Ookla® recently hosted a webinar on “Why is 5G in Europe Falling Behind, and what can we do about it?” We gathered representatives from two of Europe’s leading 5G operators, Three UK and KPN, to talk about their approach to 5G and some of the challenges they have faced. We were also joined by industry experts from the U.K. regulator Ofcom, leading equipment vendor Ericsson, as well as Counterpoint Research. Here is our summary of some of the key takeaways from that webinar.

5G makes headways in Europe … uptake disappoints

Operators’ lack of interest in 5G cannot be blamed. According to GSMA Intelligence, a majority of European countries (34 out of 50) have already deployed 5G, and just over half of operators in the region (92 out of 173) have launched 5G networks.

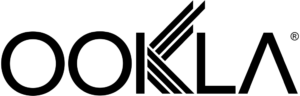

However, looking at 5G uptake measured as the proportion of 5G connections of total connections) Europe performs poorly with only 2.5% as of Q4 2021 according to GSMA intelligence. This places it well behind North America, China, Japan, and South Korea. While adoption will pick up over the next couple of years, Europe will still lag behind other regions.

Factors driving 5G adoption

The best way to express the key takeaways from the discussion is to think about the factors that affect 5G adoption:

- Network. This covers spectrum assignments, network roll out, and market structure

- Devices. Here this includes consumer devices such as smartphones, but as 5G scales there will be more dedicated industrial 5G devices in the market and other connected consumer devices e.g. AR/VR.

- Use cases. The fact of the matter is that technology for the technology’s sake won’t sell. Unless there are appealing use cases leveraging the technology the end users will remain unconvinced. These could range from delivering broadband access to rural areas via 5G Fixed Wireless Access (FWA) or private 5G networks for manufacturing plants.

The many flavors of 5G

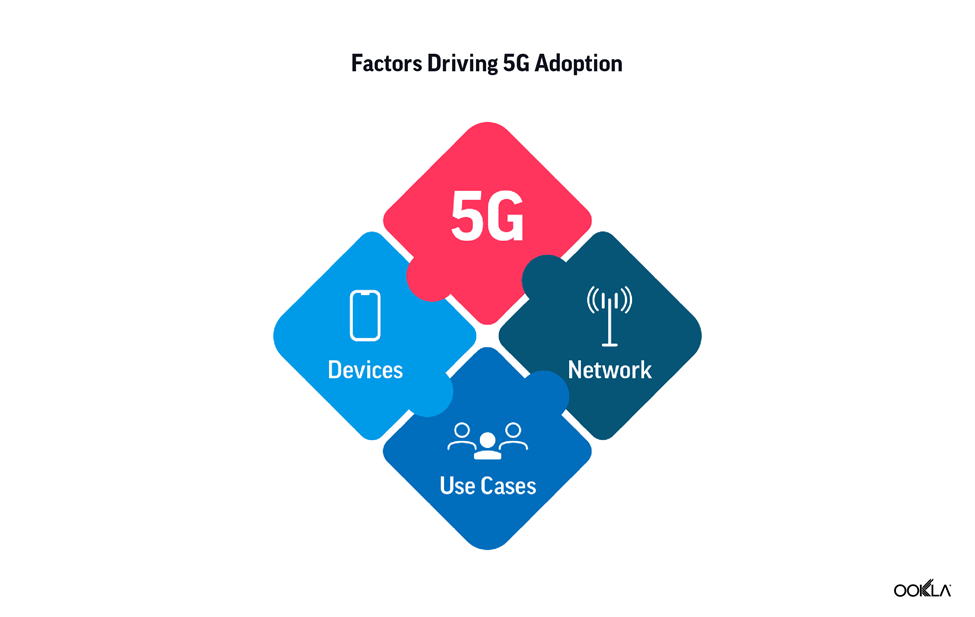

The fact that “5G is not one size fits all,” was highlighted throughout the panel. The key to understanding 5G is understanding the spectrum and there are two key considerations to keep in mind: speed performance and geographical coverage.

While mmWave is capable of delivering super-fast speeds — much faster than those that sub-6 GHz spectrum can support — sub-6 GHz signals are able to travel farther than mmWave, cover a greater geographical region, and provide deeper penetration within buildings.

Operators’ 5G performance depends heavily on their 5G spectrum holdings. In some cases, in the absence of dedicated 5G spectrum or to supplement existing spectrum, operators can use Dynamic Spectrum Sharing (DSS) to use the same spectrum band for different RAN technologies, which are allocated in real time – this in turn impacts 5G performance.

