The Sustainable Development Goals (SDGs) funding gap challenge

Social impact ventures face a range of diverse and complex challenges to scale their impact in low- and middle-income countries (LMICs), including limited market access, a lack of infrastructure, regulatory barriers and a lack of resources.

The “funding winter”, which swept across the globe in 2023, further exacerbates these challenges and has had a significant impact on start-ups in Africa and Asia where there has been a sharp decline in funding raised, a slowdown in the growth of the start-up ecosystem, and a rise in the number of start-up closures, particularly among growth-stage start-ups.

The future for social impact ventures in the Global South is particularly bleak when considering that there is a staggering $4 trillion gap in sustainable development investments. The latest UN Conference on Trade and Development (UNCTAD) report states that foreign direct investment (FDI) has declined by 22% in 2022 due to global geopolitical and economic shocks.

The role of the GSMA Innovation Fund and public sector funding

In the context of this challenging financial climate, the GSMA Innovation Fund provides grant funding and tailored technical assistance in partnership with the UK Foreign, Commonwealth & Development Office (FCDO) and the Swedish International Development Corporation Agency (SIDA) This positions innovative start-ups and SMEs in LMICs to scale their operations and amplify their social and environmental impact. We source early-stage social impact ventures in LMICs that have the potential to reduce inequalities through innovative digital solutions for a 12 to 18-month programme. These ventures often lack the necessary capital and support as they are considered too risky for commercial investors.

We support these selected innovative organisations with:

- Equity-free grant funding (between £100,000 to £250,000),

- Mentoring and technical assistance to scale their social and environmental impact,

- Support to measure their impact and understand their unique barriers to reaching commercial sustainability and female inclusion

- Profiling at GSMA events and access to our networks, and

- Partnership facilitation with mobile operators.

Through this support, the GSMA Innovation Fund de-risks innovation to make social impact ventures more attractive to follow-on investment from the private sector and achieve sustainable impact.

The journey to scale

Through research published in the Scaling Digital Innovation in Emerging Economies report, there is no one single path to scale. Digital start-ups in LMICs must navigate their own set of distinct challenges that come with being impact driven pioneers in under resourced sectors whilst trying to find the right model for commercial sustainability.

