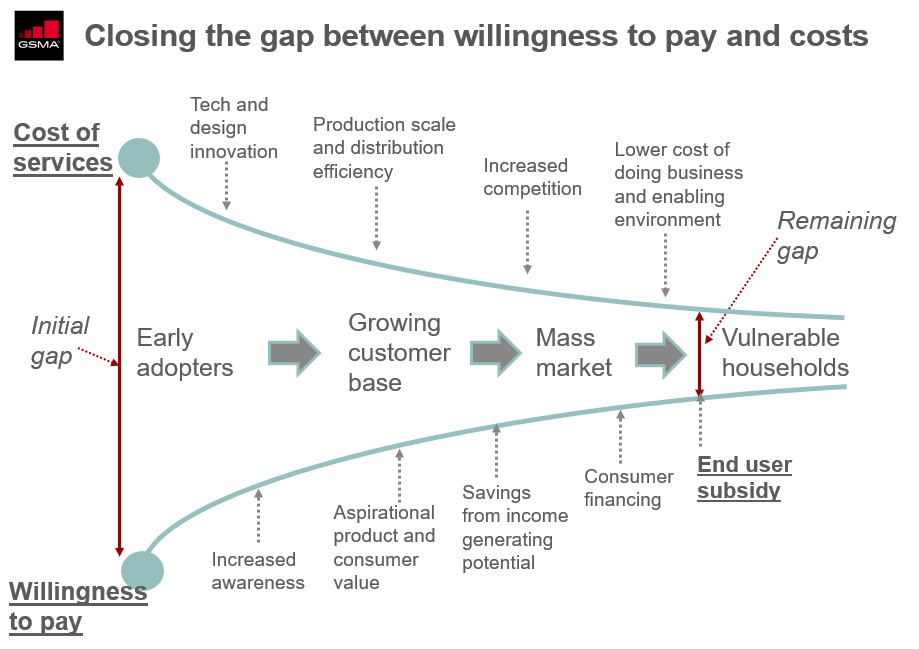

The distortionary effect subsidies can have on market dynamics are particularly significant in emerging industries, or in markets where innovation is needed. There is a risk that a subsidy fixed at too high a rate, and/or directed at too few suppliers could dis-incentivise innovation. In an excellent presentation at a GOGLA event in January 2020 staff from ESMAP, reminded us of the progress innovations have made in lowering costs for many customers. Innovation can do a lot to bring together willingness to pay and the costs of service, as highlighted in the figure below. It is quite right that subsidy – especially given limited government resources – should be targeted to those who really need it. It is important to stress that innovation as well as production scale and distribution efficiency in the off-grid solar sector has not only been driven by market forces, but has also been driven by subsidies in the form of grants, and concessional finance, as well as enabling environment interventions such as VAT exemptions and preferential government support.

Source: ESMAP presentation at GOGLA event in January 2020, adapted by authors

Key areas where digital technologies can make a contribution

The necessity of subsidies, their current prevalence, and their discontents have caused renewed attention on the need for ‘smarter’ and more targeted subsidies. Below we discuss some of the critical issues in subsidy delivery, and the roles digital and can play. In doing so we focus on end-user subsidies, as these have traditionally been one of the harder types of subsidy to administer, and are an area where digital creates new possibilities. Critically, this blog draws on examples from national-scale programmes where digital has enabled more effective delivery. While this blog looks to the future, it is important to remember that many of the tools discussed are here today.

Using digital payments to deliver subsidies directly to end-users

The first and critical contribution is related to the potential created by mobile money. The combination of the ability to deliver money directly to customers without the need to handle cash, and the potential for these to be linked to a digital identity opens the door to more effective end-user subsides. This is the case in Togo, where the government is rolling out an ambitious subsidy scheme via mobile money that aims to enable access to PAYG solar home systems to over 500,000 rural households (see our blog on this programme for more).

There are more examples beyond energy. In Pakistan, bi-monthly cash-transfers to low-income households under the Benazir Income Support Programme (BISP) are made using mobile money, while India rolled out a biometric digital ID (Aadhaar) system to reform subsidy provision. The experience of digitalising social protection programmes and Cash and Voucher Assistance (CVA) in humanitarian contexts offer some important lessons in considering digitalising utility subsides. Both of these applications have seen some early use cases, and in both applications the very real risk of exclusion is a key concern. Evidence has shown that the benefits of mobile money-enabled cash programming will only be equitable for all if interventions are designed to address the needs of the most marginalised recipients.

