Mobile money continues to grow exponentially across developing markets. As of December 2019, the industry has over one billion registered mobile money accounts and processes over $1.9 billion dollars a day. What is interesting compared to a few years ago, is the growth of digital transactions compared to cash-in and cash-out; at 57% of the total value of transactions, digital transactions now represent the majority of mobile money transactions.

Within this context, the seamless integration of third parties with mobile money platforms is a key catalyst to achieving wider access to critical products by the underserved. Third parties’ ability to integrate with mobile money platforms is also a first and necessary step to achieving the ‘payments as a platform’ (PaaP) model – one of the core facets of the GSMA’s vision for the future of mobile money. By providing easily accessible APIs, providers can create almost endless opportunities to build additional services on top of mobile money as well as opportunities to monetise those services.

With the aim to understand the main industry trends in terms of third-party integration, including API design, commercial approach, documentation/communication, testing, security and on-boarding process, the GSMA Inclusive Tech Lab is happy to publish a toolkit to uncover how mobile money providers are moving towards seamless integrations. This is on based on 37 survey responses from mobile money providers globally covering over 260 million accounts.

Ecosystem development remains a top priority for mobile money providers at a global level. The sustained growth that the industry has experienced is driven by providers hosting a large number of payments APIs, with e-commerce, bill payments and disbursements being the top use cases. Opportunities remain to increase payment (i.e. refunds) and non-payments use cases (i.e. reporting).

To facilitate the growing number of third-party integrations in the ecosystem, mobile money providers typically do not charge onboarding fees, and instead, generate revenue through transaction fees. Offering tiered pricing could further boost growth.

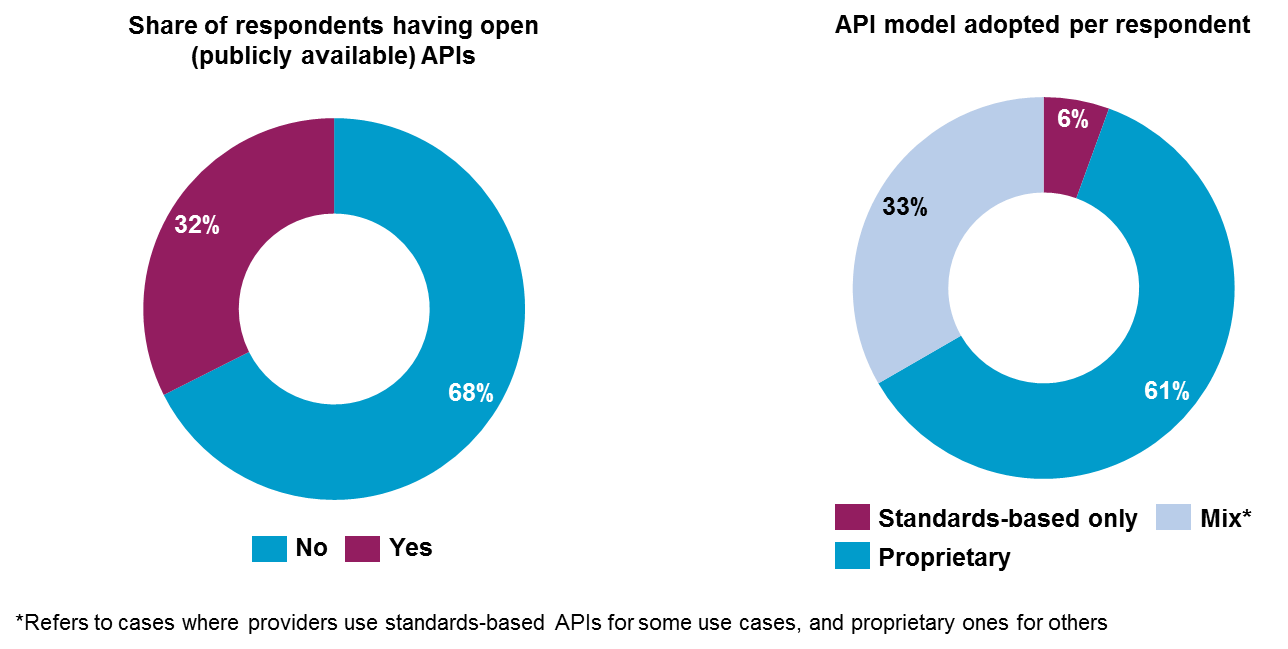

Despite the growing ecosystem, only 32 per cent of operators surveyed are exposing their APIs publicly and most providers adopted a proprietary API, which highlights market fragmentation and results in lengthy third-party onboarding time (Figure 1).

Figure 1: Providers with open APIs are able to grow their ecosystem and ARPU, while the majority of APIs are proprietary, signalling high fragmentation

To accelerate their ecosystem growth and third-party integration, mobile money providers should consider offering integration tools such as SDKs, Open Source repositories and widgets and providing paybill accounts with no development support. In addition, providers should also review their integration process to ensure best practice around the following areas:

- Adopt existing API frameworks to optimise the developer onboarding and facilitate faster updates. Currently, 40 per cent of respondents do not use an API framework;

- Provide clear documentation and leverage a developer portal when exposing APIs to third-parties;

- Expose API through a single gateway to improve security, analytic capabilities and reduce customer maintenance; and

- Ensure key features, including swagger UI, test functions for error codes and Postman collections, are implemented in the test environment.

The GSMA Mobile Money API specification can help address some of these challenges by limiting fragmentation in the mobile money ecosystem and making it more harmonised.

This is the first insight pieces covering APIs. GSMA’s Mobile Money team will continue providing insights and best practices on the topic and disseminate findings to the broader industry.

Receive the latest insights on mobile money straight to your inbox by subscribing below.