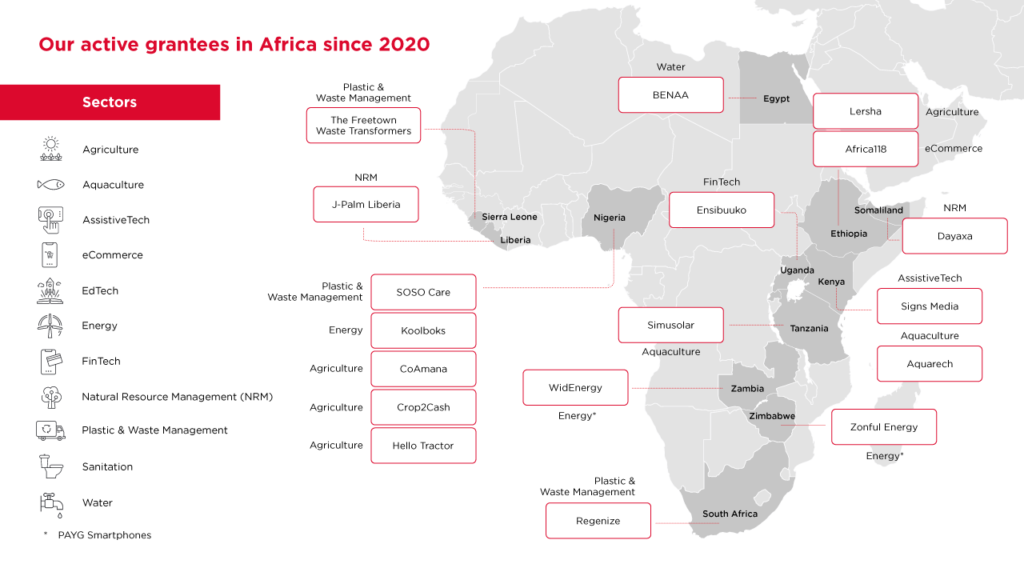

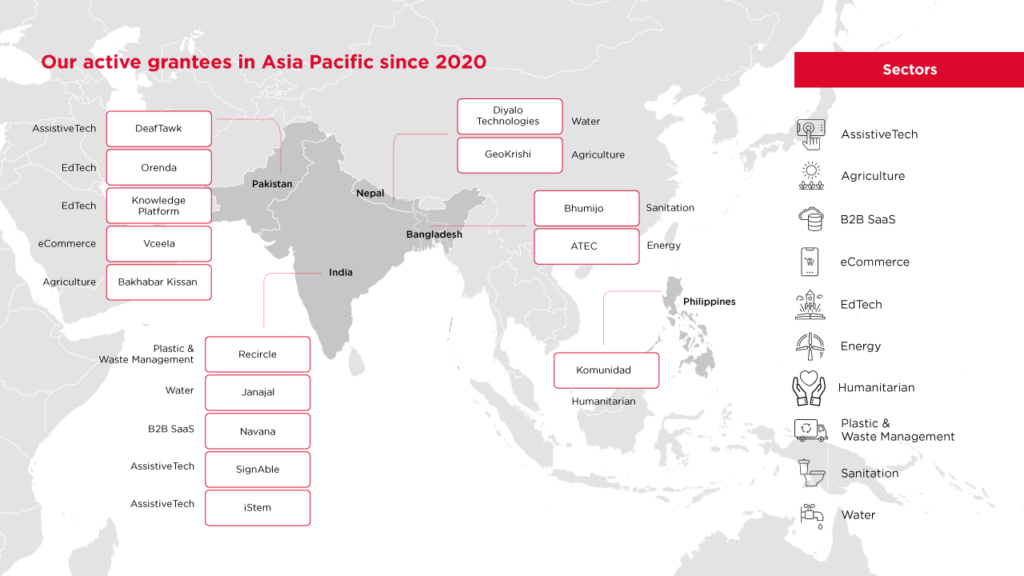

This complexity is particularly acute for the 30+ organisations we have funded in the last four years to address the challenge of mobile internet adoption, digital inclusion for persons with disabilities, access to digital urban services such as energy, water, sanitation, plastics and waste management, and climate action with a focus on building resilience and adaptation.

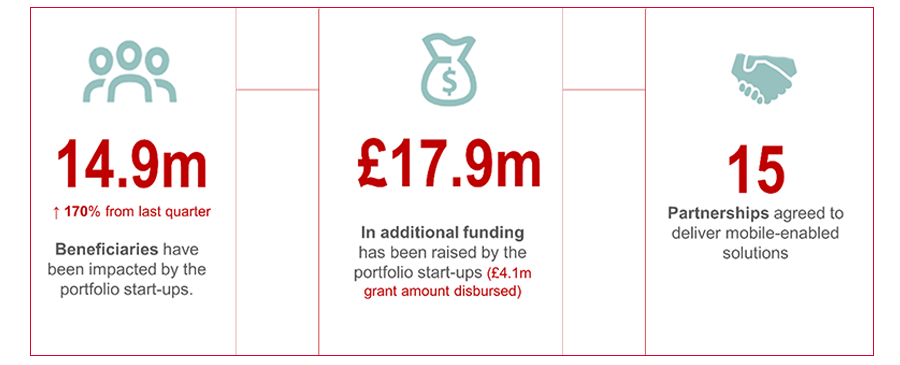

Despite these challenges, as of November 2023, the GSMA Innovation Fund portfolio has directly improved the livelihoods of 14.9 million people in Africa (12 countries) and Asia (5).

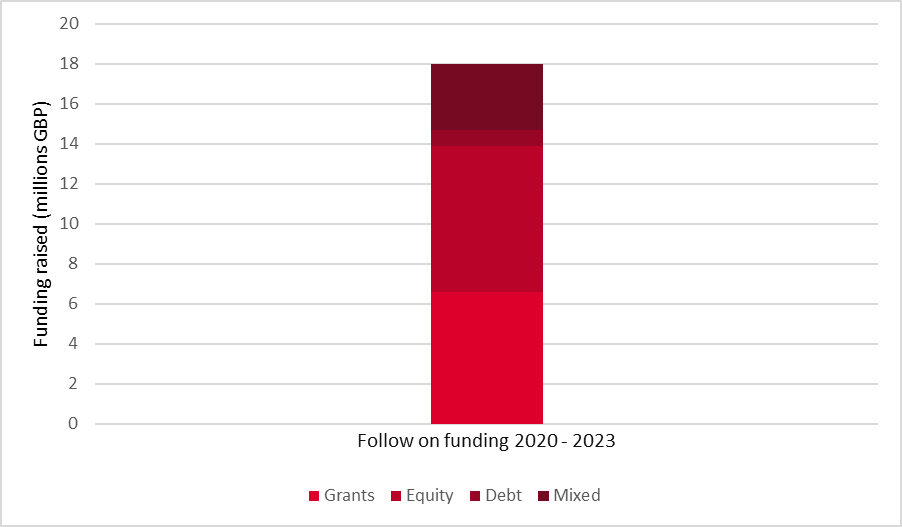

Collectively the portfolio has raised £17.9 million in follow-on funding, comprising:

In addition to funding, our research highlights the pivotal role strategic partnerships play to unlock scale and commercial sustainability. Such partnerships can be with Mobile Network Operators (MNOs) or directly with the public sector. Both have proven to be effective ways to access new markets and expand the customer base – for more insights read our Building Synergies report and Partnering with the Public Sectors: A toolkit for start-ups in the utilities sector.

The Portfolio (2020 – 2023)

For more information, reports and case studies visit our website.

The opportunity for impactful investment

Our recent portfolio provides evidence that philanthropic capital can have a catalytic effect to de-risk innovation. Further investment from the private sector and more strategic partnerships are needed to sustain this impact through increased market penetration and replication.

In February, we’ll be publishing the first edition of the GSMA Innovation Fund Impact Portfolio to showcase the impactful work of the start-ups and organisations we have supported since 2020. This publication is an open call to impact investors, venture capitalists and blended finance programmes focused on LMICs who are seeking to increase their deal flow with proven solutions.

Complete this short form to be the first to receive the first edition of the GSMA Innovation Fund Portfolio Impact 2023!

THIS INITIATIVE IS CURRENTLY FUNDED BY UK INTERNATIONAL DEVELOPMENT FROM THE UK GOVERNMENT AND THE SWEDISH INTERNATIONAL DEVELOPMENT COOPERATION AGENCY (SIDA), AND IS SUPPORTED BY THE GSMA AND ITS MEMBERS.