This blog was co-written by Claire Scharwatt and Anant Nautiyal.

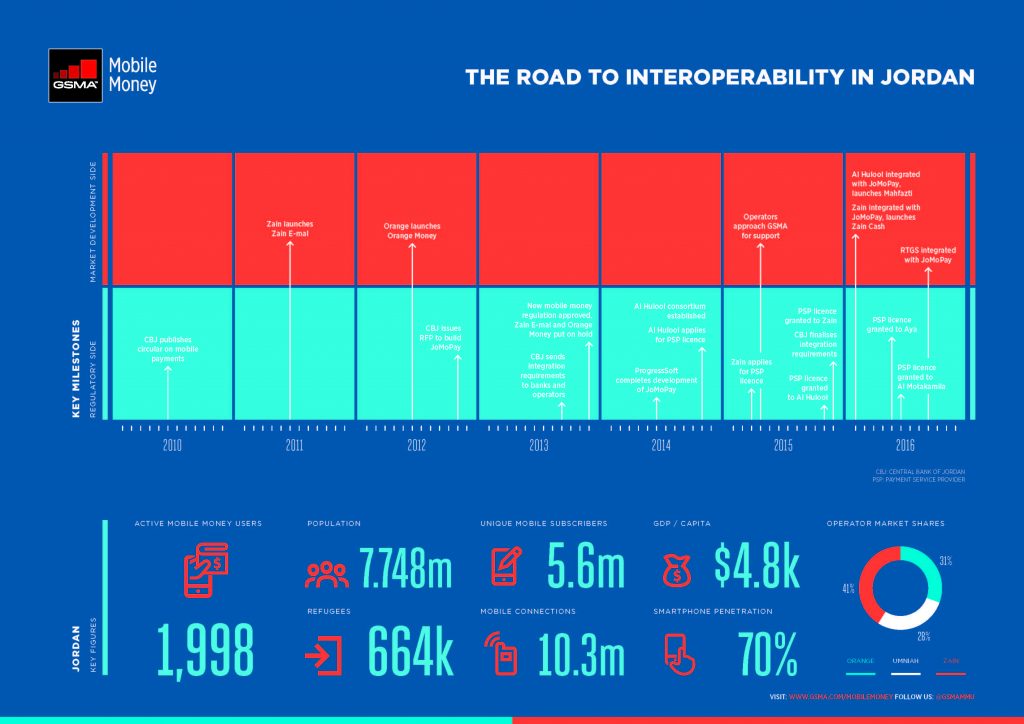

At the beginning of 2016, Jordan became the first country in the Middle East and North Africa to have implemented interoperability of mobile money services. Over the past few years, the Central Bank of Jordan has developed a clear regulatory framework for mobile money and initiated the process to develop a National Financial Inclusion Strategy. These critical steps are putting Jordan on the forefront of financial inclusion efforts both in the region and globally. However, the journey toward interoperability in Jordan has been full of pitfalls and challenges.

At the forefront of financial inclusion efforts in the region and globally, much can be learnt from the rich experience of Jordan and we commend the Central Bank for their willingness to share their approach. Here are some key success factors and challenges to the development of mobile money in Jordan:

- Dialogue between mobile money providers and regulators is key to ensure alignment in understanding the timing, benefits, costs, and risks of interoperability.

- Interoperability is only a means to an end and cannot by itself guarantee the success of mobile money if solid foundations are not in place, such as strong distribution networks or good customer experience.

- The choice of the technical solution to support mobile money interoperability has a direct impact on the cost structure and on the business model for mobile money providers.

- If mandated and introduced prematurely, interoperability could undermine early-stage investment incentives and increase operational complexity and risk, without advancing market growth.

- Ongoing monitoring of mobile money interoperability in markets where it is live, as well as further research will be necessary to ensure we continue to learn about how to swiftly connect third parties to the mobile money ecosystem in a safe and secure manner, and to develop new services to achieve the complementarity of mobile services in Jordan.

Click on image to enlarge

The way forward

A great deal has been achieved in Jordan, with the release of a more enabling regulatory framework for mobile money in 2013, the development of JoMoPay, and the launch of two mobile money services in 2016. While it has been a long process, a number of key building blocks for mobile money success are now in place.

In order to encourage greater customer adoption and to guarantee the sustainability of the model, the following issues will need to be addressed over the next few months:

- Completing the integration of JoMoPay with the rest of the financial ecosystem.

- Addressing strategic questions related to JoMoPay.

- Resolving channel issues to make mobile money available on USSD.

- Launching new products.

- Rolling out agent networks.

As the industry begins to grow in Jordan, the GSMA remains committed and will continue to support operators and the Central Bank to help create the first mobile money success story in the region.

For more details on the story of interoperability in Jordan, read our recently launched case study.