On 16 August, Safaricom launched its mobile money service M-PESA in Ethiopia, Africa’s second largest country by population at just over 120 million. The much-anticipated launch is a key milestone for the digital financial services sector and for financial inclusion in the country. Having undergone three-month period of pilot and testing, the Kenyan giant joins incumbent, state-owned Telebirr, a unit of Ethio Telecom, as the main telco-led mobile money provider.

A truly competitive mobile money market promises to address the needs of the vast unbanked and underbanked population in a country where almost a quarter of the population lives below the international poverty line.

Three weeks ahead of the launch, the Central Insights Unit of GSMA Mobile for Development together with Financial Sector Deeping Ethiopia (FSDE) and the Foreign Commonwealth and Development Office of the UK Government (FCDO) co-hosted a roundtable in Addis Ababa to discuss the findings of our brand-new report Mobile Money in Ethiopia: Advancing financial inclusion and driving growth.

We gathered mobile money providers, start-ups, multilateral organisations, the National Bank of Ethiopia (NBE), and other government agencies to discuss achievements to date, and identify opportunities to scale up mobile money adoption in the coming months. In a panel discussion with the NBE, Telebirr, and Safaricom, three key areas emerged as priorities in the coming months: Building and scaling quality agent networks; diversifying use cases; and enhancing financial literacy.

Building and scaling quality agent networks is the priority

Ethiopia has made great progress in expanding access points. The market is rapidly evolving, and recent figures show that incumbent Telebirr has over 111,000 agents with a 20% active rate on a weekly basis. According to the latest available official data from the NBE, mobile money agents grew by 200% in the year to September 2022 to over 200,000. While this is remarkable, around the same time the leading mobile money market of Kenya had reached 300,000 active agents for a population less than half the size of Ethiopia.

The GSMA’s research has found that distance to a banking point is the main reason preventing people from opening mobile money accounts, highlighting the importance of ensuring far-reaching agent networks. This is not easy to achieve in a vast country such as Ethiopia, calling for effective prioritisation based on an assessment of market needs and for partnerships with organisations that can rapidly deploy agents on the ground and support operations (e.g., super agents).

To stimulate the deployment of agent networks, the NBE, represented at the roundtable by its Director, Payment and Settlement Systems, Solomon Damtew, is focusing on ensuring that mobile money providers and partners are clear on agency banking regulations. To make things easier for implementers, the NBE is also considering splitting agency regulation in two, with one set of directives for bank agents and one for mobile money agents.

During our panel discussion led by Abel Taddele, DFS Lead at FSDE, both Bruk Adhana, Head of Telebirr at Ethio Telecom, and Douglas McAteer, Consumer Product Lead at M-PESA, emphasised the importance of effective liquidity management. This is crucial across the country, including the region of Addis Ababa, which has seen the greatest traction to date, and where bank-to-wallet is the major funding mechanism of mobile money accounts.

During interviews with mobile money agents as part of the GSMA’s research conducted in Ethiopia in early 2023, lack of liquidity was mentioned as the main challenge to running a mobile money business profitably. The inability to predict customer demand, lack of proximity to banks and insufficient working capital were all named as barriers to effective liquidity management.

Diversifying use cases to drive usage 1: P2G and G2P payments

The adoption of mobile money follows unique trajectories depending on market needs, and this is even more evident in Ethiopia where the government owns the incumbent Telebirr. For this reason, person-to-government (P2G) and government-to-person (G2P) payments have been key use cases from the beginning. This is also in light of the fact that while P2P payments are a popular use case, in urban areas they face competition from traditional banks that use their mobile banking channels for P2P transfers within the same bank and between banks.

Recent initiatives from the government to digitise a range of P2G payments, from traffic violations to passport application payments, and to mandate that certain person-to-business (P2B) payments (e.g., for fuel at gas stations) are made in mobile money, have boosted uptake. In our recently published report on the opportunity for mobile money in Ethiopia, we also highlight the opportunity to leverage mobile money for tax collection. Tax collection in Ethiopia stands at 6.2% of GDP and is less than half the Sub-Saharan Africa average (14.4% of GDP).

The government’s focus on stimulating mobile money adoption by mandating its use for certain types of government payments is understandable but has faced and may face in future challenges related to user acceptance, if the needs, incentives and experiences of users are not at the centre of the attention. Government-to-person payments, on the other hand, show great potential to onboard unbaked and underbanked populations, and fulfil the social impact promise of mobile money.

One important initiative that Bruk Adhana of Telebirr highlighted during our event in Addis Ababa is the new iteration of the Productive Safety Net Programme (PSNP), which offers support to between eight and nine million households suffering from food insecurity via payments that are made monthly for six months a year (and in some cases throughout the year). While mobile banking services such as the now discontinued M-Birr, as well as HelloCash, were utilised for part of these disbursements between 2016 – 2020, there is an arrangement with the Commercial Bank of Ethiopia to deliver PSNP payments through bank accounts. At the 25 July event in Addis Ababa, however, we learnt that Telebirr has been piloting PSNP payments through mobile wallets in two regions since February 2023.

