Since 2020, fixed broadband speeds in North Africa have improved substantially. However, there is still potential for further enhancement and adoption. This article explores the performance drivers of fixed wired internet performance (excluding fixed wireless access (FWA)) in Algeria, Egypt, Morocco, and Tunisia between Q3 2020 and Q3 2023 and discusses the market prospects.

Key takeaways

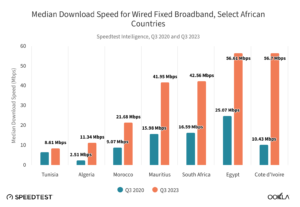

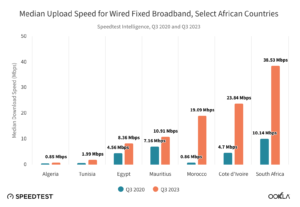

- Egypt leads North Africa in the Ookla Speedtest Global Index™ for fixed broadband in Q3 2023. Egypt widened its lead in North Africa, achieving a median download speed of 56.61 Mbps and an upload speed of 25.07 Mbps. Meanwhile, Algeria saw a significant improvement in median fixed broadband download speed, with a 4.5-fold increase to 11.34 Mbps between Q3 2020 and Q3 2023. Morocco’s upload speed has also significantly improved, rising more than 22-fold to 19.09 Mbps during that period.

- North African countries adopted different DSL migration strategies. Egypt upgraded most of its ADSL to VDSL and concentrated FTTH/B in greenfield areas. On the other hand, Algeria focused on replacing copper lines with FTTH/B, while Morocco and Tunisia deployed VDSL in tandem with FTTH/B rollout.

- Fiber upgrades and revised broadband packages help to boost speed. The deployment and adoption of FTTH/B do not necessarily lead to increased broadband speed. ISPs should consider increasing headline speeds of entry-level packages and offering discounts on higher-speed tiers to incentivize customers to upgrade.

Egypt tops North Africa in download and upload speeds for fixed broadband

In our June 2021 report on internet speed in North Africa, Egypt ranked first in North Africa for fixed broadband, followed by Morocco, Algeria, and Tunisia. All countries, except Tunisia, saw more than a 25% improvement in median broadband speeds from Q2 2020 to Q1 2021, with Algeria more than doubling its median broadband download speed.

This upward trend continued through Q3 2023, with most North African countries improving their median download and upload speeds over fixed broadband. This has resulted in a boost in their ranking in the Ookla Speedtest Global Index. Notably, Egypt extended its lead within North Africa, achieving a median download speed of 56.61 Mbps and a median upload speed of 25.07 Mbps.

Algeria showed a substantial improvement in median fixed broadband download speed between Q3 2020 and Q3 2023, increasing 4.5-fold to 11.34 Mbps. Other countries, except Tunisia, saw their median fixed broadband download speeds more than double over the same period.

Morocco saw a significant rise in median upload speed, with a more than 22-fold increase to 19.09 Mbps in Q3 2023. Despite this, it still lags behind South Africa, the African leader, which boasts more than double the upload speed at 38.53 Mbps. The other North African countries saw more modest improvements in upload speeds, ranging from a 1.5-fold increase in Algeria to a 2.5-fold increase in Tunisia.

DSL and wireless access are the most common technologies used for fixed broadband services in North Africa

Digital Subscriber Line (DSL) is the leading technology for fixed broadband services in North Africa, as they use existing phone lines for internet connectivity. The two main types of DSL are Asymmetric Digital Subscriber Line (ADSL) with speeds of up to 24 Mbps and Very high-speed Digital Subscriber Line (VDSL) offering speeds of up to 52 Mbps for VDSL1 and 200 Mbps for VDSL2. The latter can be further enhanced with G.Fast technology.

VDSL employs fiber that terminates at a nearby cabinet, a configuration often referred to as Fiber-to-the-Cabinet (FTTC). The ‘last mile’ connection to users’ premises then uses existing copper lines. FTTC typically serves as a transitional step towards Fiber-to-the-Home/Building (FTTH/B), where the fiber extends directly to the user’s location premises.

In countries like Algeria and Tunisia, mobile broadband and FWA services that use 3G and 4G technologies account for almost 30% of all fixed broadband connections. However, these cellular connections are less prevalent in Morocco and Egypt. 4G offers download speeds comparable to ADSL and VDSL1 but falls short of VDSL2 and FTTH/B.

North Africa lags behind the Gulf region in fiber coverage, adoption, and internet speed. Ambitious fiber development plans placed Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the U.A.E. high on the global speed leaderboard. For example, in Q3 2023, the U.A.E. ranked fourth on the Speedtest Global Index™ with a median download speed of 231.98 Mbps. Kuwait ranked twenty-second, and Qatar twenty-third. Other Gulf countries trailed the U.A.E. but were ahead of all markets in North Africa.

