This blog is based on a presentation by Elisa Minischetti at the Mobile Money Leadership Forum at Mobile 360 – Africa.

Women are consistently less likely than men to use mobile money — reducing this gender gap and increasing usage of mobile money services by women would not only advance women’s financial inclusion, but could unlock a significant revenue opportunity for the industry.

This blog shares insights on how women are adopting and using mobile money services and highlights the opportunities and practical approaches for better targeting women with mobile money services.

The gender gap in mobile money access and usage

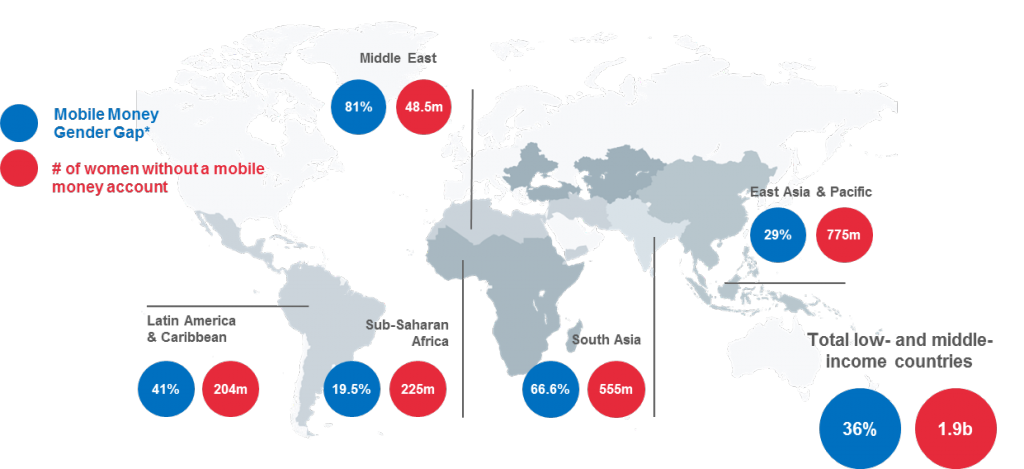

When we talk about the gender gap, we mean how much less likely women are compared to men to access and use a certain service. According to Global Findex, in low- and middle-income countries women are 36 per cent less likely to have used mobile money in the past 12 months, which translates to approximately 1.9 billion women.

It’s important to note that the regional aggregated numbers in the figure above mask bigger imbalances at the country level. For instance in Niger, the gender gap is 61 per cent, in Senegal it is 40 per cent, and in Uganda, it is 29.2 per cent.

Awareness, access and usage levels of mobile money are good indicators to help us understand the gender gap. According to Financial Inclusion Insights data, women lag behind men when it comes to awareness of mobile money. Research in Kenya, Uganda and Tanzania showed that while awareness of mobile money had grown in these countries, the gap in levels of awareness had also widened, this is largely because the awareness of mobile money by men has significantly increased. For instance, in Kenya in 2014, women were 6 per cent less likely to be aware of the concept of mobile money than men, while in 2015 they were 10 per cent less likely to be aware. The FII data also highlights that the gender gap in mobile money access is more acute in rural areas and for more sophisticated mobile money services over and above cash in – cash out.

Barriers to women using mobile money services

Through qualitative research in Rwanda and Kenya, we found that there are some barriers preventing women from using mobile money at the same rate as men, allowing us to better understand the origin of the gap.

- Price sensitivity: Transaction fees can be a bigger barrier for women than men. Women can have lower income levels than men and often make smaller and more frequent transactions. As such, women are more aware of the transaction fees and find ways to avoid costs they consider unnecessary. According to one respondent, “Men use mobile money without thinking about the charges or anything. But women are so economic, so they look at the charges for sending and receiving money.”

- Low confidence and understanding: Some women can have a perceived lower understanding of the service, and therefore are more risk averse than men in trying new services which impacts their usage of mobile money.

- Trust: Our research in Rwanda indicates that women can be less likely to trust mobile money compared to men. This can be driven by a lack of understanding of the service and negative experiences with the service. One respondent stated that “Trusting my mobile money account in such a way that I would put three hundred thousand is very difficult. I take it to my bank account as usual.”

- Product relevance: For many women, cash remains the best option for day-to-day expenses since, for instance, there is no charge for cash payments. Our research in Kenya shows that current products are not well-suited to the informal economy or savings groups — women are more likely than men to be part of both.

So how can we better reach women with mobile money?

Based on some of the above barriers, potential options for better reaching women with mobile money include:

- Adjusting pricing to incentivise more frequent use by women. This can include, for instance, addressing “double charges” on sending and withdrawing within the family or making it cheaper to pay merchants using mobile money (keeping in mind that the competing payment methods, cash or a bank card, are free).

- Marketing to women: Research shows women are significantly more likely to use a new service if shown how to use it by a friend or family – the question therefore is how to harness the power of influencers to promote the service and increase adoption with women. It is also important to consider promotions that can be attractive to women.

- Innovating your product suite: Tap into existing customer financial behaviours during development of new products (e.g. relevant products for women who belong to savings groups).

- Improving customer service: In some markets, either as a choice or driven by social/cultural norms, women prefer to interact with and feel more comfortable with female agents. Increasing available female agents could help increase women’s usage of mobile money – this was the case for Telesom ZAAD in Somaliland, who saw the number of registered women increase quickly, from 17 per cent of the customer base in 2009 (before they hired female staff) to 24 per cent one year later.