While the risk of exclusion is real it is also important to remember that the digital payment architecture has a lot of the ‘plumbing’ needed to overcome inclusion barriers. Mobile money’s branchless banking network, the system of agents, or a robust authentication system all give governments new tools to work with. CGAP’s work with early adopter Indian states hold valuable lessons for governments transitioning to government-to-person (G2P) payments. Additionally, 2020 saw a proliferation of cash-relief programmes as governments and humanitarian agencies moved to dampen the economic shock of lockdowns and the pandemic more broadly. Many had digital payments at their core, and the crisis response has fast-tracked the move to digital payments within many sectors and administrations.

Using digital identities as part of the registration and verification process in delivering subsidies

Digital identities hold the potential to link the delivery of subsidies to specific individuals, and are an essential component of mobile money. Digital identities are relevant for subsidies at the point of registering to receive a subsidy, verifying a payment has been made, or through enrolling people into a subsidy by linking their identity to another means-tested social welfare programme within government. For example, the GSMA recently worked with Care International in Somaliland on a small pilot to test the use of voice ID to verify the receipt of mobile money cash transfers. Early results from this pilot showed that using the Voice ID technology reduced the cost of delivering the programme by removing the need for staff to travel to verify delivery, and the ease of receiving the transfers was appreciated by the recipients.

However, despite the growth in connectivity in recent years, relying solely on a digital identity is likely to exclude many. 157 countries require proof of identity to register a mobile phone as part of national know your customer (KYC) requirements, yet globally up to a billion people lack the means to fulfil these identity requirements. The GSMA’s work on humanitarian cash transfers highlights that we are still some way from being able to use purely digital identification and verification without running the risk of excluding some. There can also be non-trivial integration issues. The ease of using mobile money is dependent on the fundamental building blocks of: connectivity, the digital financial infrastructure, the level of awareness and use in the population, and the architecture that enables partnerships.

More streamlined or ‘tiered’ KYC requirements can minimise the risks of exclusion, but this streamlining, of course, has to be balanced against the risks the KYC requirements are there to protect for in the first place. Over the course of the pandemic, the ID requirements for accessing SIM/mobile and mobile money were relaxed in many countries, and this enabled the on-boarding for those without ‘official’ ID. A key question for 2021 is the extent to which there is appetite from governments, regulators, and MNOs to maintain these less stringent requirements.

While there remain some barriers for digital payments, as connectivity and mobile money use continues to expand, these barriers will begin to fall away. It is also the case that in some contexts the use of mobile money or digital identity for subsidy programmes could help to drive digital adoption, and in doing so, support governments’ digitalisation and financial inclusion objectives. However, as the debate around Aadhaar in India illustrates, digitalising citizen-government payments and relationships will likely be a contentious political choice in many contexts.

Using new and innovative data sources to target subsidies more effectively

A third major area digital can make a contribution is in improving targeting. Here targeting refers to how we identify those in need and more effectively direct resources to them. Targeting subsidies can be an expensive business, especially where it relies on conducting large scale surveys. This is not an uncommon undertaking. For example, in Pakistan as part of administering the BISP a survey of 20 million people was undertaken. In designing programmes policy makers are often faced with a very practical decision: targeting subsidies at considerable expense, or having a less targeted subsidy that is cheaper to administer. Digitisation and digital technologies offer two notable contributions: i) use existing data within government to determine eligibility and target subsidies (as with Aadhaar), and ii) using novel and innovative data to target subsidies more effectively. Here we focus on the latter.

Geographical targeting has long been used in delivering subsidies as it presents an easy way to get at least some level of targeting with minimal cost. It is, however, a blunt tool. The advances in satellite mapping combined with machine learning and AI mean that increasingly high resolution targeting is possible. For example, in energy planning the World Bank’s Gridfinder application use nightlight data to identify areas not supplied by the national grid. In testing, its predictions of grid areas based on night lights were found to be 70 per cent accurate. Similarly, TFE, an energy planning company, use satellite data to predict energy demand, and for siting mini-grids. While their work is used to predict energy demand and the viability of infrastructure, the same analytics can be applied to look at where there may be service gaps that require subsidy. Similarly, consumer data analytics companies Fraym and Nithio recently partnered with Nigeria’s Rural Electrification Agency to undertake a geospatial analysis to estimate consumer creditworthiness. The aim was to locate commercially viable off-grid communities for mini-grid development and solar home system deployment. However, again, if looking at the data in another way, low creditworthiness can itself be a measure for where subsidy may be needed.