Diversifying use cases to drive usage 2: The growth of adjacent services

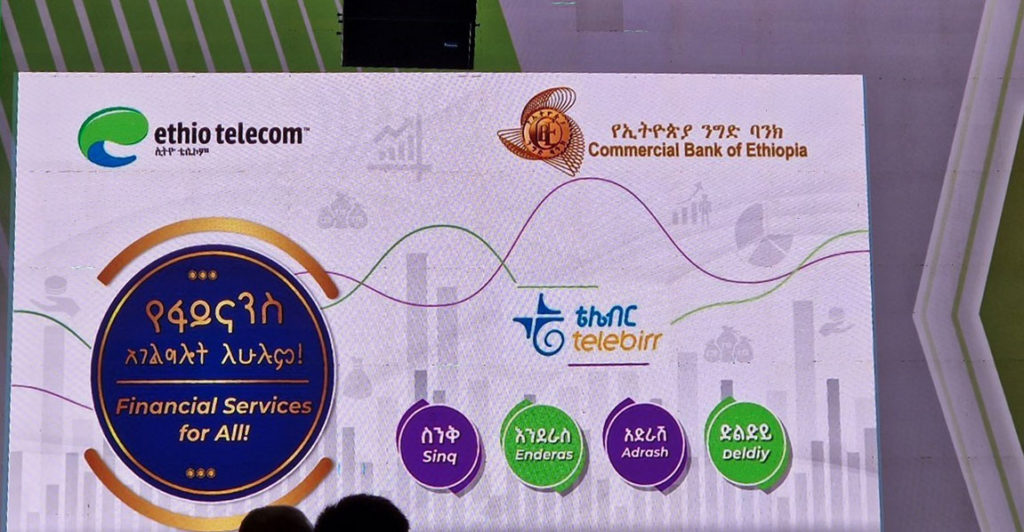

For external observers, an exciting aspect of the emerging mobile money ecosystem in Ethiopia is the rapid evolution of micro-finance services. As highlighted by participants at the roundtable, it took years in leading mobile money markets in Africa for micro-credit and micro-savings services to gain traction, while Ethiopia is already seeing a variety of offers in the market, initially available through partnerships between Telebirr and banks such as Dashen Bank and the country’s largest bank, the government-owned Central Bank of Ethiopia (CBE).

To an extent, this shows how mobile money is initially seeing stronger uptake among urban, banked populations, and often younger and more tech-savvy users, who are appreciating the convenience of opening digital wallets and accessing micro-loans for short-term needs. Telebirr states that it has disbursed over one million micro-loans, a remarkable figure for a mobile money provider that launched services in 2021. As of today, the company offers a range of micro-finance products, like Telebirr’s Mela (micro-credit), Sanduk (savings), and EndeKise (overdraft service).

These kinds of services could also be an entry point for Safaricom, which has secured key partnerships with banks. However, in light of the considerable first-mover advantage gained by Telebirr, the new entrant might find greater opportunities in driving uptake in rural and peri-urban areas and in prioritising emerging use cases, such as agricultural payments and financial services (67% of Ethiopians depend on agriculture for their livelihood). This is already an area of interest for Telebirr, which has farmer-focused products in the pipeline, as confirmed at the roundtable by Bruk Adhana of Telebirr.

Financial inclusion won’t happen without financial literacy

Increasingly, not only the issues of basic and digital literacy, but also that of financial literacy, are becoming more central to the debate around financial inclusion. This was the case at our roundtable in Addis Ababa. In Ethiopia, the issue of financial literacy becomes crucial especially in relation to addressing the needs of more marginalised segments of society such as rural farmers and women. The GSMA’s surveys conducted in the country show that only 35% of female respondents reported being aware of mobile money compared to 49% of male respondents.

At the roundtable, Solomon Damtew of the NBE highlighted the need for further campaigns for general awareness of mobile money, at a time when more and more offers come to market. Awareness campaigns will be crucial in the coming months, particularly as mobile money providers increase their focus on less affluent and potentially more marginalised consumer segments, and as the government, in partnership with Telebirr, fosters its P2G and G2P initiatives. In the meantime, while the NBE has devised a financial literacy strategy, it is also currently working on putting in place a much-needed consumer protection framework.

THE CENTRAL INSIGHTS UNIT IS CURRENTLY FUNDED BY THE UK FOREIGN, COMMONWEALTH & DEVELOPMENT OFFICE (FCDO), AND SUPPORTED BY THE GSMA AND ITS MEMBERS.

The GSMA and FSD Ethiopia are keen to hear your views about the opportunity for mobile money in Ethiopia, as we continue to monitor developments in the market. To share your experience and updates, please contact us at [email protected].