Fixed internet speeds are still relatively low in North Africa despite significant improvements in FTTH/B access

The slow pace of fiber deployment compared to the Gulf countries can be attributed to factors such as limited public funding, restrictive telecom regulations, scant private investments, as well as geographical and urbanization challenges. Most North African countries also have a larger land mass, more varied geology, and a lower level of urbanization, making fiber deployment more complex and costly.

The market’s competitive landscape is also a factor, with incumbents controlling over 80% of fixed internet subscriptions. Even in Tunisia, which boasts more alternative ISPs, Tunisie Telecom holds the majority of DSL and fiber subscriptions. By contrast, alternative network providers play a key role in accelerating fiber adoption in Europe. Furthermore, North Africans have a lower income than Gulf residents, and most cannot afford high-speed broadband services because of their high costs.

Market challenges delayed fiber deployment and limited service adoption and innovation. However, local ISPs have made significant progress since 2020 in upgrading the fixed infrastructure and making their services more affordable. Egypt has primarily upgraded its ADSL to VDSL and focused FTTH/B deployments in greenfield areas. Algeria concentrated on replacing copper lines with FTTH/B while Morocco and Tunisia deployed VDSL while also progressing with FTTH/B rollout.

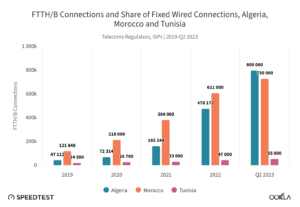

As of June 2023, Algeria has the highest number of FTTH/B connections in North Africa, totaling 800,000. Morocco follows closely with 730,000 connections and boasts the largest fiber share of the wired broadband market (see chart below). Egypt has the highest number of VDSL connections in the region, and an estimated few hundred thousand active FTTH/B customers as of September 2023. Tunisia is in fourth position with 55,000 FTTH/B connections and 176,000 VDSL connections.

In the following sections, we provide an overview of the fixed broadband market in Algeria, Egypt, Morocco, and Tunisia. We highlight the status of fiber rollout, and its impact on network performance, and discuss ISPs’ future deployment plans.

Significant progress achieved in fiber coverage in Algeria but room to drive adoption and boost speed

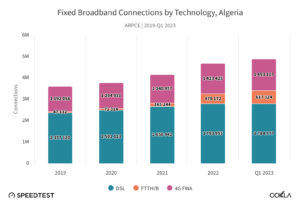

As of March 2023, Algeria boasted over 3.4 million fixed wired connections, according to the Autorité de Régulation de la Poste et des Communications Electroniques (ARPCE). The state-owned Algerie Telecom (AT) is the sole provider of wired broadband services. With an additional 1.5 million 4G FWA connections, Algeria is among Africa’s largest fixed broadband markets.

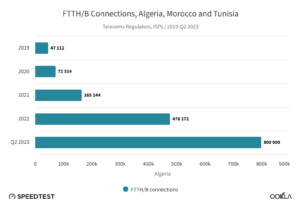

AT prioritized the replacement of copper lines with fiber in major cities while maintaining its ADSL services. It also used 4G FWA technology to service areas where wired infrastructure is unavailable or costly to deploy. AT was late to the game but it rapidly expanded FTTH/B services since their introduction in 2018. It also increased maximum speeds on fiber from 100 Mbps to 300 Mbps for consumers in 2023. AT introduced regular promotions, such as free speed doubling for new customers. It has also reduced tariffs every year since 2020, with a 100 Mbps fiber line costing $22/month in 2023. These actions contributed to the surge in the number of fiber subscribers by nearly 14-fold between 2020 and November 2023, reaching the 1 million milestone, making Algeria one of the largest FTTH/B markets in Africa.

The migration from ADSL to FTTH has undoubtedly improved the quality of service for consumers. However, it has yet to boost the speed that most households experience. While the download speed of the fastest 10% samples increased from 8.01 Mbps in Q3 2020 to 45.71 Mbps in Q3 2023, the median download speed only reached 11.34 Mbps during that period, according to Ookla Speedtest Intelligence® data.

According to the ARPCE, more than 85% of connections had a download speed of 10 Mbps in March 2023. To improve the country’s median download speed, AT should increase the speed of its entry-level fiber package from the current 10-15 Mbps. It should also work towards lowering the price of its higher-speed packages. The government proposed to exempt fixed broadband services from VAT in 2024, which should help make it more affordable for customers to upgrade to higher-speed packages.

AT has set ambitious goals to expand its fiber coverage substantially. The number of households passed by fiber (i.e. premises that can connect to the fiber network) is expected to increase from 3.5 million in 2022 to 6 million by 2024 (out of an estimated 7.4 million households). This is part of the government’s broader strategy to provide two-thirds of households with fixed broadband service by 2024, potentially adding 2 million new subscribers to the market.

