MSMEs play a critical role in creating livelihoods and generating economic value in Africa. E-commerce is increasingly enabling more MSMEs to compete, facilitating access to wider markets and making business operations more efficient. On 17 October, we launched our new report E-Commerce in Africa: Unleashing the opportunity for MSMEs at MWC Kigali.

According to the United Nations Conference on Trade and Development (UNCTAD), digital commerce has the potential to add $180 billion to Africa’s GDP by 2025. However, whilst e-commerce adoption by MSMEs is growing, it remains low (Figure 1).

Figure 1: E-commerce as a share of total retail sales in selected African markets, 2020-2021

Our new study highlights the main barriers to scaling e-commerce adoption for MSMEs in the region. We base our analysis on surveys conducted with over 1,500 MSMEs using e-commerce across six African markets: Egypt, Ethiopia, Ghana, Kenya, Nigeria and South Africa, as well as an extensive literature review and interviews with experts in these and three additional markets: Rwanda, Senegal and Tanzania.

Over 90% of surveyed MSMEs reported an increase in sales, and a similar number a decrease in costs due to e-commerce. A majority of MSMEs are using exclusively social media services to sell online, often informally, rather than selling through e-commerce marketplaces or websites (Figure 2).

Direct-to-consumer, Amazon-like marketplaces, as well as B2B platforms connecting businesses, have been expanding for a few years, though they are facing challenges related to trust and reaching customers in the last mile, especially outside of urban areas. Social commerce continues to be prevalent, as MSMEs can leverage the sense of trust stemming from being either personally known within the social media network or being a trusted member of the online community, to extend their customer base. However, convenience, efficiency, as well as the opportunity for scale, are limited. A major hurdle of social commerce is the lack of integrated payment and delivery, implying that sellers have to agree terms individually with buyers for each individual sale.

Figure 2: Use of e-commerce channels, by market

Source: GSMA e-commerce survey 2023

Our research indicated three key pain points to scaling MSMEs’ use of e-commerce:

- Regulatory gaps and weak implementation of e-commerce legislation

- Low uptake of digital payments for e-commerce

- Challenges with logistics and delivery processes and services

Regulatory gaps and weak implementation of e-commerce legislation is undermining trust

E-commerce is increasingly being adopted within the region, however, the lack of regulatory certainty makes it challenging for MSMEs to leverage it effectively. In Ghana, only 29% of the surveyed MSMEs said that they understood e-commerce laws and regulations. Between 54% and 76% of MSMEs in the remaining markets expressed understanding.

To support e-commerce adoption, fundamental enablers of a digital economy such as cybersecurity laws, intellectual property laws and personal privacy data protection laws, as well as e-commerce specific regulations, including e-transactions laws and consumer protection laws are vitally needed (Figure 3).

Figure 3: Enabling policies and regulations for e-commerce

Currently, fragmented laws and weak implementation in many markets is contributing to low consumer trust and limiting consumer uptake of e-commerce. For instance, Ghana is currently lacking an e-commerce policy framework and e-commerce business laws are outdated. Only 29% of MSMEs surveyed in Ghana said they understood e-commerce regulations, reflecting the uncertainty created by the absence of updated legislation. Clear and updated e-commerce laws build MSMEs’ confidence in trading online and support consumer uptake as well, but either gaps in the legislation or, more notably, weak implementation of the laws, is undermining confidence in online trade.

Uptake of digital payments for e-commerce remains low

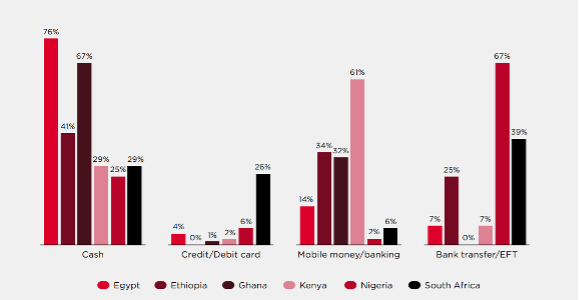

Digital payments for e-commerce are quick, efficient and safe in comparison to cash on delivery, which is resource-heavy to manage and prone to theft. Nonetheless, cash on delivery is a prevalent method of payment in many markets (Figure 4), though the uptake of digital payments is growing steadily. Ethiopia, a market with comparatively lower levels of financial inclusion and where mobile money has been adopted only recently, stands out with 41% of MSMEs indicating a preference for cash on delivery. The preference of cash on delivery for e-commerce is also higher in markets where our sample contained a large number of informal enterprises, such as Egypt and Ghana.

Figure 4: MSMEs’ preference for payment method, by market

Base: All MSMEs surveyed

Source: GSMA e-commerce survey 2023

Experts and practitioners consulted for our research project indicated as additional factors impacting the uptake of digital payments, the variation in product quality, concern over the legitimacy of online businesses, and low trust in delivery services. Each of these factors increases the likelihood that a product will be returned. With cash on delivery, products can be returned at point of delivery, before a monetary transaction has occurred. However, with digital payments customers are required to trust that a recourse process will be initiated and that their money will be promptly returned.

According to McKinsey and Company, only five to seven per cent of total payment transactions in Africa in 2020 were digital. Innovations are critical to encourage MSMEs and customers to adopt digital payments. The emergence of QR codes is an example of such innovations, as they allow quick and secure processing of transactions, can support discounts and loyalty programmes, and can simplify the process of returns and exchanges. In addition, virtual cards are enabling mobile money users to make digital payments globally using funds from their mobile wallet. Safaricom M-PESA and Visa launched the M-PESA Global Pay Visa card in 2022.

Delivery and logistics remain challenging for MSMEs

Between 21% and 26% of all MSMEs surveyed reported facing delivery challenges, including goods being damaged on delivery, lack of delivery capacity when needed and slow delivery to customers (Figure 5). Poor road infrastructure, lack of comprehensive national addressing systems and fragmented delivery solutions make the delivery of goods both expensive and unreliable. This increases costs for MSMEs and reduces the revenue MSMEs can generate from online sales.

Figure 5: Delivery challenges experienced by MSMEs

Base: All MSMEs surveyed

Source: GSMA e-commerce survey 2023

Emerging solutions to these challenges include virtual postal addressing systems (VPAS) such as What3Words, which provide users with an address via applications or webpages and using technology such as GPS. They are fast to implement and do not require the asset-heavy infrastructure of physical addressing, though they do come with their own challenges associated with community engagement and technology accessibility. We are beginning to see VPAS being implemented at the national level in countries such as in Nigeria and Ghana.

Informal delivery service aggregation platforms such as Paps Logistique are integrating informal delivery providers into a single platform to make delivery services more accessible. This kind of solution is still niche, however it shows potential to support businesses in delivering to a wider range of areas whilst maintaining low costs and ensuring quality of delivery and increasing consumer trust.

Consumer trust is crucial for e-commerce to thrive in Africa. To enable MSMEs to fully leverage the e-commerce opportunity for growth, a high level of consumer readiness is needed, and trust is a huge part of this. In our report we highlight three key areas to foster consumer trust: Enabling policy and regulations, the uptake of trustworthy digital alternatives to cash-on-delivery, as well as the facilitation of reliable and speedy delivery of goods.

To understand the e-commerce landscape in Africa and the experience of MSMEs using e-commerce in the region more comprehensively, we invite you to read our report.

We would like to thank our partners, the UK Foreign, Commonwealth and Development Office, the UK Department for Business and Trade and D3 (our survey partner) for their valuable contributions to this output.