The business case for 5G is now well established, with the subsequent global wave of commercial launches now bringing total active deployments to 46. That being said, there’s no escaping the scale of the task at hand: 5G is more than an upgrade, it is a new era, and new eras don’t come cheap. The mobile industry’s attention therefore, especially in mature markets, turns now to how 5G’s deployment can be carried out in the most cost-efficient way possible. What are the cost optimisers available to operators aiming to make 5G affordable to as many customers as possible, and how can they fine tune their deployment of 5G accordingly? That’s the focus of the GSMA’s latest Beta Labs report on 5G-era Mobile Network Cost Evolution – based on interviews with leading operators and technology partners – which uses the analytical concept of Total Cost of Ownership (TCO) to evaluate the long-term cost implications of cost drivers in 5G’s rollout.

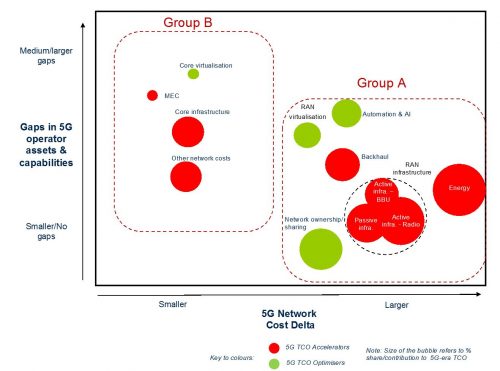

Image: An indicative 5G-era cost optimisation framework

Automation and AI will underpin many such cost optimisers, enabling a forecast potential of 25% in network TCO savings. AI in particular has dominated attention in the media, and will certainly lend itself to a broadening of the mobile industry’s commercial horizons, as operators increasingly become providers of end-to-end connected services and platforms. What the research indicates, however, is that in the more immediate term, greater savings in 5G’s deployment will come from automation than from AI. AI uses cases in cellular telecoms remain, for now, relatively rare – that will change in due course, but that fact remains for operators planning for the immediate term.

Rules-based, programmable automation can deliver ‘zero-touch, lights-out’ network operations enjoyed today by web-scale digital players such as Google and Amazon, and can do so in the immediate future. The optimal strategic sequence, then, is to reap the savings available from automation first, before becoming too engrossed in what AI can do. It can and will do plenty to improve efficiency in the 5G era, but it still needs time to germinate.

Capacity is an obvious area of interest here – with the step change in bandwidth and data transfers 5G will bring about, serious thought needs to be given not just to how this can be achieved, but how it can be delivered without passing on onerous costs to the subscriber. Massive MIMO system upgrades will help optimise capacity early on in 5G’s deployment – with up to 16 times more capacity than existing MIMO systems – but the eventual reality is they will not be sufficient to meet coverage, performance and capacity requirements in urban settings.

The message for operators is clear: start planning 5G-era RAN densification now – aggressive energy optimisation techniques may reduce the increase on 4G in consumption levels from 171% to 139%, a TCO saving of almost half. There was broad agreement amongst our interviewees that network densification with both small cells and additional macro cells will almost certainly be required.

The findings also show that operators should make energy consumption a cost-optimisation priority in the 5G era. Energy is a major network expense which accounts for up to 25% of network TCO for 4G operators. 5G-era networks will be far more efficient than their predecessors on a per-bit basis, but the demands on those networks – powered by energy-hungry Massive MIMO systems – will be volumetrically so much higher that operators are likely to face energy costs of up to 300% more than under 4G. 5G-era network densification, with new macro and small cell sites in urban areas, will also add to the increase in total energy consumption.

According to our interviewees, viable energy optimisation measures fall into three general categories. The first includes building more intelligent power management architecture, including new automation and network load optimisation algorithms running from module level to site, network and service levels. The second includes initiatives to expand the use of renewable energy sources such as solar and wind. The third includes efforts to recover energy expended by hardware and convert it back to top up back up batteries on-site.

The report provides all the technical and conceptual detail needed to make the most informed choices possible at the present time – please see here to view the full document. Among the most significant cost-optimisers will be network sharing – it’s now apparent that network sharing could unlock up to 40% of TCO savings – and securing high capacity backhaul, probably through fibre technology, to meet the planning demands of 10Gbps backhaul links per site. The report sets out how this should be approached, but should members require clarification on any aspect of the research we are naturally ready to assist.