Rapid network performance improvement in Egypt thanks to the incumbent’s ambitious FTTC strategy

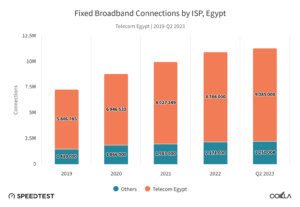

With nearly 11 million subscribers at the end of 2022, Egypt is North Africa’s biggest fixed broadband telecoms market. State-owned Telecom Egypt (TE) dominates the sector, controlling over 80.1% of the market with over 8.7 million fixed broadband subscribers.

Other operators such as Vodafone, Orange, and Etisalat by e&, offer broadband services through wholesale access to TE’s network. This allows them to provide comparable broadband speeds. Notably, the combined market share of these alternative ISPs has been on an upward trend year-on-year since 2019.

TE’s strategic focus has been to develop its core and transmission networks, upgrade ADSL to VDSL, and expand fiber to the street cabinets. As of September 2023, TE connected 95% of households to the next-generation FTTC network (up from 85% in 2019).

The introduction of VDSL services in Egypt in 2018 marked a significant shift in broadband speeds, raising the maximum from 16 Mbps to 100 Mbps. TE took this opportunity to increase the speed of its entry-level plan from 5 Mbps to 30 Mbps, with a modest price increase of 9%. Infrastructure upgrades also positively impacted alternative ISPs that boosted their broadband packages’ speeds.

These improvements in VDSL coverage, speeds, and affordability significantly accelerated the adoption of broadband services. The number of fixed broadband subscribers surged by 55% from the end of 2019 to June 2023. Raising the minimum broadband speed to 30 Mbps led to a substantial increase in the country’s median download speed to 56.61 Mbps in Q3 2023, up from 25.07 Mbps in Q3 2020, according to Ookla Speedtest Intelligence. Given that TE currently offers speeds of up to 150 Mbps, there’s ample opportunity to enhance download speeds further.

TE launched FTTH/B services in 2009, making Egypt among the early adopters of fiber in the region. It prioritized FTTH/B deployments in greenfield areas such as new developments, gated communities, and residential compounds. TE aims to eventually migrate existing VDSL customers to FTTH/B.

The government allocated a $360 million budget in 2021 to extend Fiber-To-The-Home (FTTH) to a million households to improve fiber accessibility. The development of ‘New Cairo,’ a new mega-city located 35 km east of the Capital, is also expected to spur demand for fiber services.

The competitive fiber market in Morocco drove broadband adoption and speed improvements

Maroc Telecom (MT) dominates the fixed broadband market in Morocco. The operator’s control over the copper infrastructure has spurred other ISPs, inwi and Orange, to develop their own fiber infrastructure and lease capacity from local utility and transport companies.

The fixed wired broadband market has been expanding rapidly in Morocco, increasing from just over 1.6 million in 2019 to over 2.2 million connections in June 2023 (out of around 8 million households). This growth is mainly due to a shift from DSL to FTTH/B since 2020, as observed in the chart below.

Consumers have been leaning toward faster and more reliable services, with demand for DSL connections falling since 2020 and FWA adoption decreasing since 2022. MT launched fiber in 2014 as a premium service with speeds of 100 Mbps and 200 Mbps. In 2022, MT accelerated the deployment of its FTTH/B network and increased network capacity by 40% year-on-year in June 2023, helping to expand its fiber customer base by 43%.

inwi and Orange introduced their fiber services in 2018, offering a broader range of speeds starting from 20 Mbps and lower price points than MT at the high end. These services are available in big cities like Casablanca, Rabat, and Fez. They accounted collectively for 52.69% of the fiber market in June 2023 which shows that the segment is quite competitive in Morocco.

This has resulted in a boost to user-end speeds. As of Q3 2023, the median download speed of fixed internet services had increased to 21.68 Mbps, up from 9.07 Mbps in Q3 2020, according to Ookla Speedtest Intelligence data. There has been a marked shift to higher-speed broadband packages, as evidenced by the fact that 17.3% of fixed broadband subscribers had speeds of at least 20 Mbps in June 2023, a dramatic increase from only 0.6% in 2019 who had a minimum speed of 16 Mbps, according to the Agence Nationale de Réglementation des Télécommunications (ANRT)

As only around one-third of wired broadband subscribers in Morocco use FTTH/B, there is still an ample opportunity to migrate more DSL customers to fiber and encourage existing fiber users to upgrade to higher-speed packages. This is especially relevant for inwi and Orange as they offer more affordable fiber packages starting at 20 Mbps, compared to MT’s 100 Mbps fiber package which costs around $50/month.

