Electricity cost reduction on MNOs by the Jordanian government will drive increased investment and better access to mobile services

In May 2012, faced with disruption of cheap LNG supplies from Egypt, Jordan’s government raised the electricity rates on banks and telecom companies by 150% overnight. The new rate of 0.265 JODs (0.37 USD) per kWh was close to 40% above the cost of generation at the time. The rate hike increased the 3 MNOs electricity cost by around 40 million JODs (56.3 million USD) per year. The hike, which did not have an expiry date nor any condition related to the actual cost of generation, allowed the government to subsidize electricity costs for other sectors at the expense of the telecom sector.

Mobile operators chose to absorb costs rather than passing onto their customers and the combined effects of high electricity costs, spectrum costs, high sales taxes, relatively high-income taxes and high price competition resulted in a massive drop in the sector’s profitability. By early 2018, two of the three MNOs in Jordan were operating at a loss while the third operator registered continued profit declines. To mitigate the pressures of electricity costs, operators studied moving toward solar farms to offset their very high energy costs. By early 2018, all of them had conducted their studies and one operator contracted a massive solar farm project that would significantly reduce its energy bill.

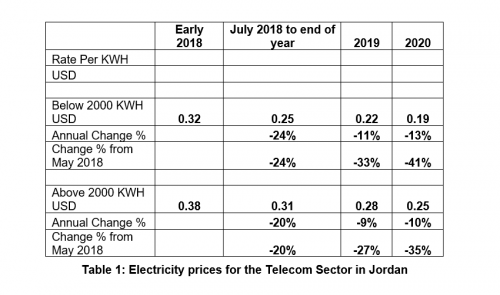

The current situation is one of financially pressured operators that will find it hard to invest in network upgrades. As such, Jordan’s Government decided to reduce the costs of electricity for mobile operators progressively starting from July 2018 through 2020. The decision reduces the current rate of electricity by 35-41% (depending on the bracket of consumption) by the start of 2020. The table below shows the rate reductions in detail:

The eventual reduction will be beneficial for the electricity bill of the three operators which currently exceeds 70 million USD a year. The current cost of generating electricity in Jordan is around 0.16 USD per kWh so the MNOs will still be paying an effective “electricity tax” on the discount. However, operators will get a much-needed cost reduction and will still be contributing to the overall health of the electricity sector in the country, including through their investment in solar farms.

Importantly, the net saving on the energy expenditure for operators will help the mobile sector to stem some of its losses. Further measures such as spectrum licenses’ cost and duration and revenue share are needed to enhance the viability of the three MNOs to enable them to invest in network upgrades and expansions, for example, acquiring more spectrum and eventual 5G deployment. This should also enhance investments in content, marketing and operators’ ability to create direct jobs and retain existing ones.

By transitioning to a more balanced structure of costs applied to the mobile sector, the government of Jordan will promote digital inclusion and access to ICT, while at the same time benefit from increased tax revenues in the medium term as a result of greater economic growth.