The GSMA Innovation Fund positions start-ups and SMEs in low- and middle-income countries to scale operations and amplify their social and environmental impact. But what is scale? Through a series of interviews conducted with our alumni, we collected in-depth insights on their journeys to scale. In the first of this three-part blog series, we’ll review how alumni understand scale and the models they are using to achieve it.

What does “reaching scale” actually mean? While our latest scaling report explains that scale can be measured by revenue, employment, users, and investment over time, there is no benchmark to indicate when it has been reached, as illustrated in Figure 1 below.

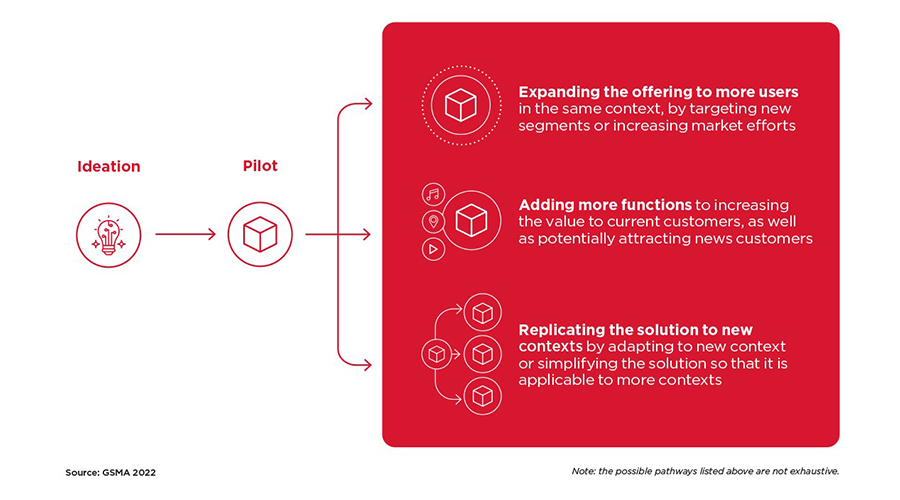

We asked our alumni what scale means for them, and the answers were predictably varied. For some, reaching scale is simply moving past the pilot stage and focusing on market penetration. Many alumni have specific user targets set for the next several years and reaching these will signal they are operating at scale. For others, scale is about replication. Once the product has reached a target number of users in its primary market, the company will replicate in other markets and will consider this as reaching scale. Both of these understandings of scale rely on the number of users as the key indicator of measurement.

However, some of our cohort measures scale with revenue. They associate reaching scale with commercial sustainability or profitability. When the company can operate without relying on outside funds, they will be operating at scale. Company revenue is one way to fund scaling, but start-ups often require several funding models to achieve scale.

Figure 2 summarises the top four funding models for achieving scale:

Just under half of our alumni include organic growth, or relying on company revenue, in their current model for scale. This is a more feasible model for products that don’t require significant hardware or physical infrastructure. For example, mobile apps and web platforms can generate subscription revenue without high upfront costs to the company. However, solutions that require physical assets, like new buildings, vehicles, or appliances, require capital to be invested before new users can be onboarded. Organic growth is also a challenging funding model if a start-up’s target market lives below the poverty line. Many of the GSMA’s alumni are generating impact for the world’s most vulnerable people and struggle to build revenue while offering services or products that remain affordable.

As a solution, some innovators develop specific B2B products or white label technology to diversify their revenue. This enables them to fund growth without having to increase prices for B2C sales. Also known as licensing, white labelling technology to diversify revenue is often cited as a future model for scale once alumni have fully refined their product. Nearly 3 in 4 alumni report that licensing is either a current or future scaling model for them because it can significantly increase profits without a heavy lift from their team. While the licensed technology may not always serve their target market, start-ups consider this a secondary product that is used to fund their core work.

Getting acquired largely refers to equity investment. We have found that while our alumni are not very focused on selling their entire company, those for whom organic growth is not a feasible option are focused on equity investment. However, most start-ups with purely software-based solutions did not include getting acquired in their current model for scale.

All start-ups reported that multi-stakeholder partnerships are part of either their current (81%) or future (19%) model for scale. Partnerships are the most important way for many of these organizations to generate enough resources to scale, given their status as social enterprises. Partners, including mobile network operators, grant funders, international organizations, and multi-national corporations have already shown to be critical for replicating into new markets, funding product development, and unlocking access to new users. Partners bring their expertise and resources to help start-ups scale because of complimentary interests in generating impact and revenue. One such partnership that the GSMA helped to broker was between MTN Nigeria and Crop2Cash, whose app was integrated on MTN’s Ayoba SuperApp in February 2023. This integration brought greater visibility, allowing Crop2Cash to onboard farmers outside of their current network.

The GSMA Innovation Fund offers technical assistance to support its alumni to build partnerships as part of their efforts to position innovators to scale. We have developed a short self-study course in English and French that offers a roadmap for start-up and mobile operator partnerships.

In our next blog, we’ll be reviewing the most common internal barriers that our start-ups face on their journey to scale and how they overcome them.

This initiative is currently funded by UK International Development from the UK Government and the Swedish International Development Cooperation Agency (Sida), and is supported by the GSMA and its members.