The following is a guest post writer by Karina Nielsen, Program Officer, Measurement, Learning and Evaluation, Financial Services for the Poor, Bill & Melinda Gates Foundation.

The opportunity for dramatically increasing financial inclusion in Nigeria is significant. According to the Global Findex (2012), of Nigeria’s more than 150 million people, only 30% of the adult population has an account at a formal institution. However, a vast majority of financial access points (banks, ATMs, etc.) are within areas that have cell phone coverage. Data from a new mapping tool show that here are nearly 44M people in Nigeria who live in an area with cell coverage, but who are more than 5km away from a financial service location. The Nigerian data portrayed on Fspmaps.com was launched at an event in Lagos on the 8th of July, 2013. Nigerian Central Bank Governor Sanusi Lamido Sanusi expressed great enthusiasm about the potential use for this tool. He underlined how this will support the government to track progress against the National Financial Inclusion Strategy and make evidence-based decisions. After the event, Governor Sanusi commented, “This is the data I have been waiting for four years!” The opportunity for greater financial inclusion through mobile money models is substantial and FSP would be supportive of exploring ways that the new data could help the Central Bank of Nigeria (CBN) advance its financial inclusion goals.

The Financial Service for the Poor (FSP) team at the Bill & Melinda Gates Foundation and its partners have developed an interactive web portal that aims to improve the way financial access is measured and tracked. The tool, Fspmaps.com, is emblematic of FSP’s belief in the power of rigorous data to help focus public and private resources to underserved people. The tool is designed to inform the decisions not only of financial service and payment providers, but also policy makers – all with an eye toward expanding financial services access in sub-Saharan Africa and South Asia. The web portal currently hosts data for Tanzania, Uganda, and Nigeria. By September 2013, data for Kenya and Bangladesh will also be available. The data and tools are designed to target investments expanding financial services access for maximum impact, and to optimally place retail access points.

A new paper summarizes the project, describing the tool and explaining how proximity-based, access analysis can transform the way financial service providers and policy makers view the field. It will provide insight into existing markets, help them recognize the potential for new markets, and promote inclusion of the world’s poor into the global economy. A brief overview of the work is provided below.

Fspmaps.com provides a simple proximity query tool that finds access points within a distance of a user-defined point.

Fspmaps.com provides a simple proximity query tool that finds access points within a distance of a user-defined point.

Traditional access measures are very general – like the number of bank branches per 100,000 people for the entire country. But these measures do not give any indication of where people live in relation to financial service access points (Bank Branches, ATMs, Mobile Money Agents, Post Offices, etc.). Over the past year, we have worked with our partners to develop a set of resources to more accurately measure and track financial access.

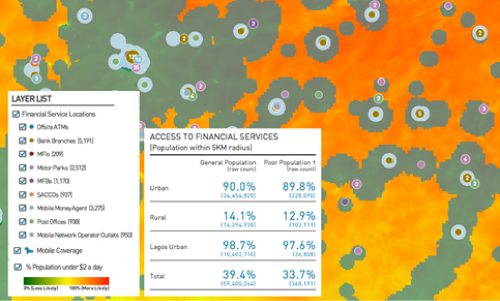

We captured two main sets of data to create this tool. The first is detailed financial access point locations, including Commercial bank branches, ATMs, Micro-Finance Institutions, Mobile Money Agents, Savings and Credit Cooperatives Organizations, and Micro-Finance Deposit Taking Institutions. The other is a high-resolution population map that includes poverty densities and other demographic attributes. The population and poverty data are developed to a 1-kilometer resolution.

Once the two sets of data were captured and developed, it was time to put them to use. We used the population within 5km of an access point as our base measurement – and ran the analysis in Nigeria, Tanzania, and Uganda. Our findings show that between 28 and 48 percent of populations in these countries live within 5km of a financial access point of some type. Not surprisingly, the data show lower financial access for poor people living under less than $2/day. In Uganda ~43% of the entire population, and only 34% of the poor population, live within a 5km radius to a financial access point. Another interesting finding is the discrepancy of access between urban and rural populations. In Tanzania, 97 percent of the urban population lives within a 5km radius to a financial access point while only 12 percent of the rural population lives within a 5km radius to a financial access point. This compares well with the Global Findex data which shows that only 17 percent of the Tanzanian adult population has an account at a formal financial institution. In Nigeria, a country of 150 million people, there are less than 16,000 access points and only 22 percent of the rural poor lives within a 5km radius to a financial access point.

The data clearly highlight gaps in access, but in doing so also provide critical insight into how countries can best address those gaps. Fspmaps.com is thus a potentially powerful and supportive tool which countries can employ in the service of achieving their poverty reduction goals. With this information, central banks, financial service providers, mobile network operators and other types of financial service providers can adapt policy and business practices to close gaps and they have already started.

A financial access footprint is overlaid with high-resolution poverty and mobile coverage layers on Fspmaps.com

Following in-country events where we shared the results of this project, several Central Banks have taken action to build upon the initial work by collecting additional data, dedicating organizational capacity to lead financial inclusion activities within their countries. Central Banks have also indicated an interest in amending policy to increase the role of digital money in expanding financial access for the poor. This is a positive start to a lengthy process of improving financial inclusion.

The long-term vision of Fspmaps.com is to have it become a public good which goes beyond serving as a tool to the financial inclusion field. It holds great potential to be expanded and used to improve management information systems of ministerial entities and local governance. Furthermore, the tool can become useful for donors and commercial players, including those involved in agriculture; health and financial services; mobile telephone services; and even fast moving consumer goods companies.

Many partners contributed to develop the tool, including Southampton and Oxford Universities (which developed high-resolution population and poverty maps), Brand Fusion (which collected financial access point location in five countries), Spatial Development (which developed the web portal and analytical tools publicly accessible), along with local partners within Tanzania, Uganda, Kenya, Nigeria, and Bangladesh. Among our local partners were: Central Banks, Ministries of Finance, Financial Service Providers, Financial Sector Deepening Trusts, CGAP, and National Statistical Bureaus. These institutions provided oversight and coordination as well as thought partnership regarding use case scenarios and sustainability efforts.

To learn more about the scope, findings, analytical capabilities and future features of the web tool we encourage you to read the paper and go to http://Fspmaps.com to provide feedback and suggestions to further improve the utility of the public good.