While these developments in geospatial analysis are exciting, and hold real potential for identifying service gaps and consequently improving targeting, they do not allow for the targeting of individuals based on their socioeconomic status. Here, again, an innovative programme from Togo is breaking ground. In response the COVID-19 pandemic the government of Togo launched ‘Novissi’, a cash transfer programme for the poorest households. Satellite data were used to target the geographical areas, and then mobile phone data were used to identify individuals eligible for the cash transfer. Data related to calls and text (date, time, duration, and cell tower), mobile data usage, and mobile money transactions were used in the identification. Those eligible then enrolled and received payments digitally. To date the programme has reached nearly 600,000 people. As with other areas this sort of targeting carries a real risk of bias and exclusion, however as compared to a blanket transfer of geographical targeting alone the approach is significantly better at reaching the poor with resources. The Togo approach is set to be rigorously evaluated shortly, the results of which will contribute significantly to understanding the extent the exclusion risk materialises when using such targeting techniques.

The potential digital creates for linking payments to specific performance areas and results

The last key point to make regarding delivery and verification is that digital technologies, particularly IoT devices with machine-to-machine (M2M) communication capabilities, allow for the linking of performance to payments. Here the discussion on subsidy meets the discussion on broader innovative finance, and in particular results-based financing (RbF). RbF has long been used in PAYG solar. Digitised PAYG models are ideal candidates for RbF: the performance area is clear and measurable, it can be verified cheaply and remotely, and payment can be made remotely. Donor RbF and government subsidy programmes can also complement one another well. RbF programmes working at a smaller scale can develop the models for, and overcome the technical challenges in, designing smarter subsidies. These aspects of subsidy design include: determining the eligibility criteria, the right amount, and developing the partnerships needed for delivery. These models can then be scaled in larger government-led programmes.

A development we’ve seen through The GSMA Innovation Fund is that PAYG models are gaining traction in other sectors. For example, City Taps and prepaid water meters, Sun-Culture and solar irrigation, and CircleGas in LPG cooking services. For all of these service models payment, performance monitoring, and delivery are heavily digitised and on a PAYG basis.

In a companion blog to this one we discuss the Togo end-user subsidy for energy access. In many ways this programme exemplifies the possibilities digital hold. For the reasons given above it’s hard to think of a more perfect candidate for digitally delivered end-user subsidies than PAYG solar, but the expansion of these technologies to other sectors opens the door to applying the same thinking and principles to subsidy design.

Summing-up and looking forward

The necessity of subsidies in utility services is clear, so too is the case for reform. Innovation in energy, water and sanitation service models have done much to close the affordability gap for basic services. Yet, in the short to medium-term – at least on SDG timelines – the necessity of subsidies for extending services to some groups cannot be questioned. What does need debate is how to target and deliver these subsidies most effectively. This blog has discussed some of the very concrete ways in which digital can improve the targeting and effectiveness. The combination of linking digital payments, identities, and performance measurement/ verification opens the door to delivering far more targeted subsidies, and at a lower administrative cost.

The national programmes in Togo and other countries are exciting, the lessons from those programmes will undoubtedly hold lessons for others seeking to accelerate off-grid electrification, as well as replication in other utility sectors. That said, the challenges are not insignificant, and there remains a real risk of exclusion in purely digital programmes. The good news is these challenges are not static barriers, and the trends are moving in the right direction. Expanding connectivity, increasing mobile and digital payment penetration, technological innovations, and the level of digitalisation within governments and utilities all work to enable the use of digital in delivering subsidies. In the short term RbF programmes hold the potential to ‘pilot at scale’ new models. For now, among the utilities services the off-grid solar sector is currently leading the charge.

The GSMA Digital Utilities programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO), and supported by the GSMA and its members.