Two weeks ago, we published the results from MMU 2012 Global Mobile Money Adoption Survey. The fact that the industry continues to grow fast is very positive, and growth in number of deployments results in increased competition. In this blog post, we discuss the impacts of increasing competition on this industry.

Mobile money is becoming an increasingly competitive industry

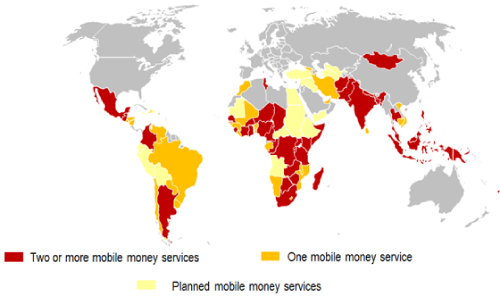

As the number of mobile money services grows, the industry is becoming increasingly competitive. As you can see on the map below, there are many countries – 40 represented in red – where there are already more than one mobile money services. There were only 33 last year. 18 markets have more than 2, and 10 have more than 3.

The fact that there are over 100 planned mobile money services also suggests that the industry will continue to grow in the next few years and that an increasing number of markets will have several competing services.

Source: MMU Deployment Tracker, December 2012

Mobile money seems to be evolving from being a differentiator to becoming a commonplace.

Is this a risk or an opportunity? Much seems to point to that will be a good thing. With many services still struggling to reach scale, sharing costs on customer communication and building trust and awareness of mobile money can be beneficial for all players.

Several services can succeed in one market

The 2012 Adoption Survey also revealed that several services could succeed in one market. In fact, we identified 14 sprinters in 10 different countries, and we believe that the development of a successful mobile money deployment can create a positive dynamic for competition. Pakistan is a good example of that.

A couple of weeks ago at Mobile World Congress, UBL and Telenor Pakistan announced themselves a GSMA Mobile Money Sprinters. In an interview with the GSMA, Abrar Mir, head of branchless banking at UBL and Roar Bjaerum, Vice President of Financial Services at Telenor Pakistan shared their perspectives on competition. Roar Bjaerum: “It definitely helps to have a competitor… They established their service UBL Omni more coming from a disbursement perspective in the beginning. We’re coming more from the retail and bill payment and money transfer perspective. So we’ve been helping each other in growing that market form different kinds of perspectives… It always helps to have a strong competitor in terms of motivating your own team.”

Abrar Mir: “Having a competitor helped us a lot because Telenor launched a couple of months before we did, and they spent a lot of money in terms of the initial education and awareness of the customers… So thank you Telenor!”

In markets where other mobile money services are already available, MNOs will tend to launch mobile money not to differentiate themselves, but because they don’t want to lag behind their competitors and lose customers. However, the example of Pakistan shows that it is interesting to think about how mobile money services can differentiate themselves and complement each other by focusing on different aspects of the market.

Can competition increase the opportunity through interoperability?

As competition increases and some markets become more mature, interoperability becomes a hot topic. What positive network effects can interoperability have between these deployments and with other existing financial infrastructure? Can interoperability increase the market opportunity for mobile money in mature markets? MMU believes it can, provided the timing for it is right.

Read more about MMU position on interoperability and the work we are doing in this space here.