Market structure and the role of government

The optimal market structure and role of governments in supporting the rollout of 5G remains a heavily debated topic. As Brian Potterill from Ofcom pointed out, governments and regulators are not in the best position to decide on targets, and that investment decisions should be left to the market to decide. As a result, Ofcom pursues a light-tough approach to 5G, working to enable the market to remain competitive. In addition, he downplayed the role of 5G targets, given the different flavors of 5G networks and the fact that unless tied to license obligations, they wouldn’t be binding. Despite this, the EU maintains key targets on 5G rollout for member states, a position we critiqued in our report 5G in Europe: EU Targets Require a Rethink.

For Gabriel Solomon of Ericsson, the main reason why Europe is falling behind on 5G lies in the investment environment, given the weighted average cost of capital remains higher than the return on invested capital in the region. He noted that there are huge sums of public money being made available via the EU’s Recovery and Resilience Facility, some of which is being directed by member states at improving connectivity. Beyond this investment, he outlined three main levers governments have to help spur 5G deployment:

- Spectrum. There is a need for a trade off between spectrum fees and incentives for operators to deploy networks more widely.

- Removing barriers to deployment. This is clearly an issue, with the EC recently announcing a new Connectivity Infrastructure Act designed to make barriers to passive infrastructure and backhaul much more available and affordable. In the U.K., the Government recently announced new plans to slash red tape from 5G roll outin a bid to help spur deployment.

- Market structure. Half of European markets have four or more mobile operators. There is a clear desire for further mobile network consolidation which operators see as key in helping improve the investment case for 5G deployment. During Three UK’s recent 2021 results announcement, Robert Finnegan, Three UK’s Chief Executive Officer, warned that despite achieving positive results, “the U.K. market with four operators continues to remain dysfunctional and requires a structural change to improve the overall quality of infrastructure that U.K. customers should expect.”

KPN: The tale of 5G Availability

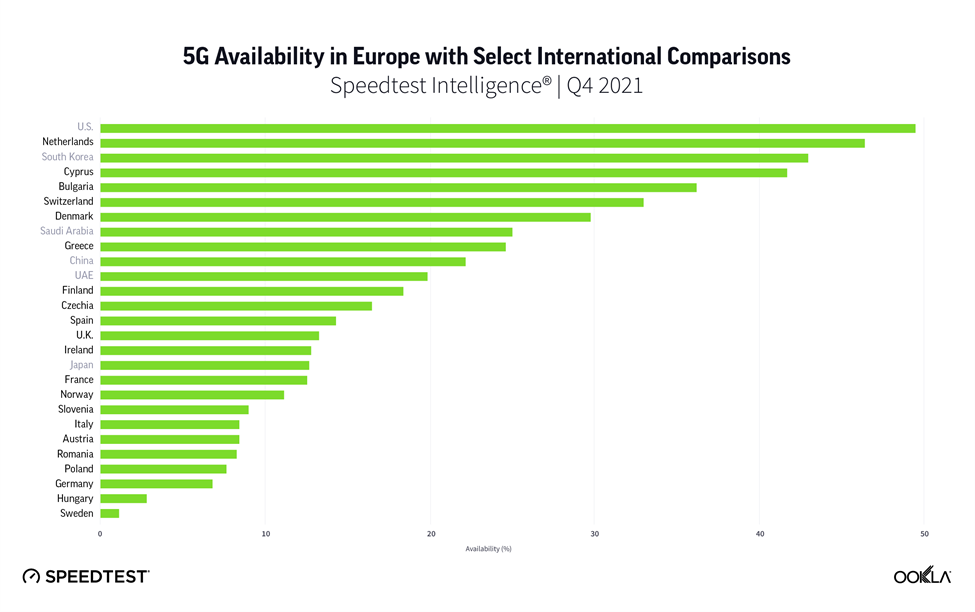

Within Europe, the Netherlands comes top in terms of 5G Availability (the proportion of users of 5G capable devices who spend a majority of their time on 5G networks). Only six European markets had 5G Availability above 20% by Q4 2021. Not surprisingly, the U.S. is in the lead with almost 50% 5G Availability, having started 5G deployment in the 600 MHz (low band) range.

