This blog post was co-written by Francesco Pasti and Nicolas Vonthron. This post is a second in a two-part series reviewing the existing landscape of and trends in transactions between bank accounts and mobile money accounts. Read the first post.

Ecosystem development is key for mobile money providers to have sustainable and profitable services. In order to achieve a fully digital ecosystem, robust bank account to mobile money account (B2M) capabilities are required.

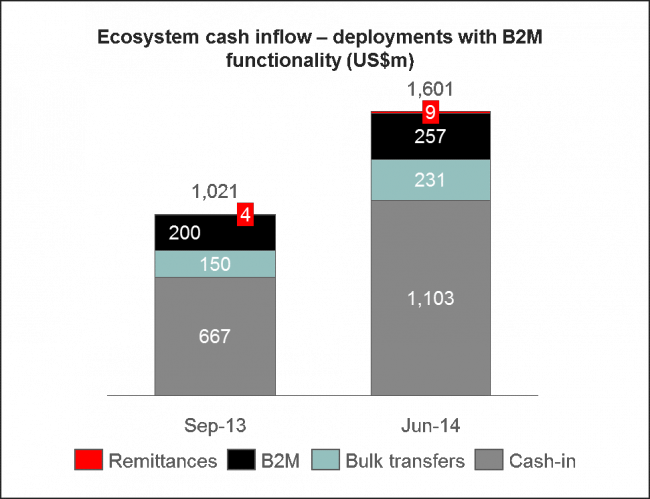

B2M can be a strong contributor to money flowing into the system

B2M transfers grew 28% in value between September 2013 and June 2014 (US$200m to US$257) and today, for all mobile money providers connected to banks, B2M represents 16% of the total flow entering their mobile money system. In contrast M2B transfers transactions account for 9.6% of total value leaving the mobile money system and for only 1% of the volume, illustrating that mobile money acts as a capillary-like system for the banks.

Integration with the banking system can be accomplished through two different ways, both with challenges

In order to achieve Bank Account to Mobile Money Account interoperability, mobile money providers can go through two different routes. Each has its own nuances and challenges which have been previously discussed, and none of these models seem to be perfectly optimal.

1. Bilateral connections and APIs

The vast majority of providers are interconnecting to banks through direct API connections, especially in markets where there is no available or relevant infrastructure. For instance, this is the case for M-PESA in Kenya and Tigo Money in Paraguay. These bilateral integrations are cost-efficient, as transactions not processed through a third party.

Safaricom acknowledged that their system upgrade in early 2014 enabled them to allow their customers to conduct near real-time bank account to mobile money account transactions, on top of other disbursements and payments.

With this model, scalability is a question. M-PESA has successfully integrated with 38 banks, but it means that this integration has been done 38 times. Harmonised APIs can be a solution, to which Safaricom answered earlier on this year by allowing the developer community to easily plug into M-PESA.

2. Existing switches

In Pakistan, 24 banks are connected to Easypaisa, Mobicash and U-Paisa through 1Link, a commercial switch owned by 11 banks. According to the State Bank of Pakistan, “The interoperability between Core Banking and Branchless Banking (BB) platforms, through Inter Bank Fund Transfer, continued to add value to the Branchless Banking Ecosystem.” Indeed, we see that 20% of the value transacted through accounts (branchless banking) is with the banking system. The key advantages of this solution is that 1Link allows also branchless banking providers to interconnect with each other. However, this solution could raise long-term questions on whether the governance in place at 1Link ensures that branchless banking players have a fair representation.

Note: we also seeing aggregators as a way of connecting to banks – in some markets, aggregators are acting as hubs in order to facilitate this integration. This is the case in Tanzania. It answers problems around scalability, however, it would be good to understand the functionality these aggregators are offering. For instance, are they actually payment systems or are they switches?

Understanding the availability of efficient infrastructure to support robust B2M integration

Synergies between banks and mobile money providers are necessary to allow greater financial inclusion, and mobile money providers are actively working on these integrations:

- B2M and M2B is crucial to develop the ecosystem, to keep money digital

- Banked customers seem to use mobile money as a valuable infrastructure (either to cash-out, or to send money to previously unbanked customers)

- Banks can also leverage the reach of mobile money to extend their products and services and offer, for instance, credit and savings

These synergies are also very important to improve efficiency in payment systems. Recently, the Bill & Melinda Gates Foundation’s Financial Services for the Poor (FSP) initiative released the Level One project, a guide to rethink and redesign national retail payment systems. At its core is the Interoperability Service for Transfers, or in other words, a switch.

In the coming months, we will be publishing a white paper which presents our analysis of the importance and the challenges of switches to support efficient mobile money and bank interoperability.