Looking ahead, the Moroccan government has ambitious plans to connect more households to high-speed broadband services under the “Maroc Digital 2030” program. The government aims to connect 5 million households with fiber by 2026, potentially making Morocco one of the largest FTTH/B markets in Africa.

Limited infrastructure sharing and investments in Tunisia constrained speed improvement

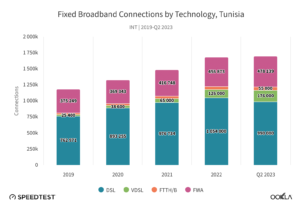

Tunisia has the lowest fixed download speeds in North Africa at 8.61 Mbps in Q3 2023, according to Ookla Speedtest Intelligence. This is despite having eight ISPs – compared to one in Algeria, three in Morocco, and five in Egypt. The poor network performance is due to the limited coverage of high-speed broadband services and their unaffordability for many households. For example, a 50 Mbps VDSL line costs more than $26/month. Furthermore, it was not until 2022 that the ISPs lifted the speed of basic DSL packages from 4 Mbps to 10 Mbps

The wired broadband sector has consistently grown, reaching over 1.2 million subscribers by June 2023. This represents a 50% increase from 2019 levels. Interestingly, this growth rate outpaced that of the 4G fixed wireless access segment, which only saw a 27.4% increase, reaching just over 470,000 connections during the same period. On the other hand, fiber service remains a niche offering due to its limited coverage and high cost. Fiber share of the fixed wired broadband market saw a minor increase, rising from 3.0% in 2019 to a modest 4.5% in June 2023.

Tunisie Telecom (TT), a state-owned entity, holds the majority stake in the fixed broadband sector. TT controls the national copper infrastructure, operates the nationwide fiber-optic backbone, and competes both directly and indirectly in the retail market via its subsidiary, Topnet. Ownership of TT is divided between the Tunisian state (at 65%) and Emirates International Telecommunications (EIT, at 35%).

TT maintains a strong position within this sector, controlling 72.9% of all fiber connections in Tunisia by June 2023. This figure includes direct customers (39.1%) and those provided through Topnet (33.8%). Fiber services, which were launched in 2012, are only available in Greater Tunis and Sfax. Additionally, TT dominates the VDSL market with a substantial 92.4% market share, mostly through Topnet.

Regulatory pressure from the telecom authority INT (Instance Nationale des Telecommunications) has urged TT to reduce its network access charges and expedite line activation to help other ISPs. Despite these efforts, various challenges persist, prompting operators such as Ooredoo and Orange to supplement their wired offerings with mobile broadband services based on 3G and 4G, in addition to TD-LTE-based FWA.

Ooredoo, which introduced fiber services in 2013, saw its share of the fiber market rise to 16.8% by June 2023. Its fiber network covers Greater Tunis and Sfax. Orange, however, lacks consumer fiber offerings. Other ISPs, including Bee, GlobalNet, and HexaByte, use a mix of ADSL, VDSL, and FTTH/B by accessing TT’s infrastructure.

In the short term, TT plans to upgrade most DSL ports to VDSL and promote higher-speed packages. This strategy aims to increase the average fixed speed from 10 Mbps in 2022 to 50 Mbps in 2024. Over the medium term, TT aims to expand its FTTH coverage and capacity from 100,000 connections in 2022 to 500,000 by 2025. These initiatives are expected to enhance fiber service accessibility and improve the country’s median download and upload speeds.

Furthermore, the INT initiated a consultation in August 2023 to set the conditions required to share facilities to avoid infrastructure duplication and ensure efficient fiber investments. The proposal is to have all ISPs and infrastructure operators provide shared access to their telecom facilities after 12 months of commercial operations. This initiative should help expand fiber coverage, reduce access costs, and support the development of 5G.

Fiber can further unlock the connectivity potential in North Africa

As discussed above, North African ISPs have adopted various strategies to roll out fiber and promote its take-up. They have made considerable strides in enhancing fiber accessibility and fixed broadband speed since 2020. However, a significant gap remains when compared to more advanced markets in the Middle East and Africa.

To bridge this gap, it is essential to facilitate fiber investment through public-private partnerships, promote infrastructure sharing, encourage competition, provide robust regulatory frameworks, and increase international bandwidth. Such initiatives will make high-speed broadband services more affordable and accessible, which is integral to advancing national digital transformation and boosting economic growth.

Ookla has been working with ISPs, such as Bahrain Network (BNET) and telecoms regulators, to support their national broadband plans, track improvements to fiber connectivity and coverage, and promote their networks to consumers. If you are interested in Ookla’s solutions and services for network intelligence and management, get in touch.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.