Solar Farms in the Desert

The GSM Association (“Association”) makes no representation, warranty or undertaking (express or implied) with respect to and does not accept any responsibility for, and hereby disclaims liability for the accuracy or completeness or timeliness of the information contained in this document.

Executive Summary

As part of the Future Networks Programme, Network Economics workstream, a series of case studies have been developed, exploring areas where Mobile Network Operators (MNOs) can potentially reduce their Operational Expenditure (OpEX) through the application of innovative energy solutions. This case study focuses on Orange’s launch of an RFP to establish Solar Farms for electricity generation based on a design, build, finance, and operate (DBFO) model wherein, they can save costs with no capitalised expenditure and to significantly reduce their Co2 emissions

Solar power is set to play a pivotal role in helping achieve Jordan’s goal of having renewables meet 20% of its energy needs by 2020. Regional volatility and a lack of hydrocarbon reserves spurred the government to develop one of the most comprehensive policy frameworks for renewable energy projects in the Middle East.

With 80 per cent[1] of the power produced in Jordan coming from diesel and other fossil fuels, almost all of which is imported results in added taxes and costs that could be removed if energy is sourced from ‘greener’ avenues. Jordan is now seeking to beat its 2020 targets, aiming to produce 25 per cent of its electricity from renewables.

To evaluate the potential impact, the Network Economics Model baselines a hypothetical tier 1 operator’s cost structures, models innovation scenarios to identify the delta in terms of operational expenditure (OpEX) and capital expenditure (CapEX) these can deliver.

[1] Jordan Times – Jordan explores renewable energy goals progress

Introduction

Orange is one of the largest operators of mobile and internet services in Europe and Africa and a global leader in corporate telecommunication services. Their mission is always to be there to meet their customers’ essential needs by providing them with a unique experience every day, through digital services that allow them to focus, in full confidence, on what matters most to them. They believe in starting with their customers, their expectations and their aspirations, which involves taking action so that together they can come up with made to measure solutions that genuinely meet the needs of their customers.

Read more at https://www.orange.com

Orange Jordan is one of the 29 subsidiaries of the Orange Group. The company was first registered in the Hashemite Kingdom of Jordan in September 1999, launching a full public service across the Kingdom the following year. In March 2010, Orange Jordan launched its 3G network – The first 3G network in Jordan. By summer 2010 the network coverage included most urban locations, delivering services to approximately 70% of populated areas, equivalent to around two million people. In line with Orange Jordan’s strategy to make 2011 the ‘Year of Broadband’, the company unveiled its new ADSL2+ and 3G+ package, offering unprecedented broadband speeds of up to 24Mbps and 21Mbps respectively. It has an expanding customer base of more than five million, a network of around 1,800 dedicated employees, and more than 55 branches.

The solar energy potential in Jordan is enormous as it lies within the solar belt of the world with average solar radiation ranging between 5 and 7 KWh/m2, which implies a potential of at least 1000GWh per year annually.

