On 16 March 2022, the GSMA Digital Utilities programme, in partnership with National Incubation Center Pakistan, hosted a virtual workshop with over 100 participants. This provided a forum for these stakeholders to discuss key challenges and opportunities for public-private partnerships in three thematic areas: investments in climate-tech; water and sanitation; and clean cooking. Our pre-event blog provides a more complete overview of the themes addressed, organisations represented, and the speakers.

Imran Ghazali (Official Spokesperson, Digital Media, Government of Pakistan) opened the workshop. Ghazali highlighted some key initiatives being undertaken by the government which include:

- Transitioning towards clean transport by framing Pakistan’s first electric vehicle policy;

- Introducing a ‘Clean Green Cities Index‘, a city/tehsil and neighbourhood-level index which aims to rank cities/tehsils and neighbourhoods according to their cleanliness and greenery, to trigger improved waste management and sanitation;

- Implementing the ‘Recharge Pakistan‘ (funded by World Wild Fund for Nature Foundation) initiative focused on effectively managing and prudently utilising Pakistan’s water resources; and

- A shift towards 60 per cent clean-carbon-free energy by 2030.

How can climate technology become a new focus for investors in Pakistan?

The panellists highlighted two major challenges facing the sustainable tech sector in Pakistan:

- Grant funding dominating space – there are not enough follow-on investment opportunities for sustainable tech entrepreneurs. This means that many piloted solutions lack a pathway to scale. Grant funders should actively facilitate and cultivate these follow-on investment opportunities by engaging larger investors about opportunities in sustainable tech.

- Technology nascent, and limited success stories to galvanise investor appetite – for investments to gain traction in the Cleantech tech space, there needs to be evidence of successful exits and investments which progressed from initial angel investments to series A, B, and C rounds. Until or unless, there are concrete examples of investments taking place in the clean/green tech sector many investors would be hesitant to put bets on a sector that is still considered “complex” and “high-risk”. The success of start-ups in other sectors such as fintech and e-commerce however, has been important in helping global investors understand that there are many commercial opportunities in the country, which will hopefully also benefit private sector innovators in cleantech.

Additionally, for start-ups to raise investments in climate-tech it was important to take into consideration the following two factors:

- Sustainability and scalability – Sustainability in investor metrics meant ability to get continued funding (angel, series etc.) Scalability on the other hand was assessed on: i) user growth, ii) adaptability across contexts, and iii) extent of user acceptance.

- A supportive ecosystem – for start-ups to attract investments, especially in the climate-tech space, it was important for the government to strengthen incentives through a supportive policy environment that incentivises private sector investment in climate-tech and provides active support to local innovators working in the ecosystem.

The two main takeaways from the panel discussion were:

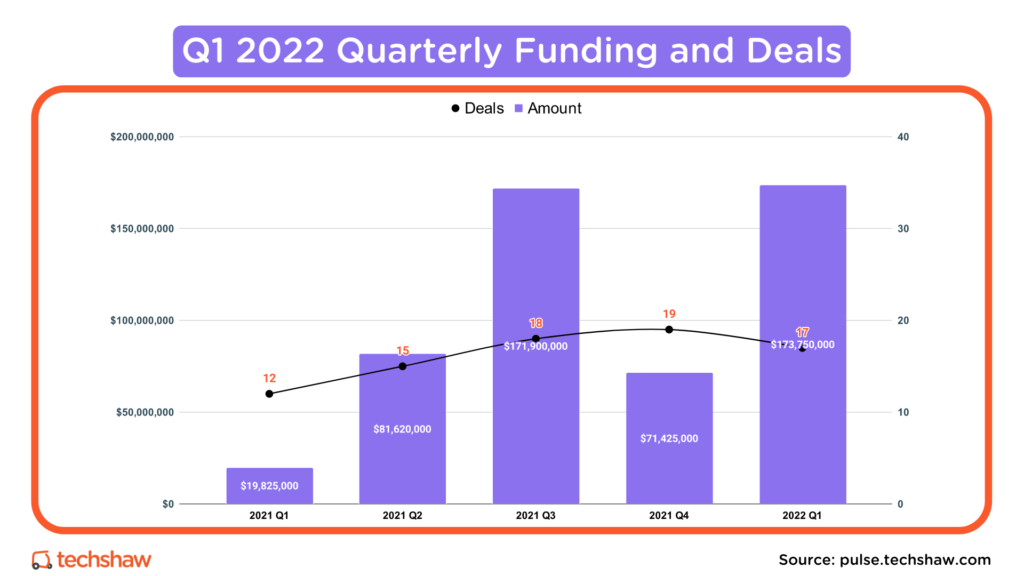

- While investments in Pakistani start-ups have increased over 50 per cent in just the first quarter of 2022, there still is a lack of comfort for investors to invest in climate-tech space given that the ecosystem is still at a nascent stage; and

- Investors in Pakistan look for quick returns however climate-tech startups have a longer return on investment.

