As mobile money expanded into the mainstream and increasingly diversifies into digital finance products, crossing the $1 trillion transaction mark in 2021, remittances have become a key mobile money use case. The number of international remittances sent and received via mobile money grew by 48 per cent in 2021, reaching $16 billion. However, despite this remarkable progress, there are still significant regulatory barriers that are restraining market access and social impact.

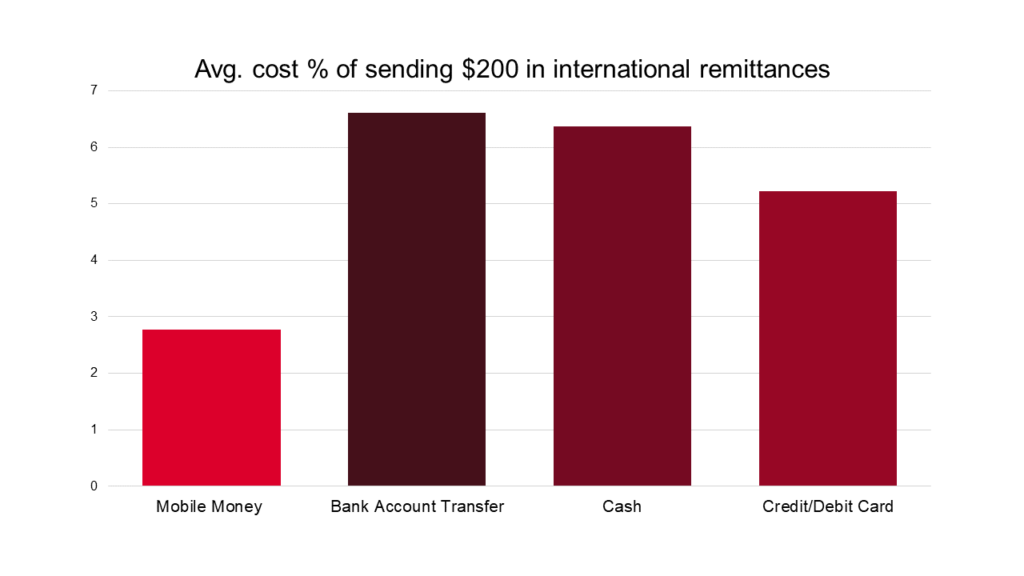

Mobile money contributes to nearly all the Sustainable Development Goals (SDGs) and significantly impacts SDG 10c which sets a target to reduce the transaction costs of migrant remittances to less than 3 per cent by 2030. By achieving this target in a majority of the corridors – well before the 2030 timeline – mobile money remittances have become the most affordable method for sending international remittances compared to the other available channels and instruments, including cash. According to the World Bank’s latest Remittance Price Worldwide survey released in June, the average cost of sending $200 in international remittances using mobile money is 2.77 per cent, compared to the global average of 6.09 per cent for Q1, 2022.

By reducing the costs of international remittances, mobile money increases recipient families’ disposable income compared to other channels and allows extra savings to generate socio-economic improvements.

To increase the safety of mobile money remittances and stay ahead of the evolving risks, mobile money providers are spending significant sums to strengthen compliance with customer due diligence, AML/CFT, and fraud prevention. Some mobile money providers have gone beyond the regulatory requirements to implement international best practices in compliance. As a result, mobile money has also increased last-mile resilience. During the COVID-19 pandemic, when cash couriers and other remittance channels were disrupted, mobile money providers were at the forefront, playing an essential role in digitally connecting migrants with their families back home, thus ensuring the financial and economic lifelines remained active and affordable.

Recognising the role of mobile money in maintaining a safe and resilient financial lifeline, regulators in many countries played an important role in permitting an increase in mobile money transactions and account balance limits, facilitating customers in using remittance services during the COVID-19 pandemic.

According to the Global Findex database (2021), mobile money has become an essential enabler of financial inclusion in Sub-Saharan Africa—especially for women—both as a driver of account ownership and account usage.

However, despite these clear advantages, there are challenges for mobile money providers. Based on the GSMA’s Global Adoption Survey in 2021, more than 40 per cent of mobile money providers are not offering international remittance services. This includes 30 per cent of respondents in Sub-Saharan Africa, where the cost of sending money across remittance corridors is amongst the highest in the world – at eight per cent on average.

The critical challenge here is restrictive licensing regimes. Unlike Rwanda, for instance, remittance licensing frameworks are not embedded in many countries’ mobile money licensing frameworks. Therefore, mobile money providers must either seek or obtain approval to offer remittance services (such as in Uganda and Tanzania) or establish a separate legal entity (as in Kenya) before being granted a license for remittance services.

In many countries where separate authorisation is required, the license requirements are often onerous, and the process is unclear with no indication of timelines. Most low- and middle-income-income countries still restrict outward remittances (including DRC, Ethiopia and Pakistan), as evidenced in GSMA’s Mobile Money Regulatory Index. As a result, millions of people are not benefitting from the safer, faster and more affordable mobile money remittances. At the same time, governments in low and middle-income countries are deprived of the massive influx of foreign exchange through formal remittance channels.

The G20 made enhancing cross-border payments a priority. This includes remittances. The Financial Stability Board (FSB) has developed a roadmap to address critical challenges in coordination with the Committee on Payments and Market Infrastructures (CPMI). The GSMA is closely engaging with the FSB on the building blocks and providing an industry perspective for a more enabling remittance environment.

The GSMA has also renewed its commitment to deliver ground-breaking research and innovative projects to support the accelerated growth of affordable, safer, sustainable and resilient mobile money remittances while observing the International Day of Family Remittances (IDFR) on June 16.

As we move closer to the UN’s 2030 timeline, policymakers and regulators should review the national regulatory frameworks for mobile money remittances to align with the recommendations of organisations such as the FSB, Financial Action Task Force (FATF), and the World Bank to create a more enabling and sustainable environment for remittances.

The GSMA also published a set of recommendations for regulators. Countries yet to publish remittance regulatory frameworks could leverage central bank associations such as the Alliance for Financial Inclusion for peer learning and knowledge sharing in this area.

Efficient and enabling regulatory frameworks that promote a level playing field and competition while balancing inclusivity with risks will play a decisive role in the future of innovative digital remittance initiatives and adoption. Such frameworks will catalyse the mobile money sector to increase remittance access and adoption while maintaining affordability and safety. Doing so together, we will build a resilient future for the one billion migrant senders and their families.

Want to know more about the GSMA’s work on remittances? Click here.