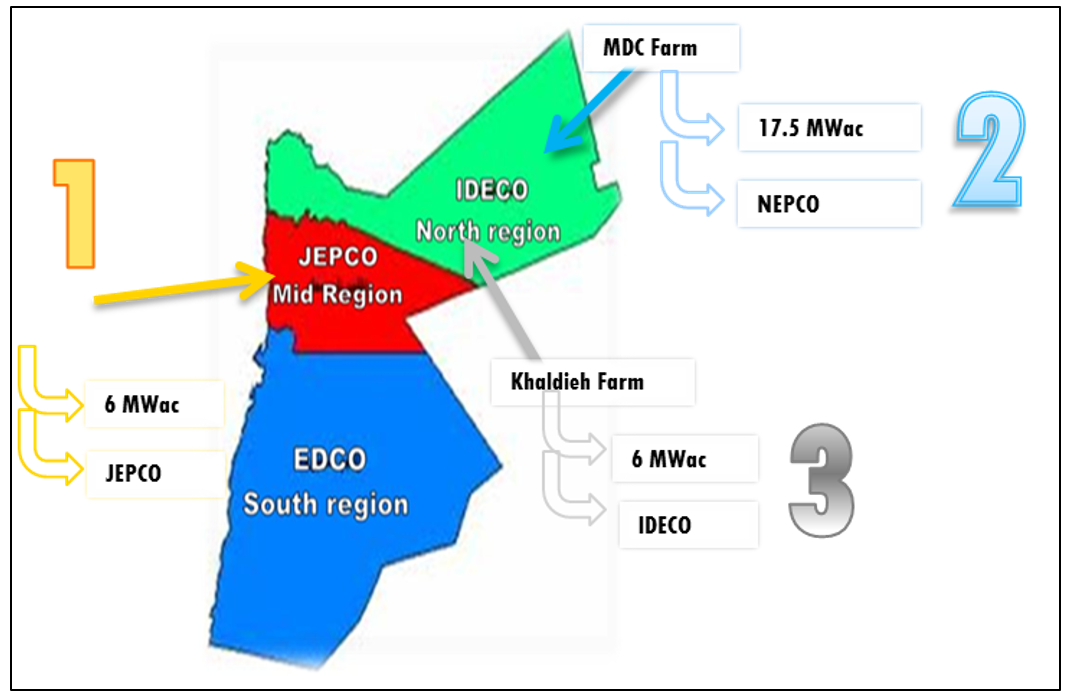

Fig 1.0 One of three solar farm sites in Jordan

Business Imperative

In May 2012, faced with disruption of cheap LNG supplies from Egypt, Jordan’s government raised the electricity rates on banks and telecom companies by 150% overnight. The new rate of 0.265 JODs (0.37 USD) per kWh was close to 200% above the cost of generation at the time. The rate hike increased the 3 MNOs electricity cost by around 40 million JODs (56.3 million USD) per year. The hike, which did not have an expiry date nor any condition related to the actual cost of generation, allowed the government to subsidise electricity costs for other sectors at the expense of the telecom sector.

Mobile operators chose to absorb costs rather than passing onto their customers, and the combined effects of high electricity costs, spectrum costs, high special taxes, relatively high-income taxes and high price competition resulted in a massive drop in the sector’s profitability. By early 2019, at least one of the three MNOs in Jordan were operating at a loss while the others registered continued profit declines. To mitigate the pressures of electricity costs, operators studied moving towards solar farms to offset their very high energy costs resulting in two key changes; Jordan’s Government decided to reduce the costs of electricity for mobile operators progressively starting from July 2018 through 2020; and the Electricity Regulations Commission introduced the wheeling regime[1], where it allows large enterprises like Orange to generate electricity via renewable energy sources for their use.

A wheeling agreement or regime, allows solar electricity to be generated in one location and consumed by a company or institution in another. Where regulation allows, such as in Jordan, Orange Jordan purchased, and rents land, while Kawar Energy builds the solar power generating assets directly associated with electricity accounts in urban environments. This allows companies or institutions that may not have appropriate land or roof space, to enjoy the cost savings of solar energy.

By early 2017, all of Jordan’s Mobile Operators had conducted feasibility studies, and Orange launched a Request for Proposal (RFP) to establish Solar Farms for electricity generation based on a design, build, finance, and operate (DBFO) model wherein, they are able to save costs with no capitalised expenditure and to significantly reduce their CO2 emissions, and subsequently contracted a massive solar farm project.

In partnership with E-Dimension, a member of The Jordan Telecom Group, Orange Jordan has engaged with Kawar Energy to construct the infrastructure for three solar farms, located in the mid-region the TC Farm, the northern region MDC Farm in Mafraq development zone, and the Khaldieh Farm in the south of the Northern region

[1]http://www.iepa.com/wheeling.asp.

Further details of taxation of Energy in Jordan can be found at Electricity Cost Reduction in Jordan

Fig 2.0 Location of Solar farms

[2] Independent – Solar and wind power cheaper than fossil fuels for the first time

Orange and the Solution

While the government has agreed to reduces the current rate of electricity by 35 – 41% (depending on the bracket of consumption) by the start of 2020, the current cost of generating electricity in Jordan is around 0.16 USD per kWh so the MNOs will still be paying an effective “electricity tax” even after the reduction. Nevertheless, operators will get a much-needed cost reduction and will still be contributing to the overall health of the electricity sector in the country, including through their investment in solar farms.

The Orange Jordan Project solar farms use the Photo-voltaic panels to produce energy from sunlight and will generate approximately 75-80% (70GWh) of Orange Jordan’s energy consumption. Jordan has an average of 330 days of sunshine per year, one of the world’s highest annual daily averages of solar irradiance.

Through a 20-year wheeling agreement, this project anticipates savings of 75 – 80% of the current energy bill. This percentage is less the cost of generation, wheeling operations, maintenance, and government taxes, and meters monthly subscription.

The main criteria to adopt this solution is adequate to finance, coordination with government entitles and departments for the necessary licenses and permits and other legal formalities. To secure the needed permits and licenses from related authorities as the project will be connected through national electricity grid (Electricity Distribution Companies, Electricity Transmission Company ”NEPCO”, Energy ministry/commission etc.,) permits are obtained from the government, outlines the deadlines for the progress of development. Once all the permits and studies have been obtained, the civil works begin. For telecommunication operators, a special purpose vehicle (SPV) is needed to be able to work in the energy investment field.