Erik Brands from KPN explained that they had a good starting point with over 99% nationwide 4G LTE coverage. In 2019, KPN embarked on a nationwide network modernization — a full upgrade of all equipment on every site, installing all available frequencies and making it technology neutral so they refarm frequencies by software. As a result KPN scores well on 5G coverage, partially because they have access to low band 5G spectrum (700 MHz). They have managed to extend 5G coverage to more than 80% of the country, including rural areas. Some of this is driven by the coverage requirement as part of the 700MHz licenses: a minimum speed of 8 Mbps in 98% of the cases in each municipality of the country in 2022.

While KPN scores well on 5G Availability, 5G performance is not yet at gigabit levels. This is mainly caused by the lack of available spectrum in the C-band, which is currently occupied by Inmarsat and local licenses. The Netherlands is very late clearing this band and it still isn’t clear when it is going to be auctioned. In time, KPN will need this spectrum to maintain quality and to enable other applications. KPN currently sees mmWave, which is also not available yet, as addressing more niche use cases that require very high bandwidth.

Three UK: “We can’t run as fast as we want to”

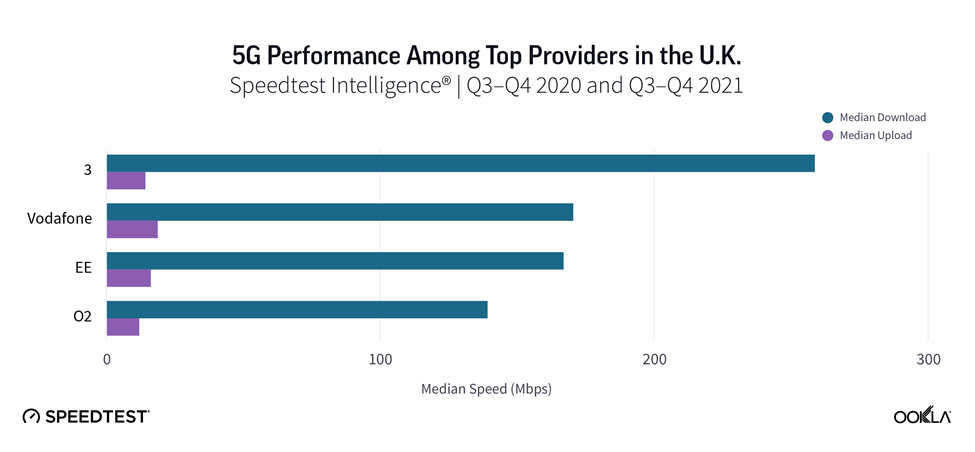

Three UK has a very “data hungry” customer base — while their subscribers account for around 15% of the UK population, the network is carrying 30% of the traffic. Three UK benefited from having the largest, dedicated 5G spectrum — 140 MHz of frequency across several 5G spectrum bands, including a 100 MHz block of continuous spectrum in the 3.3-3.8 GHz band, which positions it well in terms of median download speeds compared to other U.K. operators — read our latest article to find out more about 5G in The U.K.

In order to fulfill their customers’ demand, the operator has embarked on a network transformation journey, consisting of upgrading all sites over time to 5G. They are also deploying C-band with Massive MIMO on 60% of all sites — targeting all major cities, towns and even villages covering 85-90% of total traffic on their network — Anil Darji, Three UK’s Chief Network Architect, called it “a capacity play.” In the remaining 40% of sites, which are rural and mostly coverage driven, the operator will utilize DSS and potentially refarm some of the 4G spectrum to 5G NR — this is “a coverage play” to get the 5G capabilities like reduced latency out there.

Both operators pointed to a number of constraints in terms of deployment, including planning, regulation, site landlords, and aging infrastructure. Anil Darji mentioned that even once planning approval has been granted for a new site, some local councils can look to delay deployment through the process of requiring application for road closures. Three UK’s strategy is to upgrade all its sites and to build new macro sites to respond to growing demand.

However, recent planning reforms fell short in terms of allowing them to deploy taller sites required for the deployment of all 4G & 5G spectrum, and he called for more government support and reforms to the planning process.

