GSMA Mobile Money API

What is the GSMA Mobile Money API?

The GSMA Mobile Money API is an initiative developed through collaboration between the mobile money industry and the GSMA. It was created to support the mobile money industry speak the same technical language by providing a modern harmonised API for mobile money transactions and management that is both easy to use and secure.

The GSMA harmonised API initiative aims to increase adoption of the mobile money API through dedicated engagement with mobile money providers and support for ecosystem vendors. The GSMA also aims to maintain updated versions of the API Specification with new features and up to date functionality.

This common technical language, the API Specification, enables easy integration between mobile money providers and organisations who want to interface with these providers, by allowing any third party to implement a common solution which will work with all mobile money platforms which implement the API.

The Mobile Money API uses best practices from the technology industry in API design which provide benefits such as flexibility and scalability. The API initiative also provides best practice security recommendations for API implementations which can be found on the developer portal.

Use Cases

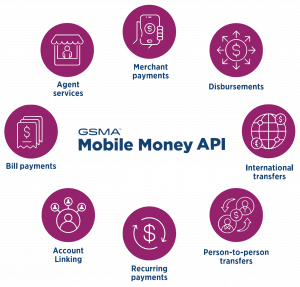

The Mobile Money API supports the core set of mobile money use cases:

Design Principles

The Mobile Money API uses best practices from the technology industry in API design and security.

- Use of REST architectural principles;

- Use of the JSON data format for requests and responses;

- Provision of a set of well-defined abstracted objects;

- Definition of a standard set of transaction types;

- Definition of key enumerations used in financial services;

- Compatibility with ISO international standards for enumerations where applicable; and

- Support for supplementary metadata and sub-types for bespoke properties.

Specifications

The first version of the Mobile Money API Specification 1.0.0 was published in 2016 after initial collaboration with mobile money industry stakeholders and has been adopted by several providers in live markets.

API Use Cases

|

Merchant payments |

Disbursements |

International transfers |

Person-to-person transfers |

|

Recurring payments |

Account Linking |

Bill payments |

Agent services |

API Guidlines

Developer Portal

The GSMA has provided developers with a Developer Portal including all the documentation and tools required to assist with developing a Mobile Money API which meets the specification requirements or a mobile money solution which uses the Mobile Money API.

If you are interested in adopting the Mobile Money API or wish to know more about existing adopters, please contact us at [email protected].