Economic Benefits

Solar energy has now become cheaper than traditional fossil fuels and is now either the same price or less expensive than new fossil fuel capacity in more than 30 countries according to a report by the World Economic Forum. The low cost of solar is encouraging companies to build more plants to harvest energy and pass on those savings to their customers. Achieving this relatively lower consumption price is mainly due to advances in technological improvements and the economics of scale.[1] Renewable energy is cheaper in developing countries that are looking to add more electricity to their national grids, however nations where new renewable energy generators must compete with existing fossil fuel power stations, the cost of carbon-free electricity can still be high[2].

Orange Jordan is setting a new standard for sustainable corporate social responsibility (CSR). In line with its role as an international company with a local spirit, Orange Jordan is committed to continuing its CSR strategy, inspired by one of the key pillars of its five-year corporate strategy Essentials 2020. Throughout the years, Orange has continued to elevate our commitment to society across all sectors, by forming strategic partnerships with civil society organisations, in addition to offering quality products and services.[3]

The factors that can be highlighted that help in operational efficiencies and reduced costs can be attributed to reduced cost of installation and operation. This is almost 35% lower than standard gas-based power generation.

The cost of renewables is getting cheaper than the cost of grid available power. As is the case in Jordan, wheeling agreements benefit from no or low upfront capital expenditure. Kawar Energy has been fully contracted to provide a full turnkey solar PV system solution excluding the cost of land, any rental expenses, and cost of licenses and interconnection work to operate. Orange can adopt solar and begin saving money as soon as the system becomes operational. Kawar is also fully responsible for system performance and operating risk, significantly limiting risk for the mobile operator.

A vital benefit of a wheeling regime is in the predictable, fixed cost of electricity for the term of the agreement which may be structured in one of two ways. Under the fixed escalator plan, the price the customer pays rises at a predetermined rate, typically between 2 – 5%. This is often lower than the projected utility price increases. The fixed price plan, on the other hand, maintains a constant price throughout the term of the agreement saving the customer more as utility prices rise over time.

Most benefits are articulated in terms of improvements or cost savings. According to Orange, the way this solution will be measured will be evident in the operational cost savings, i.e. in terms of saving on electricity bills. Orange believe if their solution is adopted, they expect to see a return on investment of 75-80% coverage of the electricity bills.

[1] Independent – Solar and wind power cheaper than fossil fuels for the first time

[2] Independent – Solar power worlds cheapest electricity production

[3] https://www.orange.jo/en/pages/csr.aspx

Implementing the Solution

This project is a first of its kind for Jordan with Orange being the first operator to launch the Solar Farms project. They are putting every effort to ensure the project is completed as per the given deadline.

Due to the nature and profile of the project, Orange was thorough in their due diligence and approach to achieving a relatively short turnaround of approximately 30 months. Within the planning and development phase’s contract preparation, initial permit approvals, land selection, technical studies of the selected site, and the implementation of the solution was achieved. Orange confirmed the timeline for the physical implementation is seven months from the implementation stage to completion.

