This blog post is adapted from a presentation given at the MMU Global Event in Nairobi in July. MMU will be publishing a guide on using business intelligence to increase the frequency of customer activity this Thursday.

Electronic payments through mobile money represent a significant behavioural change in economies where almost all payment transactions are conducted in cash. And behavioural changes always take time, especially financial ones.

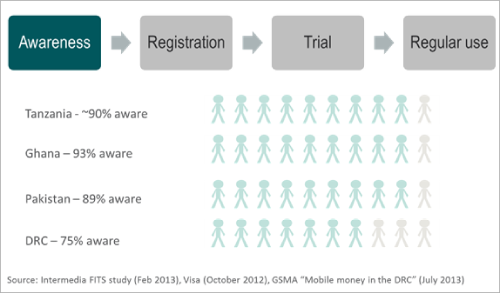

How long is the customer journey to regular mobile money usage in cash-based economies? New data indicates that this journey is longer and bumpier than might be expected. Here we review how the mobile money industry has fared in moving customers along that journey – from awareness, to registration and then to regular usage.

Generating awareness: Clear success

The customer journey begins with awareness of mobile money. Here is one area where the industry shines. Mobile money operators, particularly MNOs, have flexed their above-the-line (ATL) marketing muscle to create widespread awareness of their services. Just years after the first services were launched, a few of markets have reached 90%+ awareness of mobile money with more markets headed that way.

Even in Democratic Republic of Congo, where mobile money only launched just over one year ago, about 3/4 of household decision-makers reported awareness of the service.

Registering users: No problems here either

Mobile money operators have demonstrated a similar knack for registering large numbers of users. In select African markets, mobile money operators have managed to register 12-15% of the adult population every year.

Below-the-line (BTL) field activities have played an important role here. For example, EcoCash in Zimbabwe has relied on a field force of 300 “Brand Ambassadors” to register 75% of its 2.3 million subscribers just 18 months after launch.

Driving regular usage: More work to be done

Here is where operators have struggled. Despite swelling ranks of registered users, mobile money active rates remain frustratingly low in many markets. As of June 2012, only 9% of registered users in West Africa were active. Even in East Africa, this figure is just 20%.

Should we be discouraged by these low activity rates? Perhaps not. While this remains a challenge for many, a few operators have shown us that driving regular customer usage across a broad base is possible. For example, active users of Telesom’s Zaad service in Somaliland do 39.5 transactions per month – more than one per day. Safaricom M-PESA recently reported its 30-day active rate at 62%.

What is causing low activity rates? Data from one operator

Interviews with dormant or infrequent mobile money customers will usually surface a few core barriers to usage: Understanding and trust. Like other new technologies, customers simply need a long time and plenty of reassurance to fully gain comfort using the service and to explore different use cases.

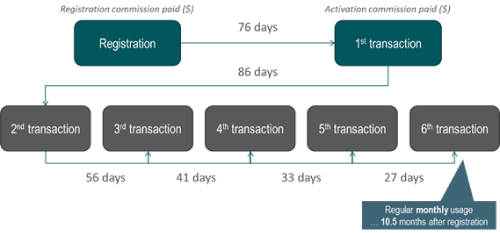

Let’s look at the step from registration to first usage. Data from one anonymous operator [1] shows that the average customer takes 76 days between registration and their first transaction. Furthermore, 49% of registered users will go dormant and never initiate a transaction in the first place (though some, 19%, will passively receive money).

Time to Trial for Average User (anonymous operator)

Furthermore, first time users don’t instantly become regular users. Data from this same operator revealed that the average user took almost 3 months between their first and second transaction and almost 2 months between their second and third transaction. In fact, 10.5 months elapses before the average subscriber of this service begins transacting at least monthly

Customer Journey for Average User (anonymous operator)

What can operators do to increase activity?

What is clear is that a mobile money operator’s work doesn’t end with awareness, registration or even the first time a customer tries the service. There is a certain degree of hand-holding that needs to take place during the early stage interactions with the service to convert a customer to regular usage. In an industry where most KPIs and incentives are built around registration or activation, this later part of the customer journey – what happens after registration and first trial – may be given insufficient attention.

New MMU resource to help operators accelerate customer adoption

On Thursday, MMU will publish a guide to customer business intelligence in mobile money. This guide will provide mobile money operators tools to better assess their customer base and ideas for spurring usage in particular customer segments along the journey to regular mobile money usage. Stay tuned!

[1] Data from live telco-led wallet-based service offering P2P transfers, bill payment, and other services. These are not industry-wide figures.