Photo: Mobisol customer’s house in Rwanda.

Last week over 2000 people from across the globe convened in New York for the Sustainable Energy For All Forum (SE4All Forum). The forum, in its 2nd year, brought together governments, multilateral and bilateral organisations, NGOs, entrepreneurs and academics to discuss our collective progress towards reaching the goals set forth by SE4ALL.

A rapidly-maturing mobile for energy access market

Five years since the pioneering work of mobile-enabled energy access organisations such as Simpa Networks and M-KOPA began, and the release of our very own publication “Community Power from Mobile: Using mobile to extend the grid” in 2010, the Forum confirmed to me that the role of mobile to support energy access is finally no longer a fringe idea but a concept that is becoming more mainstream, as the diversity of players in the market evolves and competition increases. For many of the early adopters and long-term supporters, 2015 and the SE4All Forum felt somewhat like a coming-of-age party, with Akon as the celebrity guest!

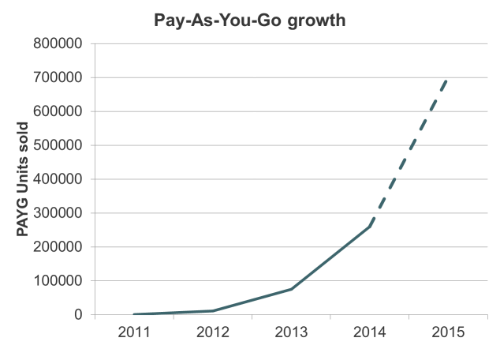

In the past 18 months we have seen mounting evidence that the time for mobile-enabled energy services has finally arrived. Striking developments include tremendous investments into the wider sector, with off-grid solar companies closing a record-breaking $64 million last year; rapid growth of PAYG solar products, with nearly 30 companies operating in at least 32 countries; the evolution of programs like CGAP’s Digital Finance Plus; publications such as the IFC/World Bank Lighting Global program’s ‘Off-grid power and connectivity study,’ released at the Forum; and new partnerships between our GSMA mobile operator members and solar product providers, including Orange and Greenlight Planet, and Azuri and Tigo Tanzania. All are indications of the rapidly maturing mobile for energy access market.

The shift towards a service-centred approach

While the future outlook for mobile-enabled energy services looks promising, it is important to remember how we got here. The state of our sector is the result of a perfect storm of conditions: the vision of risk-taking entrepreneurs, the support of donors, foundations and commercial investors taking bets on unproven technology and business models, and the unprecedented growth of mobile services and mobile money services in emerging markets. But potentially most important to the early success and growth of mobile-energy is a significant change in approach. While mobile technology helps to support operations, these companies have moved beyond delivering a product, to focus on delivering a high-quality service at a price-point that customers can afford. Just as pre-paid airtime drove mobile penetration in emerging markets (still over ~95% of mobile accounts in emerging markets are pre-paid), PAYG supports a symbiotic relationship between energy providers and their customers. The customer only pays when they are sure that the service will be reliable and companies are highly incentivised to maintain high-quality services or risk the reduction of customer repayment rates. But beyond the payment mechanism, mobile-enabled energy companies are bolstered by strong after-sales customer services, many of them having significant call centres and technical staff on-call to ensure customer satisfaction. The investment and dedication required to deliver such a service is not for the faint at heart.

But there is still much to do

But there is still the risk of overhyping the sector, inflating investor and mobile operators’ expectations, as well as running the risk of crippling entrepreneurs with unrealistic valuations and expectations of scale and profitability. We must remember that mobile money is also still a relatively new sector. According to GSMA’s 2014 State of the Industry report, globally there are 21 deployments that have reached over 1 Million active users and in Sub-Saharan Africa, where mobile money is the most developed, (75 out of 144 MNOs have launched mobile money services), there are over 146 million registered mobile money accounts but only 42% are considered active. It is important to remember that mobile money has yet to take off in a number of markets, due to regulatory barriers, low levels of investment and lack of industry collaboration, limiting the expansion of mobile money and consequently the uptake of mobile-enabled energy services. In addition, many of our Innovation Fund Grantees speak at length about the technical challenges of mobile money integration and specifically the need to repeat the process (essentially recreating the wheel) every time they expand to a new market or sign an agreement with a new mobile money service provider.

We are at the beginning of a journey

So while the sector is still nascent and there is still a lot of work to do, we have reason to be excited about the future of mobile-enabled energy services. We are at the beginning of this journey. Just as we could not have predicted the current situation 5 years ago, we can expect more experimentation and the development of new business models as the synergies between the energy and mobile sectors continue to be strengthened. The mobile industry’s interest in driving mobile internet access and the demand from utility providers to get better and more-on-time data from the grid is leading to new business models such as KPLC’s new revenue stream following their investment into fiber optic cables (see blog). Similarly efforts like the GSMA’s Digital Inclusion programme and Internet.org will have to consider the total cost of internet access in off-grid areas, wherein phone charging at about $0.2/charge, 3 to 4 times a week plays a significant role. Furthermore, as mobile-enabled energy companies are looking to expand their services beyond lighting and phone charging we see the potential for GSM-enabled solar kits to provide Wi-Fi services at household levels, allowing customers the ability to access the internet from the comfort of their own homes via their PAYG financed televisions. Finally, we cannot forget about the challenges that cities will increasingly face. As urban population continues to grow and more demands are put on existing grid infrastructure we believe more and more “electrified” people will begin living with increasingly poor and intermittent access, and there is the potential that solutions originally designed for off-grid settings will begin to see uptake in peri-urban and urban areas.

Of course, there are a number of significant challenges that lie ahead of us, but for the first time I am able to say with confidence that mobile energy is now an established sector that has permeated into the mainstream. The SE4All Forum was a definite realisation of this. Let’s draw on the lessons learnt over the past 5 years in the mobile for energy access space and continue to move forward on an upward trajectory, towards ensuring energy access to underserved communities across the globe.