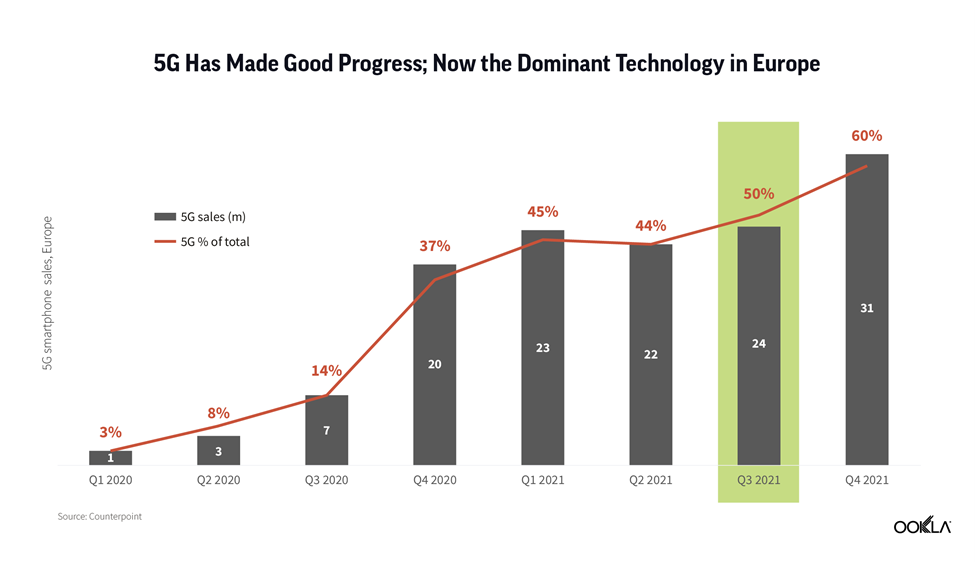

European 5G smartphone sales picked up strongly in 2021

Jan Stryjak of Counterpoint Research struck a positive note on 5G smartphone sales in Europe, noting that 5G now accounts for a majority of smartphone sales in the region. However, Europe lags behind other advanced markets in smartphone adoption with the latest data for Q4 2021 showing 5G smartphones accounted for 60% of smartphone sales vs. 73% in North America and 79% across China, Japan and South Korea. Within Europe itself there is wide variation, with the U.K. having the highest ratio globally at 83%, while some Eastern European markets come in below 40%.

5G is also moving down the smartphone price tiers. It is ubiquitous in the premium tiers (wholesale price of over $700) boosted by the iPhone 12 in Q4 2020 and iPhone 13 in Q4 2021, accounts for the majority in the mid tier ($250 – $499) and growing, where it is driven mostly by the Samsung A series. It is even growing fast in the budget tiers too ($100 – $249), thanks to affordable 5G devices from the likes of realme and Xiaomi sub-brand Redmi.

In time, smartphone sales will translate into a larger installed base of 5G devices and share of overall subscriptions.

The importance of 5G use cases cannot be overlooked

The vast majority of European 5G networks are Non Standalone (NSA), meaning that they still rely on the 4G LTE core network and therefore don’t offer the full advantage of 5G. So far, only four operators across three countries deployed 5G Standalone (SA), partially because most operators started 5G deployment by utilizing DSS, where 5G SA is less relevant. As operators move to focus more on massive MIMO using mid-band spectrum (which delivers a step change in capacity and throughput) then the functionality of SA becomes more attractive to use. Not surprisingly, the GSA says 46 operators across 27 counties are planning to deploy 5G SA. 5G SA also enables additional 5G capabilities beyond high speed such as Ultra-Reliable Low-Latency Communication (URLLC) and virtual network functions such as network slicing, which will in turn, enable new 5G use cases. 5G Fixed Wireless Access (FWA) is also one of key use cases for consumers, in areas with limited fiber rollout across Europe.

Brian Potterill of Ofcom sees connectivity as enabling economic growth and productivity and in this context more connectivity is good, and 5G plays an important role as it enables higher bandwidth and lower latency. He says that it is important that regulators allow the market to function effectively and also sees regulators and governments playing an important role in helping to understand how customers — both consumers and enterprises — can take advantage of 5G and different use cases, and helping to bridge the information gap.

All in all, there is a clear agreement that “build it and they will come attitude” does not work with 5G, there is a need to educate the customers on the benefits that 5G brings and attract them with innovative use cases to persuade them to upgrade, both their devices and tariffs.

See the full webinar recording here.

Ookla retains ownership of this article including all of the intellectual property rights, data, content graphs and analysis. This article may not be quoted, reproduced, distributed or published for any commercial purpose without prior consent. Members of the press and others using the findings in this article for non-commercial purposes are welcome to publicly share and link to report information with attribution to Ookla.