Challenges in water and sanitation: Awareness, quality of water, sufficient funding and effective public-private partnership (PPP) frameworks

Cities in Pakistan are rapidly urbanising further accentuating existing urban service gaps with one in 10 residents are lacking access to safely managed drinking water. Collaboration between government, private sector innovators, enabling organisations, and community organisations can help close the service gap. During the workshop the panellists highlighted four key challenges facing the water and sanitation sector:

- Awareness – for sanitation, there is low public awareness due to lack of effective marketing campaigns by the government and public sector entities;

- Water quality – a major issue with water quality is microbial contamination from sewer lines mixing with drinking water lines;

- Insufficient Funding – panellists highlighted low budget allocations to utilities, this was attributed, in part, to low policy prioritization at the provincial and federal levels; and

- Effective PPP frameworks – water and sanitation PPP are nascent in Pakistan, and a new concept for many public entities. While efforts had been made in the past – e.g. the Saaf Pani initiative – a lack of trust, effective management, and misaligned incentives hampered implementation.

The overall discussion between all stakeholders ended on two main conclusions:

- Continuity in government programmes and initiatives is important to sustaining improvements, including continuity in funding; and

- An overall policy framework needs to be defined by Federal and Provincial governments to instil responsibility and accountability and support city-level service provision.

Clean cooking and its future in Pakistan

Half of Pakistan’s population use solid fuel and traditional cookstoves in combination with charcoal, dung cakes, firewood, and crop residue for cooking and heating. The panellists raised some of the key challenges for clean cooking in urban area:

- Limited government support of clean cooking programmes – in 2018 the incoming federal government listed clean cooking as one of the top priorities to address. However, after some internal shifts in policy clean cooking was deprioritized, in part as there was no lead ministry with responsibility for the area.

- Lack of awareness and resistance towards of new and sustainable clean cooking technologies – using anything other than firewood and gas is foreign to many people living in major urban areas of Pakistan. This is due to a lack of awareness amongst the population, affordability, limited support from public organizations, and lack of confidence in new and sustainable clean cooking technologies.

The overall discussion by both the panellists concluded that:

- Incentives are needed for the clean-cooking space, including: tax breaks, interest free loans, and funding opportunities. Additionally, the federal and provincial governments should restart the ‘Ehsaas Clean Cooking Programme’, which was originally a key initiative that was subsequently deprioritised.

- Non-government organisations need help to spread awareness on the negative impacts of solid fuels and traditional stoves, and clean cooking start-ups need technical assistance and incubation and access to finance.

Key takeaways

Amongst the sectors discussed, digital innovators are already involved in a range of interesting and impactful projects. To further unlock their potential to scale, and to ensure that digital innovations are helping to close the urban service gap, there is a need for public-private entities to work together to create an ecosystem where private sector innovators in urban utility service provision can excel.

- Private sector innovators need to pay attention to changes in government policy and ensure that their business models and service offerings support public sector organisations in meeting their objectives. Investors and entrepreneurs also highlighted that it is important to learn from success cases in other countries with vibrant innovative service delivery ecosystems such as Kenya, India, and Bangladesh, and adapt relevant models to Pakistan’s context.

- The government needs to provide long-term policy certainty and make affordable, reliable, safe, and sustainable urban utility service provision a priority, while encouraging public sector institutions to actively pursue partnerships to close the service gap.

- Funders and investors need to make long-term investments in the clean-tech ecosystem rather than look for quick exits. These long-term investments will give confidence to the ecosystem and improve its overall health attracting more investments.

We would like to thank all the attendees, the panellists and the organisers for their time and valuable insights. for any inquires contact Arham Shoukat, Senior Market Engagement Manager APAC, at [email protected].

In the meantime, make sure to keep an eye out on some exciting start-up initiatives in urban utility service delivery in Pakistan:

- Project Ujala by K-Electric – a multi-year journey to improve the network resilience and quality of service to customers by reducing losses through an integrated programme of community investment, network improvements and smart meter deployment;

- Water Smart Meter Induction In Lahore by WASA – deployment program of water meters in Punjab to monitor loss of non-revenue water; and

- Smart Village by USF- model village where proof of concepts of digital utilities will be implemented; and

- Pakistan Tech Startup Funding Program by Ignite Technology Fund – a government sponsored fund supporting investments in start-ups.

The Digital Utilities programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO), and supported by the GSMA and its members.