GSMA Mobile for Development, in partnership with the UK Department of Business and Trade, is undertaking research with micro-, small- and medium-sized enterprises (MSMEs) in Egypt, Ethiopia, Ghana, Kenya, Nigeria and South Africa, to understand pathways, opportunities and challenges for the adoption of e-commerce.

Research findings will be published at MWC Kigali, in Rwanda in October 2023.

The e-commerce value proposition

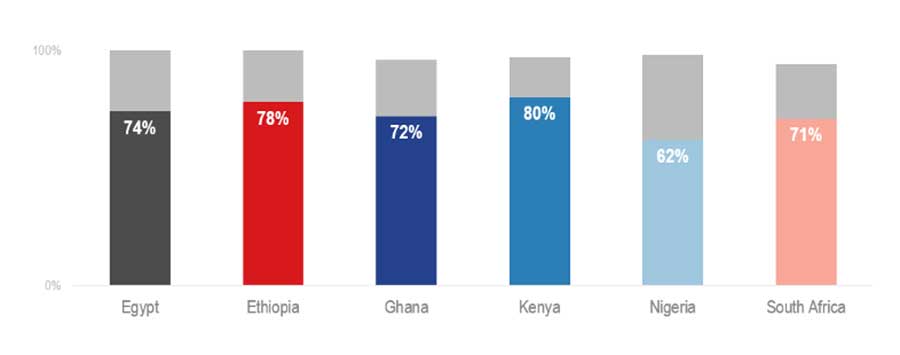

E-commerce has the potential to build the profitability and sustainability of the regions’ MSMEs by simplifying business processes through digital tools and enabling wider access to markets. In a survey we recently conducted with 1,500 MSMEs across the six markets, most agreed that e-commerce has increased their sales (Figure 1) and reduced their operational costs (Figure 2). MSMEs contribute between a quarter to almost 80% of GDP in these countries, and employ approximately 80% of the workforce in Sub-Saharan Africa.

Transitioning to e-commerce is a stepping stone for MSMEs in scaling up their businesses and building their resilience, and presents an opportunity for growth and well-being in the region.

Figure 1: The majority of all businesses surveyed agreed that e-commerce has helped increase the sales of their business

Figure 2: The majority of all businesses agreed that e-commerce has reduced the cost of running their business

Maturing ecosystems

While there are wide variations in the readiness of the ecosystem in a given country to support e-commerce (e.g., connectivity, payments, logistics), by and large, governments in the region are keen to support e-commerce adoption. Many are developing e-commerce strategies and changing business regulations to provide more enabling conditions.

Internet connectivity is improving, though in Sub-Saharan Africa the usage gap – the percentage of people who are covered by a broadband network but are not using it – is still the highest in the world at 44%.

Digital payments are increasingly being adopted. Payments interoperability and instant settlement is improving in all the markets, with Egypt, Kenya, Ghana, Nigeria and South Africa having made significant advances, and Ethiopia undergoing a transformation post market liberalisation.

Delivery solutions are also emerging, though currently insufficient. A key challenge is the lack of national address systems, as well as affordable third-party delivery solutions. To fill the gap, leading e-commerce platforms like Jumia have been developing their own delivery solutions.

Lack of trust: a key barrier to consumer adoption

Despite improvements in the ecosystem, consumer trust remains a major hurdle to overcome. In our survey, 48% of MSMEs identified customers’ lack of trust in e-commerce marketplaces and websites as a challenge to growing their e-commerce business (Figure 3).

Figure 3: Lack of trust in e-commerce marketplaces and websites was identified as a key challenge by MSMEs

This challenge has multiple dimensions and there is no single solution to building trust with customers. Solid partnerships and coordinated action between the different actors engaged in e-commerce – from digital marketplaces, to internet service providers and payment providers, to logistics companies – will be required to deliver e-commerce services that customers trust, effecting behaviour change from in-person to digital commerce.

For example, connectivity infrastructure that is reliable is essential to ensuring that e-commerce transactions are successfully processed. The quality of infrastructure currently varies significantly between markets, resulting in disrupted transactions.

Customers also need to trust the quality of products sold online. Better quality control by online sellers and platforms will help to build trust.

Reliable delivery services for shipping products ordered online are greatly needed, but poor addressing systems act as a big challenge to accurate, cost-effective deliveries. Governments can work with partners to find innovative solutions to improve the national address system to ease the strain on existing delivery solutions providers and improve their reliability.

Trust also relies on effective regulations and consistent enforcement. Regulations for personal data protection and cybersecurity, and their effective implementation, is especially important for e-commerce services to thrive. The region has seen rising rates of cybercrimes causing understandable concern among customers, especially in making digital payments. Less literate and digitally skilled consumers are much more vulnerable to losses.

In South Africa, a relatively mature e-commerce market, the E-commerce Forum South Africa, an association of eShop owners including brick and mortar stores transitioning to digital commerce, is now using trustmarks. Under the Safe Shop South Africa initiative, e-commerce companies can be verified by lawyers against the country’s laws as well as the forum’s code of conduct, and are then provided a trustmark for their website to confirm that they are reliable. This kind of scheme is an example of private sector innovation in addressing the issue of consumer trust and could be scaled with direct support from governments.

We look forward to sharing more detailed findings from our research on e-commerce in Africa in Kigali, in October 2023. If you are a trade regulator or industry player providing e-commerce, digital payments or delivery solutions in Africa, or are interested in our research more generally, please reach out to Daniele Tricarico, Senior Director, or Nigham Shahid, Senior Insights Manager, at [email protected].

Sign up here to the Mobile for Development newsletter to receive updates about this research.