Digital technologies are a gamechanger, able to reach the “last mile” and empowering women with unprecedented access to information, services, and opportunities. In 2023, digital technologies were the focus of the Commission of the Status of Women and International Women’s Day, as well as the theme of the Asian Development Bank’s (ADB) 56th Annual Meeting, where the GSMA and the ADB, as well as other key ecosystem representatives, discussed the still untapped potential of digital technologies to accelerate digital and financial inclusion of women in Asia and the Pacific.

Digital innovations have spurred important advances globally, including in Asia and the Pacific. However, a significant digital gender divide persists. Gender gaps negatively affect women’s empowerment opportunities and the region’s growth trajectories and strategies to build more dynamic and resilient economies in the wake of the COVID-19 pandemic.

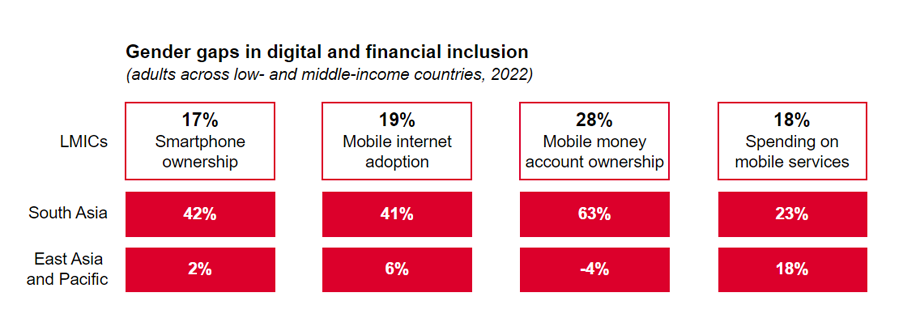

Women in Asia and the Pacific are behind at every stage of digital and financial inclusion

Mobile internet is the primary – and often only – way people access the internet in low- and middle-income countries (LMICs), making it a key indicator of the digital gender divide. For the second year in a row, the rate of mobile internet adoption by women across LMICs has slowed, according to the latest data from the GSMA. Last year it also slowed for men, which means the gender gap hardly changed: women in LMICs are 19% less likely to use mobile internet than men. This gender gap varies significantly by country and region. Across LMICs in South and East Asia and the Pacific, an estimated 440 million more women need to adopt mobile internet by 2030 to close the gender gap in the region.

Despite recent gains in mobile-led financial inclusion, women are left behind at every stage of digital and financial inclusion (see Figure 1). Even when connected, women tend to use mobile internet for a narrower range of activities and spend less on mobile services. Barriers that result in the gender gaps in smartphone ownership and mobile internet use include the inability to afford handsets and data, a lack of literacy and digital skills as well as safety and security concerns. For example, women often have cheaper, more basic handsets or have to borrow a device. One of the most important barriers to owning a mobile money account is a lack of perceived relevance, for example due to a preference for cash or other ways to transfer money.

The digital gender gap is underpinned by social norms and structural inequalities, including differences in income and education. We need to better measure, understand and address the barriers that perpetuate the digital gender divide. During the panel ‘Digital Technologies and Financial Inclusion: Enablers for Gender Equality’, hosted by ADB, these areas of action were discussed:

1. Being intentional about reaching women with relevant products and services

There are several ways the private sector can reach more women, such as focusing on female customers, spearheaded by senior management; adapting existing products and services to reach female customers rather than developing female-specific ones; and including women in sales and distribution activities to onboard women clients.

Sex-disaggregated data, which can help inform the development of products, services and approaches to reaching women, is often lacking. In research of one mobile operator’s subscriber base in Bangladesh, 78% of female subscribers were registered as male. One example to improve the accuracy and availability of subscriber data is the GSMA’s Gender Analysis and Identification Toolkit (GAIT), which uses machine learning to estimate the gender of unknown customers based on the usage patterns of a sub-sample of customers with a known gender[1].

Another example of collecting sex-disaggregated data is the WeFinance Code, which aims to improve the financial inclusion of women. It just launched its pilot phase and will work across the finance ecosystem to encourage regulators, financial institutions and all stakeholders to commit to collecting and reporting on sex-disaggregated financial data, and to integrating the data into better policies and programmes for women clients.

2. Ensuring government policies are gender-responsive

Governments can incentivise gender-responsive changes across the digital and financial ecosystem by prioritising women’s digital and financial inclusion in national financial strategies and digital development plans. This was the case in Indonesia’s National Financial Inclusion Strategy for Women in 2020. Supported by ADB and JP Morgan, the Strategy includes a time-bound action plan with sex-disaggregated targets to ensure that dedicated approaches are pursued to support women’s financial inclusion and entrepreneurship, including enhancing women’s digital financial inclusion.

It is also important for governments to have organisational structures in place to oversee the implementation and evaluation of gender-responsive policies, and that budgets are allocated in line with gender equity targets.

3. Establishing partnerships that bring different stakeholders together

Addressing the digital gender divide requires multi-stakeholder action due to the complexity of the challenge. An example is the GSMA Connected Women programme, which works with the mobile industry, policymakers and other partners on accelerating digital and financial inclusion for women across LMICs. The programme is funded by the UK’s Foreign, Commonwealth & Development Office and Sweden’s Sida and supported by the GSMA and its members. Through the Connected Women Commitment Initiative, over 40 mobile operators across LMICs have made formal commitments to reduce the gender gap in the customer base of their mobile internet or mobile money services, collectively reaching over 65 million additional women with these services since 2016.

Development financial institutions (DFIs) such as the ADB are also key partners in this journey. Working across both public and private sectors, DFIs can prioritise women’s financial and digital inclusion through target-setting and earmarking of resources to address gender gaps in its investments, supporting sex-disaggregated data collection, and strengthening knowledge. For example, ADB with the support of JP Morgan has worked with the Central Bank of the Philippines to conduct a financial inclusion survey with a gender lens to understand how women entrepreneurs use financial, including digital, services. In Vietnam, through a We-Fi grant, ADB has included new questions on women’s financial inclusion in the Economic Census (2021) to help inform government policies.

No progress without action

The latest data paints a dire picture about women being excluded from an increasingly connected and digital society. There are encouraging examples of initiatives to bridge the digital gender divide. We should build on these experiences and accelerate efforts to ensure every woman has an equal opportunity to benefit from digital and financial services in Asia and the Pacific.

[1] GSMA’s Inclusive Tech Lab also researches, builds and pilots other technological solutions to increase digital and financial inclusion and makes these available to the wider industry.

The Connected Women programme is funded by the UK Foreign, Commonwealth & Development Office (FCDO) and the Swedish International Development Cooperation Agency (SIDA), and is supported by the GSMA and its members.