Challenges

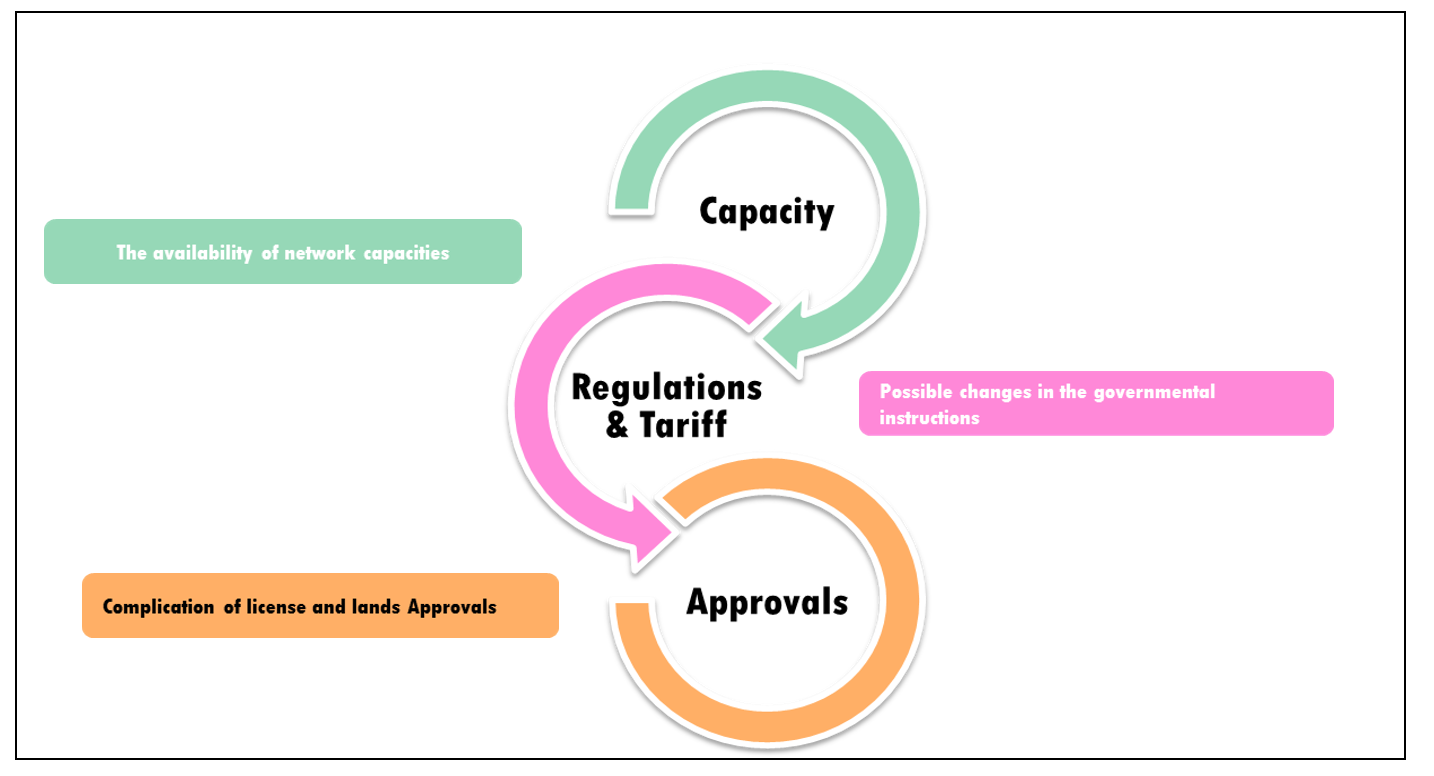

The main challenges for this project have been in terms of laws and regulations when dealing with changes in governmental instructions, the availability of network and grid capacities, the complication of licenses and land approvals, and funding for the project.

Laws & regulations

In terms of size, scale and maturity, this project faces a few challenges. Not only it is it a very, large scale project. It is also considered to the first of its type for the region, and this brings about a set of new related laws and regulations applicable to renewable energy projects. Therefore the challenges in regards to the application of laws and regulations at present are slower; however, they are likely to improve and become more streamline as related bodies become more accustomed to the necessary procedures.

Network and Grid Capacity

At present, the electricity network availability and ability to handle the extra energy coming from non-conventional sources such as renewable energy has reached its maximum capacity, particularly in the southern region of Jordan, and grid has no more capacity to take in any more power.

The governmental solution is to increase the reliability of renewable energy resources for Jordan to produce its energy instead of relying on the importation of energy. This is to be achieved by developing and upgrading the electricity network infrastructure. This is likely to take two to three years before the pressure on the grid is alleviated.

Funding

Financial commitment has been challenging to secure due to the uniqueness of this type of project for the region and Jordan, the structure of the project being a wheeling project, and its duration of approximately 20 years. The laws and regulation associated were also a challenge as lenders were hesitant to enter into such projects where laws and regulations could change, affecting the profitability or the stability of the project. However, based on Oranges’ positive business reputation, Kawa Energy are have been able to confidently secure the necessary funds.

Fig 3.0

Conclusion

Solar energy has now become cheaper than traditional fossil fuels and is now either the same price or cheaper than new fossil fuel capacity in more than 30 countries, the low price of solar is encouraging companies to build more plants to harvest energy and pass on those savings to their customers. The solar energy potential in Jordan with average solar radiation ranging between 5 and 7 KWh/m2, which implies a possibility of at least 1000GWh per year annually or 330 days of sunshine each year.

The Orange Jordan solar farm project will use Photo-voltaic panels to produce energy and will generate approximately 70GWh or 75-80% of Orange Jordan’s energy consumption.

Through a wheeling agreement, this project anticipates savings of 75 – 80% of the current energy bill (less the cost of generation, wheeling operations, maintenance, and government taxes, and meters monthly subscription).

To evaluate the potential impact, the Network Economics Model baselines a hypothetical tier 1 operator’s cost structures, models innovation scenarios to identify the delta in terms of operational expenditure (OpEX) and capital expenditure (CapEX) these can deliver.